Is FTMO banned in US? Not anymore! FTMO, one of the most popular proprietary trading firms, has made a triumphant return to the United States market. After previously suspending services to US clients due to regulatory and operational challenges, FTMO has partnered with OANDA, a US-regulated broker, to bring their educational tools and simulated trading platforms back to American traders.

This partnership allows US residents to access FTMO’s renowned training programs through the FTMO Rewards Account, where participants can earn rewards by trading with simulated capital. The collaboration is separate from FTMO Group’s pending acquisition of OANDA Global Corporation, which remains subject to regulatory approval.

Now that FTMO accepts US clients once again, aspiring traders have access to the platform that has helped over four million users worldwide test and improve their trading skills since 2015. However, US traders still have excellent alternatives available. Here are the top six prop firms, including the newly returned FTMO, that welcome US traders.

FTMO Banned In US Then Returned – 6 Best Prop Firms for Traders

These prop trading firms offer unique strengths that make them standout choices for US traders. Let’s explore six options tailored for different trading styles and needs:

- FTMO

- FunderPro

- 5%ers

- The Funded Trader

- FundingPips

- FundedNext

FTMO

FTMO reclaims its position as the premier choice for US traders seeking world-class proprietary trading opportunities. With its return to the US market through the strategic partnership with OANDA, American traders can once again access the platform that generated nearly $213 million in revenue in 2023, demonstrating its robust business model and trader success.

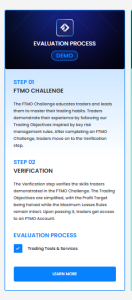

The firm’s educational approach focuses on simulated trading environments where traders can develop their skills without risking real capital. FTMO’s challenge-based system has been refined over years of operation, creating a structured pathway for traders to prove their abilities before accessing larger capital allocations. The platform emphasizes risk management and consistent performance, qualities that have made it a global leader in prop trading education.

Pros:

- Proven track record with millions of users worldwide

- Partnership with US-regulated broker OANDA ensures compliance

- Comprehensive educational resources and risk management tools

- Strong financial performance indicates stability and reliability

- All offerings remain educational and simulated for learning purposes

Cons:

- Services are currently limited to educational and simulated trading only

- Real capital trading not yet available through the US partnership

FTMO Available in USA: What This Means for Traders

The return of ftmo available in usa represents a significant development in the prop trading landscape. US traders who were disappointed by FTMO’s previous departure can now rejoin a platform known for its rigorous standards and educational excellence. This partnership with OANDA provides the regulatory framework necessary for FTMO to operate compliantly in the US market.

While the current offering focuses on educational and simulated trading, this foundation may pave the way for expanded services in the future. US traders can benefit from FTMO’s proven methodology, comprehensive training materials, and the same high standards that have made it successful globally.

5%ers

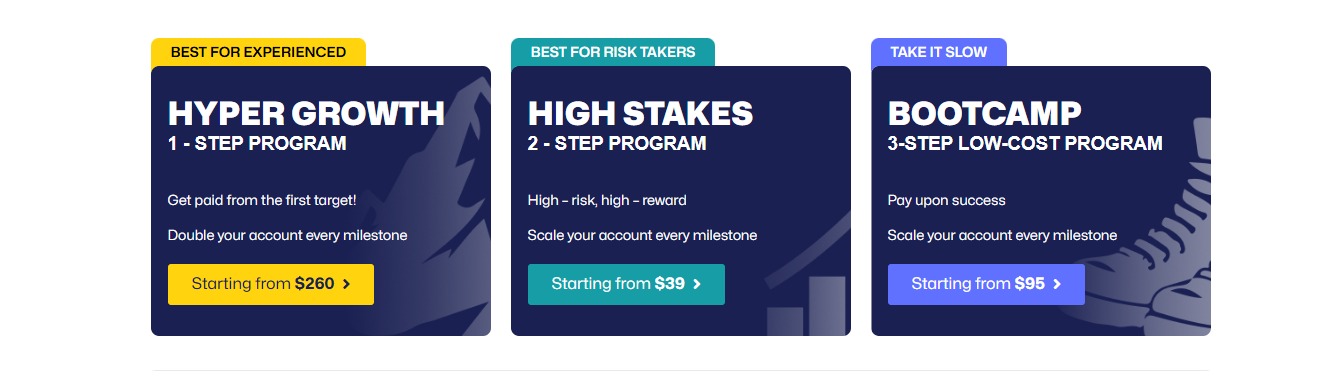

The 5%ers (Five Percent Online Ltd) is a standout option for traders who prioritize risk management and long-term growth. Unlike many prop firms, 5%ers does not require traders to pass a time-constrained challenge. Instead, it focuses on low-risk, consistent trading over an extended period. Funded accounts start at $39, with scaling opportunities reaching up to $4,000,000, making it ideal for traders aiming for large capital management.

The firm’s proprietary trading platform offers a seamless experience, and traders can also use MT4 for added flexibility. Profit-sharing begins at 50% but increases as traders progress through the scaling program. This progressive model encourages steady growth and rewards disciplined trading habits.

Pros:

- No time limits for challenges.

- Significant scaling opportunities up to $4 million.

- Focus on risk management and consistent performance.

- Access to MT4 and proprietary platforms.

- No restriction on trading style. Swingers, scalpers are all welcome.

Cons:

- Profit-sharing starts lower than some competitors.

- Conservative trading approach may not suit high-risk traders.

FundingPips

FundingPips is an emerging prop trading firm that offers a streamlined evaluation process designed to get traders funded quickly. It provides account sizes starting at $5,000 and scaling up to $300,000, with clear milestones for progression. The firm emphasizes flexibility, allowing traders to use a wide range of trading strategies without unnecessary restrictions.

FundingPips supports the MetaTrader 4 (MT4) platform, ensuring traders have access to advanced charting tools and expert advisors. The profit-sharing model is competitive, allowing traders to keep up to 85% of their profits. Additionally, FundingPips has a strong focus on transparency, ensuring there are no hidden fees or surprise costs.

Pros:

- Quick and straightforward evaluation process.

- High-profit share of up to 85%.

- Access to MT4, a trusted and versatile trading platform.

- Transparent rules and fee structure.

- Weekly, bi–weekly, or monthly rewards.

Cons:

- Smaller scaling opportunities compared to larger firms.

FunderPro

FunderPro is an excellent choice for US traders seeking a straightforward pathway into proprietary trading. The firm’s evaluation process is designed with beginners in mind, focusing on consistent performance rather than aggressive risk-taking. FunderPro provides funded accounts starting at $5,000, with scaling opportunities that allow traders to manage accounts of up to $200,000.

The firm offers access to multiple trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are preferred for their ease of use and advanced tools. Profit-sharing is competitive, with traders retaining up to 80% of their profits. Additionally, FunderPro emphasizes transparency, with no hidden fees or unexpected costs.

Pros:

- Beginner-friendly evaluation process.

- Generous profit-sharing up to 80%.

- Payouts whenever you want

- Access to popular platforms like MT4/MT5.

- No time limits for completing challenges.

Cons:

- Limited asset selection compared to some competitors.

- Higher initial costs for larger account sizes.

The Funded Trader

The Funded Trader has become a favorite among US-based traders for its versatility and community-driven approach. It offers a variety of account types, including Knight, Knight Pro, and Royal challenges, catering to traders with different strategies and risk tolerances.

Traders can start with funded accounts of $5,000 to $600,000, and the firm provides scaling opportunities for consistent performers.

The firm uses MetaTrader 4 (MT4) and MetaTrader 5 (MT5), both renowned for their reliability and advanced tools. Profit-sharing is highly competitive, with traders earning up to 95% of their profits. Additionally, The Funded Trader frequently hosts trading competitions, giving traders a chance to win additional capital or prizes.

Pros:

- Wide range of account options to suit various trading styles.

- Maximum virtual allocation is up to $2.5 million

- Generous profit split of up to 95%.

- Engaging community and regular competitions.

- Flexible scaling opportunities for long-term growth.

Cons:

- Challenges may be too aggressive for beginners.

- High-profit targets for some accounts.

FundedNext

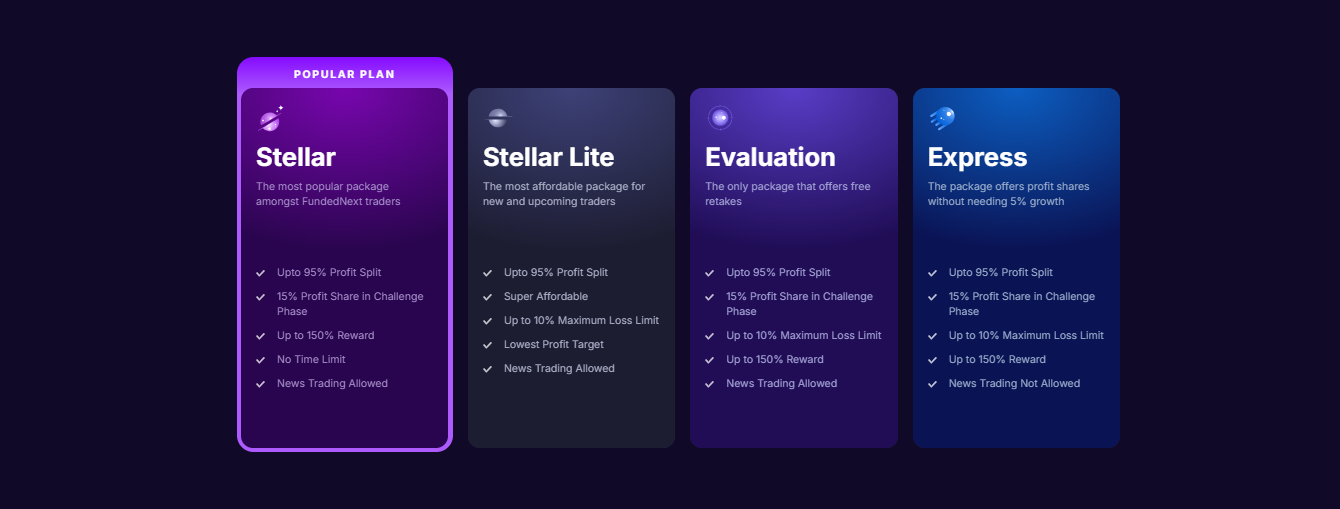

FundedNext has quickly gained traction for its flexible funding models and strong support system. Traders can choose between three challenges: Evaluation (a two-phase process) or Express (direct funding with stricter criteria).

Funded accounts range from $6,000 to $200,000, with options to scale up significantly based on performance.

FundedNext supports MT4 and MT5, offering traders the best tools for analysis and execution. The profit-sharing model is one of the highest in the industry, reaching up to 95%. Additionally, FundedNext provides educational resources and one-on-one mentorship to help traders improve their strategies.

Pros:

- Multiple funding options to suit different needs.

- High-profit share up to 95%.

- Comprehensive educational resources and mentorship.

- Access to MT4 and MT5 platforms.

Cons:

- Strict rules in the Express program may deter some traders.

- Evaluation process can be challenging for beginners.

These five prop trading firms provide excellent alternatives to FTMO. Each of them offers unique features to help US traders succeed. Whether you’re seeking simplicity, high-profit potential, or robust educational support, there’s a firm on this list to match your needs.

Is Forex Prop Trading Legal in the US?

Forex proprietary trading is legal in the United States. However, it operates under strict regulatory oversight to protect traders and ensure market integrity. The Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC) are the primary regulatory bodies overseeing prop trading firms in the US.

These agencies enforce rules to ensure transparency and accountability, especially for firms offering funded trading accounts. For instance, firms must avoid misleading marketing practices and adhere to financial disclosure requirements. As a result, while prop trading itself is allowed, firms must comply with these regulations to remain operational in the US.

Rules and Regulations of Prop Trading in the US

Prop trading firms in the US must comply with a web of regulations enforced by the CFTC and SEC to operate lawfully. These agencies require firms to register with the National Futures Association (NFA) if they provide leveraged Forex or futures trading. They also demand strict adherence to anti-money laundering (AML) policies and know-your-customer (KYC) requirements to ensure transparency and security.

However, retail prop trading firms are unregulated entities, even though they remain duly registered companies. To bridge this gap, they partner with regulated brokers that provide the trading platforms and infrastructure. This setup ensures compliance with trading standards while allowing the prop firms to maintain flexibility.

Each prop firm sets its own internal rules, including strict risk management policies and restrictions on trading strategies. As a result, traders must carefully evaluate a firm’s policies, profit-sharing terms, and risk guidelines to determine if they align with their trading style and objectives. These variations in rules explain why choosing the right firm is critical for a successful trading experience in the US.

How to Choose a Prop Trading Account in the US

Finding the right prop trading account in the US involves balancing several important factors:

1. Funding Models

- Instant Funding: Some firms provide capital upfront, ideal for experienced traders ready to start.

- Evaluation Programs: Other firms require traders to pass profit and risk management tests before granting access to funded accounts, offering a structured entry point for beginners.

2. Profit-Sharing Structure

- Most firms share profits in the range of 50% to 80%.

- Look for terms that balance earning potential with the level of support provided.

3. Trading Conditions

- Leverage: Ensure the firm offers leverage levels that match your trading style.

- Fees and Spreads: Partnered firms with regulated brokers typically offer competitive spreads and lower commissions.

4. Transparency

- Seek firms with clear rules on risk management, payouts, and trading restrictions.

- Avoid firms making unrealistic promises or hiding terms in fine print.

5. Reputation and Compliance

- Prioritize firms that partner with regulated brokers for a safer trading environment.

- Check reviews, industry standings, and the firm’s track record to ensure reliability.

By considering these elements, traders can confidently choose a prop trading account that aligns with their experience and goals.

Pros and Cons of Prop Trading

Prop trading comes with its own set of advantages and drawbacks. Understanding these can help traders decide if this path is right for them.

Pros of Prop Trading

- Access to Capital: Trade with significant funds provided by the firm, reducing personal financial risk.

- Professional Tools: Benefit from access to advanced trading platforms, data feeds, and analytics.

- Shared Risk: Losses are typically limited to the firm’s capital, not the trader’s personal account.

- Structured Growth: Many firms offer educational resources and mentorship programs to enhance trader skills.

Cons of Prop Trading

- Profit-Sharing: Firms take a percentage of profits, often between 20% and 50%, which lowers the trader’s net earnings.

- Evaluation Challenges: Meeting strict profit targets and adhering to risk limits can be stressful, especially for beginners.

- Strategy Restrictions: Some firms prohibit specific approaches, such as scalping or overnight trades, limiting flexibility.

- Unregulated Risks: While many firms are legitimate, unregulated ones may expose traders to risks, especially if they lack partnerships with regulated brokers.

By carefully weighing these pros and cons, traders can better understand what to expect from prop trading and decide if this model aligns with their trading objectives.

What Can You Trade with a Prop Firm in the US?

Prop trading firms in the US offer access to a diverse range of assets. The most common instruments include Forex pairs. Forex trading remains a cornerstone of prop trading due to its high liquidity and 24-hour market availability. Additionally, traders can trade stocks, indices, commodities like gold and oil, and even cryptocurrencies, depending on the firm’s offerings.

However, not all firms provide the same breadth of options. Some focus primarily on Forex and indices, while others expand to include equities and digital assets. This makes it essential for traders to evaluate the asset classes a firm supports to ensure they align with their trading goals. A good understanding of what’s available can significantly influence a trader’s profitability and long-term success.

Final Thoughts

FTMO’s return to the US market marks an exciting new chapter for American prop traders. With FTMO accepting US clients through their partnership with OANDA, traders now have access to one of the industry’s most respected educational platforms alongside five other excellent alternatives.

The six firms listed in this article—FTMO, FunderPro, 5%ers, The Funded Trader, FundingPips, and FundedNext—each provide unique advantages and a range of trading opportunities for different trader needs. Whether you choose the newly returned industry leader or one of the other established alternatives, you’ll have access to the substantial funding and educational resources needed to thrive in the competitive trading landscape.

Frequently Asked Questions

- Is FTMO banned in the US?

No, FTMO is no longer banned in the US. FTMO has returned to the US market through a partnership with OANDA, a US-regulated broker, allowing American traders to access their educational tools and simulated trading platforms.

- Is FTMO regulated?

FTMO operates as a proprietary trading firm providing educational services and simulated trading environments. In the US, it partners with OANDA, a regulated broker, to ensure compliance with local regulations.

- What payment methods are available?

FTMO accepts payments via bank wire transfer, credit/debit cards, cryptocurrencies, Skrill, and PayPal. Processing times range from instant to 5 business days, depending on the method.

- How do I withdraw my reward?

Rewards can be withdrawn monthly or on-demand after meeting the firm’s requirements. Processing typically occurs within 1-2 business days through various methods including bank transfer and digital payment platforms.

- Does FTMO charge any recurring fees?

FTMO charges a one-time fee for challenges and evaluations. There are no hidden or recurring fees, and fees may be reimbursed after achieving certain milestones.

- What trading platforms can I use with FTMO in the US?

Through the partnership with OANDA, US residents have access to OANDA’s regulated trading platforms and infrastructure, ensuring compliance with US regulations.

- Why is there a fee for FTMO challenges?

The fee covers the costs of providing comprehensive educational tools, platform infrastructure, risk management systems, and various applications designed to enhance trader development.

- Can I use a VPN/VPS to trade with FTMO?

VPN/VPS use policies vary by firm and should be checked with each individual prop trading company to ensure compliance with their specific terms and conditions.