When it comes to investing in cryptocurrencies, choosing the right exchange platform can make all the difference. With the crypto craze showing no signs of slowing down in Australia, more and more people are looking to get in on the action – but choosing the safe exchanges out there can be a daunting task.

That’s where this review of the best crypto exchanges in Australia comes in. We’ll be putting the following top 8 exchanges under the microscope:

- Binance

- Bybit

- KuCoin

- OKX

- Bitfinex

- Kraken

- Swyftx

- Coinbase

For each platform, we’ll dive deep into the key aspects that matter most, including:

- Trading fees and fee structures

- Security protocols and compliance measures

- Range of supported trading pairs and liquidity levels

- User interface and overall trading experience

- Customer support and reputation

- And much more!

By the end, you’ll have a comprehensive understanding of what each exchange brings to the table, allowing you to choose the one that aligns perfectly with your specific needs and preferences. So buckle up and get ready to explore the best Australian crypto exchanges!

Best Crypto Exchanges in Australia

Binance

Let’s start with Binance, one of the biggest names in the crypto exchange game. Launched in 2017, this platform has skyrocketed in popularity, becoming a go-to spot for traders worldwide, including a massive Aussie user base. Whether you’re a fresh-faced newbie or a seasoned crypto veteran, Binance has got you covered with its all-encompassing trading environment.

Please read our complete Binance Review!

Trading fees and fee structure

Now, one of the major drawcards of Binance is its super competitive fee structure – we’re talking some of the lowest rates out there. They charge a flat 0.1% trading fee for spot trading, and if you’re holding their in-house Binance Coin (BNB), you can score even lower fees. But that’s not all – high-volume traders and market makers can cash in on various fee discounts and incentives, making Binance an attractive option for the big players too.

Security measures and compliance

Security is no joke at Binance – they’ve got industry-leading measures in place to keep your funds and personal info locked down tight. Plus, they’re fully compliant with all the Australian regulations, implementing strict Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols. So you can trade with peace of mind, knowing your crypto is safe and sound on this transparent, by-the-books platform.

Binance Pros and Cons

| Pros | Cons |

|---|---|

| Low trading fees (0.1% for spot trading) | Limited fiat currency support |

| Fee discounts for BNB holders and high-volume traders | Some regulatory concerns in certain countries |

| Wide range of cryptocurrencies supported | Customer support can be slow at times |

| Strong security measures (cold storage, 2FA, etc.) | User interface can be overwhelming for beginners |

| User-friendly mobile app | |

| Liquidity and high trading volumes | |

| Regulated and compliant with Australian laws |

Bybit

Alright, next up we’ve got Bybit – a relative newcomer to the crypto exchange scene, but one that’s been making some serious waves since its launch in 2018. While it might not have the same legacy as some of the OG platforms out there, Bybit has quickly carved out a reputation as a go-to spot for traders looking for a cutting-edge experience.

Please read our full Bybit Review!

Trading fees and fee structure

One of the major drawcards of Bybit is its super competitive fee structure. We’re talking maker fees as low as 0.075% for those high-volume traders out there. And even for the rest of us, the fees are still pretty darn reasonable. But wait, there’s more! Bybit also offers fee discounts for those big-time traders, making it an attractive option for the whales in the game.

Security measures and compliance

Now, when it comes to security, Bybit doesn’t mess around. They’ve got robust measures in place, including cold storage for those all-important crypto assets and mandatory 2FA for an extra layer of protection. Plus, they’re fully compliant with Australian regulations, so you can trade with peace of mind knowing your funds are safe and sound.

Trading pairs and liquidity

Bybit might be a newcomer, but they’ve already managed to build up some seriously impressive liquidity for a good chunk of the popular trading pairs out there. So whether you’re dealing with the big guns like BTC and ETH or exploring some of the more niche altcoins, you can generally expect a smooth trading experience without any major slippage issues.

User interface and trading experience

The Bybit platform itself is a pretty slick piece of kit, with a user interface that’s clean and intuitive (at least, once you get the hang of it). That said, if you’re a total crypto newbie, you might find the array of features and options a bit overwhelming at first. But hey, that’s just part of the learning curve!

Customer support and reputation

While Bybit’s customer support isn’t necessarily winning any awards just yet, they’re definitely making strides in the right direction. And in terms of reputation, they’ve managed to build up a solid following of traders who appreciate their low fees, strong security, and innovative features.

| Pros | Cons |

|---|---|

| Low trading fees (up to 0.075% maker fees) | Limited fiat currency support |

| Fee discounts for high-volume traders | Relatively new exchange (launched in 2018) |

| Supports spot, futures, and derivatives trading | Customer support could be improved |

| Strong security measures (cold storage, 2FA, etc.) | User interface may be overwhelming for beginners |

| Regulated and compliant with Australian laws | Limited educational resources for new traders |

| High liquidity for popular trading pairs | – |

| User-friendly mobile app |

KuCoin

Next on our list is KuCoin – another relative newcomer to the crypto exchange game, having launched back in 2017. But don’t let their youth fool you, this platform has been making some serious moves and rapidly gaining popularity among traders worldwide, including a growing Aussie user base.

Trading fees and fee structure

One of the major selling points of KuCoin is their low trading fees, with a flat 0.1% fee for spot trading. Not too shabby, right? And if you’re dealing with some serious volume, you can even score some additional fee discounts, making KuCoin a pretty attractive option for those high-rollers out there.

Security measures and compliance

Security is no joke at KuCoin. They’ve implemented some serious measures to keep your crypto safe and sound, including cold storage for those all-important assets and mandatory 2FA for an extra layer of protection. Plus, they’re fully compliant with Australian regulations, so you can trade with peace of mind knowing your funds are in good hands.

Trading pairs and liquidity

One of the major strengths of KuCoin is the sheer number of cryptocurrencies they support. We’re talking hundreds of different trading pairs here, folks. And while liquidity might not be off the charts for some of the more obscure altcoins, you can generally expect a pretty smooth trading experience for the more popular pairs.

User interface and trading experience

The KuCoin platform itself is pretty user-friendly, with a clean and intuitive interface that even crypto newbies can generally navigate without too much of a headache. That said, if you’re planning on diving into some of the more advanced trading features and options, you might find the learning curve a little steeper.

Customer support and reputation

KuCoin’s customer support is decent, but they’re not exactly setting the world on fire in that department just yet. As for their reputation, they’ve managed to build up a solid following of traders who appreciate their low fees, strong security, and vast selection of trading pairs.

KuCoin Pros and Cons

| Pros | Cons |

|---|---|

| Low trading fees (0.1% for spot trading) | Limited fiat currency support |

| Wide range of cryptocurrencies supported | Relatively new exchange (launched in 2017) |

| Strong security measures (cold storage, 2FA, etc.) | Customer support could be improved |

| Liquidity for popular trading pairs | User interface may be overwhelming for beginners |

| Regulated and compliant with Australian laws | Limited educational resources for new traders |

| User-friendly mobile app | – |

| Futures and margin trading available |

OKX

Up next, we’ve got OKX – a crypto exchange that’s been around the block a few times since its launch back in 2017. While it might not have quite the same household name recognition as some of the other big players, OKX has managed to carve out a solid reputation for itself, particularly among more experienced traders.

Could you read our up-to-date OKX Australia Review?

Trading fees and fee structure

When it comes to trading fees, OKX is definitely competitive, with a flat fee of 0.1% for spot trading. But where they really shine is their fee structure for high-volume traders and market makers. We’re talking some seriously juicy discounts and incentives that can make a big difference for those moving some serious crypto volume.

Security measures and compliance

Security is a top priority at OKX, and it shows. They’ve got robust measures in place, including cold storage for crypto assets and mandatory 2FA to keep your accounts nice and secure. Plus, they’re fully compliant with all the relevant Australian regulations, so you can trade with confidence knowing your funds are in good hands.

Trading pairs and liquidity

One area where OKX really excels is in the sheer number of trading pairs on offer. We’re talking hundreds of different cryptocurrencies supported here, folks. And while liquidity might not be off the charts for some of the more obscure altcoins, you can generally expect a pretty smooth trading experience for the more popular pairs.

User interface and trading experience

The OKX platform itself is a bit of a mixed bag. On one hand, it’s packed with features and tools that more advanced traders will definitely appreciate. On the other hand, the interface can be a bit overwhelming for newcomers, with a bit of a steep learning curve to navigate all the bells and whistles.

Customer support and reputation

OKX’s customer support is decent, but nothing to write home about. They’ve got the usual channels covered (email, live chat, etc.), but response times can be hit-or-miss depending on the volume of inquiries. As for their reputation, they’ve managed to build up a solid following among more experienced traders who appreciate their advanced features and competitive fee structure.

| Pros | Cons |

|---|---|

| Wide range of cryptocurrencies supported | User interface can be overwhelming for beginners |

| Competitive trading fees for spot trading (0.1%) | Customer support could be improved |

| Attractive fee discounts for high-volume traders | Limited educational resources |

| Strong security measures (cold storage, 2FA, etc.) | |

| Regulated and compliant with Australian laws | |

| Good liquidity for popular trading pairs |

Bitfinex

Next up, we’ve got Bitfinex – a crypto exchange that’s been around since the early days of the game, having launched way back in 2012. And while they might not have quite the same mainstream name recognition as some of the other big players, Bitfinex has managed to build up a loyal following among more experienced traders and enthusiasts.

Trading fees and fee structure

When it comes to trading fees, Bitfinex is pretty competitive, with a flat fee of 0.1% for spot trading. But where they really stand out is their fee structure for high-volume traders and market makers, offering some seriously juicy discounts and incentives that can make a big difference for those moving some serious crypto volume.

Security measures and compliance

Security is no joke at Bitfinex. These guys have been around the block a few times, and they’ve learned the hard way just how important it is to have robust security measures in place. We’re talking SOC 2 certification, cold storage for crypto assets, mandatory 2FA, and a whole host of other protocols to keep your funds safe and sound. Plus, they’re fully compliant with all the relevant Australian regulations, so you can trade with confidence.

Trading pairs and liquidity

One area where Bitfinex really shines is in the sheer number of trading pairs on offer. We’re talking hundreds of different cryptocurrencies supported here, folks. And while liquidity might not be off the charts for some of the more obscure altcoins, you can generally expect a pretty smooth trading experience for the more popular pairs.

User interface and trading experience

The Bitfinex platform itself is a bit of a mixed bag. On one hand, it’s packed with features and tools that more advanced traders will absolutely love. On the other hand, the interface can be a bit overwhelming for newcomers, with a pretty steep learning curve to navigate all the bells and whistles.

Customer support and reputation

Bitfinex’s customer support is decent, but nothing to write home about. They’ve got the usual channels covered (email, live chat, etc.), but response times can be hit-or-miss depending on the volume of inquiries. As for their reputation, they’ve managed to build up a loyal following among more experienced traders and enthusiasts who appreciate their advanced features and competitive fee structure – despite a few hiccups along the way.

Pros and Cons

| Pros | Cons |

|---|---|

| Longstanding reputation (launched in 2012) | User interface has a steep learning curve |

| Wide range of cryptocurrencies supported | Customer support could be improved |

| Competitive trading fees for spot trading (0.1%) | Has faced some controversies in the past |

| Attractive fee discounts for high-volume traders | Limited educational resources for beginners |

| Strong security measures (cold storage, 2FA, etc.) | |

| Good liquidity for popular trading pairs |

Kraken

Next up, we’ve got Kraken – a crypto exchange that’s been around since the early days, having first launched way back in 2011. In 2024, Kraken has managed to build over 10 million loyal clients who appreciate their no-nonsense approach and focus on security.

Trading fees and fee structure

When it comes to trading fees, Kraken is pretty darn competitive, with a flat fee of 0.16% for spot trading on their standard account tier. But if you’re moving some serious volume, you can score even lower fees by upgrading to their premium account tiers, which offer discounted rates as low as 0.00% for high-volume traders.

Security measures and compliance

Security is an absolute priority at Kraken, and it shows. These guys have implemented some seriously robust measures to keep your crypto safe and sound, including ISO/IEC 27001:2013 and SOC 2, Type 1 certifications. They also make use of cold storage for those all-important assets, mandatory 2FA, and a whole host of other protocols to keep the bad guys at bay. Plus, they’re fully compliant with all the relevant Australian regulations, so you can trade with peace of mind.

Trading pairs and liquidity

While Kraken might not have quite the same breadth of trading pairs as some of the other exchanges on this list, they more than make up for it with seriously impressive liquidity for the pairs they do support.

We’re talking top-notch liquidity for the major players like Bitcoin, Ethereum, and Litecoin, ensuring a smooth trading experience with minimal slippage.

User interface and trading experience

The Kraken platform itself is a bit of a mixed bag. On one hand, it’s designed with a focus on functionality over flashiness, which more experienced traders will likely appreciate. On the other hand, the interface can feel a bit dated and clunky at times, especially for newcomers who might find it a bit overwhelming.

Customer support and reputation

Kraken’s customer support is generally pretty solid, with a range of channels available (email, live chat, etc.) and reasonably quick response times. As for their reputation, they’ve managed to build up a loyal following among traders and enthusiasts who appreciate their focus on security, their commitment to compliance, and their no-nonsense approach to the crypto game.

| Pros | Cons |

|---|---|

| Longstanding reputation (launched in 2011) | Limited range of trading pairs |

| Competitive trading fees (0.16% to 0.00%) | User interface can feel dated/clunky |

| Strong security measures (cold storage, 2FA, etc.) | Limited educational resources |

| Excellent liquidity for major cryptocurrencies | |

| Regulated and compliant with Australian laws | |

| Solid customer support |

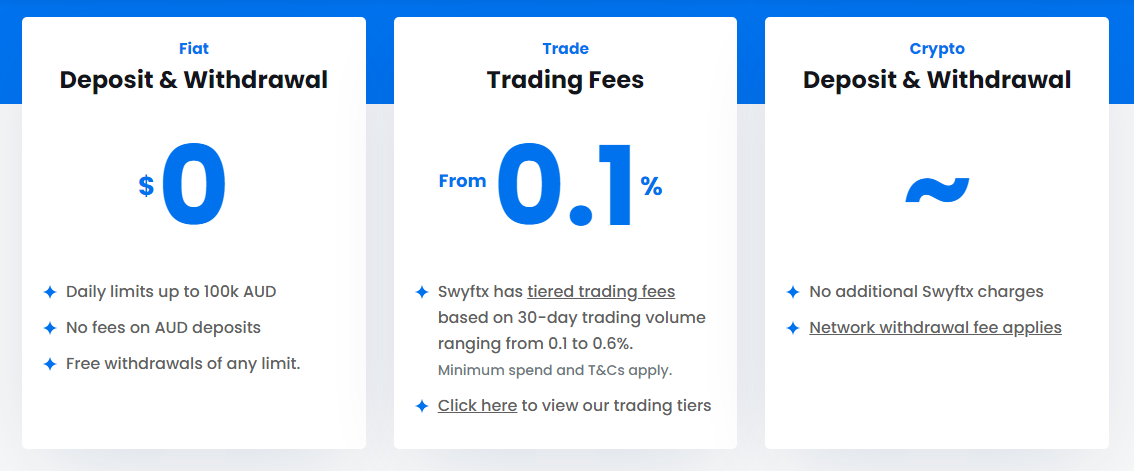

Swyftx

Switching gears now to Swyftx – an Australian crypto exchange that’s been making some serious waves since its launch in 2018. While they might not have quite the same global reach as some of the other big names on this list, Swyftx has quickly become a favorite among Australian traders of over 660,00o.

Trading fees and fee structure

Regarding trading fees, Swyftx is pretty darn competitive, with a flat fee of 0.1 to 0.6% for both buying and selling crypto on their platform.

And while that might seem a tad higher than some of the other exchanges out there, it’s worth noting that Swyftx doesn’t charge any additional fees for things like deposits or withdrawals, which can add up pretty quickly on other platforms.

Security measures and compliance

Security is a top priority at Swyftx, and they’ve implemented a range of robust measures to keep your crypto safe and sound. We’re talking cold storage for those all-important assets, mandatory 2FA, and a whole host of other protocols to keep the bad guys at bay. Plus, as an Australian-based exchange, they’re fully compliant with all the relevant local regulations, so you can trade with peace of mind.

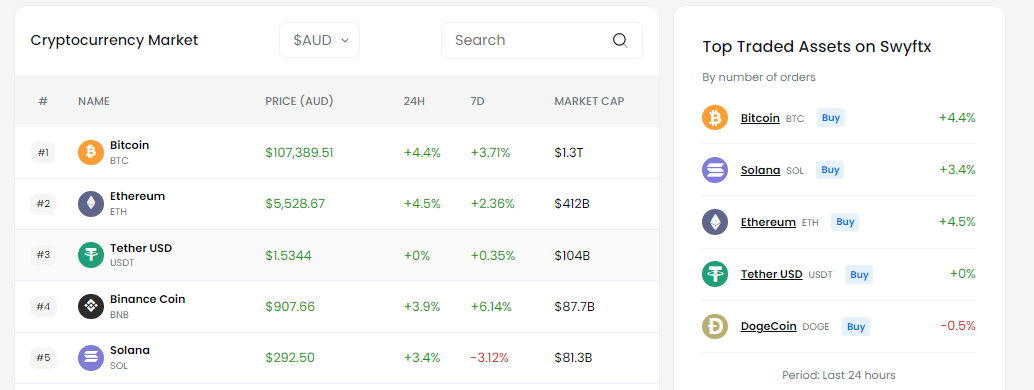

Trading pairs and liquidity

Now, it’s worth noting that Swyftx might not have quite the same breadth of trading pairs as some of the bigger global exchanges out there.

But what they lack in sheer quantity, they more than make up for in quality, offering support for all the major players like Bitcoin, Ethereum, and Tether, as well as a solid selection of popular altcoins. And thanks to their focus on the Australian market, you can generally expect decent liquidity for the pairs they do support.

User interface and trading experience

One of the major selling points of Swyftx is their user-friendly platform and overall trading experience. The interface is clean, intuitive, and designed with newcomers in mind, making it a great option for those just dipping their toes into the crypto waters. That said, more advanced traders might find the platform a bit too simplified for their liking, lacking some of the more advanced features and tools found on other exchanges.

Customer support and reputation

Swyftx’s customer support is generally pretty solid, with a range of channels available (email, live chat, etc.) and reasonably quick response times. And as a locally-based exchange, they’ve managed to build up a strong reputation among Australian traders who appreciate their user-friendly approach, their focus on security and compliance, and their commitment to catering to the local market.

| Pros | Cons |

|---|---|

| User-friendly interface for beginners | Higher trading fees (0.6%) compared to some rivals |

| No additional fees for deposits/withdrawals | Liquidity may be lower for some altcoins |

| Strong security measures (cold storage, 2FA, etc.) | |

| Regulated and compliant with Australian laws | |

| Solid customer support | |

| Focus on catering to Australian market |

Coinbase

Last but not least, we’ve got Coinbase – a name that needs no introduction for anyone even remotely familiar with the crypto world. This US-based exchange has been around since 2012 and has quickly become one of the most popular and well-known platforms out there, especially for those just dipping their toes into the crypto waters.

Trading fees and fee structure

When it comes to trading fees, Coinbase is pretty straightforward – they charge a flat fee of 0.6% for most trades. Now, that might seem a tad high compared to some of the other exchanges on this list, but it’s worth noting that Coinbase is really geared more towards casual investors and newcomers rather than high-volume traders.

Security measures and compliance

Security is an absolute top priority at Coinbase, and they’ve implemented some seriously robust measures to keep your crypto safe and sound. We’re talking cold storage for assets, mandatory 2FA, and a whole host of other protocols to keep the bad guys at bay. Plus, as a US-based exchange, they’re fully compliant with all the relevant regulations, so you can trade with peace of mind.

Trading pairs and liquidity

Now, it’s worth noting that Coinbase might not have quite the same breadth of trading pairs as some of the bigger global exchanges out there. But what they lack in quantity, they more than make up for in quality, offering support for all the major players like Bitcoin, Ethereum, and Litecoin, as well as a solid selection of popular altcoins. And thanks to their massive user base, you can generally expect excellent liquidity for the pairs they do support.

User interface and trading experience

One of the major selling points of Coinbase is their user-friendly platform and overall trading experience. The interface is clean, intuitive, and designed with newcomers in mind, making it a great option for those just starting their crypto journey. That said, more advanced traders might find the platform a bit too simplified for their liking, lacking some of the more advanced features and tools found on other exchanges.

Customer support and reputation

Coinbase’s customer support is generally top-notch, with a range of channels available (email, live chat, etc.) and reasonably quick response times. And as one of the most well-known and respected exchanges out there, they’ve managed to build up a stellar reputation among traders and enthusiasts worldwide, who appreciate their focus on security, their user-friendly approach, and their commitment to compliance.

| Pros | Cons |

|---|---|

| User-friendly interface, ideal for beginners | Higher trading fees (0.6% flat fee, higher for small trades) |

| Supports over 50 major cryptocurrencies | Limited range of trading pairs compared to some rivals |

| Excellent liquidity for popular pairs like BTC, ETH | Lacks advanced trading tools/features for experienced traders |

| Strong security measures (cold storage, 2FA, FDIC-insured USD balances) | |

| Highly regulated and compliant with relevant laws | |

| Top-notch customer support | |

| Well-established reputation and brand recognition |

Comparison and Recommendations

Now that we’ve covered the ins and outs of some of the best crypto exchanges in Australia, let’s take a moment to compare them side-by-side across some key features and criteria:

| Exchange | Trading Fees | Security Measures | Trading Pairs | Liquidity |

|---|---|---|---|---|

| 0.1% for spot trading, lower fees (0.075% or less) for BNB holders and high-volume traders | Robust security with cold storage for assets, mandatory 2FA, CCSS-compliant, regulated | Over 600 trading pairs supported | Excellent liquidity, especially for major pairs like BTC, ETH, BNB | |

| Maker fees as low as 0.075%, taker fees around 0.1%, discounts for high-volume traders | Strong security with cold storage, 2FA, regulated and compliant with Australian laws | Supports spot, futures, and derivatives trading for BTC, ETH, and other major pairs | Good liquidity for popular trading pairs | |

| 0.1% flat fee for spot trading, discounts available for high-volume traders | Robust security with cold storage, 2FA, regulated and compliant | Over 600 trading pairs supported, including many altcoins | Good liquidity for major pairs, moderate for smaller altcoins | |

| 0.1% for spot trading, competitive discounted fees (as low as 0.02% maker fees) for high-volume traders | Implements cold storage, 2FA, and other robust security protocols, regulated and compliant | Over 400 trading pairs available, including many altcoins | Excellent liquidity for major pairs, good for popular altcoins | |

| 0.1% for spot trading, discounts (down to 0% maker fees) for high-volume traders/market makers | Utilizes cold storage, mandatory 2FA, regulated and compliant, strong security track record | Over 100 trading pairs supported, focus on major pairs | Very good liquidity for major pairs like BTC, ETH | |

| Fees range from 0.16% for low-volume traders to 0% for high-volume makers/takers | Cold storage, 2FA, PGP encryption, full reserve audits, highly secure and compliant | 200+ trading pairs, focused on major cryptos | Extremely high liquidity for BTC, ETH, and other top pairs | |

|

0.1 to 0.6% flat fee for buying/selling crypto | ISO27001 certification, cold storage, 2FA, regulated and compliant with Australian laws | Around 310 trading pairs including major and some altcoins | Good liquidity for major pairs and popular altcoins |

| 0.6% flat fee for trades (higher for smaller trades under $200) | Stores majority of assets in cold storage, 2FA, FDIC-insured USD balances, regulated and compliant | Supports over 50 major cryptocurrencies | Excellent liquidity for major pairs like BTC, ETH |

Of course, no single exchange is going to be the perfect fit for every trader out there. Your specific needs and preferences will play a big role in determining which platform is the best choice for you.

For beginners and casual investors just starting their crypto journey, exchanges like Coinbase, Swyftx, and even Binance (with its user-friendly mobile app) are great options thanks to their intuitive interfaces and focus on simplicity.

If you’re an advanced trader or high-volume investor, you’ll likely want to prioritize exchanges with more advanced trading features, lower fees (especially for makers/takers), and strong liquidity. In that case, platforms like Bybit, KuCoin, OKX, Bitfinex, and Kraken might be more up your alley.

And if security and compliance are your top priorities, exchanges like Coinbase, Kraken, and Binance (with their robust security measures and adherence to Australian regulations) could be the way to go.

What are crypto exchanges?

A crypto exchange is essentially a marketplace where you can buy, sell, and trade various cryptocurrencies like Bitcoin, Ethereum, and countless others. Think of it like a stock exchange, but for the wild world of crypto. These platforms act as the middleman, connecting buyers and sellers and facilitating transactions in a secure (ideally) and regulated environment.

How do crypto exchanges work?

It’s actually pretty straightforward. When you sign up for an exchange, you’ll need to go through some verification processes to prove your identity – this helps with security and compliance. Once you’re set up, you can deposit funds (either crypto or fiat currency like AUD) into your account. From there, you can place buy or sell orders at the current market rates, or even set up more advanced trades using tools like limit orders, stop-losses, and so on. The exchange acts as the matchmaker, pairing up buyers and sellers and taking a small fee off each transaction.

How safe are crypto exchanges?

This is a valid concern, given the prevalence of hacks and scams in the crypto world. The safety and security of an exchange can vary quite a bit.

Reputable exchanges like Coinbase, Binance, and Kraken employ robust security measures like cold storage for assets, mandatory two-factor authentication, and strict compliance with regulations. However, some smaller or shadier exchanges may cut corners, putting your funds at risk.

It’s always important to do your research, stick to well-known and regulated platforms, and follow best practices like enabling 2FA and using secure wallets for storage. While no exchange is 100% risk-free, the top players generally have strong track records when it comes to safeguarding user assets.

Conclusion

At the end of the day, there’s no such thing as a one-size-fits-all “best” crypto exchange for Australian traders. Each platform has its own unique strengths, weaknesses, and features that will appeal to different types of users.

The most important thing is to carefully evaluate your own specific needs and priorities – whether that’s ease of use, advanced trading tools, low fees, strong security, or a combination of factors – and choose the exchange that best aligns with those requirements.

And of course, don’t forget to always do your own research, practice proper security hygiene, and never invest more than you’re willing to lose. The crypto world can be a wild ride, but with the right platform and a bit of due diligence, you’ll be well on your way to navigating it like a pro.