Ethereum (ETH) is the second-largest cryptocurrency by capitalization. Despite holding a prominent position, its performance is closely tied to its “big brother” – bitcoin (BTC). MarketsXplora has explored how ETH might respond to a significant upcoming event in the digital asset market – Bitcoin halving 2024.

Historically, when such events occur, coins often reach new all-time highs. A potential new peak could be reached in 2025.

To provide insights into this matter, we have prepared this long term Ethereum price forecast that considers all the factors influencing the coin’s performance.

In this Ethereum price forecast for 2025, we’ll find the answers to the following questions:

- Why do Bitcoin and Ethereum move together?

- How much Ethereum is dependent on BTC?

- Impact of 2024 Bitcoin Halving on Ethereum

- What else affects the price of Ethereum?

- Ethereum price prediction 2025 after the 2024 Bitcoin halving

Why do Bitcoin and Ethereum move together?

Bitcoin is the first and most well-known crypto. It symbolizes a new type of financial asset and is considered the leader that guides the market. This is one of the reasons why Ethereum has a slowest growth than Bitcoin. When Bitcoin’s value decreases, other cryptocurrencies also tend to lose value, and vice versa. When Bitcoin is on the rise, other coins generally show a positive trend.

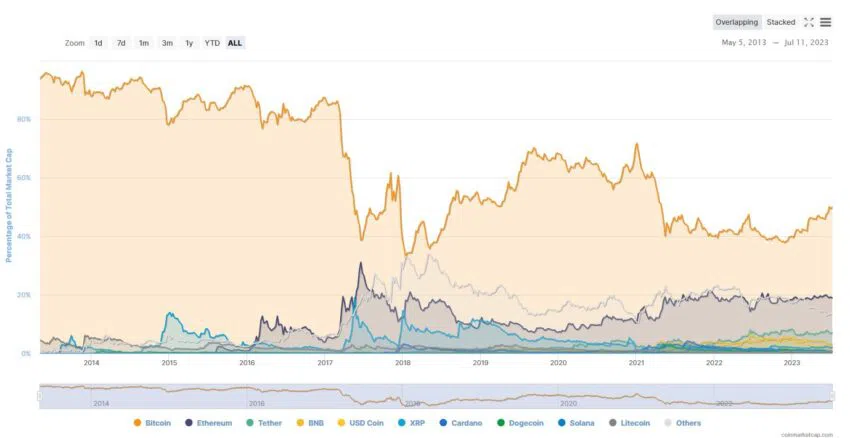

As of the time of writing, Bitcoin holds about 50% of the digital asset market, while Ethereum is only 19%.

How much ETH is dependent on BTC?

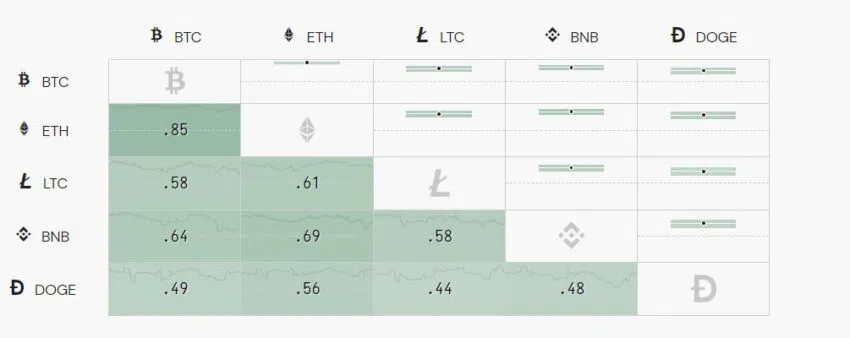

To understand how exactly ETH is dependent on BTC, let’s consider the correlation of two coins (what percentage on a 100-point scale ETH repeats for BTC). To do this, we will study the cryptocurrency correlation matrix. The table shows that the recurrence price of Ethereum for Bitcoin is about 85%.

Based on the correlation indicators, if roughly rounded, we can conclude that Ethereum repeats 85% of the movements of Bitcoin.

Impact of 2024 Bitcoin halving on Ethereum

In the spring of 2024, an important event will take place – the Bitcoin halving. The event implies a halving of the BTC mining (extraction) speed. Based on our observations of Bitcoin halving history, we have consistently witnessed a positive impact on the behavior of BTC. Each time after the halving event, the coin tends to reach new all-time highs (ATH).

Following BTC, other cryptocurrencies, including Ethereum, also go up. How exactly halvings trigger growth cycles, we figured out earlier.

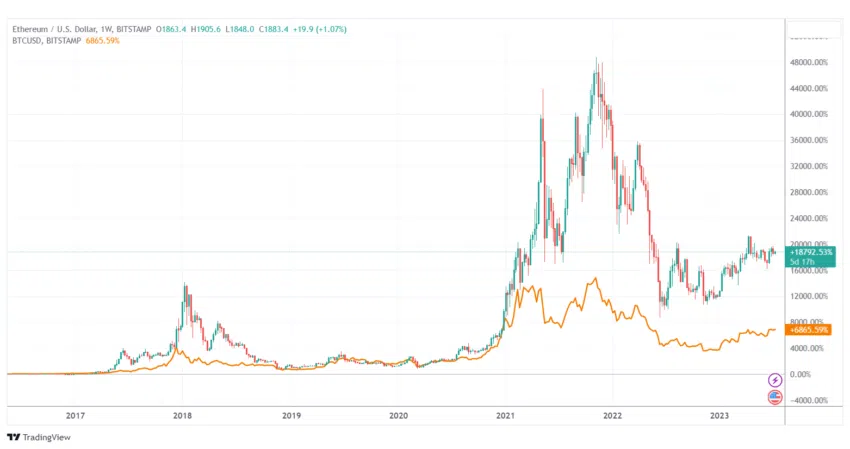

The chart below shows that ETH almost exactly repeats the movements of Bitcoin. The price of the crypto has consistently risen and reached new all-time highs during periods of positive movement of its “big brother” in conjunction with halving events. This trend was observed on November 28, 2012, July 9, 2016, and May 11, 2020.

Therefore, it can be assumed that the upcoming Bitcoin halving 2024 can bring Ethereum into growth and allow the coin to reach new all-time highs.

What else affects the price of Ethereum?

In 2023, there was a looming threat to Ethereum regarding the potential classification of the crypto as an illegally issued security. The US Securities and Exchange Commission (SEC) has begun compiling a list of coins that it believes violate the law. As of the time of writing the review, over 60 digital currencies got into it. Many coins — the leaders of capitalization — were under attack. At the same time, Ether is not on the list.

Earlier, SEC representatives have repeatedly hinted at the possibility of recognizing Ethereum as an illegally issued security. Members of the crypto community believe that the coin managed to avoid being blacklisted because of a bribe. Why, in fact, Ethereum has not yet been recognized as a security, MarketsXplora understood earlier.

It is noteworthy that ETH’s main rival, BTC, turned out to be the only cryptocurrency that the SEC considers a commodity. This status saves BTC from possible recognition of the coin as an illegally issued security.

Ethereum price forecast 2025 after the next Bitcoin halving

To understand how Ethereum might react to the next Bitcoin halving, you first need to figure out the prospects for BTC movement after the event. Most of the experts that Markets Xplora managed to talk to believe that Bitcoin will reach a new all-time high. In their opinion, BTC can set a new ATH at +50% to the previous one ($68,789) — that is, close to $100,000.

Read also: Standard Chartered Analysts Bullish on Bitcoin: Forecasts $120,000 by 2024

The absolute maximum of Ethereum is fixed at $4891 on November 16, 2021. In the event that Ether repeats after Bitcoin and sets a new peak at a height of + 50% to the previous result, the Ethereum prediction suggests a movement of the coin to $7300.

The recognition of Ethereum as a security may put pressure on the coin value. In this case, the probability of a significant growth of the coin will be in question. If, on the contrary, the developers of Ethereum manage to resolve the conflict with the SEC and protect the coin from being blacklisted, a more confident growth of Ether is possible against the backdrop of the 2024 Bitcoin halving.

Participants of the crypto community, guided by the history of BTC behavior, came to the conclusion that the cryptocurrency will update the absolute maximum no earlier than 2025. Since Ethereum repeats after its “big brother”, it can be assumed that investors will see Ethereum as well – in 2025.

Thus, the Ethereum prediction for 2025 does not exclude the renewal of the all-time highs near $7300.

FAQ

- Why do Bitcoin and Ethereum move together?

Bitcoin and Ethereum often move together because they are both major cryptocurrencies and have a strong correlation in the overall crypto market. They are influenced by similar factors such as market sentiment, investor behavior, and macroeconomic trends.

- How much will Ethereum be worth in 2025 after the next Bitcoin halving?

Based on historical patterns and the upcoming Bitcoin halving in 2024, we can speculate in this Ethereum price forecast 2025 that the crypto may reach a new all-time high around the $7300 level in 2025.

- If Bitcoin crashes what happens to Ethereum?

If Bitcoin experiences a crash, it can have a significant impact on the broader digital currency market, including Ethereum. While Ethereum may also decline in value during a Bitcoin crash, the extent of the impact can vary. Ethereum’s performance can be influenced by its own unique factors, developments in its ecosystem, and investor sentiment toward the platform.

- How is Ethereum different from Bitcoin?

Ethereum differs from Bitcoin in several ways. Firstly, Ether is not solely a digital currency but also a decentralized platform for creating smart contracts and decentralized applications (DApps). Bitcoin, on the other hand, primarily functions as a digital currency and a store of value. Additionally, Ether uses a different blockchain technology called Ethereum Virtual Machine (EVM), which enables the execution of smart contracts. Ethereum also has a faster block time and has been more open to upgrades and innovation compared to Bitcoin.

- Can Ethereum be recognized as a security?

The US SEC has repeatedly hinted at the possibility of recognizing Ether as a security. Therefore, it can be assumed that there is a risk of the coin being blacklisted.