Welcome to this 2024 Robinhood review! In online investing, few platforms have caused as much buzz and disruption as Robinhood. This innovative app promises to democratize finance by offering commission-free trades and making the markets accessible to everyone – not just the wealthy.

But is Robinhood really a game-changer or just empty hype? In this latest Robinhood review, we’ll explore every facet of the platform to help you decide if it’s the right fit for your investing needs.

Robinhood Review 2024

Here’s what you can expect from this review:

- An in-depth look at Robinhood’s background, mission, and business model

- Detailed walkthrough of opening an account and the user experience

- Breakdown of all the investment products and services offered

- Analysis of Robinhood’s fee structure compared to competitors

- Evaluation of the trading platforms, tools, research, and mobile app

- Assessment of security, regulation, customer support, and educational resources

- Pros, cons, and final verdict on who should use Robinhood

Whether you’re a seasoned trader or brand new to investing, this guide will provide all the insights you need to determine if Robinhood’s commission-free trading is truly revolutionary or just smoke and mirrors. Let’s dive in!

What is Robinhood?

Robinhood is a pioneering financial services company that offers commission-free stock, options, cryptocurrency and ETF trading through its easy-to-use mobile app and website. Launched in 2013 and headquartered in Menlo Park, California, Robinhood is owned by Robinhood Markets, Inc., a FINRA-approved brokerage firm.

The current CEO of Robinhood is Vlad Tenev, who co-founded the company with Baiju Bhatt. They started Robinhood with the mission to democratize finance for all by offering zero commission trading and making the markets accessible to everyone, not just the wealthy Wall Street types.

Many folks wonder if Robinhood is safe since they offer commission-free trading, which is pretty disruptive. But yes, it’s 100% a real, regulated brokerage firm. If you want to get more details on their security measures and regulations, you can read the article; Is Robinhood Legit?

So how does this Robinhood thing actually work? Let’s find out next…

How Does Robinhood Work?

Instead of charging you commissions like traditional brokers, Robinhood makes money through market makers’ rebates and lending out your idle cash to others. Sounds a bit confusing, but here’s the simple explanation:

When you place a trade on Robinhood, they send it to these big Wall Street firms called market makers. These guys facilitate the trade behind the scenes and give Robinhood a tiny rebate or payment for routing your order to them. Robinhood also takes the cash sitting uninvested in your account and lends it out to others for interest income.

So in a nutshell, while you get to trade for free, Robinhood collects those small rebates and interest to generate their revenues. No more paying $5, $10 or more per trade like the old days! Just simple, commission-free trading through a beautifully designed app on your phone. It’s honestly made investing way more accessible and affordable for the average person.

Account Opening Process

Getting started on Robinhood is super straightforward. You can open an individual regular taxable account, or go for joint accounts if you’re married or want to invest with someone else. They’ve also got retirement accounts like Roth and Traditional IRAs available.

What are the requirements? To sign up, you just need to provide some basic personal details to verify your identity – things like your name, birthday, social security number, employment details and stuff like that. It only takes a few minutes to fill out the application. Don’t worry, it’s all secure and just standard brokerage account requirements.

From personal experience, the account opening process is extremely smooth and user-friendly from start to finish. Robinhood’s interfaces are very clean and modern, with a fun, casual vibe that makes it all feel super simple and accessible, even if you’re new to investing.

Trading Platform

Robinhood offers two platforms for trading, the web platform and mobile app.

Web Platform

- Whether you use the web version or not, Robinhood’s trading platforms have this awesome user-friendly design. The layout is super clean and easy to navigate as you browse stocks, view your portfolio, place trades and check out the sleek charting tools.

- While simple, Robinhood doesn’t hold back on tools and features. You get candlestick charts, indicators, drawing tools, customizable views and pretty much everything an active trader needs. Plus, options trading capabilities with multi-leg strategies.

- The built-in research isn’t extremely robust, but it covers market data, analyst ratings, income statements and the core fundamentals to help evaluate investments. There are also some basic educational resources for beginners.

Mobile App

- Where Robinhood really shines is their best-in-class mobile app. It’s beautifully designed and just so fun to use, with an extremely intuitive layout that’s perfect for trading on-the-go.

- The app essentially mirrors the web platform’s features but in a smart mobile-optimized format. So you can easily monitor your portfolio, place basic and advanced trades, and leverage all the charts and tools from anywhere.

- You also get alerts and customizable notifications pushed right to your phone or mobile device. So you can closely track price movements, earnings, news and more in real-time.

Read also! How to Use Robinhood: Step-by-Step Guide to Your First Trade

Investment Products and Services

With Robinhood, you can invest in all the classic stock names you’d expect – from big companies like Apple and Amazon to even penny stocks and ETFs. Their stock trading capabilities are super robust.

Options trading is also available if you want to get into more advanced strategies. Robinhood supports multi-leg options plays, spreads, rolling options and more. Pretty much everything an active options trader could need.

Cryptocurrencies like Bitcoin, Ethereum, Dogecoin and more are also on the menu. Robinhood’s crypto trading platform makes it easy to buy, sell, and hold various popular digital coins.

They’ve also got this cool cash management account where you can earn interest on uninvested cash instead of just letting it sit idle.

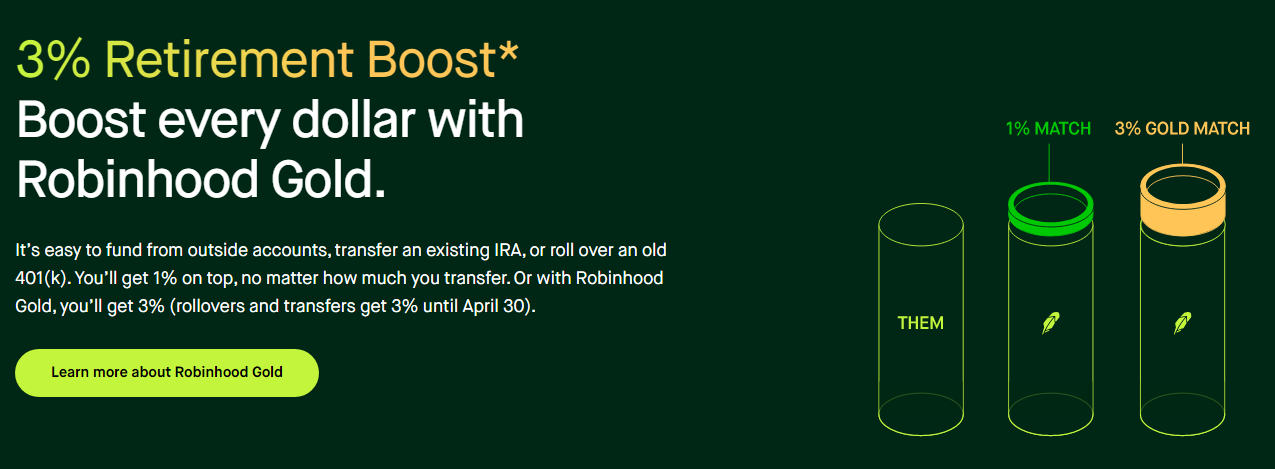

They also offer Robinhood Gold, which is an upgraded membership that gives you access to professional research, increased instant deposit limits, and margin trading.

Robinhood has also recently launched their Robinhood Gold Card, an ambitious credit card that promises unlimited cash back riches along with innovative features rarely seen from major issuers. We’ve fully reviewed the Robinhood Gold Card, so definitely check that out.

Fractional shares are a neat feature that lets you buy slices of expensive stocks with just a few bucks. So you don’t need thousands to get exposure to pricey names.

Recurring investments on Robinhood allow you to automatically invest on a regular schedule. So you can keep putting money into the market effortlessly over time.

Fees and Pricing

One of Robinhood’s biggest claims to fame is their commission-free trading model for stocks, ETFs, options and cryptocurrencies. You literally pay no commissions when buying or selling.

However, there are still some other associate fees like $5 per monthly account transfer. But compared to competitors, Robinhood’s fees are dramatically lower overall.

While traditional brokers charge $5-10 per stock trade, plus options contracts fees, Robinhood blows them out of the water by not charging any trading commissions whatsoever. Their fee structure is undeniably industry-leading for casual and active traders alike.

Security and Regulation – Is Robinhood Safe?

When it comes to security, Robinhood has you covered with standard account protection measures like SIPC insurance that protects up to $500,000 of your cash and securities in case they go belly-up. Your funds are also held at reputable clearing firms.

As a FINRA-approved brokerage firm, Robinhood plays by all the rules and regulations set by governing bodies like the SEC. So you can be confident they operate a fully compliant and above-board business.

Data privacy and security are also taken seriously, with measures like encryption, monitoring, and multi-factor authentication in place to safeguard your personal info and account. Though they did have a data breach a while back that’s worth being aware of.

Customer Support

If you ever need help, Robinhood offers customer support through a few different channels – phone, email, and even live chat in the app or on the website. So you’ve got options depending on your preference.

Their support team is generally responsive and knowledgeable from my experience, though wait times can sometimes be long during high-volume periods. The quality is a bit inconsistent but gets the job done for basic queries.

In terms of educational materials, Robinhood provides some nice getting started guides and FAQs to teach investing basics. However, their research library and learning resources are relatively limited compared to some other brokers out there.

Pros and Cons

Advantages of using Robinhood:

- Zero commission fees for stock, ETF, options and crypto trades is a game-changer

- Extremely user-friendly mobile app that makes trading stupid simple

- No account minimums so anyone can start investing with just a few bucks

- Ability to buy fractional shares makes pricey stocks affordable

- Streamlined and hassle-free account opening process

Potential drawbacks or limitations:

- Research, tools and data are relatively basic compared to premium brokers

- No human advisors available if you need professional investment advice

- Trading platform lacks some advanced features active traders may want

- Customer service can be inconsistent and slow during peak times

- That whole GameStop trading controversy raised some trust issues

Comparison with Competitors

Robinhood really disrupted the online trading industry with their free-trading model. While most traditional brokers like Fidelity and TD Ameritrade charge $5-10 per stock trade, Robinhood said no more to commissions.

The key difference is Robinhood’s rock-bottom pricing with zero commissions as their big hook. However, the trade-off is a more streamlined trading platform with less research, data, tools and support compared to those premium brokers.

It’s really designed for the casual, cost-conscious investor. Active traders may prefer more advanced platforms despite higher fees.

Robinhood Review – Final Thoughts

To conclude this Robinhood review – the app/platform really lives up to its mission of making investing accessible and affordable for everyone. With no account minimums, zero commissions, and an incredibly user-friendly mobile experience, Robinhood removes many of the traditional barriers and costs to investing.

Robinhood is a fantastic choice for beginner investors, passive investors, and really anyone looking to easily buy stocks, ETFs, options or cryptos without paying an arm and a leg in trading fees. The simplicity and low costs are hard to beat.

However, active traders and those wanting more robust research, data, tools and support may be better off with a professional-grade platform like Fidelity or TD Ameritrade despite the commissions. It really depends on your needs and priorities.

Overall, Robinhood gets two thumbs up from me, especially for anyone just starting out. The no-fee, dead simple trading experience is really unmatched. I’d personally rate Robinhood 4.5/5 stars – the ultimate democratizer that makes investing accessible to the masses.

FAQs

- What is Robinhood?

Robinhood is this super popular investing app that allows you to buy and sell stocks, ETFs, options, and cryptocurrencies without paying any commission fees. It’s designed to make investing easy and affordable for everyone, even those just starting out with a small amount of money.

- Is Robinhood legit?

Yes, Robinhood is 100% legitimate and legit. It’s a FINRA-approved brokerage firm that follows all regulations. While their no-fee model is disruptive, they operate an entirely legal business.

- Is Robinhood FDIC insured?

No, Robinhood is not FDIC insured since it’s not a bank. However, your cash and securities held in Robinhood accounts are protected by SIPC insurance up to $500,000.

- Does Robinhood have fees?

Robinhood’s claim to fame is they don’t charge any commission fees for stock, ETF, options or crypto trades. However, there are still some ancillary fees like $5 for monthly account transfers. But their fee structure is very low overall.

- How does Robinhood make money?

Instead of charging you commissions, Robinhood makes money from rebates they receive from market makers who facilitate your trades behind the scenes. They also earn interest income by lending out idle cash in customer accounts.

- Who owns Robinhood?

Robinhood is owned by Robinhood Markets, Inc., a company founded by Vlad Tenev and Baiju Bhatt who still serve as the CEO and Chief Creative Officer respectively.

- Can you day trade on Robinhood?

Yes, you can absolutely day trade on Robinhood. However, you’ll need at least $25,000 in your account to be considered a pattern day trader and avoid any restrictions.

- Is Robinhood good?

Robinhood is excellent for beginner investors, passive traders and anyone looking for an easy, affordable way to invest without high fees. The user experience is incredibly simple yet powerful.

- Why is Robinhood bad?

Some drawbacks of Robinhood are limited research/tools compared to other brokers, occasional customer service delays, and that GameStop controversy raised some concerns. Active traders may want a more advanced platform despite higher costs.