FBS is an international online brokerage offering forex and CFD trading services to over 27 million clients globally. Headquartered in Cyprus, they have established themselves as one of the most recognized retail trading brands worldwide.

In this detailed review, we provide an in-depth look at FBS, evaluating its background, regulation compliance, trading conditions, safety features, and customer satisfaction. The goal of this FBS broker review is to help traders understand what FBS brings to the table and determine if it’s a recommended choice as a Forex broker.

Company

FBS was founded in 2009 by a group of industry professionals with prior experience at leading forex brokers. The company is now headed by FBS Markets Inc. and has its headquarters in Limassol, Cyprus (Arch. Makariou III & Vyronos, P. Lordos Center, Block B, Office 203).

Over its 13+ years of operations, FBS has expanded to serve more than 27 million clients in over 150 countries.

As an award-winning broker, FBS has over 90 industry recognition honors from well-regarded outlets like Global Brands Magazine, European CEO Awards etc. It is also the Official Principal Partner of Leicester City Football Club since 2016 underscoring global ambitions.

However, FBS services are NOT accessible to clients in regions such as Canada, USA, Israel, the Islamic Republic of Iran, Myanmar, Turkey, Brazil, and Sudan primarily for regulation compliance reasons imposed by company policy or local laws. They continue building more localized offerings for such markets.

With over a decade of operations, multiple international licenses, a steady expansion strategy, and the absence of any major investor complaints against license withdrawal or fraudulent activities – FBS demonstrates the hallmarks of a reliable and recommended forex broker as evaluated in this FBS broker review.

Pros and Cons

Analyzing the overall offerings of FBS, some of the key advantages are:

| Pros | Cons |

|---|---|

| ✅ Competitive spreads (0 pips) and high leverage (up to 3000) | ⚠️ Not explicitly regulated in every country of operation |

| ✅ Well-regulated globally, including CySec license | |

| ✅ No commissions or hidden fees | |

| ✅ Advanced MT4 platforms supported | |

| ✅ Wide range of funding methods without transaction fees | |

| ✅ Superior educational resources for novice traders | |

| ✅ 24X5 live multilingual customer support | |

| ✅ Ability to trade stocks, crypto, and indices |

The positives of regulation compliance, platform features, and customer service appear to outweigh most limitations as per existing trader feedback.

As we go deeper into this review and look into areas like trading fees, regulations, and platform features – we’ll see that FBS checks several boxes in terms of services and credibility. But how good are the actual trading conditions it offers clients? We analyze next.

Trading Conditions

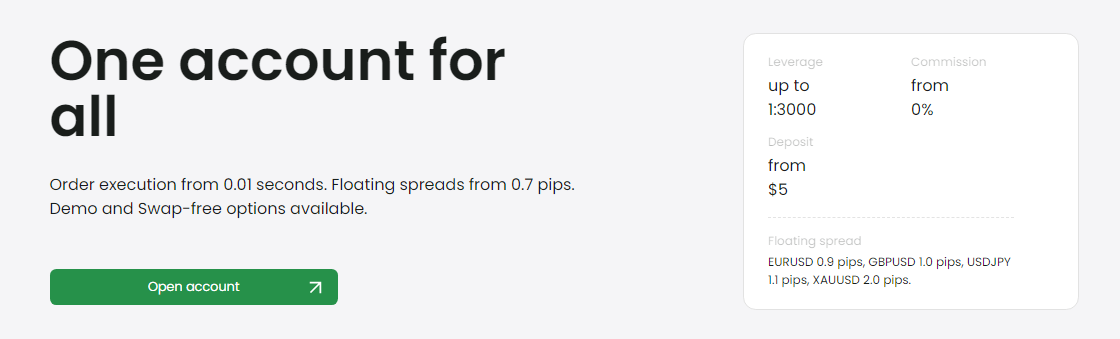

FBS offers 3 main account types suitable for traders of all skill levels – Cent, Standard and Zero Spread. The minimum deposit starts from $1 and the maximum leverage offered is up to 1:3000.

Traders can choose from a wide range of funding methods for deposits and withdrawals including Wire Transfers, Debit/Credit Cards, e-wallets like Neteller, and more. No fees are charged on transactions.

Average spreads on Standard account starts from 1.2 pips on EUR/USD which is quite competitive. The lowest spreads are offered under the Zero Spread account starting from 0 pips during high liquidity hours. Swap fees and other hidden commissions are also not applied.

In terms of learning resources, FBS provides educational materials under FBS Trading Academy covering basics, analytics, webinars and more.

Safety & Security

Under its regulatory purview, FBS segregates client funds from its own capital separately at reputable global banks. This ensures full protection even in highly unlikely cases if the broker goes bankrupt.

For data security, FBS deploys the latest 256-bit SSL certificates for full data encryption on its website, alongside two-factor authentication. Also, site authentication (Extended Validation certificates) and data encryption algorithms are implemented to provide privacy of customer information.

Compliance to strict protocols under regulatory agencies like CySEC (Know Your Customer, Anti-money laundering requirements) also offers a high degree of trust and transparency.

FBS has also earned a reputation among the trading community of being a highly reputable broker due to the timely processing of withdrawal requests, quick customer issue resolution, and overall transparent operations.

The measures taken by FBS ensure funds, personal information and securities of traders remain protected while maintaining a seamless trading experience.

Regulation

FBS takes legal compliance and regulation seriously as it ensures trader safety and builds trust. FBS is regulated by two tier-1 regulators:

- Cyprus Securities and Exchange Commission (CySEC) – CySEC certifies FBS operations including client fund segregation and financial reporting comply by strict European Union standards.

- International Financial Services Commission (IFSC) Belize – The IFSC license further authorizes FBS to legally offer online trading across multiple jurisdictions globally under stringent supervision criteria.

By obtaining licenses from globally recognized regulators in EU and Belize, FBS remains compliant across different countries providing traders assured security regardless of their location and local regulation terms. Mandatory practices like periodic audits and maintaining capital adequacy ratios are followed conservatively underscoring their commitment to principles of ethical trading.

Between multiple licenses and highest encryption measures adopted for payments and data, traders at FBS can remain fully confident of both fiscal accountability and information safety at all times.

Trading Platforms

FBS grants clients access to the globally popular MetaTrader suite of platforms – both MT4 and MT5. These advanced trading platforms allow traders to analyze markets, access charts and trading tools, execute orders and implement diverse trading strategies.

The proprietary FBS platform is also available for beginners starting out with simpler tools for order execution. Alongside desktop platforms, FBS also offers free mobile apps for iOS and Android granting access to accounts while on the go. Seamless sync across devices is enabled.

The range of platforms cater to both advanced and starter traders. One advantage is that the MT4/5 platforms allow smooth transition for traders moving from other brokers. The desktop and mobile apps also facilitate convenient trading analysis and execution from anywhere globally.

Account Types

FBS offers three primary account plans suitable for beginner to expert traders alike – Cent, Standard and Zero Spread account. The starter Cent account has minimum deposit of $5, 1000:1 leverage ratio and fixed spreads from 3 pips.

The Standard Account allows leverage upto 1:3000, variable spreads from 1 pip and minimum deposit ranges $100-500 depending upon funding method. The premium Zero Spread account offers raw spreads from 0 pips during high liquidity periods along with high 1:3000 leverage.

The tiered account structure guarantees traders have the flexibility to choose account parameters aligned with their capital capacity, risk appetite, and trading strategies from a regulatory-compliant broker.

Cryptocurrencies

For traders interested in crypto assets, FBS now offers CFD trading on leading cryptocurrencies including Bitcoin, Ethereum, Litecoin, Ripple and more. Crypto/Crypto and Crypto/Fiat pairs are available allowing speculation on crypto price movements.

Leverage of up to 1:5 is permitted on crypto CFD positions. Spreads are competitive starting from just 30 points on certain pairs. Swap-free accounts are also available for Islamic crypto traders per Sharia principles.

With the new crypto trading product suite, FBS traders can now diversify their portfolios beyond forex and indices to include the high growth crypto market while still accessing robust trading platforms, analytics and tight spreads.

Fees

One of the standout aspects of FBS is highly reasonable fee structure. Trading forex, stocks, crypto or indices incurs zero commissions and no hidden charges. Accounts can be opened with minimum deposits ranging $5 to $500 depending on type selected.

Raw spreads are among the lowest in industry starting from 0 pips on premium account during high liquidity periods. Swap fees are not charged allowing easier long term positions holding.

Deposits via Wire Transfer, Credit Cards, popular e-wallets, etc. do not incur processing charges either facilitating easy funding. FBS derives mainly from spreads rather than nickle and diming clients on other fees leading to overall lower costs.

Customer Support

FBS prioritizes customer satisfaction by providing dedicated multilingual support 24 hours 7 days a week via Phone, Email, and Live Online Chat interaction.

Support reps are well trained in troubleshooting technical platform issues, assisting on trading questions, guiding on deposits/withdrawals, and resolving account queries. Queries are typically addressed within minutes assuring seamless experience.

Such responsive customer support coverage beyond just market hours builds additional trust and ensures trader issues never hinder one’s ability to seize timely trading opportunities whenever they may arise in the global markets.

FBS Review – Conclusion

Based on this comprehensive and detailed FBS review across multiple aspects, we rate FBS as an excellent and recommended online brokerage.

FBS is ideally suited for beginner and advanced traders seeking forex, stocks, crypto, and indices trading given competitive spreads from 0 pips, option of high leverage, and free educational resources that facilitate efficient trading decisions.

With the ability to trade a wide range of asset classes from a single account, FBS caters well to veterans and novice investors alike. Overall, FBS checks all the boxes in terms of security, platform capabilities, dedicated customer support and ethical operating practices expected from industry-leading brokers.