Okay, so you’re looking for a new online broker and Capital.com has probably popped up in your research, am I right? They’ve definitely been making some noise lately with their techy trading platforms and educational resources.

But are they actually legit? That’s what we’re going to get to the bottom of in this Capital.com review. I’m going to break it all down for you by covering:

- Who exactly is behind this broker and what makes them unique

- What their trading software is like on desktop and mobile

- The different account options for different types of traders

- All the markets you can trade like forex, stocks, crypto, etc.

- The rundown on deposits, withdrawals, and any fees involved

- How their pricing stacks up with spreads and commissions

- If their customer support is actually helpful or just a headache

- Crucially – confirming they’re properly regulated and secure

By the end, you’ll have a crystal clear picture of whether Capital.com is a broker legit worth signing up with or just more empty hype. No sugar-coating, no paid promotions, just real talk based on digging into their whole deal.

Sound good? Let’s get into it then and see if Capital.com deserves a place on your trading platform shortlist.

Capital.com Review – What is Capital.com?

Capital.com is an online trading broker that provides access to trade 3000+ asset classes including forex, indices, shares, commodities, cryptocurrencies and more.

Founded in 2016, this brokerage is owned by Capital.com Investment Ltd, a company incorporated in Bermuda and St. Vincent and the Grenadines. They are regulated by top-tier authorities in multiple countries, ensuring their operations meet strict financial standards and investor protection rules globally.

They’ve quickly grown to serve over 610,000 traders in 183 countries, including Europe, Australia, Canada, the Middle East and Northern Africa.

What sets Capital.com apart is their user-friendly trading platforms, low fees, quality research and education, plus a focus on simplifying trading through innovative AI technology that provides personalized insights and trade ideas.

Pros and Cons

| Pros | Cons |

|---|---|

| ✅ Regulated by multiple top-tier authorities globally (FCA, ASIC, etc.) | 📉 No options and futures trading |

| 💳 Low account minimums ($20 for Standard account) | 💸 Spreads can be higher than some competitors on certain assets |

| 🖥️ User-friendly web and mobile trading platforms | |

| 📱 Ability to trade crypto CFDs alongside other asset classes | |

| 🆓 Free demo account to practice | |

| 🤖 Innovative AI insights and trade idea generation | |

| 💹 Competitive spreads on major forex pairs | |

| 📚 Educational resources and research for beginners |

Trading Platforms

Capital.com provides traders with access to their markets through an intuitive web-based platform and dedicated mobile apps.

The Web Platform can be accessed from any modern web browser without downloading additional software. It features:

- Interactive charting with over 80 technical studies

- Customizable workspace to arrange charts/tools as needed

- Built-in news feed, economic calendar and research reports

- Full trading capabilities across all markets

The Mobile Apps for iOS and Android bring Capital.com’s trading experience on-the-go. Key features include:

- Fast execution with just a few taps

- Streaming real-time quotes

- Advanced charting tools

- Ability to seamlessly sync with web platform

Account Types

Capital.com offers three main account types designed for different experience levels:

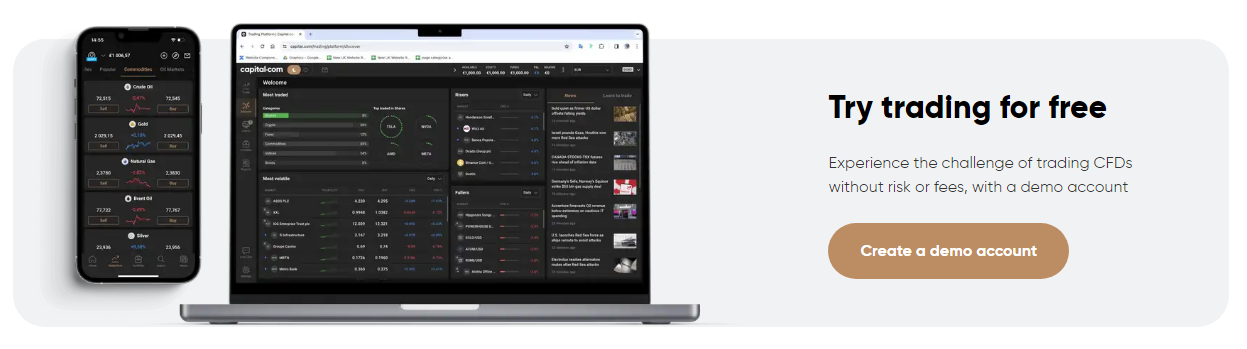

Demo Account

- Risk-free practice environment

- Funded with $10,000 in virtual money

- 75+ indicators and drawing tools

- Access all trading platforms/markets

- Test strategies before risking capital

Standard Account

- $20 minimum deposit

- Ideal for beginners

- Access to trade all assets

- Competitive spreads

Professional Account

- $3,000 minimum deposit

- Tailored for active traders

- Tighter spreads on forex/shares

- No commissions on certain trades

- Leverage as high as 300:1

- Monthly cash rebates

Both account types provide full access to Capital.com’s user-friendly web and mobile trading platforms packed with research, charts and analysis tools.

Cryptocurrency Offerings

At Capital.com, traders can access the cryptocurrency markets by trading crypto derivatives called CFDs (Contracts for Difference).

The crypto CFDs available include:

- Major coins like Bitcoin, Ethereum, Litecoin

- Ability to go long or short on price movements

- Crypto cross pairs (e.g. BTC/ETH)

- Crypto vs fiat currency pairs (e.g. BTC/USD)

A unique crypto offering is Capital.com’s AI-generated crypto insights and social media sentiment analysis. This uses data from tweets, news, and online trends to provide potential trading ideas around market-moving crypto events.

Deposits and Withdrawals

Funding your Capital.com trading account is straightforward with multiple payment methods accepted:

- Debit/Credit Cards

- Bank Wire Transfers

- E-wallets (Skrill, Neteller)

- Other methods may be available by region

Deposits are typically processed instantly with no fees charged. Withdrawals take 1-5 business days depending on the payment method. Withdrawals under $200 incur a $10 fee, while withdrawals over $200 are free of charge.

Trading Fees

Account Fees:

- Opening/Closing Account: FREE

- Demo Account: FREE

- Inactivity Fee (after 1 year): $10 per month

- Deposit: FREE (Min $20/€20/£20 or 100 PLN)

- Withdrawal: FREE (Min $50/€50/£50)

Trading Costs:

- Variable Spreads based on asset class

- Forex: Avg 0.6 pips on EUR/USD

- Shares: Avg 0.08% spread + $0.07 per $1 traded

- Crypto CFDs: Avg 50 points on BTC/USD

- Overnight Financing Charges if holding positions

Other Fees:

- Currency Conversion: 0.7% of spot forex rate (0.5% pro)

Capital.com derives its revenues primarily from the spreads on each market. Most account administration and funding is free of charge apart from the inactivity fee after prolonged periods.

Customer Support

If you need any assistance, Capital.com provides customer support through multiple contact methods. You can reach their support team 24/7 via live chat directly from the trading platforms.

There is also email support at support@capital.com with typical response times of 1-2 hours.

For more urgent matters, telephone callback services are available during UK/EU daylight hours at (+44) 203 769 7865. Support is offered in over 10 languages including English, Spanish, Arabic, Chinese and more to serve their global client base.

Regulation and Security – Is Capital.com Safe?

Yes! Capital.com is regulated and authorized by top financial authorities globally, including the FCA (UK), ASIC (Australia), FFAJ (Japan), SFSA (Seychelles), and SCA (UAE). Client funds are kept segregated in tier-1 bank accounts.

Capital.com takes security extremely seriously, employing cutting-edge measures like:

- Encryption and Two-Factor Authentication (2FA) to secure client accounts

- Never storing passwords in plain text, using secure hashing instead

- Firewalls, load balancers, VPNs to monitor/filter network traffic

- Encrypted data transmission over TLS

- Continuous security monitoring and bug bounty program

They also maintain rigorous security certifications like ISO 27001 for information security management and PCI DSS for handling credit card data safely.

By operating under multiple top regulators and implementing advanced cyber security controls, Capital.com ensures maximum protection of client funds and data.

Capital.com Trustpilot Reviews

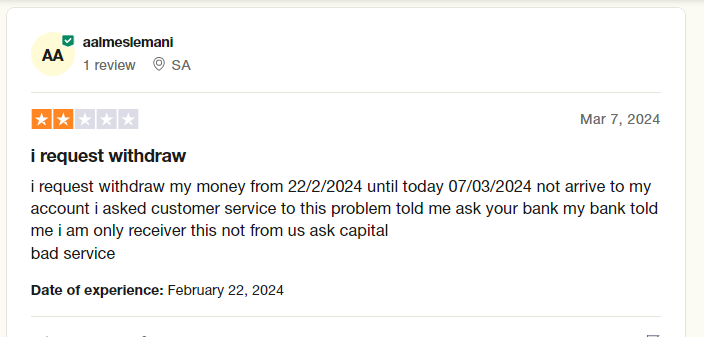

Capital.com currently holds a solid 4.2/5 rating on the popular review platform Trustpilot, based on over 10,000 reviews from its global client base. Here are some of the most recent customer feedbacks:

As the reviews show, Capital.com receives praise for its user-friendly platforms, educational resources, regulated status, and responsive customer support. While overwhelmingly positive, there are occasional complaints around matters like withdrawal processing times.

However, Capital.com makes an effort to publicly respond to and resolve any customer grievances expressed on Trustpilot. Their attentiveness to client feedback further instills trust in their broker services and commitment to client satisfaction.

Overall, the volume of reviews and strong aggregate rating on a third-party site like Trustpilot serves to validate Capital.com’s reputation and quality of offering in the eyes of its clients.

Conclusion

In summary of this review, Capital.com provides an intuitive multi-asset trading experience across forex, shares, commodities and cryptocurrencies. With low account minimums, competitive spreads and innovative AI technology, Capital.com caters well to both beginners and active traders looking for an all-in-one broker.

Traders who prioritize simplicity, education, AI-driven insights and global regulation may find Capital.com particularly appealing.

However, more advanced traders may prefer brokers with additional products like options or futures.

Not satisfied with Capital.com? Check out these Capital.com alternatives for online trading!

FAQs

- What is Capital.com?

Capital.com is an online trading broker that provides access to trade forex, shares, commodities, cryptocurrencies and more on their web and mobile platforms.

- Who owns Capital.com?

Capital.com is owned by Viktor Prokopenya, a serial technology entrepreneur and qualified lawyer. Prokopenya owns 100% of the shares in Capital.com through his global investment firm VP Capital.

- Is Capital.com a regulated broker?

Yes, Capital.com is regulated by multiple top-tier authorities globally including the FCA (UK), ASIC (Australia), and FSCA (South Africa).

- What is the Capital.com minimum deposit?

The minimum deposit to open a Standard Capital.com trading account is $20/€20/£20 or 100 PLN. The Premier account has a $3,000 minimum.

- Is Capital.com good for beginners?

Capital.com can be a good choice for beginner traders, offering low account minimums, educational resources, virtual demo accounts to practice, and user-friendly trading platforms.

- What cryptocurrencies can you trade on Capital.com?

Capital.com allows trading of major cryptocurrency CFDs like Bitcoin, Ethereum, Litecoin and others versus fiat and crypto cross pairs.

- How can I withdraw funds from Capital.com?

Accepted Capital.com withdrawal methods include debit/credit cards, bank wires, Skrill, Neteller and more. Withdrawals over $50/€50/£50 are free.

- What fees does Capital.com charge?

There are no commissions or fees for depositing funds. Trading costs are derived from the spreads, which are variable based on asset class and market conditions.