FXTM is a global forex and CFD brokerage that has been in business for over a decade, FXTM has quickly grown into one of the most well-regarded brokers in the industry.

In this FXTM review, we will take an in-depth look at everything this broker has to offer traders.

Specifically, we will cover FXTM’s trading platforms, account options, funding methods, fees and commissions, customer support, and regulation. By the end, you should have a solid understanding of the broker’s key features and offerings to determine if they are the right fit for your trading needs.

Company

FXTM (ForexTime) is a globally regulated broker specializing in forex and CFD trading for both retail and institutional clients. Originally founded in 2011 and headquartered in Cyprus, FXTM has grown rapidly over the last decade to become a top trusted broker with over 1 million registered accounts worldwide.

FXTM is licensed and regulated across major financial centers including the UK, Cyprus, South Africa, and Mauritius while accepting clients globally. The broker is renowned for its speed of order execution, tight spreads, cutting-edge trading platforms, and excellent multilingual customer support.

We can now dive into the various offerings covered in this 2024 review that underscore FXTM’s strengths as an award-winning broker. First, we will explore the range of powerful trading platforms supported.

Trading Platforms

![]()

FXTM provides access to the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms developed by MetaQuotes. These advanced platforms allow for automated and custom indicator-based trading through Expert Advisors and technical analysis with a range of built-in tools and overlays.

For those who prefer simplicity, FXTM also offers a user-friendly web-based trading platform perfect for new traders, in addition to mobile apps for Android and iOS devices to support trading on-the-go. No matter your experience level or device preference, FXTM has an intuitive platform solution.

The availability of MT4, an industry standard in the retail trading space, along with flexible web and mobile apps really sets FXTM’s platform offering apart. These technologies help enable seamless trading across devices without sacrificing features for more advanced traders.

Account Types

FXTM offers three core account types to suit different trader needs and strategies.

Micro Account

- Minimum Deposit: $10/€10/£10

- Spreads From: 1.53 pips

- Commissions: Zero commission

The Micro account has the lowest minimum deposit making it accessible for all traders, including beginners. This account offers competitive variable spreads averaging 1.53 pips with no hidden commissions.

Advantage Account

- Minimum Deposit: $500/€500/£500

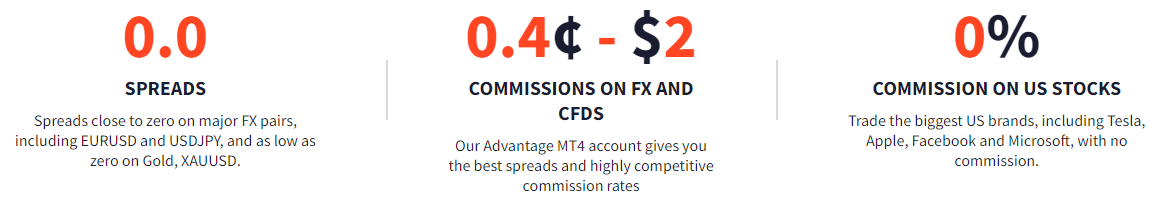

- Spreads From: 0.0 pips

- Commissions: Average of $0.4-$2 per lot based on volume. For crypto, average of $30-$150 per lot.

The Advantage account provides direct market access through the popular MT4/MT5 platforms with ultra-tight spreads from 0 pips. As an ECN model, a commission is charged per trade based on monthly trading volumes.

Advantage Plus Account

- Minimum Deposit: $500/€500/£500

- Spreads From: 1.5 pips

- Commissions: Zero

With spreads from 1.5 pips and zero commissions, the Advantage Plus account offers tight variable spreads balanced with an accessible $500 minimum deposit across FXTM’s range of platforms.

Demo Account

- Minimum Deposit: $0

- Spreads From: 1.53 pips

- Commissions: Zero

The Demo account allows new traders to try FXTM’s platforms and markets without risk before funding a live account. The range of live accounts suit different trading strategies based on spreads, commissions, and deposit requirements.

The account types suit different trading strategies and requirements around spreads, commissions, and deposits. Fortunately, FXTM makes it easy to upgrade between accounts as your experience develops.

Deposit and Withdrawals

![]()

FXTM supports a variety of convenient and secure payment methods for deposits and withdrawals. Minimum deposits start at just $10 across account types, making it easy to get started. Deposit options include credit cards, e-wallets like Skrill and Neteller, as well as bank wires and transfers. Most options have instant processing for quick access to trading funds.

Withdrawals are completed through the same methods, though payout speed can vary. E-wallet withdrawals are fastest at 24 hours while bank wires take about 5 days as expected given banking procedures. FXTM does not charge fees on deposits or withdrawals, allowing you to maximize your trading capital.

The broker certainly delivers flexibility and responsiveness when moving funds in or out of your trading account. By catering to a global client base, FXTM allows you to select the payment solutions you are most familiar with in your region.

Trading Fees and Commissions

As a forex and CFD broker, FXTM generates trade revenue through the spreads, commissions, and financing rates on trades. Spreads starting from just 0.1 pips across platforms make for competitive trade execution costs.

For accounts with commission pricing, range from $0.40 and $2 per 100,000 units with discounts for higher volumes. Inactivity fees do apply after 6 months of no trading, however these are avoidable and outlined clearly in the fee schedule.

It is worth noting that FXTM has no deposit or withdrawal fees, while spreads and commissions are well below industry norms based on our analysis. For active traders focused on tight pricing and transparency around fees, FXTM delivers.

Customer Support

FXTM commits significant resources into customer service with support teams available 24/5 in various languages. Communication channels include phone, email, and live chat for convenience.

Based on client reviews and our own experience reaching out, response times are prompt across these mediums showing FXTM’s dedication to supporting traders. For self-help resources, FXTM provides an extensive Education Center with eBooks, webinars, videos, and more to supplement their service offerings.

Between timely responses and trading education materials, FXTM does an excellent job of keeping clients informed. Their customer support should provide both new and experienced traders the assistance needed to thrive in the markets.

Regulation and Safety

FXTM holds regulatory licenses from top-tier jurisdictions like the UK’s Financial Conduct Authority (FCA) and Cyprus Securities and Exchange Commission (CySEC). These strict authorities oversee activities like client fund segregation and transparency reports to ensure the broker maintains high ethical standards.

FXTM further safeguards client deposits in top banks while keeping company funds separate. The broker also provides negative balance protection should markets see extreme volatility.

The focus on regulatory compliance and security of funds by FXTM instills confidence they operate safely and fairly. Traders can have peace of mind knowing their capital is secure and trading conditions transparent as enforced by major regulators.

Verdict – Is FXTM Legit?

Based on this FXTM review across key categories, we can safely say FXTM is a legitimate, ethical and recommended forex broker. As covered in our guide “Is FXTM legit?”, they check all the boxes of a well-regulated business with strong security measures and trading infrastructure.

Some key takeaways cementing FXTM as one of the industry’s top brokers include:

- Trusted global brand with over 12 years of market experience

- Cutting-edge trading platforms and analysis tools

- Competitive pricing with tight spreads/commissions

- Array of safety practices and top-tier regulations

- Efficient banking and multilingual customer service

Traders browsing forex broker options should strongly consider FXTM if wanting a reputable all-around solution.

Conclusion

To conclude this FXTM review, we can say that this is a well-established, trusted forex and CFD broker serving clients globally since 2011. Some of the key strengths covered include:

- Advanced MetaTrader platforms with desktop, web, and mobile access

- Account options fit for any experience level or trading style

- Competitive pricing with low spreads, fast execution

- Multilingual customer service available 24/5

- High security standards enforced by major regulators

FXTM is an excellent choice for beginning traders wanting education and simple platforms to sophisticated day traders needing fast pricing and order execution. The broker offers the tools and resources to meet most styles.

If ready to experience FXTM’s services yourself, visit their website to browse account types, market offerings, and open a risk-free demo account. Fund your live account when ready to unlock full trading capabilities across asset classes. With seamless account management, robust trading infrastructure, and helpful support – FXTM provides an ideal trading home to meet your needs.