What are meme stocks? If you’ve ever been curious about those buzzworthy “meme stocks” that seem to be shaking up the financial world, you’re in for a treat.

In this article, we’re going to break down what meme stocks are, their origins, and whether they’re worth investing in now. We’ll also provide a list of the 7 hottest meme stocks in 2024 that you should keep an eye on.

What are meme stocks?

Meme stocks refer to company shares that have become popular internet sensations, often due to viral online discussions and memes shared across social media platforms. These stocks tend to have a dedicated community of retail investors who drive massive buy-ins, causing sudden and dramatic price surges.

Social media and online forums like Reddit’s WallStreetBets subreddit play a crucial role in fueling the meme stock phenomenon. Users share investment tips, memes, and coordinate buying efforts, creating a frenzy around certain stocks that can lead to meteoric rises in their prices.

Retail investors, or individual traders, are the driving force behind meme stock rallies. Unlike institutional investors, retail investors often prioritize online hype and community sentiment over traditional financial metrics when making investment decisions, leading to unconventional and highly volatile trading patterns.

When did meme stocks start?

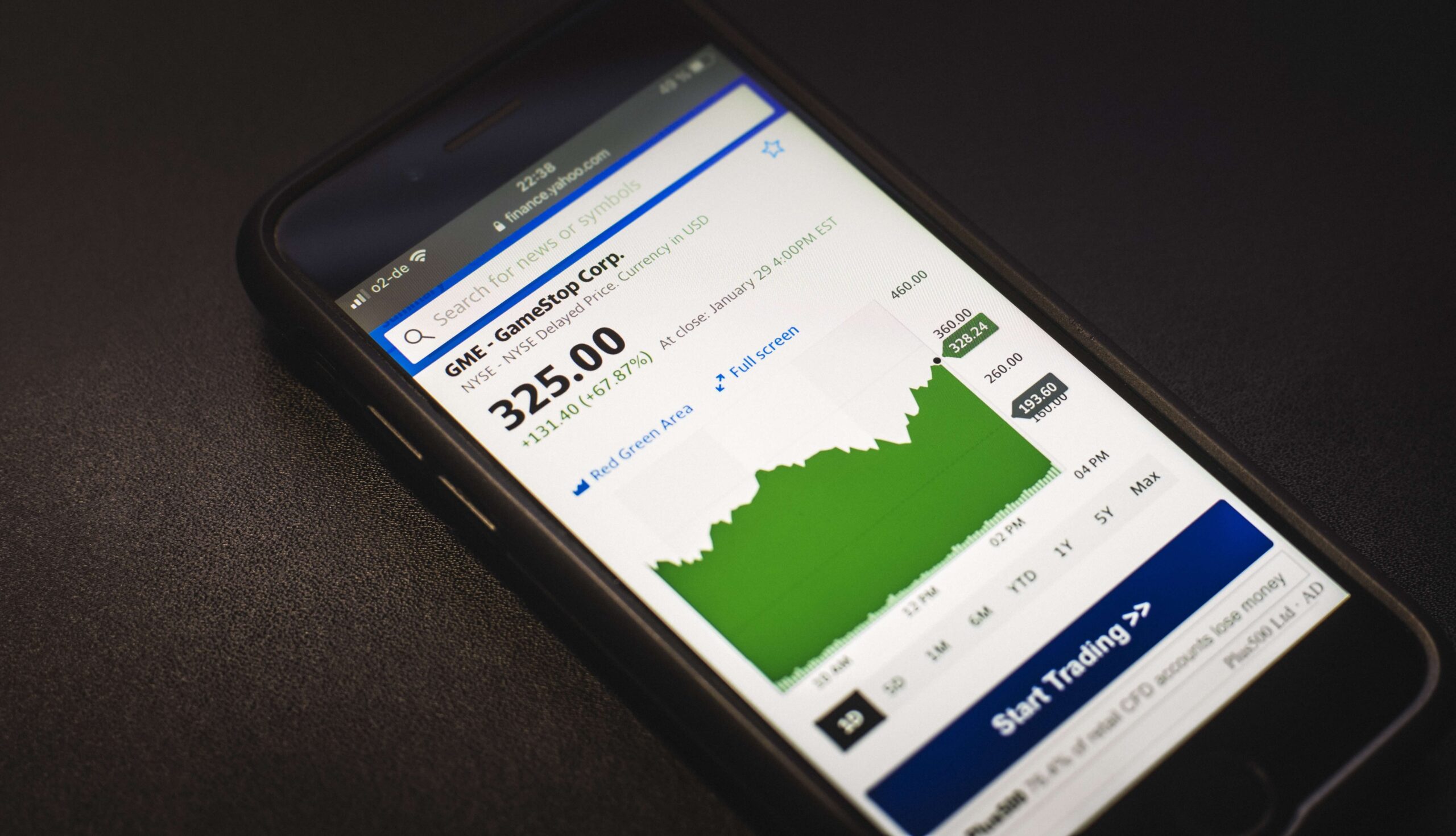

The meme stock craze truly kicked off in January 2021 with the GameStop saga. A group of retail investors on Reddit forum r/wallstreetbets banded together to drive up the share price of the struggling video game retailer, causing massive losses for hedge funds that had shorted the stock.

The WallStreetBets subreddit, with its growing community of amateur traders, became the epicenter of the meme stock movement. Users shared investment tips, memes, and coordinated buying efforts, amplifying the hype around certain stocks and fueling unprecedented price rallies.

Following the GameStop frenzy, other companies like AMC Entertainment, BlackBerry, and Nokia also experienced meme stock rallies in 2021 and 2022. These events caught the attention of regulators and sparked debates about market manipulation and the power of social media in driving investment trends.

The GameStop Phenomenon: A David vs. Goliath Tale

Cast your mind back to August 2020, when a YouTube video by Roaring Kitty (a.k.a. Keith Gill) went viral. He outlined why GameStop Corp.’s stock had the potential to soar, sparking interest in the trading community.

The video highlighted the stock’s vulnerability to short bets, especially by hedge funds.

A few months later, former Chewy.com CEO Ryan Cohen made a massive purchase of GME stock, a move that ignited a chain reaction.

Fast forward to January 2021, Cohen’s entry into the company’s board led to an explosive surge in the stock’s value.

The concept of a short squeeze, as predicted by Roaring Kitty, came to fruition, causing the stock price to soar to near $500.

Hedge funds faced heavy losses, and the narrative of meme stocks gained a “David vs. Goliath” twist.

Intriguing, isn’t it?

But the first hype about meme stocks is long gone. So does it make sense to buy meme stocks in 2024?

Is it worth buying meme stocks now?

Are we still in the digital gold rush? Ultimately, there’s no one-size-fits-all answer to when to invest in meme stocks.

Meme stocks are inherently risky and volatile investments. These stocks can skyrocket or plummet in value within a matter of days or even hours, driven more by online hype and speculation rather than company fundamentals.

There are contrasting perspectives among analysts on whether meme stocks present worthwhile opportunities in 2024. On one hand, Stephen Ethan of MarketsXplora argues;

“Meme stocks are purely speculative plays with no real underlying value. Investing in them is akin to gambling, and the odds are stacked against retail investors.”

However, Jim Cramer of CNBC takes a more optimistic view, stating;

“While risky, meme stocks can offer quick gains for nimble traders who know when to get in and out.”

So if you’re considering buying meme stocks, it’s crucial to approach them with extreme caution and a thorough understanding of the risks involved.

Best time to buy meme stocks?

Some new investors may wonder, when should I buy meme stock?

For meme stocks, there is no defined “appropriate time” to buy, as their price movements are often highly unpredictable and driven by social media hype rather than traditional fundamentals. However, some general advice from analysts includes:

- At the beginning of a meme stock rally: This is considered the riskiest entry point, as you are buying into the initial hype before knowing how high the stock may climb or how quickly the rally may fizzle out.

- After an initial surge: Some investors prefer to wait and see if a sustained rally develops before buying in, though this means potentially missing out on the largest gains.

- On pullbacks: Others look for dips or consolidation periods within an ongoing meme rally to try and buy at relatively lower prices before the next potential upswing.

- After the peak: The least risky but often least rewarding approach is to wait for a meme stock frenzy to cool off completely before considering an entry, based on fundamental analysis of the company.

Ultimately, given the speculative nature of meme stocks, there is no definitively “right” time to buy. Careful risk management, position sizing, and being prepared for volatile swings in either direction is crucial whenever trading these social media-driven phenomenons.

Which meme stocks to buy in 2024?

Below are the meme stocks 2024 to consider:

- Wall Street Memes (WSM): Social trends transforming the stock market

- GameStop (GME): From video game retailer to meme stock icon

- Nvidia (NVDA): The world’s leading chip designer

- AMC Entertainment (AMC): The cinema giant is being revived by the phenomenon of meme stocks

- Bed Bath & Beyond (BBBY): The homewares retailer is fueled by the meme wave

- Rivian (RIVN): The US electric car manufacturer

- Virgin Galactic (SPCE): The company specializes in commercial space travel

Wall Street Memes (WSM)

This is where the traditional financial world meets digital culture. WSM, an icon of this intersection, has shaped the financial landscape in a previously unthinkable way and has developed a lively community (with almost 1 million followers on all social media channels) for years.

WSM’s rise to a meme stock was a testament to the power of digital ascension. Elon Musk has already interacted with the platform, which has certainly helped the upswing in part and ensured that Wall Street memes have risen to the “big players”.

GameStop (GME)

GameStop (GME), a traditional video game retailer, experienced a sudden and dramatic rise in its stock price that drew global attention. Against the growing number of digital games, GameStop suddenly found itself at the center of an unprecedented stock market move. Over 1,400% — a return that GameStop hasn’t matched in its best days, shows the possibility of the meme movement.

As GameStop’s stock soared, the once-clear distinction between retail investors and Wall Street professionals began to blur. The rise of GME highlighted the potential for small investors acting collectively to influence the market.

GameStop’s transformation into a meme stock was a spectacle that had the financial world in suspense. Led by users of the Reddit forum r/WallStreetBets, GameStop became the face of a new movement that sought to challenge the dominance of Wall Street institutions.

Nvidia (NVDA)

With a market cap now at $2.283 Trillion as of May 2024, Nvidia is well on its way to becoming a large-cap with a trillion-market cap. In the past week, the Nvidia share jumped by 25% – the reason: the quarterly figures were above expectations, the sales outlook was raised massively.

As the world’s leading chip designer, the US company is of course not a real meme stick. In a market environment shaped by AI, investors are still hyping the stock. Some price jumps are reminiscent of the volatile price development of meme stocks.

Read also: What are the Best AI Stocks to Buy Now in 2024?

Anyone who considers such hype potential with real substance attractive can take a look at the Nvidia share. But beware: Should the valuation continue to rise, there will also be a correction here at some point. Similar to meme stocks, this should also proceed with serious deductions.

AMC Entertainment (AMC)

With movie theaters shutting down around the world due to the pandemic, the company was on the brink of bankruptcy. But a wave of retail investors, fueled by social media hype, rushed to rescue the company and sent shares skyrocketing — nearly 300%.

This unexpected resurrection was not brought about by a drastic change in business processes or an economic boom, but by an army of individual investments that rallied behind the ailing company, showing once again the power of social media hype.

Bed Bath & Beyond (BBBY)

Bed Bath & Beyond (BBBY), an established retailer specializing in homewares, has found itself in the odd position of becoming meme value. A company is usually appreciated for its retail outlets.

From its humble beginnings as a home goods retail store, BBBY has been thrown into an investment frenzy. This unexpected turn was prompted by the collective actions of an online community that focused their attention and resources on the company.

What sparked this sudden interest in BBBY? The company’s rise as a meme stock, like other meme stocks, was a product of online hype rather than traditional financial metrics.

Rivian (RIVN)

While stocks have actually been developing solidly in 2023 to date, the Rivian share has lost around 13% of its value year-to-date. The US electric car manufacturer, best known for its longstanding, exclusive partnership with Amazon, wants a piece of the lucrative e-mobility market.

While global manufacturers are lowering their prices and paying tribute to increasing competition, Rivian is sticking to its pricing policy. The ambitions are gigantic, but implementation is often lacking. But this is exactly the mantra of many meme stocks, with which Rivian could well rise to Tesla 2.0 in the eyes of risk-taking investors.

JIM CRAMER IS BULLISH ON RIVIAN $RIVN

Inverse Cramer Tracker’s $SJIM trade activity from today 5/12

Buys = Cramer is bearish

Sell Short = Cramer is bullish pic.twitter.com/dKQ205HbVt— THE MORNING SHOW (@CramerDaily) May 12, 2023

Virgin Galactic (SPCE)

Virgin Galactic is a company specializing in commercial space travel. This aims to make space tourism accessible to private individuals. The company develops spacecraft. Passengers have the opportunity to take short trips into space and experience weightlessness. Virgin Galactic aims to create a new era of space tourism and push the boundaries of commercial space travel.

Incidentally, in the current year, the Virgin Galactic share rose by around 15% and thus more strongly than the benchmark indices. However, a look at the past 365 days shows that the share price has halved. With a market cap of less than $1 billion, Virgin Galactic should continue to see explosive stock price action as market participants see spaceflight making its way into the mainstream.

Given the Nvidia valuations, I think it's worth sharing this anectode from the 2000s.

At its peak, the Sun Microsystems stock hit valuation of 10x sales.

When stocks took a massive beating later on, this is what its CEO Scott McNealy had to say to investors: pic.twitter.com/qOETfgtNa8

— Alf (@MacroAlf) May 25, 2023

Where to buy meme stocks 2024

Meme stocks are shares of publicly-traded companies, so investors can buy them through any mainstream stock brokerage platform or trading app in 2024, just like regular stocks.

Some of the most popular platforms for retail investors trading meme stocks include:

Robinhood – This free trading app gained notoriety during the GameStop saga for its accessibility to amateur investors. Its simple interface makes it easy to buy and sell meme stocks.

eToro – As a global leader in social trading and investing, eToro offers a range of meme stocks including GameStop, AMC, Rivian and others. Users can easily search for their favorite stocks, access relevant information, and execute trades with just a few clicks.

ETRADE – One of the largest online brokers, ETRADE offers advanced trading tools that can be useful for timing entries/exits on volatile meme stocks.

Fidelity – A classic full-service brokerage, Fidelity allows trading of meme stocks alongside research reports and professional guidance.

TD Ameritrade – Their thinkorswim platform provides in-depth data and analysis popular among active meme stock traders.

Webull – This mobile-focused app offers free stock/ETF trades and a social media-style feed for sharing meme stock ideas.

Charles Schwab – With branches nationwide, Schwab combines a user-friendly platform with personal support for those new to meme stock trading.

Additionally, most major banks like Chase, Wells Fargo, and Bank of America also offer online stock trading capabilities for meme stock investors in 2024. The key is selecting a platform that fits your experience level and trading needs when dealing with the extreme volatility of meme stocks.

Read also: Best Stock Apps 2024 in Comparison – Where to Buy Stocks via App?

Conclusion

In this article, we’ve taken a deep dive into the world of meme stocks – those company shares that have become internet sensations, driven by social media hype and the collective power of retail investors. From the GameStop saga that kicked off the craze to the ongoing volatility and unpredictability surrounding these stocks, it’s clear that meme stocks are a unique and fascinating phenomenon in today’s market.

However, as we’ve discussed, investing in meme stocks is not a decision to be taken lightly. These stocks can experience wild price swings that defy traditional market analysis, making them incredibly risky and speculative investments. That’s why it’s absolutely crucial to conduct thorough research beyond the online chatter, carefully evaluating factors like company financials, and long-term growth prospects before considering any meme stock investment.

At the end of the day, responsible investing practices should always be the priority. Only invest what you can afford to lose, set tight stop-loss orders, and maintain a well-diversified portfolio to mitigate the impact of any single meme stock’s volatility. While the potential for quick gains may be alluring, it’s important to approach meme stocks with caution and a level head, never letting the fear of missing out overshadow sound investment strategies.