This Topstep review cuts through the hype to answer one crucial question: is it worth your time and money in 2025? While the dream of becoming a funded futures trader is alluring, choosing the wrong program could cost you thousands in evaluation fees with nothing to show for it. After helping hundreds of traders evaluate prop firms, I’ll break down exactly what you need to know about Topstep’s program.

What Is Topstep?

Topstep® is a futures trading platform that helps traders earn funding by participating in the Trading Combine® challenge. Michael S. Patak founded Topstep in 2012 in Chicago, Illinois, where it has grown into a leading prop firm funding provider for futures traders.

Since 2020, Topstep has paid out over $180,823,980 to traders and has funded 85,124 accounts as of December 2024. Throughout its 12-year history, Topstep has continuously supported traders, with some earning funding in as little as 2 days.

Key Features of Topstep

Topstep stands out with a suite of features designed to support and enhance your trading experience:

- TopstepX™ Trading Platform: Purpose-built for prop traders, TopstepX allows you to trade seamlessly from a PC or Mac. Its customizable dashboards and tools focus on fostering discipline and consistency.

- TradingView Integration: Get access to industry-leading charts with advanced drawing tools, indicators, and full customization. This integration ensures you have the insights needed to make informed trading decisions.

- The Tilt™ Indicator: A unique real-time tool that displays the collective sentiment of Topstep traders across the S&P, NASDAQ, Crude Oil, and Gold. It’s an excellent way to gauge market bias while trading.

- TopstepTV™: A daily live broadcast directly within the platform. Watch professional traders analyze markets, share tips, and engage with special guests to stay motivated throughout the trading day.

- Coaching Tools: Topstep offers features that guide traders toward building better habits, emphasizing the importance of discipline and risk management.

These features combine to create an environment that supports growth, offering much more than just a place to trade.

Is Topstep Regulated?

N0! Topstep operates differently from brokers and doesn’t fall under direct regulation from major financial regulatory bodies like the CFTC (Commodity Futures Trading Commission) or NFA (National Futures Association).

When you trade with funded account money, regulated FCMs and brokers who answer to the CFTC and NFA execute your trades.

The Trading Combine® works as a simulation where you trade without real money during the evaluation phase. This structure differs from platforms where you trade with your own capital, eliminating the need for the same regulatory oversight.

After earning funding, you’ll conduct all your live trading through regulated channels and exchanges.

Account Options

Topstep offers three flexible account sizes, designed to cater to traders with different goals and risk levels:

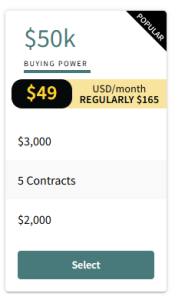

$50k Account

$50k Account

- Profit Target: $3,000

- Maximum Position Size: 5 contracts

- Maximum Loss Limit: $2,000

- Monthly Cost: $49 (Regularly $165)

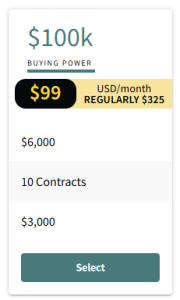

$100k Account

$100k Account

- Profit Target: $6,000

- Maximum Position Size: 10 contracts

- Maximum Loss Limit: $3,000

- Monthly Cost: $99 (Regularly $325)

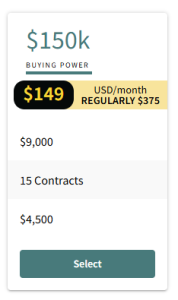

$150k Account

$150k Account

- Profit Target: $9,000

- Maximum Position Size: 15 contracts

- Maximum Loss Limit: $4,500

- Monthly Cost: $149 (Regularly $375)

All account sizes require a one-time $149 activation fee after passing the evaluation and receiving funding.

This tiered structure makes it easy to find an option that fits your trading style—whether you prefer starting small with the $50k account or going bigger with $150k for more room to scale. The competitive pricing, combined with clear profit and loss rules, encourages discipline and accountability, ensuring you trade smarter, not riskier.

Topstep Trading Platform

What platform does Topstep use? Topstep offers its traders the flexibility to choose from several platforms, but the standout option is TopstepX—a proprietary platform designed specifically for prop traders. TopstepX combines seamless functionality with an intuitive interface, tailored to meet the unique needs of traders who are part of the Topstep community.

However, TopstepX is just one of the options available. Here’s a breakdown of the supported platforms:

- TopstepX

- Fully integrated with Topstep’s system.

- Features built-in TradingView charts and real-time data.

- Available for PC and Mac, and includes mobile accessibility.

- Ideal for traders who prefer a streamlined, Topstep-centric experience.

- NinjaTrader

- Offers advanced charting tools and indicators.

- Compatible with Rithmic and CQG data feeds.

- Available for both Windows and mobile.

- A great choice for traders who need customization and third-party integrations.

- Quantower

- Another powerful platform that integrates well with Rithmic data.

- Suitable for traders who require deep order flow analysis and multi-market access.

- Available on Windows with mobile support.

- Tradovate

- Supports CQG data feeds and can be paired with TradingView for enhanced charting.

- Available on PC and mobile.

- Best for traders looking for an intuitive interface and easy-to-use features.

Switching Platforms

Once you’ve selected your platform for the Trading Combine, it’s the one you’ll continue using if you pass and earn funding. If you wish to switch platforms, it’s possible but requires starting a new Trading Combine, especially if you’re moving between different data feeds.

For Mac/iOS users, the options are more limited, with TopstepX, MotiveWave, and a few others being the primary choices. If you’re on a mobile device, Tradovate and RTrader Pro are solid options to consider.

How Topstep Evaluates and Funds Traders

Topstep’s evaluation process is designed to test a trader’s skill, discipline, and consistency before offering funding. This journey consists of three key stages: the Trading Combine®, the Express Funded Account™, and the Live Funded Account™. Here’s how it works:

1. Trading Combine®

The Trading Combine® is where traders prove their abilities. It’s an evaluation phase that includes the following parameters:

- Profit Target: Reach and maintain a specific profit target to demonstrate your trading edge.

- Consistency Target: Your Best Day should be no more than 50% of your total profits to show steady performance.

- Daily Loss Limit: Stay within the daily loss limit to avoid deactivation. However, starting August 25th, TopstepX™ accounts will no longer have this daily loss limit. For other platforms (like NinjaTrader, Quantower, etc.), the daily loss limit still applies.

- Maximum Loss Limit: Ensure your account balance does not exceed the maximum loss limit.

You can complete the Trading Combine in as little as 2 trading days, which is the minimum time needed to meet our Consistency Target objective. While you could pass in just two days, feel free to take your time – there’s no rush. Your subscription will automatically renew each month until you either pass or decide to cancel.

2. Express Funded Account™

Once you meet the Trading Combine objectives, you qualify for the Express Funded Account™, where the rules become slightly more flexible:

- 5 Winning Days: Achieve 5 winning days with a minimum of $200+ profit per day.

- Scaling Plan: Follow the provided scaling plan to increase your trading power.

- Daily Loss Limit: Like the Trading Combine, you must avoid exceeding the daily loss limit, but this rule does not apply to TopstepX™ accounts as of August 25th.

- Maximum Loss Limit: Ensure your account balance stays within the maximum loss limit.

3. Live Funded Account™

After proving yourself in the Express Funded Account, you graduate to the Live Funded Account™, where real capital is at stake:

- 5 Winning Days: Similar to the Express Funded Account, you need 5 winning days with $200+ in profit per day.

- Daily Loss Limit: You must avoid hitting the daily loss limit, as exceeding it will result in account deactivation for the day.

- Account Balance: Your account balance should not reach $0, ensuring you manage risk effectively.

Through this well-structured, multi-phase evaluation process, Topstep helps traders gradually prove their skills, discipline, and risk management abilities before providing access to live funding.

Tradable Products

Topstep focuses exclusively on Futures trading, offering a wide selection of products across major markets. However, it’s important to note what they do not offer:

- Stocks, Options, Forex (spot trading), Cryptocurrency, and CFDs are not supported.

Instead, Topstep provides access to Futures products listed on the CME, COMEX, NYMEX, and CBOT exchanges. Here’s what you can trade:

- Commodities:

- Precious Metals: Gold (GC), Silver (SI), Copper (HG).

- Energy: Crude Oil (CL), Natural Gas (NG), Heating Oil (HO).

- Agriculture: Corn (ZC), Wheat (ZW), Soybeans (ZS), and related products.

- Indices:

- E-Mini S&P 500 (ES), NASDAQ 100 (NQ), Russell 2000 (RTY), and Dow Jones (YM).

- Micro E-Minis for added flexibility: MES, MNQ, M2K, and MYM.

- Currencies (FX Futures):

- Major pairs like Euro FX (6E), British Pound (6B), Japanese Yen (6J), and Australian Dollar (6A).

- Micro currency contracts for precise sizing.

- Fixed Income:

- 2-Year, 5-Year, 10-Year Notes, and 30-Year Bonds.

Both Mini and Micro contracts are available, with a 10:1 Micro-to-Mini contract ratio for most products (5:1 for Silver). This range of assets ensures you can trade your preferred markets, whether you specialize in metals, energy, or indices. With such variety, Topstep empowers traders to diversify their strategies and maximize opportunities.

Educational and Motivational Tools

Topstep goes beyond just providing a platform to trade. It offers a range of educational and motivational tools to help you grow as a trader. One of the standout features is TopstepTV™, which streams live broadcasts daily. These broadcasts feature real-time trading insights, market discussions, and guest traders sharing their experiences and strategies.

Another key resource is online coaching for futures traders. You can access personalized advice and tips from experienced coaches like Gregg McLeod, who brings years of expertise to guide traders through their evaluation process. These tools, combined with real-time sentiment indicators like The Tilt™, which shows the bias of Topstep traders on key markets like the S&P 500 and Gold, create a supportive environment to help you stay motivated and improve your trading skills.

Pricing

As mentioned earlier in this Topstep review, the pricing and fees are straightforward and designed for transparency. Monthly costs depend on your chosen account size:

- $50k Account: $49/month (regularly $165)

- $100k Account: $99/month (regularly $325)

- $150k Account: $149/month (regularly $375)

In addition to the monthly subscription, all traders pay a one-time $149 activation fee upon passing the Trading Combine and receiving funding.

The costs are competitive, especially considering the access to premium features like TradingView integration, TopstepTV, and educational tools.

Topstep Review: Payouts

Topstep’s payout process is designed to be straightforward and flexible, allowing traders to access their profits while maintaining discipline. Here’s how it works:

- Eligibility:

- Traders can request payouts after accumulating five non-consecutive winning trading days, where the Net PNL (profit and loss) is $200 or more per day.

- After 30 non-consecutive winning days, traders unlock access to withdraw 100% of their account balance.

- Payout Limits:

- With five winning days, traders can withdraw up to $5,000 or 50% of their account balance.

- Once 30 winning days are achieved, traders can request any amount (minimum $125) up to 100% of their balance.

- Rules to Note:

- After each payout, traders must complete five additional winning days before making another request.

- Requesting a 100% payout will result in account closure since the balance will drop to the Maximum Loss Limit.

- Processing Times:

Payouts are approved within 1-3 business days, with funds arriving in:- 1-3 business days via Wise or ACH.

- 3-5 business days via Wire/SWIFT.

- 5-10 business days for international transfers.

By following this structure, Topstep ensures that traders remain consistent while enjoying the fruits of their efforts.

Profit Sharing and Withdrawal Rules

Topstep offers an industry-leading profit split policy that maximizes trader earnings while incentivizing growth.

- Initial Profit Split: Traders keep 100% of their profits until they cumulatively withdraw $10,000 across all Funded Accounts.

- After $10,000 Threshold: A 90/10 profit split applies, where the trader retains 90% of payouts and Topstep retains 10%.

- Important Notes:

- Once a payout is processed, the Maximum Loss Limit is reset to $0, meaning the trader must not let their account balance reach or fall below zero.

- Payouts are subject to verification, including submitting accurate banking information and KYC documents.

This approach ensures that traders are rewarded generously for their success while maintaining accountability for sustainable performance.

Customer Support

Topstep takes pride in offering exceptional customer support to ensure that traders always have the help they need. Whether you have questions about the Trading Combine® or need assistance with platform issues, you’re in good hands. Their support team is made up of Funded Traders and industry experts, providing top-notch, knowledgeable assistance.

Support Hours:

- Chat Support: Monday – Friday, 5:30 AM – 8:00 PM CT

- Phone Support: Monday – Friday, 7:00 AM – 6:00 PM CT

- Phone Number: 1-888-407-1611

For quick and efficient assistance, you can start by chatting with Windy, Topstep’s AI chatbot. Located in the bottom right corner of the website, Windy is capable of answering most questions related to Topstep. If needed, Windy will seamlessly connect you with the dedicated Trader Support Team for further help.

Additionally, Topstep Ambassadors—a community of traders, coaches, and experts—are available on Discord for real-time support. This platform fosters a unique environment where traders help other traders, giving you immediate access to answers and a community to learn from.

For detailed guidance, visit the Help Center on the website, where you’ll find comprehensive information on account setup, program objectives, platform connections, payouts, and more. If you can’t find what you need, simply reach out to Windy or the Trader Support Team.

Topstep Review: Pros and Cons

Pros:

- Clear evaluation process with set profit targets and loss limits.

- Access to TopstepX, TradingView charts, and the Tilt™ indicator for real-time market insights.

- Over 30 assets to trade, including FX futures, and commodities.

- Continuous support via TopstepTV™ and other coaching tools.

- Built-in loss limits to help traders stay disciplined.

Cons:

- Trading of Stocks, Options, Forex, Cryptocurrency, and CFD’s are not available.

- The monthly subscription fees, though discounted, can still be costly for those starting out.

- Traders must meet specific profit and loss criteria during the Trading Combine®—which can be challenging for some.

- The one-time $149 activation fee may be an additional barrier for some traders.

Comparing Topstep vs Apex vs FTMO

After reading this Topstep review to this point, you might be wondering if this platform is the best fit for your trading goals—or if another prop trading firm could offer something better. Traders have different needs, whether it’s more flexibility, lower fees, or access to a wider range of trading products. Comparing Topstep vs Apex Trader Funding vs FTMO, three of the most popular proprietary trading firms, can help you make a well-informed decision based on your priorities.

Below, we break down the key factors—like account options, tradable products, profit-sharing, and fees—so you can identify which firm aligns best with your trading style. If you’re interested in learning more about Apex or FTMO, check out our in-depth reviews of these firms for a closer look.

|

|

|

|

|---|---|---|---|

Account/Challenges |

Three account sizes: $50k, $100k, $150k Profit targets: $3k-$9k Two-step Trading Combine® process |

Flexible account sizes ranging from $25k to $300k Single-phase evaluation |

Multiple account sizes: €10k to €200k Two-step evaluation process |

Trading Platform |

Proprietary TopstepX, NinjaTrader, Tradovate |

NinjaTrader, TradingView, R Trader Pro |

cTrader, MetaTrader 4/5 |

Tradable Products |

Futures (e.g., S&P, NASDAQ, Crude Oil, Gold, Forex) |

Futures (e.g., Indices, Commodities, Forex) |

Forex, Indices, Commodities, Crypto |

Profit Sharing |

100% profit up to $10k, 90/10 split thereafter |

100% for first $10k; 90/10 or 80/20 depending on plan |

90/10 profit split |

Fees |

$49-$149/month (depending on account size) + $149 activation fee |

Starting at $147/month (frequent discounts) |

Starting at €155 for the €10k account |

As you can see from this comparison, each firm offers unique advantages depending on your trading preferences. Topstep is ideal for futures traders focused on discipline. Apex shines with flexibility and frequent promotions. FTMO is highly regarded for its global reach and comprehensive platform support.

Topstep Review: Conclusion

Topstep is a solid choice for traders looking to access capital without risking their own funds. Its structured evaluation process, robust trading tools, and emphasis on discipline create an environment that promotes both skill development and growth.

Whether you’re just starting out or looking to scale your trading, Topstep provides the resources and support you need to succeed. The platform’s clear, transparent pricing and diverse account options make it accessible to traders at various levels. For anyone serious about trading with real funding, Topstep is a proven path worth considering in 2025.

FAQs

Is Topstep regulated?

No, Topstep is not a regulated financial institution. However, it operates transparently, providing a secure and professional environment for traders.

Where is Topstep located?

Topstep is headquartered in Chicago, Illinois, the heart of the global futures trading industry.

When was Topstep founded?

Topstep was founded in 2012 with the mission of helping traders succeed in live markets.

What platform does Topstep use?

Topstep offers its proprietary trading platform, TopstepX™, tailored to meet the needs of prop firm traders.

What broker does Topstep use?

Topstep’s live accounts are powered by Phillip Capital and other top-tier futures brokers.

Can I trade Forex?

No, Topstep focuses exclusively on futures trading and does not support Forex trading at this time.

What is the Profit Split?

Traders keep 100% of profits up to $10,000. After that, a 90/10 profit split applies, with traders retaining 90% of future payouts.

What is the monthly cost?

Topstep offers three account options:

- $50k account: $49/month

- $100k account: $99/month

- $150k account: $149/month

How many Topstep accounts can I have?

You can have and take payouts from up to five Express Funded Accounts simultaneously.

Is there an age requirement?

Yes, you must be at least 18 years old to join Topstep and trade on a Funded Account.

We’d love to hear about your experience with Topstep! Share your review with us in the comment section below.