In the hunt for your ideal trading partner to navigate markets? With so many brokers fishing for your capital – it’s wise to examine credentials closely before biting. This brings us to 15-year industry player AvaTrade now boasting over 400,000 clients. 🎣

This independent AvaTrade review will cover:

- Trading platforms and tools

- Account types offered

- Funding and withdrawal processes

- Cryptocurrency support

- Regulation and safety measures

- Fees for trading spreads, swaps

- Multilingual customer service

2024 AvaTrade Review

We’ll weigh up everything from tradable assets to inactivity charges. Cut through hype measuring what truly counts – from scalping Euros to Gold mining or even fretting about fees ding futures flips. Whether a seasoned shark or rookie guppy, understand exactly how AvaTrade stacks up across the full spectrum spanning slick apps to crypto.

Company – What is AvaTrade?

AvaTrade has rapidly grown since Emmanuel and Negev Nosatzki founded the company back in 2006. Headquartered in Dublin, Ireland, their global presence now spans over 400,000 retail traders that use AvaTrade’s platforms.

In 2016, the company was acquired by Playtech PLC for $105 million. Playtech is a multinational gambling and financial trading software developer located in the Isle of Man. Despite the buyout from this industry giant, AvaTrade continues to operate independently under its original brand name and leadership.

Over the years, they earned multiple awards that recognize their easy-to-use platforms, top-notch educational resources, competitive pricing, and innovative products. For example, their all-in-one app, AvaTradeGO earned “Best Forex Trading App” at the ADVFN International Awards in 2022. Additionally, Global Brands Magazine awarded AvaTrade the title of “Best Online Trading Platform UAE” in 2023.

With over a decade’s experience catering to traders of all skill levels spanning over 200,000 customers globally, it’s clear why AvaTrade is praised as a reliable broker by both novice retail traders and institutional investors alike.

Read also! Is AvaTrade Legit?

Trading Platforms

AvaTrade gives you a choice of popular trading platforms to meet your needs.

AvaTradeGO is their innovative mobile app, bringing the tools you depend on to iOS and Android devices. It provides real-time alerts, advanced charts, and the ability to execute orders and manage positions efficiently while on the go.

For desktop trading, AvaTrade offers both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. MT4 is regarded as the industry standard with advanced charting capabilities and the ability to automate trades using Expert Advisors (EAs) and custom indicators. The more sophisticated MT5 platform allows you to also trade stocks, futures and additional CFDs.

Another option is WebTrader, their browser-based platform, giving you flexibility to analyze financial markets, follow price trends, test trading strategies and execute orders directly online. This comes integrated with tools like live Reuters news and market updates.

And for institutional investors that demand the highest level of API and FIX trading access, AvaTrade caters to high volume traders as well.

No matter your level, AvaTrade delivers an award winning experience. The only question is – how will you take on the markets?

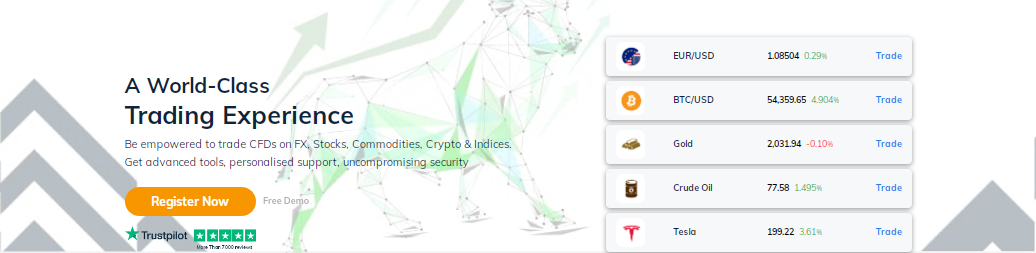

Trading Instruments & Assets

When it comes to asset diversity, AvaTrade delivers access to global markets – so you can diversify risk across forex, stocks, commodities, cryptocurrencies, bonds, ETFs and more.

Trade over 250 FX pairs including majors, minors and exotics with industry-low spreads. Fine tune exposure with fractional ‘AvaScalper’ contracts on the world’s most popular currencies.

Or tap into market movements across hundreds of stocks from 11 global exchanges. Long or short shares from as little as $1 per pint-sized ‘AvaStocks’ contract.

Cryptocurrencies have also gained traction with ability to trade top names like Bitcoin, Ethereum and Ripple. And coming soon – decentralised finance assets and tokens according to the AvaTrade roadmap.

So whether you think the next opportunity is rising in Europe, China, USA or the metaverse, AvaTrade serves up the instruments you need. The only question is – which markets will you conquer next?

Account Types

AvaTrade offers 5 main account types plus Islamic swap-free accounts to suit different trader requirements:

- AvaSocial Account: The AvaSocial Account is a great starting point for new traders with a reasonable $100 minimum deposit. It has variable spreads from 0.9 pips on over 250 FX pairs. You can even earn commission rebates for higher volume trades which helps depend your trading.

- AvaSelect Account: For more advanced traders, the AvaSelect Account opens access to over 1,250 trading instruments including CFDs, stocks and crypto. The $100 minimum deposit gives flexibility and tight fixed spreads begin at just 0.8 pips.

- AvaPrime: The AvaPrime account focuses on Forex trading with ultra competitive fixed spreads from 1 pip without any commissions. It’s an excellent choice for active FX traders.

- Demo Account: If you need to practice strategies before putting real money on the line, their free Demo Account starts you with $100K in virtual funds allowing risk-free paper trading. Master the markets before you invest capital.

- AvaPro: And for large professional traders, the custom-tailored AvaPro solution features interbank spreads plus dedicated support catered to your volume needing a $100K minimum balance.

- Islamic Accounts: They round it off with Islamic accounts conforming to Sharia principles – allowing swap-free trading for those who cannot collect or pay overnight interest on positions held past market close.

So from starter offerings to VIP treatment, AvaTrade has an account option well-suited for all walks of forex and CFD traders. The only question is – at what level will you step on?

Cryptocurrency

Looking to diversify your portfolio beyond forex? AvaTrade also opens the door to crypto trading. Get exposure to major digital coins like Bitcoin, Ethereum, Litecoin, and Ripple as CFDs without needing to directly buy and store them.

Trade these crypto CFDs with 1:2 leverage meaning you only have to put up half of the notional trade size as margin. And enter positions even for fractional coin amounts starting from just 0.001 size contracts.

While many brokers only allow crypto to fiat trading pairs, AvaTrade also facilitates crypto-to-crypto pairs. For example, trade between Bitcoin and Ethereum price movements without converting through USD at all.

They continue working to expand the number of cryptocurrencies supported too. So you can keep your finger on the pulse of the latest hot coins as the crypto space rapidly evolves.

By handling the custody and security behind the scenes, AvaTrade makes diversifying into this new asset class straightforward even for crypto novices.

Deposit & Withdrawals

Funding your account is swift and convenient with AvaTrade supporting an array of global payment methods. Choose from credit/debit cards, bank transfer, e-wallets like Neteller, or online payment processors such as Skrill and PayPal.

Most funding options are fee-free for deposits, while bank transfers have a competitive $10 flat rate. Deposits are instantly processed for e-wallet and card methods or within 2 to 3 days for wire transfers.

When it comes time to withdraw your profits, bank wires do have a $10 processing fee per transaction. However, e-wallet and card withdrawals are conveniently fee-free – with flexible limits of up to $10,000 per transaction in most cases.

They aim to process withdrawals within 24 hours for digital methods or 1 to 3 days for bank transfers, so your funds are readily accessible. You can even set up automatic withdrawals on a regular schedule, so profits flow directly to your linked account hassle-free.

With great payment flexibility tailored to your country and responsive processing times, AvaTrade ticks the boxes for convenient funding and withdrawals.

Read also! What is AvaTrade Minimum Deposit?

Market Analysis & Research

To help guide your trading decisions, AvaTrade has you covered with quality market research and integrated auto analysis.

Their team of global market analysts publish daily and weekly forecasts across forex, indices and commodities. So you can keep pace with the latest fundamental forces driving prices. Traders also appreciate the technical analysis reporting which identifies trend reversals and potential breakouts at a glance.

For automated chart pattern recognition, AvaTrade built in AutoChartist tools. This scans over 220 currency pairs, crosses and exotic currencies – spotting high probability trade opportunities based on historical outcomes. Useful for all experience levels.

And convenient market calendars make it simple to monitor upcoming financial events, economic data releases or central bank meetings that routinely impact currency and index prices.

While research helps set the stage, traders do value drawing their own insights from the markets. So AvaTrade packs an array of customizable technical indicators and charting tools traders depend on across all platforms.

With a mix of quality market research plus analysis tools tailored to your strategy, AvaTrade delivers trading intelligence you can act on.

Trading Fees

When it comes to costs, AvaTrade presents a straightforward structure around spreads, commissions and financing:

For forex trades, you simply pay the spread – with competitive variable and fixed spreads starting from 0.9 pips or $3/lot commission pricing available across accounts.

On CFDs for assets like commodities, indices and stocks, both spreads and commissions apply per trade. Stock CFD commissions are €0.15 per executed lot for example.

Swaps are financing rates applied if you hold a position past market close time. Short positions deduct the overnight swap rate, while long swaps will be credited. Swap rates range from -1% to -15% for popular currency pairs like EUR/USD.

One cost to remain aware of is AvaTrade’s inactivity fee of $50 charged quarterly if no trades completed in the prior 3 months. But this is easily avoidable with nominal account activity.

With full transparency around variable spreads, swap rates that vary per instrument and simple capped commissions per asset class traded, it’s straightforward to calculate trading costs.

Regulation – Is AvaTrade Safe?

When choosing a broker, you need assurance your funds and data are secure. AvaTrade complies with strict standards across multiple jurisdictions like Australia, South Africa, Japan and the EU.

Specifically, they meet regulatory requirements set by top-tier authorities like the Central Bank of Ireland, ASIC in Australia, FSA in Japan, and FSCA in South Africa. Compliance affirms business practices adhere to investor protections and fair trading principles in each region.

For extra fund protection, accounts based in the EU qualify under the Investor Compensation Scheme covering up to €20,000 per person. Additional client asset insurance up to €1 million further shields user money from company risk.

Globally, AvaTrade secures over $2 billion in trade volume each month across their encrypted trading platforms and data infrastructure monitored 24/7 for threats.

Between regulatory oversight, fund protection programs, and security measures, you can execute your money moves knowing risk is actively managed.

Customer Support

When you need trading assistance or account support, AvaTrade provides multiple contact options managed by a skilled multilingual team available 24/5.

Get answers via email, live chat, phone, and even social channels like Twitter and Facebook. Their international staff speak over 15 languages – from English, Spanish, and French to Polish, Portuguese, and Chinese.

Response times are prompt across channels. Live chat inquiries saw replies within one minute during testing. While phone and email ticket resolutions usually land within an hour based on reports.

Support covers technical and account queries plus handles deposit and withdrawal requests with friendly service. Traders compliment the depth of knowledge from the first response through to resolution.

And helpful resources like FAQs, e-courses, and market analysis further supplement formal support when needed.

With responsive multilingual teams available to guide your needs, AvaTrade shows their commitment to smooth trading and member satisfaction lasts beyond the sign up form.

Advantages and Disadvantages

When weighing up brokers, let’s summarize a few of AvaTrade’s most compelling perks:

Pros

- Choice of user-friendly trading platforms (MT4, custom web & apps)

- Access thousands of instruments from stocks to cryptos

- Funded accounts have insurance up to €1 million

- Educational resources and daily market analysis

- Regulation across EU, Australia and globally

Cons

- Inactivity fee charged if no trades for 3 months

- Variable spreads may widen during volatility

- Crypto options currently smaller vs competitors

Across their 15+ years in business, AvaTrade has clearly optimized strengths around asset variety, platform options and strong regulation – making them anbroker worth considering.

AvaTrade Review – Final Verdict

So is AvaTrade a high-performing broker worthy of your hard-earned cash and emerging opportunities? With over $6 billion dollars traded through its digital corridors each month by over 400,000 traders, it’s certainly a trusted platform to consider.

After weighing essentials like exemplary regulation, fund security, multilingual customer support, reasonable fees and advanced software – positives far outweigh the negatives. AvaTrade doesn’t appear to excel in any one specific feature, for example industry-leading crypto variety, but solidly covers the must-haves desired by most traders.

For an accessible broker with third-party integrations like MetaTrader 4 and diversity across instruments and accounts – from forex scalping to Iranian-won social trading – AvaTrade is a flexible choice. And their 15+ year track record battling the best and worst of market volatility looks poised to continue into the decade ahead.

So if you seek an established broker with the resources to help seasoned day traders and trading newcomers alike discover opportunities – open your account with confidence. Overall, AvaTrade stands as an industry leader that aptly balances robust trading infrastructure for both casual dabblers and serious pros chasing outsized returns across growing asset classes.