As cryptocurrencies go mainstream across the globe, crypto exchanges must meet the needs of investors worldwide. With availability in over 40 countries from Europe to Africa and Asia, Luno aims to make crypto trading accessible to all.

This 2024 Luno review provides an in-depth analysis of the features, fees, security, and overall usability of the Luno cryptocurrency exchange. The purpose of this review is to help you decide if this global exchange can provide a smooth and secure trading experience no matter where users are located.

Luno Review – What is Luno?

Founded in 2013 by Timothy Stranex and Marcus Swanepoel, Luno has emerged as one of the largest regulated cryptocurrency exchanges catering to over 8 million customers across 40 countries today.

Headquartered in London with regional hubs in Singapore and South Africa, Luno built an easy-to-use platform enabling retail crypto adoption through local payment partnerships and stablecoin-powered remittances focused on emerging markets.

With over $7 billion in transactions annually, Luno currently enables crypto access with a smoother onboarding process, integrated wallet storage and competitive trading fees compared to alternatives.

Positioning itself as the “safest, most trusted gateway to cryptocurrency”, let’s examine the validity of that promise through the rest of this Luno review outlining its setup, features and real-world performance for new and existing crypto traders globally.

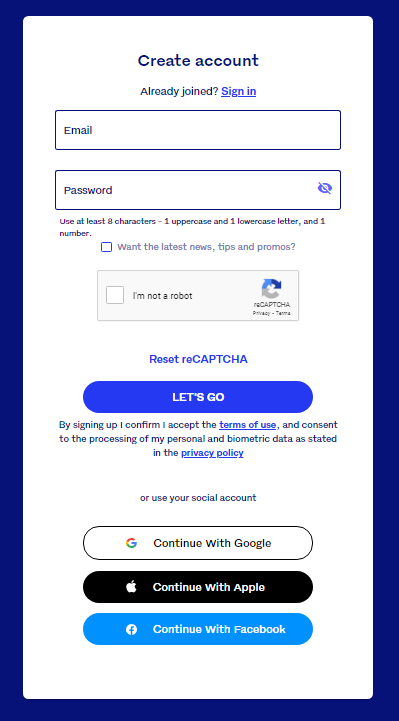

Getting Started on Luno

Opening a Luno account is fairly simple even for cryptocurrency beginners – taking under 5 minutes via web signup or mobile app download. You start by entering your name, email address, and password to sign up. Email verification is required.

Verification and KYC requirements

Luno operates as a regulated exchange so identity verification is mandatory before any transactions. Users need to submit a valid government ID like a passport or national ID card and a selfie photo holding the ID. After sharing these Know Your Customer (KYC) details, verification timeframes range from a few hours to 1-2 days as Luno’s AI and manual checks authenticate users.

Funding Luno account with fiat currencies

To begin crypto trading, you must deposit fiat currency into your Luno wallet. Supported fiat currencies include NGN, ZAR, IDR, MYR, EUR, and GBP, among others across Europe & emerging markets.

Luno uses trusted payment partners to enable low-fee deposits through bank transfers and credit/debit card payments involving Visa or Mastercard networks. Deposited funds show up immediately for trading into Bitcoin, Ethereum, or other coins offered on Luno’s platform.

Hence, Luno smartly streamlines onboarding formalities allowing quicker access to cryptocurrency deals. The multi-currency wallet also grants flexibility to directly swap between currencies using the latest forex rates for convenience.

Key Features and Benefits

Luno aims to make crypto trading intrinsically easy through its cleanly designed web and mobile interfaces. New users are guided through simple step-by-step prompts to execute first purchases. The platform also provides free online learning resources about cryptocurrencies.

Supports top cryptocurrencies

Over 60 cryptocurrency trading pairs are offered on Luno including top coins like Bitcoin, Ethereum, XRP, Bitcoin Cash, and Litecoin paired against USD, EUR, GBP, ZAR among other fiat currencies.

Having market leading crypto assets creates abundant trading opportunities. Sell orders also get matched instantly with Luno’s built-in order book visible across the web and app.

Low trading fees and minimums

Competitive fees starting from just 0.1% per transaction make frequent crypto trading affordable. Minimum buy/sell amounts are also low at as little as $2 worth of crypto. So those new to digital currencies can test the waters cost-effectively.

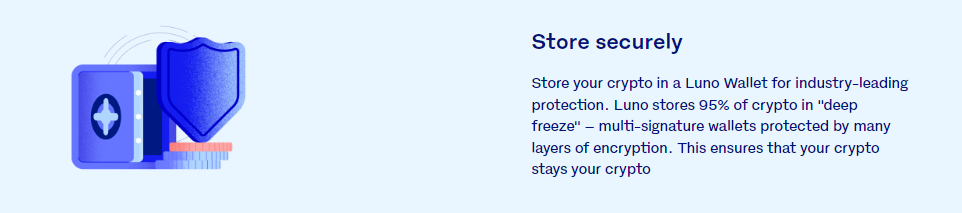

Secured cold storage wallet option

An exclusive Luno feature is its free multi-signature Bitcoin wallet allowing secured offline storage. By keeping private keys in cold storage, traders enjoy robust protection against online hacks with funds transferable anytime to Luno’s hot wallet for liquidity.

With both simplicity and flexibility as focus areas, Luno delivers an accessible yet full-featured platform to own and trade cryptocurrencies.

Now let’s evaluate Luno’s security implementation for customer asset protection…

Luno Security

Given crypto assets are highly liquid and removable, Luno employs best-in-class measures so customers trade worry-free without compromising account or wallet safety.

Two-factor authentication and validation

After login, all transactions and withdrawals require two-factor authentication through email confirmation or Google Authenticator codes sent to your phone. Address whitelisting also prevents mistaken transfers by ensuring crypto moves only to verified personal wallets initially saved by the account holder.

Majority funds in cold storage

For storage reliability, over 98% of all crypto funds are kept in Luno’s deep freeze cold wallets. These employ multi-signature protections and air-gapped protocols recognized industry-wide as the most hardened defense against breach of reserves.

Additionally, Luno secures policies with leading insurers to cover user funds across crime, theft and hack scenarios. This protects against financial loss in the rare cases of security incidents disrupting asset recovery.

Insurance coverage for asset loss

By mandate, Luno undergoes routine audits to prove custodied asset figures match user balances on its platform. Multiple layers of preventative controls and insurance give peace of mind for customers to build their crypto portfolio.

Now that we’ve seen Luno checks the boxes on security, how does its availability look across global markets?

Is Luno Regulated?

When assessing a cryptocurrency platform, checking its regulatory standings across target markets offers an integrity gauge before sharing personal data or funds. On this count, Luno upholds licensed provider status across multiple regions.

Specifically, Luno entities have secured registrations with appropriate financial authorities in Australia, France, Indonesia, Malaysia, Nigeria, Singapore, South Africa, and Uganda. These registrations classify Luno as a regulated digital asset/crypto service provider for buying, selling, and transferring cryptocurrencies within stated jurisdictions.

For example, Luno Malaysia is registered as a Recognized Market Operator under the country’s Securities Commission. Similarly in the United States, Luno’s services are offered by Luno US, Inc. which holds a money transmitter license and money services business registration at the federal level.

Maintaining these jurisdictional licenses and corporate registrations enables Luno to provide regulated crypto exchange services while meeting compliance standards set by local regulatory bodies.

Read also! Luno vs VALR

Customer Service

An exchange stands and falls based on its customer support, as crypto traders need assistance handling assets or navigating platform tools especially early on.

Luno offers email support, detailed FAQs, and active community forums for queries. Customers highlight quick, courteous responses from agents signaling dependability. If stuck on a process like identity verification, Luno’s in-app/email support guides users smoothly with the next steps.

Luno Reviews

Across third-party sites, over 15,000 Trustpilot ratings averaging 4 out 5 stars demonstrate predominantly satisfied experiences.

Though some early reviews flagged account blocks, recent testimonials show streamlined compliance processes for legitimate traders. Repeated security and functionality upgrades also manifest in praise.

Regionally, Luno garners favourable feedback, especially from African traders who highlight support for local transaction methods. Acclaim also comes from Southeast Asian customers who faced no hurdles or hidden charges depositing/withdrawing via online banking or e-wallets.

Overall, simpler onboarding, reliable functionality for trading, holding and moving crypto assets coupled with dedicated customer assistance makes Luno a credible exchange – even for non-tech savvy beginners across global markets.

Conclusion

So in summary of this review – Does Luno make the cut as a recommended mainstream cryptocurrency exchange? With over 8 million customers globally and licensed operations across Europe, Asia and Africa, Luno seems to have the credentials stacked in its favor.

Pros:

- Robust measures protecting account, wallet, and stored asset safety

- Localized offerings and support catering to 40+ countries

- Smooth sign-up, convenient payments, and assistance for newcomers

- Low, transparent fees and order book matching

Cons:

- Limited available cryptocurrencies compared to some exchanges

- Not immediately accessible across a few states in the USA including New York, West Virginia, Nevada, Texas, and Hawaii where Luno does not currently provide money transmission services.

Regulations continue evolving across states. But Luno US, Inc. commits focus here with availability in 45 other states upholding compliance standards.

Considering its accessible and secure crypto trading ecosystem tailored for global retail and newcomers, Luno ticks the boxes to recommended status for those seeking their first cryptocurrency exchange or an alternative platform to efficiently buy, sell and hold digital assets. As global crypto adoption accelerates, expect enhanced offerings and supported territories from the Luno brand.

FAQs

- Is Luno safe to use?

Yes, Luno employs multiple security layers including cold storage, address whitelisting, two-factor authentication, and data encryption to protect user assets and information to industry standards. It also secures insurance coverage against crime or hacks.

- What are Luno’s trading fees?

Luno charges competitive trading fees starting from just 0.1%. There are customized fee schedules for each supported fiat/crypto trading pair outlined in its fees guide, with discounts based on 30-day volumes.

- Does Luno have an integrated crypto wallet?

Yes, Luno offers a free multi-signature Bitcoin wallet leveraging advanced cryptography for account holders. It facilitates secured offline storage with funds always retrievable to Luno’s hot wallet supporting active trades.

- What countries does Luno operate in?

Headquartered in London, Luno is available across 40 countries in Europe, Southeast Asia, and key African crypto markets. It secures necessary licenses to comply with local regulations regarding digital asset services.

- Can beginners easily use Luno?

Yes, Luno prioritizes simplicity targeted at mainstream adoption. From intuitive web/mobile design to guided onboarding procedures and responsive customer support, Luno simplifies crypto adoption even for complete beginners starting their trading journeys.