Managing investments without obsessing over markets now comes care of robo-advisors. With so many robo-advisors out there, how do you decide where to invest in 2023?

In this guide, I’ll focus on unpacking two major players – Wealthsimple vs Wealthfront. These two leading robo-advisors leverage algorithms to build portfolios and harvest tax savings so you can just sit back and watch your money grow.

Ever wondered how they stack up against each other? Well, that’s what we’re here to explore. Let’s compare human access vs pure automation along with fees, features, and more to crown the superior choice!

Wealthsimple vs Wealthfront: Quick Comparison

Need some help deciding between these two top robo-advisors? Get the key facts with this snapshot overview before digging deeper.

| Aspect |  |

|

|---|---|---|

| Founding Year | 2014 | 2008 |

| Ownership | Power Company of Canada (83.2%) | Private |

| Account Minimum | $100 | $500 |

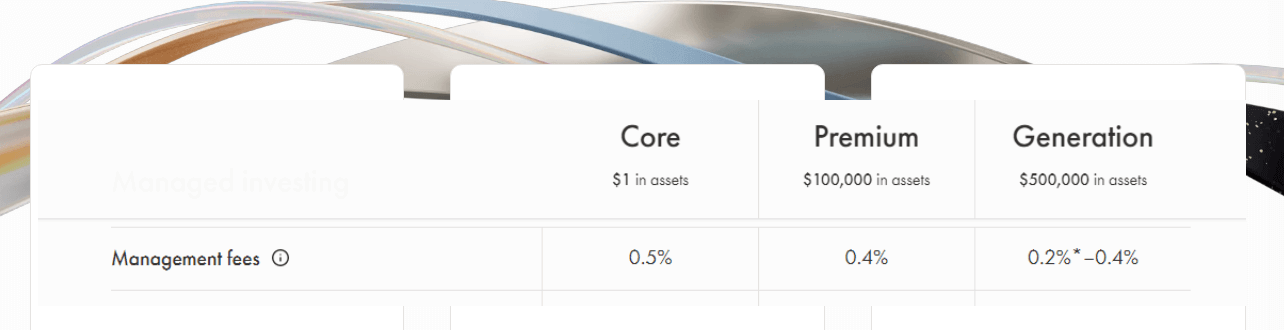

| Management Fees | 0.4% – 0.5% | 0.25% |

| Best For | Socially responsible investors, Tax-loss harvesting | Hands-off investors, Taxable accounts |

| Human Advisor | Yes – for all clients | Fully digital, no human advisor |

| Total Assets Under Management | Over $20 billion | Over $50 billion |

| Promotion | $10,000 in assets managed free for 1 year | None |

| Key Features | Access to human advisors, Tax advantages, Socially responsible investing | Automated management, Tax-saving strategies, Direct Indexing |

| Customer Support | Human advisor available, Email and phone support | Email and phone support |

| Security | SIPC coverage in the US, CIPF coverage in Canada | SIPC coverage, FDIC protection for cash accounts |

Now that you’ve got the lay of the land, let’s discuss your personal priorities and see which approach resonates most!

Background

What is Wealthsimple?

Let’s kick things off by shining a light on Wealthsimple. Established in September 2014 by Michael Katchen, and Brett Huneycutt, Wealthsimple is a Toronto-based financial management firm that’s been making waves in the robo-advisor scene. The Power Company of Canada owns the majority, holding 83.2% of the reins.

Now, think about this – over 300,000 users entrusting their finances to Wealthsimple, and the assets under management? A whopping $20 billion! That’s some serious trust in those algorithms.

Wealthsimple made its debut in the US back in 2017, bringing its robo-advisor magic across the border. With an easy-to-use platform tailored for millennials, it’s been turning heads with both automated investing and the added touch of human advisors.

What is Wealthfront?

Now, let’s turn our attention to Wealthfront founded by Andy Rachleff and Dan Carroll. This California-born robo-advisor has seniority, entering the game in November 2008. Considered one of the pioneers, Wealthfront boasts being among the first and most popular robo-advisors in the United States.

And guess what? It’s got quite the fan following – over 700,000 users are part of the Wealthfront family. That’s like a small city of people trusting Wealthfront with their finances.

But wait, there’s more to this story too. Wealthfront is not just about being digital; it’s a financial powerhouse managing over $50 billion in assets. That’s a ton of cash, right? It’s clear they’re not messing around. This robo-advisor prides itself on accessibility and customizability, catering to both beginners and seasoned investors.

Accounts Types

When it comes to investing, having options for different account types can be crucial – especially when looking towards retirement. But between trendy robo-advisors Wealthsimple and Wealthfront, who serves up the most diverse account selection menu? Let’s compare what’s cooking!

Wealthsimple Account Types

FHSA (First Home Savings Account): Save up to $40,000 tax-free for your first home. Contribute up to $8,000 per year to cut your yearly tax bill.

RRSP (Registered Retirement Savings Plan): Tax-advantaged retirement account. Contribute up to 18% of last year’s income or $30,780. Reduces your tax bill, and investment earnings are tax-deferred.

TFSA (Tax-Free Savings Account): Flexible, tax-free savings. Lifetime contribution limit of $88,000. Withdraw funds anytime without penalties.

Cash Account: Combines chequing perks with high-interest savings. Earn 4% interest and 1% back on spending. No minimum balance or fees.

Non-registered account: Flexible investment with no tax advantages. No contribution limits. Your money, your rules.

Spousal RRSP (Spousal Registered Retirement Savings Plan): Save for retirement with your spouse. Tax-deferred growth. Optimizes tax benefits for couples with different incomes.

RESP (Registered Education Savings Plan): Save up to $50,000 for your child’s education. Government matches 20% of your contribution. Earnings are tax-deferred.

Corporate: Ideal for businesses with cash reserves. Invest business funds smartly for growth. Withdraw at a lower tax rate during slow years.

LIRA (Locked-In Retirement Account): Smart investment for pension funds. Investments grow tax-free even without contributions. Access retirement funds when needed.

RRIF (Registered Retirement Income Fund): Converts RRSP funds at 71. Minimum yearly withdrawal. Spreads tax impact over time.

Wealthfront Account Types

Now, let’s hop over to Wealthfront’s account types. These guys have crafted a comprehensive selection that covers the whole financial spectrum. Individual and joint accounts? Check. Traditional, Roth, SEP, and rollover IRAs? Double-check. Trusts for those legacy dreams? Absolutely. They even throw in a 529 College Savings Plan for the academic adventurers.

But what caught my eye is the inclusion of general non-retirement accounts – it’s like they’re saying, “Hey, we’re here for all your financial journeys, not just the retirement ones.” They’re not holding back on the diversity, ensuring everyone finds their financial flavor.

So, whether you’re eyeing a retirement nest egg, planning for the kiddo’s education, or just want to see your money grow without the retirement label, Wealthfront’s got a seat for you at the account table.

Winner – Wealthsimple

So in weighing account diversity against value, Wealthfront appears the pick if you just need simple taxable and IRA accounts to implement core strategy. But for wider investment vehicles spanning trusts, inheritance and more, Wealthsimple brings to the table a robust selection including niche offerings that give extra financial maneuvering room!

Financial Planning Approaches

When it comes to planning your financial future, Wealthsimple and Wealthfront have their own unique approaches.

Wealthsimple – A Hybrid Advisor System

So, Wealthsimple likes to keep it simple. No surprises there, right in the name! They’ve got a hybrid advisor system, combining the ease of automation with a touch of human wisdom.

First things first, it’s user-friendly. No complicated jargon or intricate processes. You create a plan, put in some cash, and let the robo-advisor do its thing. But here’s the twist – you get to chat with a real-life human advisor. Yep, an actual person, not just lines of code.

This human touch comes in handy for setting goals. Want a house, saving for college, and preparing for retirement? No problem! You can manage all of these simultaneously. Now, here’s the fun part. Wealthsimple offers 10 portfolio options based on the Nobel prize-winning Modern Portfolio Theory.

Oh, did I mention automatic rebalancing? Your portfolio won’t go off-kilter; it adjusts itself regularly. And if you change your mind about your portfolio choice, no biggie – switch it up in a snap.

Worried about keeping the cash flowing? Set up automatic monthly deposits, and you’re on autopilot toward your financial goals. They even have a prediction chart to give you a rough estimate of your savings over time.

Wealthfront – Fully-Digital and Customizable

Now, Wealthfront takes a different route. It’s all about being fully digital and super customizable. They’ve got this planning process called “Path.”

You set your goals – buy a house, save for college, or retire in style. Then, you throw in some details like your age, monthly income, and risk tolerance. Path crunches the numbers and gives you a projection with a recommended portfolio.

The cool part? You can tweak the settings until you’re happy. Wealthfront then handles the heavy lifting, investing your money based on your preferences.

But wait, there’s more! Investors with large portfolios get some extra perks. At $100,000, you unlock services like direct indexing and risk parity. At $500,000, you enter the Smart Beta territory. Fancy terms, right? They basically fine-tune your investments, minimizing costs and maximizing profits.

Now, if your portfolio isn’t growing as expected, Wealthfront sends you an alert with a recommended fix. Talk about having your back!

And here’s a neat feature – account aggregation. Link all your financial accounts, get a bird’s eye view of your money, and make informed decisions. But, it’s not all rainbows and unicorns. Customization means you might need to put in some effort, choosing stocks manually if you go the socially responsible investing route.

Draw – Wealthsimple and Wealthfront

Alright, let’s call it a draw, shall we? Both platforms have their A-game.

- Strengths of Both Platforms: Wealthsimple, with its human touch, easing newbies into the robo-advisor game. Wealthfront, the champ of cost-effective planning and detailed customization.

- Trade-offs in Planning Approaches: It’s a tight race. Wealthsimple’s simplicity versus Wealthfront’s tech-savvy and detailed planning. One suits the human connection seekers; the other, the meticulous planners.

So which is better? Well, we can’t really say one’s better than the other. It’s like comparing Batman and Iron Man – both superheroes, just different styles. So it’s all about what suits your financial taste buds.

Fees Comparison

Let’s now talk money – the fees, to be precise.

Wealthsimple

A lot of robos lure you in with $0 minimums – not Wealthsimple which requires a $100 opening deposit. And its 0.5% annual fee on assets under management, which, let’s be honest, is a bit heftier than its rivals.

But, fear not, Wealthsimple offers numerous ways to invest for free. They’ve got a bunch of promotions up their sleeve. Invite a friend and get $10,000 managed for free. That’s like a financial high-five. Signing up? Boom, you get a temporary discount. Set up automatic deposits? Another discount. Download the app? Yep, you guessed it – more savings.

All these moves can get you anywhere from $100 to $10,000 managed sans fees. Sweet, right? These perks last for a year, though. It’s like having discount coupons that expire, so use them wisely.

Now, if you’re sitting on a pile of cash – $100,000 or more to be exact – you’re in for a treat. Enter the Wealthsimple Black Account. Your management fee drops to 0.4%, and they throw in some extra perks. Tax-loss harvesting, anyone? It’s like a financial spa day for your investments.

Not a fan of the market rollercoaster? Wealthsimple’s got your back with the Smart Savings Program. Pop your cash in their high-yield savings account, and you’re looking at a 2.4% yearly interest rate. Not bad for playing it safe, right?

Wealthfront

Now, let’s flip the fees coin to Wealthfront’s side. These folks kick off with an annual management fee of 0.25%. That’s right, half the price of Wealthsimple. Sure, there’s a $500 minimum initial deposit, but it’s a small toll for a cheaper ticket.

Wealthfront’s not just playing the discount card; they’ve got tricks up its sleeve. Tax-loss harvesting starts at $500, a cool feature that can soften the tax blow on your gains. And for the high rollers – those with $100,000 or more – Wealthfront lays out the red carpet to Direct Indexing. It’s like creating a bespoke index for you, not too shabby.

And for the cash nesters, Wealthfront’s got the Cash Account. It’s got a 1.27% interest rate, although it recently took a dip from 2.57%. Keep tabs on interest rates; they’re like stock prices – always on the move.

Winner – Wealthfront

Wealthfront emerges as the winner in this fee comparison. Why, you ask? It’s not just about the low annual fee; it’s the long-term gains. Wealthfront’s arsenal of cost-reducing features is like having a financial superhero by your side.

Sure, Wealthsimple’s got some short-term party tricks with promotions, but Wealthfront’s commitment to trimming costs over the long haul gives it the edge.

Security

Alright, let’s talk about keeping those hard-earned bucks safe and sound. It’s like having a personal bodyguard for your money, and who doesn’t want that, right?

Wealthsimple

So, Wealthsimple takes its security seriously. Picture this as a fortress protecting your funds. They’ve got the Securities Investor Protection Corporation (SIPC) standing guard through Apex Clearing. This means, if something catastrophic were to happen, and the company goes belly up, your investments are covered up to $500,000 if you’re in the US.

For our friends up north in Canada, ShareOwner plays the role of the financial protector, offering coverage up to CAD 1,000,000. Meanwhile, in the UK, SEI Investments steps up with coverage up to £85,000.

In addition to this, Wealthsimple employs the gold standard of online security – a 256-bit SSL encryption. And just to add an extra layer of protection, they’ve got a two-step authentication process via text message. So, your money’s not just sitting there; it’s sitting there in a high-security vault.

Wealthfront

Now, Wealthfront’s got its own set of security superheroes. They’ve got the SIPC, just like Wealthsimple, giving you up to $500,000 in coverage. But wait, there’s more! Wealthfront steps it up with FDIC protection for cash accounts, covering you up to $1,000,000.

Wealthfront also boasts the 256-bit SSL encryption and a two-step authentication process. They’re essentially saying, “Your money is safe, and we’ve got the digital bouncers at the gate to prove it.”

Draw – Wealthsimple and Wealthfront

In the security comparison, it’s a draw! Both Wealthsimple and Wealthfront play by the same rules here, offering similar levels of protection. So, whether you’re on Team Wealthsimple or Team Wealthfront, your funds are under a tight digital lock and key. Safety first, right?

Customer Support

Alright, let’s talk about the support you’ll get when you’re knee-deep in the finance world. Customer support can be a game-changer, trust me.

Wealthsimple

First up, Wealthsimple. These guys bring in the human touch. Yup, you heard it right – human advisors. So, when you’re juggling numbers and need a real person to guide you, Wealthsimple’s got your back. They don’t stop there; you can reach out through phone and email.

Now, bear in mind, the US phone lines are open from 9 a.m. to 8 p.m. ET on weekdays, and Canadians get an extra hour. No live chat, though – you’re sticking to emails if you’re not dialing them up.

So, how’s the response time? We sent an email with a random question, and they got back to us in about 2 days. Pretty standard in the robo-advisor world.

Wealthfront

On the other side of the ring, Wealthfront. They keep it digital – no humans in the mix. But hey, they’ve got phone and email support too. Lines are open from 7 a.m. to 5 p.m. PT, Monday to Friday.

We threw a question their way via email, and guess what? They replied within a cool 3 hours. Now, that’s some speedy service, right?

Winner – Wealthsimple

And the winner is… Wealthsimple! Why? Well, they bring in the human touch. Having an actual person to talk to about your financial concerns is like having a financial buddy, right? But, let’s give credit where it’s due – Wealthfront, with their quick responses, definitely knows how to keep things moving. It’s like comparing apples and oranges; both have their strengths, but Wealthsimple takes this round for adding that personal touch to customer support.

Other Features

Now, let’s talk about the extra goodies that make these robo-advisors stand out.

Wealthsimple

First off, we’ve got the Round-Up feature. Every time you swipe your card, Wealthsimple rounds up the purchase to the next dollar and funnels the spare change into your investment account. Sneaky savings, right?

Next on the list is the Dividend Reinvestment Program (DRIP). It’s like a financial wizard that automatically reinvests your monthly dividends to buy more stocks. Imagine your money working for you, even while you sleep.

Now, here’s a socially responsible twist – Wealthsimple lets you invest in “green” companies, aligning your investments with your values. And for those who adhere to Islamic principles, they’ve got you covered with Halal Investing, steering clear of any forbidden financial activities.

Wealthfront

Moving on to Wealthfront, they’ve got a unique set of tricks up their sleeve, known as PassivePlus features. These include tax-loss harvesting, a $500 investment strategy that helps you minimize taxes by offsetting investment gains with losses. Smart move!

But wait, there’s more – direct indexing for portfolios over $100,000. Wealthfront goes beyond traditional ETFs and mutual funds, creating a personalized index just for you. It’s like having a custom-fit investment suit, tailored to maximize your returns and minimize those pesky taxes.

Now, for the big picture – Wealthfront introduces account aggregation. Link all your financial accounts, and voila! You get a 360-degree view of your financial world.

Winner – Wealthfront

It’s decision time. Both Wealthsimple and Wealthfront bring something special to the table. Wealthsimple has these innovative features – Round-Up, DRIP, and the ethical investment options that can make your financial journey a bit more exciting. But, drumroll, please – the winner is Wealthfront. Why? Because Wealthfront is all about the long game, focusing on those cost-reducing features.

Conclusion

Alright, my friend, we’ve covered quite a bit, so let’s tie it all together.

In the accounts and fees arena, Wealthsimple and Wealthfront both offer unique advantages. Wealthsimple, with its human touch and promotional perks, seems like the friendly neighbor. Meanwhile, Wealthfront goes all-digital, keeping it sleek and cost-effective.

When it comes to financial planning, Wealthsimple’s hybrid advisor system caters to simplicity, while Wealthfront’s fully-digital approach screams customization.

Now, fees – the necessary evil. Wealthsimple’s got some promotions to ease the burden, but they’re not forever. Wealthfront, with its lower base fee and cost-cutting features, might be your long-term savings buddy.

Customer support? Wealthsimple brings in the human touch, albeit with a tad slower response time. Wealthfront is quick and efficient but lacks that personal connection.

And security – both are on par. Your money’s guarded by the financial equivalent of superheroes.

So, dear Xploras, here’s the scoop – your choice between Wealthsimple and Wealthfront boils down to your style. Are you looking for a human advisor, unique features, and promotional perks? Go for Wealthsimple. Want a sleek, fully-digital experience with a focus on cost reduction? Wealthfront’s your play.

It’s your financial journey, your preferences, your priorities. Take a moment, weigh the options, and choose the robo-advisor that aligns with your money goals. Happy investing! 🚀