Finding the best futures prop firms for 2026 can transform your trading career by giving you access to capital up to $2.5 million without risking your own money.

The prop trading industry has exploded this year, with established firms paying out over $378 million to successful traders who proved their skills. This comprehensive guide reveals which firms offer the best profit splits, fastest payouts, and most realistic evaluation requirements for both beginners and experienced traders.

What Is a Prop Trading Firm?

A proprietary trading firm, or “prop firm,” is essentially a financial partner that gives you their money to trade with in exchange for a cut of your profits. Think of it like this: they provide the capital, you provide the skill, and everyone wins when you succeed.

So you’re no longer limited by your bank account.

Let’s say you’re a skilled trader with only $5,000 to your name. Even if you’re incredibly talented and make 15% monthly returns, you’re looking at just $750 profit per month. Nice, but not life-changing.

Now imagine trading with $100,000 of prop firm capital:

- Same 15% monthly return = $15,000 profit

- You keep 80-90% = $12,000-$13,500 in your pocket

- That’s potentially $150,000+ annually vs. $9,000 with your own money

The beautiful part? If you lose money, it’s not your personal savings at risk – it’s theirs. You’re essentially getting a high-paying job where your “salary” is based on your trading performance.

The catch? You have to prove you can actually trade profitably first.

Are Prop Trading Firms Legit or Scam?

The short answer is that most established prop trading firms, like the ones reviewed in this article, are legitimate businesses operating within legal business models. Prop firms only make money when you make money. They’re not trying to take your evaluation fees and run – they need you to succeed because that’s how they profit long-term. It’s a rare business model where everyone’s interests are perfectly aligned.

However, like any growing industry, the prop trading space has attracted both reputable companies and questionable operators, making due diligence essential for prospective traders.

The most known prop firms in the market operate legitimate businesses and provide valuable experiences for highly skilled traders. The legitimate business model is straightforward: firms profit when traders succeed, creating aligned incentives. Established firms have paid out millions in profits to traders and maintain transparent operations with clear terms and conditions.

However, the rapid growth of the industry has also created opportunities for fraudulent schemes. Most likely it is fraudulent and only masquerades as a legitimate firm in the hope of attracting as many gullible traders as possible when operators focus solely on collecting evaluation fees without intending to fund successful traders.

Red Flags to Avoid:

Unrealistic Promises: Be wary of firms promising guaranteed profits or claiming their evaluation process is “easy money.” Legitimate trading requires skill and carries inherent risks.

Hidden Fees: Reputable firms are transparent about all costs upfront. Watch out for unexpected charges, withdrawal fees, or monthly platform costs not clearly disclosed.

Poor Reviews and Communication: If you see a lot of negative reviews on forums, refrain from cooperating with a prop company. Patterns of delayed payouts, poor customer service, or traders unable to withdraw profits are major warning signs.

Lack of Transparency: Legitimate firms provide clear information about their business registration, terms of service, and risk management

Top 10 Best Futures Prop Firms 2025

Apex Trader Funding

Apex Trader Funding is a legitimate company with TrustPilot ratings of 4.5 out of 5 stars and over 10,000 reviews. The company is based in Austin, Texas, and has active users in over 150 countries worldwide. Founded in 2021, it has quickly established itself as a leader in the futures prop trading space.

Key Details:

- Country of Origin: United States (Austin, Texas)

- Year Founded: 2021

- Trustpilot Rating: 4.5/5 stars with over 14,762 reviews

- Assets: Futures (E-mini S&P 500, Nasdaq, Russell 2000, Dow Jones, Oil, Gold, etc.)

- Trading Platforms: Rithmic, Tradovate, NinjaTrader

- Maximum Allocation: Up to $2,500,000

- Account Sizes: $25K, $50K, $75K, $100K, $150K, $250K

- Evaluation Steps: One-step evaluation process

- Profit Target: $3,000 (for $50K account)

- Daily Loss Limit: $2,000 (for $50K account)

- Maximum Loss: $2,500 (for $50K account)

- Profit Split: 90% to trader after first $25K in profits

- Payout Frequency: Every 8 trading days

- Price: Starting from $97 for $25K evaluation

Pros |

Cons |

Highest profit split in the industry (90%) |

Founded recently (2021), limited track record |

Fast payout frequency (8 trading days) |

Some negative reviews regarding rule changes |

One-step evaluation process |

30% rule limits single-day profits |

Multiple platform options |

Higher evaluation fees compared to some competitors |

Strong Trustpilot rating |

Topstep

Overview: Topstep has been in the game for over 12 years, funding more than 10,000 traders during that time. With a solid Trustpilot rating of 4.6/5, and a well-established name, Topstep is one of the best futures prop trading firms in 2025.

Key Details:

- Country of Origin: United States

- Year Founded: 2012

- Trustpilot Rating: 4.6/5 stars

- Assets: Futures (E-mini contracts, commodities, currencies)

- Trading Platforms: Rithmic, NinjaTrader, TradingView

- Maximum Allocation: $150,000

- Account Sizes: $50,000, $100,000, and $150,000

- Evaluation Steps: Two-step evaluation (Trading Combine + Funded Trader Prep)

- Profit Target: $3,000 (for $50K account)

- Daily Loss Limit: $2,000

- Maximum Loss: $2,500

- Profit Split: 100% of first $10,000, then 80/20 split

- Payout Frequency: Bi-weekly

- Price: $165 for $50K evaluation

Compare: Topstep vs Apex Trader Funding

Pros |

Cons |

12+ years of proven track record |

Two-step evaluation process |

Funded over 10,000 traders |

Lower maximum allocation ($150K) |

100% of first $10K profits |

Higher evaluation costs |

Strong educational resources |

Longer payout frequency |

Excellent reputation |

More restrictive rules |

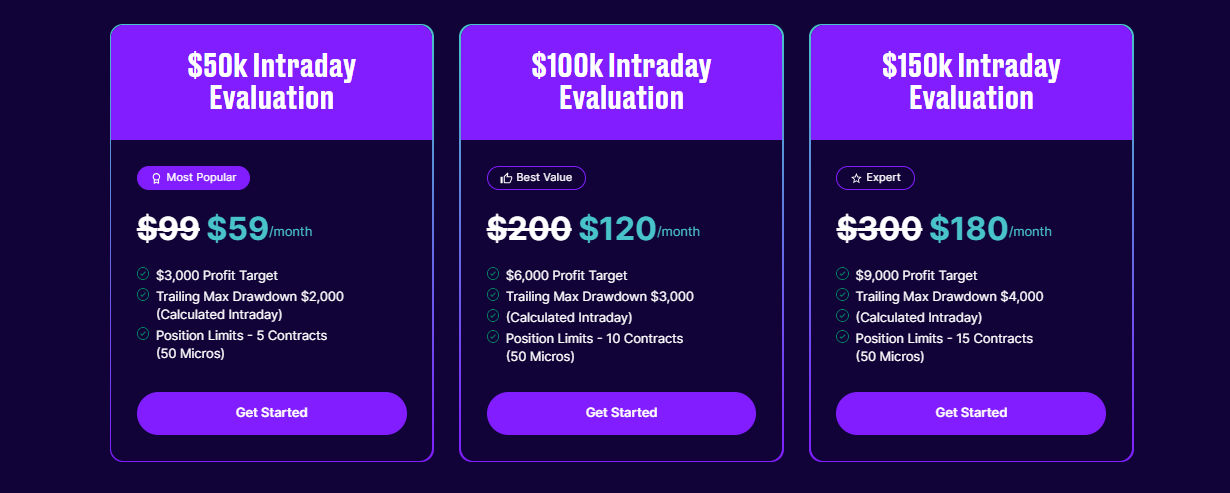

Tradeify

Tradeify made it into our list of the best futures prop trading firms for 2026 because its focus is on futures trading with a streamlined evaluation process and competitive terms for active day traders.

Key Details:

- Country of Origin: United States

- Year Founded: 2022

- Trustpilot Rating: 4.2/5 stars

- Assets: Futures (ES, NQ, YM, RTY, CL, GC, etc.)

- Trading Platforms: TradingView, NinjaTrader

- Maximum Allocation: $200,000

- Account Sizes: $25K, $50K, $100K, $200K

- Evaluation Steps: One-step evaluation

- Profit Target: 8% for evaluation

- Daily Loss Limit: 5% of account balance

- Maximum Loss: 8% of starting balance

- Profit Split: 80/20 (80% to trader)

- Payout Frequency: Bi-weekly

- Price: $99 for $25K evaluation

Pros |

Cons |

Simple one-step evaluation |

Newer company (2022) |

Competitive evaluation pricing |

Limited track record |

Multiple account sizes |

Lower profit split than top competitors |

Fast evaluation process |

Smaller maximum allocation |

Modern trading platforms |

Take Profit Trader

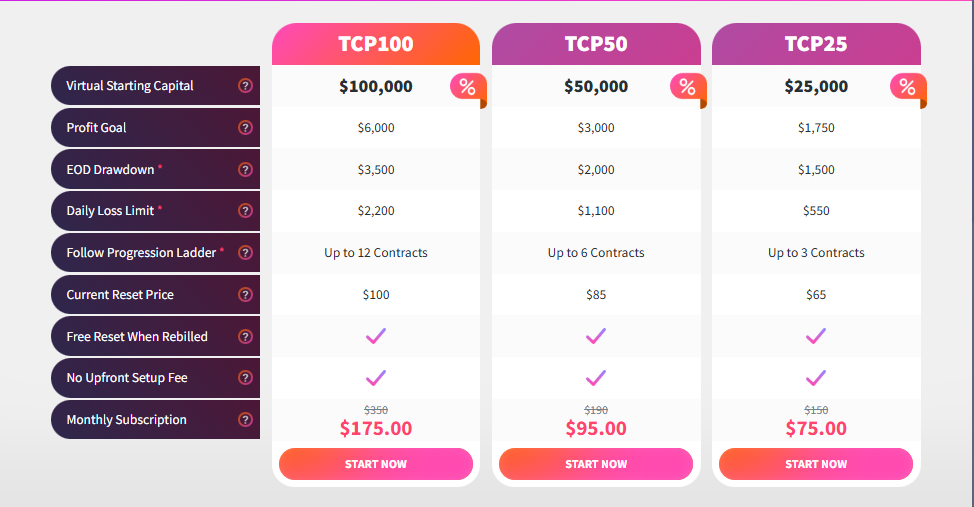

Overview: Take Profit Trader is a UK-based prop firm that has expanded globally, offering both forex and futures trading opportunities with flexible account options.

Key Details:

- Country of Origin: United Kingdom

- Year Founded: 2020

- Trustpilot Rating: 4.3/5 stars

- Assets: Futures and Forex

- Trading Platforms: MetaTrader 4, MetaTrader 5, cTrader

- Maximum Allocation: $200,000

- Account Sizes: $25K, $50K, $100K, $200K

- Evaluation Steps: Two-step evaluation

- Profit Target: 8% (Phase 1), 4% (Phase 2)

- Daily Loss Limit: 5% of account balance

- Maximum Loss: 10% of starting balance

- Profit Split: 80/20 initially, scaling to 90/10

- Payout Frequency: Bi-weekly

- Price: $150 for $50K evaluation

Pros |

Cons |

Multi-asset trading (Forex + Futures) |

Two-step evaluation required |

Profit split increases over time |

Higher evaluation fees |

Multiple platform choices |

UK-based (potential regulatory differences) |

Established presence |

Lower maximum allocation |

Flexible account options |

MyFundedFutures

Overview: MFFU is one of the best futures prop trading firms for beginner and experienced traders alike, focusing exclusively on futures trading with competitive terms and strong trader support.

Key Details:

- Country of Origin: United States

- Year Founded: 2021

- Trustpilot Rating: 4.4/5 stars

- Assets: Futures (all major contracts)

- Trading Platforms: Rithmic, NinjaTrader, Tradovate

- Maximum Allocation: $150,000

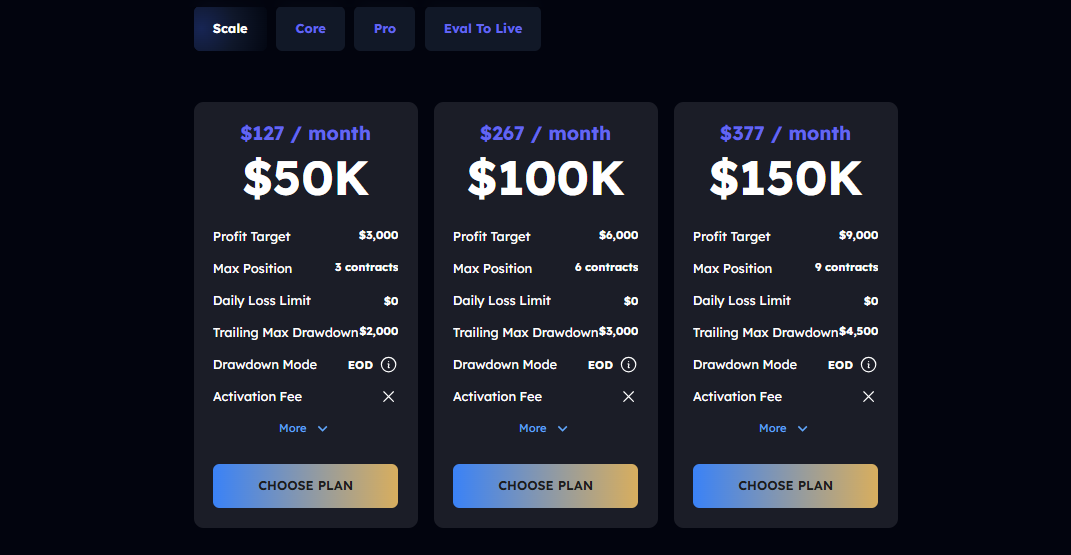

- Account Sizes: $50K, $100K, $150K

- Evaluation Steps: One-step evaluation

- Profit Target: $3,000 (for $50K account)

- Daily Loss Limit: $1,500

- Maximum Loss: $2,000

- Profit Split: 85/15 (85% to trader)

- Payout Frequency: Bi-weekly

- Price: $127 for $50K evaluation

Pros |

Cons |

One-step evaluation process |

Limited maximum allocation |

High profit split (85%) |

Newer company (2021) |

Beginner-friendly approach |

Unique account sizing |

Competitive pricing |

Smaller starting accounts |

Multiple platform support |

TickTick Trader

Overview: TickTick Trader is a growing prop firm that focuses on providing straightforward terms and competitive profit splits for futures traders.

Key Details:

- Country of Origin: United States

- Year Founded: 2022

- Trustpilot Rating: 4.1/5 stars

- Assets: Futures (E-mini contracts, commodities)

- Trading Platforms: NinjaTrader, TradingView

- Maximum Allocation: $100,000

- Account Sizes: $25K, $50K, $100K

- Evaluation Steps: One-step evaluation

- Profit Target: $1,500 (for $25K account)

- Daily Loss Limit: $500 (for $25K account)

- Maximum Loss: 6% of starting balance

- Profit Split: 80/20 (80% to trader)

- Payout Frequency: Monthly

- Price: $89 for $25K evaluation

Pros |

Cons |

Low evaluation fees |

Limited maximum allocation |

One-step process |

Monthly payout frequency |

Straightforward terms |

Lower profit split |

New company flexibility |

Newer company (limited history) |

Reasonable profit targets |

Limited platform options |

Earn2Trade

Overview: Earn2Trade is an established prop firm with a strong educational focus, offering the Gauntlet Mini challenge for futures traders looking to prove their skills.

Key Details:

- Country of Origin: United States

- Year Founded: 2018

- Trustpilot Rating: 4.0/5 stars

- Assets: Futures (E-mini S&P, Nasdaq, Russell, etc.)

- Trading Platforms: Rithmic, NinjaTrader

- Maximum Allocation: $200,000

- Account Sizes: $25K, $50K, $100K, $150K, $200K

- Evaluation Steps: One-step evaluation (Gauntlet Mini)

- Profit Target: $2,500 (for $25K account)

- Daily Loss Limit: $1,200

- Maximum Loss: $1,500

- Profit Split: 80/20 (80% to trader)

- Payout Frequency: Bi-weekly

- Price: $150 for $25K evaluation

Pros |

Cons |

Strong educational resources |

Higher evaluation costs |

Established track record |

Standard profit split (80%) |

Multiple account sizes |

Stricter loss limits |

Professional platform support |

Lower profit targets relative to risk |

Good reputation |

BluSky Trading Company

Overview: BluSky Trading Company offers a unique approach to prop trading with focus on trader development and long-term success in the futures markets.

Key Details:

- Country of Origin: United States

- Year Founded: 2021

- Trustpilot Rating: 4.2/5 stars

- Assets: Futures (major indices and commodities)

- Trading Platforms: NinjaTrader, Sierra Chart

- Maximum Allocation: $100,000

- Account Sizes: $30K, $50K, $100K

- Evaluation Steps: Two-step evaluation

- Profit Target: 10% (Phase 1), 5% (Phase 2)

- Daily Loss Limit: 3% of account balance

- Maximum Loss: 6% of starting balance

- Profit Split: 75/25 initially, scaling to 85/15

- Payout Frequency: Monthly

- Price: $199 for $50K evaluation

Pros |

Cons |

Focus on trader development |

Two-step evaluation required |

Profit split improves over time |

Higher evaluation fees |

Conservative risk parameters |

Monthly payout frequency |

Professional trading environment |

Lower initial profit split |

Scaling opportunities |

Limited maximum allocation |

TradeDay

Overview: TradeDay is a European-based prop firm that has expanded to serve international traders, offering competitive terms for futures trading.

Key Details:

- Country of Origin: Czech Republic

- Year Founded: 2019

- Trustpilot Rating: 4.3/5 stars

- Assets: Futures (US indices, commodities, currencies)

- Trading Platforms: TradingView, NinjaTrader, Tradovate,

- Maximum Allocation: $200,000

- Account Sizes: $25K, $50K, $100K, $200K

- Evaluation Steps: One-step evaluation

- Profit Target: 8% for evaluation

- Daily Loss Limit: 4% of account balance

- Maximum Loss: 8% of starting balance

- Profit Split: 80/20 (80% to trader)

- Payout Frequency: Bi-weekly

- Price: $125 for $25K evaluation

Pros |

Cons |

One-step evaluation |

European-based (regulatory differences) |

Multiple account sizes |

Standard profit split |

International trader focus |

Currency conversion considerations |

Reasonable evaluation pricing |

Limited platform options |

Good maximum allocation |

Bulenox

Overview: Bulenox is a newer entrant in the prop trading space, focusing on providing competitive terms and modern technology for futures traders.

Key Details:

- Country of Origin: United States

- Year Founded: 2023

- Trustpilot Rating: 3.9/5 stars

- Assets: Futures (E-mini contracts, energy, metals)

- Trading Platforms: TradingView, NinjaTrader

- Maximum Allocation: $150,000

- Account Sizes: $25K, $50K, $100K, $150K

- Evaluation Steps: One-step evaluation

- Profit Target: 7% for evaluation

- Daily Loss Limit: 4% of account balance

- Maximum Loss: 7% of starting balance

- Profit Split: 82/18 (82% to trader)

- Payout Frequency: Bi-weekly

- Price: $79 for $25K evaluation

Pros |

Cons |

Very competitive pricing |

Very new company (2023) |

One-step evaluation |

Limited track record |

Good profit split (82%) |

Lower Trustpilot rating |

Modern platform integration |

Unproven payout reliability |

Flexible account options |

Small maximum allocation |

How Do Futures Prop Trading Firms Work?

Futures prop trading involves trading futures contracts with capital provided by proprietary trading firms through a futures prop trading account, minimizing personal financial risk and enabling traders to handle larger accounts. Understanding this process is crucial for any trader considering the prop firm route.

The Evaluation Process:

Step 1: Purchase Evaluation Account The journey begins when you purchase an evaluation account from your chosen prop firm. The evaluation phase can be stringent, but it serves as proof that you can trade profitably and manage risk effectively. You’ll pay a fee (typically $79-$299) to access a simulated trading account with specific rules and targets.

Step 2: Meet Profit Targets During the evaluation, you must achieve predetermined profit targets while adhering to strict risk management rules. For example, a $50,000 evaluation might require you to make $3,000 in profits within 30 trading days while never losing more than $2,000 in a single day or $2,500 total.

Step 3: Follow Risk Management Rules Practice managing drawdown, profit targets, and daily limits is essential. Firms monitor every trade to ensure you’re not taking excessive risks. This includes daily loss limits, maximum drawdown rules, and sometimes position sizing requirements.

Step 4: Get Funded Account Once you successfully complete the evaluation, the firm provides you with a live funded account. This account contains real capital that you can trade, with profits shared between you and the firm.

The Funding Process:

Account Activation: After passing evaluation, your funded account is typically activated within 1-3 business days. You’ll receive login credentials for your live trading account with the agreed-upon capital allocation.

Live Trading Begins: You start trading with real money, following similar but often slightly relaxed rules compared to the evaluation phase. The pressure is different because real money is at stake, but the profit potential is also real.

Profit Sharing Kicks In: Benefits of futures prop trading include potential earnings of up to 90% of profits, with the firm taking the remainder. Some firms offer scaling programs where successful traders can gradually increase their account sizes.

Scaling Opportunities: Many firms offer account scaling programs. If you consistently profit and follow rules, you might progress from a $50,000 account to $100,000, $150,000, or even larger allocations over time.

Revenue Model:

Prop firms make money through evaluation fees and their share of trading profits. This creates aligned incentives – firms profit when their traders succeed. Many firms provide extensive resources to help traders improve, including training, mentorship, and trading tools, creating a learning-focused environment.

Common Rules:

All funded accounts come with specific trading rules designed to protect the firm’s capital while allowing profitable trading. These typically include daily loss limits (often 3-5% of account balance), maximum drawdown limits (usually 6-10% of starting balance), consistency requirements to prevent gambling-style trading, and sometimes trading hours restrictions to limit overnight risk exposure.

The key to success in this model is viewing the evaluation not as a hurdle but as training for real funded trading. Traders who use demo accounts to simulate the evaluation process are more likely to pass on their first try, making preparation essential for long-term success.

How to Choose the Best Futures Prop Firm

Selecting the right futures prop firm can make the difference between trading success and frustration. With dozens of firms competing for your business, understanding what to evaluate ensures you make an informed decision that aligns with your trading style and goals.

Define Your Trading Style

Before comparing firms, honestly assess your trading approach. Are you a day trader who opens and closes positions within hours, or do you prefer swing trading over several days? Scalpers need firms with minimal restrictions and fast execution, while swing traders require firms that allow overnight positions. Your risk tolerance also matters – aggressive traders might prefer higher profit targets with larger drawdowns, while conservative traders want smaller, more manageable risk parameters.

Evaluate Key Factors

Capital Requirements: Consider both the evaluation fee and your realistic profit expectations. A $97 evaluation might seem attractive, but if the profit targets are unrealistic for your skill level, you’re unlikely to succeed. Look for firms where the profit targets align with your historical trading performance.

Profit Targets: Profit Potential: Futures offer significant profit potential due to leverage and high liquidity, but targets should be achievable. A firm requiring 10% profits in 30 days may offer large accounts, but the pressure could lead to overtrading. Realistic targets of 6-8% allow for sustainable trading strategies.

Risk Parameters: Daily loss limits and maximum drawdowns should match your trading style. If you’re used to risking 2% per trade, a 3% daily loss limit provides reasonable flexibility. However, if you typically risk 1% per trade, even a 2% daily limit gives you adequate room for multiple positions.

Profit Splits: While 90% splits sound attractive, consider the complete package. A firm offering 80% splits with better support, platforms, and scaling opportunities might be more valuable long-term than a 90% split with limited growth potential.

Asset Coverage: Ensure your preferred markets are available. If you trade crude oil and gold, verify these contracts are offered with reasonable margin requirements. Some firms restrict certain volatile markets or impose additional rules on commodity trading.

Platform Quality: Training and Mentorship: Many firms provide extensive resources to help traders improve, including training, mentorship, and trading tools. Professional platforms like NinjaTrader, Rithmic, or Tradovate can significantly impact your trading experience. Test demo versions to ensure compatibility with your strategies.

Support Quality: Responsive customer service becomes crucial when you need account adjustments, have technical issues, or require clarification on rules. Firms with live chat, phone support, and active trader communities typically provide better experiences.

Research & Due Diligence

Never rely solely on marketing materials. Read reviews thoroughly on Trustpilot, Reddit, and trading forums, paying attention to recent reviews and patterns in complaints. Check the firm’s regulatory status – while prop firms aren’t regulated like brokers, legitimate companies are properly registered and transparent about their business structure.

Understand fee structures completely, including any hidden costs for platform access, data feeds, or withdrawal fees. Many firms offer free demos or trial periods – take advantage of these to test their systems before committing evaluation fees.

Contact support teams with specific questions about rules, scaling policies, and payout procedures. Their responsiveness and knowledge level often indicate the quality of service you’ll receive as a funded trader.

Start Small

Choose smaller account sizes initially, even if you can afford larger evaluations. A $25,000 or $50,000 account lets you learn the firm’s specific rules and culture without significant financial risk. Many successful funded traders recommend proving yourself on smaller accounts before pursuing larger allocations.

Red Flags Checklist

Avoid firms making unrealistic promises about easy money or guaranteed profits. Trading involves inherent risks, and legitimate firms acknowledge this reality. Be wary of hidden fees appearing after signup, poor communication including delayed responses to support tickets, negative review patterns especially regarding payout delays or rule changes, and lack of transparency about company registration, terms of service, or business practices.

The best prop firm for you balances realistic evaluation requirements, fair profit splits, quality support, and alignment with your trading style. Take time to research thoroughly, start conservatively, and remember that the cheapest option isn’t always the best value. Success in prop trading depends as much on choosing the right partner as it does on your trading skills.

Final Thoughts

The best futures prop trading firms in 2026 offer unprecedented opportunities for skilled traders to access professional-level capital and build substantial trading careers. The firms featured in this guide represent the cream of the crop, each offering unique advantages depending on your specific needs and trading style.

To succeed, you need to find the right match for your skills, risk tolerance, and trading goals. Apex Trader Funding’s 90% profit split appeals to experienced traders, while Topstep’s 12-year track record provides confidence for beginners. MyFundedFutures offers beginner-friendly terms, and newer firms like Tradeify provide competitive alternatives with modern approaches.

The most important factor isn’t the profit split or account size – it’s your ability to trade profitably within the firm’s rules. A trader earning consistent 5% monthly returns on a $50,000 account with an 80% split earns more than someone struggling to meet targets on a $150,000 account with a 90% split.

Risk management remains the cornerstone of success. Every funded trader who maintains long-term success prioritizes capital preservation over aggressive profit pursuit. The evaluation process isn’t just a hurdle to overcome – it’s training for real funded trading where consistent profitability matters more than occasional big wins.

Related ↓

3 Best Options Prop Firms 2026

Frequently Asked Questions (FAQs)

Which is the best futures prop firm in 2026?

Apex Trader Funding stands out as the top choice for 2026, offering the industry’s highest profit split at 90% after your first $25,000 in profits.

How much money do I need to start with a prop firm?

Evaluation fees typically range from $79 to $299, depending on the account size and firm. You don’t need significant capital beyond the evaluation fee, as the firm provides all trading capital once you’re funded. However, ensure you can afford to lose the evaluation fee, as not all traders pass on their first attempt.

Can I really make money with prop trading firms?

Yes, many traders earn substantial income through prop firms. As of January 2025, their website reports they’ve paid out over $378 million to customers for Apex Trader Funding alone. However, success requires genuine trading skills, discipline, and the ability to follow rules consistently. Most firms publicly display their payout statistics, demonstrating that profitable traders do receive regular payments.

What happens if I lose the firm’s money?

You cannot lose more than the firm’s predetermined risk limits. Once you hit the maximum drawdown, your account is typically terminated, but you’re not liable for losses beyond that point. This is one of the key advantages of prop trading – limited downside risk compared to trading your own capital.

How long does it take to get funded?

Evaluation periods typically range from 15 to 30 trading days, depending on the firm and your trading frequency. Once you pass, funded accounts are usually activated within 1-5 business days. Some traders complete evaluations in just a few weeks, while others may take several attempts to meet the requirements.

Can I trade multiple accounts simultaneously?

Policies vary by firm, but many allow multiple accounts once you’ve proven success with one. Some traders eventually manage several funded accounts across different firms, significantly multiplying their earning potential. Always check specific firm policies, as some restrict concurrent evaluations or funded accounts.

What’s the difference between evaluation and funded accounts?

Evaluation accounts use simulated money to test your trading skills and rule-following ability. Funded accounts contain real capital where your profits are actual money that gets paid out. Rules are often similar, but funded accounts may have slightly different parameters and always include profit-sharing arrangements.

Are prop firms regulated?

Prop firms operate differently from traditional brokers and aren’t subject to the same regulatory oversight. However, legitimate firms are registered business entities that comply with applicable business laws in their jurisdictions. They typically use regulated brokers to execute trades and hold funds in segregated accounts for trader protection.

How often can I withdraw profits?

Payout frequencies vary by firm, ranging from every 8 trading days (Apex Trader Funding) to monthly. Most established firms offer bi-weekly payouts. Minimum withdrawal amounts and processing times also vary, so check specific firm policies when making your selection.

What trading platforms do prop firms use?

Popular platforms include NinjaTrader, Rithmic, Tradovate, TradingView, and MetaTrader. Most firms offer multiple platform options, allowing you to choose based on your preferences and strategy requirements. Many provide free access to professional platforms that would otherwise cost hundreds monthly.

Can beginners succeed with prop firms?

While prop trading isn’t recommended for complete beginners, traders with some experience and demonstrated profitability can succeed. MFFU is the premier futures prop trading firm for beginner and experienced traders alike. Focus on developing consistent profitability with small amounts of personal capital before attempting prop firm evaluations. Many firms offer educational resources to help traders improve their skills.