When it comes to robo-advisors, two main contenders tower above the rest – Wealthfront and Betterment. But which financial giant should serve your nest egg? Before you hand over your hard-earned cash, read our full comparison that covers fees, security, support, and exclusive features.

Wealthfront vs Betterment: Quick Comparison

Trying to choose between these top robo-advisors? Learn the essential details from this quick overview before going into more detail.

| Aspect |  |

|

|---|---|---|

| Founding Year | 2011 | 2008 |

| Account Minimum | $500 | $0 (Digital), $100,000 (Premium) |

| Management Fees | 0.25% annually | 0.25% annually (Digital), 0.40% annually (Premium) |

| Human Advisor Option | No | Yes, with Betterment Premium (0.40% fee) |

| User Base | Over 500K | Over 800k |

| Financial Planning Tools | Free automated financial planning | Goal-oriented investing, visual progress tracking |

| Security Measures | SIPC coverage up to $500,000 | SIPC coverage, excess SIPC insurance for additional protection |

| Portfolio Construction | ETF-based, stock-level tax-loss harvesting | ETF-based, automatic rebalancing, tax-loss harvesting |

| Accessibility and Features | More emphasis on automation and tax strategies | Goal-oriented approach, human advisor option |

| Fee Structure | Uniform fee of 0.25% | Digital plan (0.25%), Premium plan (0.40%) |

| Account Types | Various account types, including trusts | Traditional, Roth, SEP, & rollover IRAs, joint accounts |

Now that you understand the basics, let’s talk about what matters to you and figure out which approach suits you best!

Background

What is Wealthfront?

Wealthfront is an automated digital wealth management platform empowering hands-off investing through powerful algorithms. The company was originally called KaChing – not exactly a confidence-inspiring brand.

Founded in 2011 by Andy Rachleff, Dan Carroll, and Jeff Lu, Wealthfront aimed to open robust money optimization normally only accessible to the ultra-wealthy up to everyday folks.

Headquartered in Silicon Valley, Wealthfront’s set-it-and-forget it financial autopilot approach plus next gen tech advantages like direct indexing tax-loss harvesting quickly resonated. Today, Wealthfront boasts over 700,000 users entrusting over $50 billion in assets under management.

Through its slickness and specialization, this disruptive upstart has cemented itself as a top fintech innovator. But can flashy new tech overtake pioneering vision?

What is Betterment?

Betterment – the OG robo-advisor that boldly declared software could manage money far better than the vast majority of human advisors while costing a fraction of outdated fees. Launched in 2008 by Jon Stein and Eli Broverman, Betterment became the first to fully automate key investing activities through algorithms.

Based in NYC, Betterment now serves over 800,000 customers with nearly $40 billion in assets under management as of November 2023. Beyond baseline digital management, Betterment’s Premium plan opened access to human CFP pros – a differentiator setting it apart.

So while Wealthfront packs cutting-edge advancement, Betterment boasts the wisdom, stability and name recognition that comes from trailblazing.

Accounts Types

When you’re thinking about investing, having different types of accounts can be really important, especially for retirement. So, which robo-advisor, Wealthsimple or Wealthfront, offers the most varied account options? Let’s compare and see what each has to offer!

Wealthfront Account Types

- Individual Accounts: Ideal for personal investments, these accounts are taxable, and Wealthfront uses strategies like tax-loss harvesting to optimize returns.

- Joint Accounts: Designed for two or more people, joint accounts allow multiple individuals to invest collectively and share ownership.

- IRA (Individual Retirement Account): Wealthfront provides Traditional, Roth, and SEP IRAs, offering tax advantages for retirement savings.

- Trust Accounts: Trust accounts are suitable for managing wealth that you intend to pass on to beneficiaries, offering flexibility and control.

- 529 College Savings Plans: Tailored for education savings, these plans offer tax advantages when used for qualified education expenses.

- Business Accounts: Wealthfront offers investment solutions for small businesses, including SEP IRAs, which provide retirement benefits for employees.

Betterment Account Types

- Individual Cash and Investment Accounts: The classic, open-to-all account. Whether you’re saving for a rainy day or investing for the future, this is where you start.

- Joint Accounts: Just like Wealthfront, Betterment lets you invest with a partner or family member. It’s a shared account, simplifying your financial journey together.

- Traditional IRAs: Again, the tax-deferred retirement account. Contributions may be tax-deductible, and you pay taxes on withdrawals in retirement.

- Roth IRAs: Post-tax contributions for future tax-free withdrawals. It’s like planting a tax-free money tree for your retirement.

- SEP IRAs: Betterment caters to the self-employed or small business owners too. Simplified Employee Pension Individual Retirement Account for tax-deductible contributions.

- 401(k) Rollover: Roll over that old 401(k) from your previous job into a Betterment IRA. Keep it all together and keep it growing.

Winner – Wealthfront

Wealthfront clinches the win in this section for 3 key reasons. While Betterment is an excellent choice, Wealthfront’s attention to detail in tax strategies, the inclusion of a free planning tool, and the innovative Portfolio Line of Credit make it the slightly more enticing option in this comparison.

Financial Planning Approaches

When it comes to mapping out your money moves, Betterment and Wealthfront take differing approaches to financial planning.

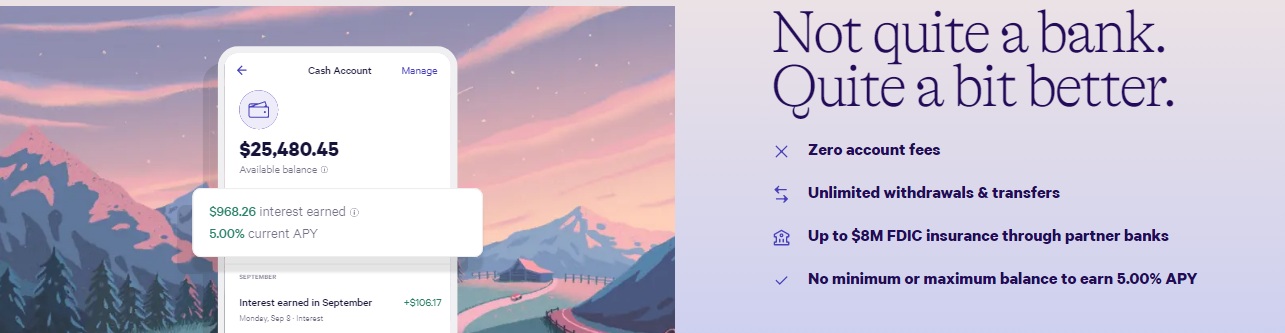

Betterment

Taking Betterment first, a key piece of their financial planning process is setting customized goals like saving for retirement or a downpayment. For example, if you’re 35 and want a $500k retirement fund by age 65, Betterment calculates your target contribution, expected investment returns at various risk tolerances, and how much you’d have in 30 years. The projections update over time to keep you on track. This goal-oriented planning really motivates you.

Wealthfront

Wealthfront approaches planning differently. Rather than future goals, their focus is optimizing all of your current assets holistically – accounts, risk levels, taxes, etc. So for example, Wealthfront would automatically analyze if you should contribute to a traditional or Roth IRA based on your income tax bracket. Or they may recommend allocating some funds to an emerging market stock ETF to balance risk. It’s about fine-tuning behind the scenes.

Regarding returns, historical performance has typically been around 8% per year for both after fees, quite consistent with overall market benchmarks for the robo-advisor space.

So, who’s the winner in this financial planning showdown?

Winner: Betterment

If I had to choose one, I think more investors would resonate with Betterment’s goal-based planning approach as it is more personalized to your dreams. Seeing projections tied specifically to when I want to retire or buy a house gives me more motivation and confidence in how I’m investing. The automation of Wealthfront is great but feels more detached from my bigger financial aims. So if choosing, Betterment gets the slight edge for putting my goals first while still providing automation.

Fees Comparison

Let’s now talk money – the fees, to be precise. Let’s assume you’re opening up a Betterment or Wealthfront account with that standard $500 minimum investment.

Betterment

With Betterment, you’ll pay a flat 0.25% annual fee no matter if you invest $500 or $50,000. So every year, you’ll pay 0.25% of whatever amount you have invested. If you put in $500 bucks, 0.25% of that is roughly $1.25 per year in fees. If your account grows to $5,000 over time, 0.25% would equal about $12.50 that year. It stays at that 0.25% rate no matter what.

Wealthfront

With Wealthfront, that $500 account would also start off paying 0.25% annually since you’re under $10,000 in assets. Same math – 0.25% of $500 is $1.25 per year paid in fees. But as your account grows over $10k, $25k, etc., the fees decrease. Above $100k invested, Wealthfront drops to just 0.15% yearly. So bigger portfolios pay less in dollar amounts for fees.

Winner: Wealthfront

At the end of the day, costs come out fairly even in my book. But if going on fees alone, I think Wealthfront edges out Betterment. The ability to get to a 0.15% fee means larger portfolios can save money versus Betterment’s 0.25% flat rate for all assets. So Wealthfront wins on fees due to the savings for bigger accounts.

Security

When it comes to the security of your money, both Betterment and Wealthfront provide solid protection that gives peace of mind:

Betterment

For Betterment, security of your money and data is ensured through SIPC insurance protection, FDIC pass-through insurance, two-factor authentication, and encryption. Specifically, your investment assets are covered up to $500,000 per account by the Securities Investor Protection Corporation (SIPC) if anything happens to Betterment’s broker, Apex Clearing. Any cash in your Betterment checking or savings accounts is also insured by the FDIC up to $250,000 through partner banks via pass-through insurance. This protects your deposits if the banks fail.

In terms of account security, Betterment requires two-factor authentication through text or Google Authenticator when logging in, meaning you need to enter unique codes from your phone for extra login protection. Their website and mobile apps also use sophisticated SSL encryption to prevent any personal information from being intercepted.

Wealthfront

Regarding Wealthfront’s protections, your invested assets are covered by SIPC insurance up to $500,000 per account through Wealthfront’s broker, DriveWealth. Cash deposits also receive FDIC coverage through partner banks up to the standard limit, just like Betterment. For account login, Wealthfront has two-factor authentication using text messages or authentication apps as well. They also employ encryption measures on their digital platforms too.

Winner: Betterment

Between the two, I’d say Betterment may have a slight edge in security assurances. They are a dedicated registered investment advisor with a fiduciary duty to clients. Wealthfront calls client support “backline” staff while Betterment has licensed financial experts. This may inspire more trust for some.

But essentially you can’t go wrong with either for robust protection of your money and personal data through insurance, authentication standards and responsible service teams. If I had to pick one, I’d go with Betterment since their focus as advisors puts extra emphasis on security. But only by a little bit over Wealthfront.

Customer Support

Knowing how Betterment and Wealthfront handle customer support is important before entrusting them with your money! Let me break down how they compare:

Betterment

Betterment customers get support from financial advisors if they upgrade to the Premium level ($100k minimum), otherwise, you get “specialists”. These specialists seem excellent though from reviews – suave on phone, quick online chat assistance 24/7, and detailed email responses within 24 hrs usually. Support guides customize portfolios upon request too.

Wealthfront

Wealthfront users get support from what’s called “client service” or “backline” teams rather than “advisors” or “specialists.” While less fancy in name, assistance still appears quick (online chat, phone, email) and knowledgeable like Betterment from the reviews we have seen. Some say not as personalized, but solid.

Winner: Betterment

Between typically speedy, competent assistance, you can’t go too wrong with either in my book. Yet when picking just one, I’d give the slender win to Betterment. Why? Well, because having that direct line with phone support is like having a financial buddy on speed dial. Sometimes, you just want to hear a friendly voice when you have questions about your money matters.

Wealthfront is solid, especially with their thorough Help Center, but the personal touch of being able to call up Betterment tips the scales. So, in the customer support showdown of Wealthfront vs. Betterment, Betterment takes the trophy for being the one you can reach out to with a simple phone call.

Special Features

When it comes to special features, both Betterment and Wealthfront offer some unique bells and whistles beyond basic investment management:

Betterment

Betterment has retired CFP professionals available for unlimited one-on-one guidance if you upgrade to their premium plan (minimum $100k). This allows crafting customized financial plans for your specific needs outside just investment allocation. Nice for more holistic guidance.

Wealthfront

Wealthfront focuses more on advanced investing features as their special sauce. They provide automated tax-loss harvesting, which sells losing assets to offset gains and save on taxes. For amounts over $100k, you get access to their Portfolio Line of Credit feature, letting you borrow against account assets at low rates for big purchases.

Winner: Wealthfront

In the end, I’m going to pick Wealthfront as the winner for special features due to the advanced investing functionality. While Betterment’s advisor access is great, I think automated tax-loss harvesting and the PLOC options enable a more sophisticated strategy. The hands-off, set-it-and-forget-it approach with impactful behind-the-scenes optimization gives Wealthfront the edge here.

Take Away

While both Wealthfront and Betterment deliver on the core robo-advisor premise of automatized, affordable investing, Betterment clinches the win by a nose when all the evidence is weighed. Their personalized financial planning focus and dedication as trusted registered advisors give them a slight but meaningful edge.

Yet Wealthfront remains a solid choice for those seeking automated tax strategies and portfolio optimization above all. When the bell rings, Betterment stands victorious – but only by a split decision. So, whether you pick Wealthfront’s automation or Betterment’s personal touch, you have a winner in your corner.

Read also! Wealthsimple vs Wealthfront