Key Insights

- XM is now regulated in Dubai after securing the SCA Category 5 licence through its local entity, XM Financial Products Promotion, and plans to activate it before the end of 2025.

- The licence allows XM to promote services in the UAE but not hold client funds or execute trades, aligning with its current business model.

- The move comes as global brokers compete for access to high-value Middle East traders, with UAE clients driving a significant share of regional trading volumes.

DUBAI – (MarketsXplora) XM, one of the world’s largest contracts for differences (CFDs) brokers, has secured a Category 5 licence from Dubai’s Securities and Commodities Authority (SCA) as it expands deeper into the Middle East. The broker confirmed it plans to activate the new licence before the end of 2025.

The authorisation was granted to XM Financial Products Promotion, a locally incorporated entity established in January this year. Alongside the licence, XM has opened a new office in Dubai’s iconic Opus Building at Business Bay, underlining its growing commitment to the UAE market.

Under Dubai’s regulatory framework, a Category 5 licence allows firms to operate in a manner similar to introducing brokers. They may promote their services and direct clients in the UAE to open accounts with non-UAE entities but are not permitted to hold client funds locally or execute trades. Those activities require a Category 1 licence.

XM has clarified that the Category 5 approval is better aligned with its business model, which focuses on promotion rather than direct execution in the UAE. Still, the broker has left the door open to applying for a full Category 1 licence in the future.

XM Already Regulated in Dubai

This is not XM’s first regulatory foothold in the emirate. The broker is already regulated in Dubai by the Dubai Financial Services Authority (DFSA) under License No. F003484, which oversees firms operating in the city’s free-trade zones.

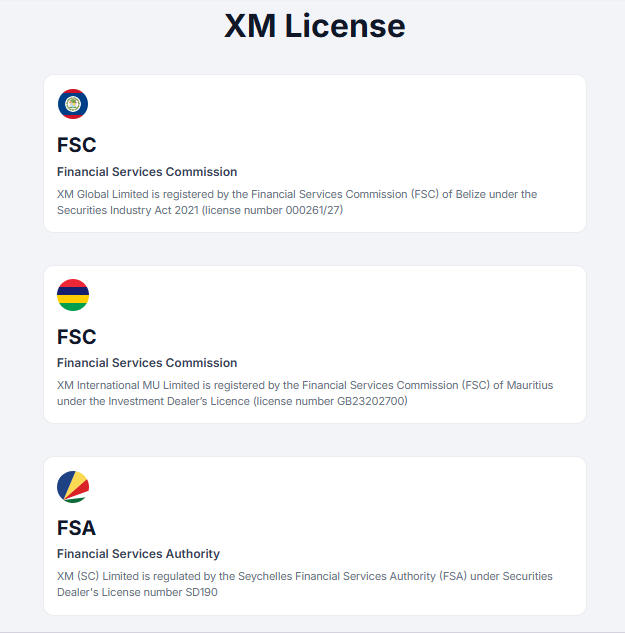

Beyond Dubai, XM holds licences from regulators in Cyprus, Belize, Seychelles, Mauritius, and South Africa. Its sister brand, Trading.com, is authorised in the United States, the United Kingdom, Cyprus, and Australia.

XM’s move comes amid a wider rush by global brokers to secure SCA authorisation in Dubai. Most firms—including Exinity, VT Markets, Eightcap, EC Markets, and Taurex—have opted for the Category 5 model. Others, such as Plus500, XTB, and RoboMarkets, have taken the more demanding step of obtaining full brokerage licences.

The surge of interest is being fuelled by the Middle East’s status as a magnet for high-value traders. Capital.com recently disclosed that 52 percent of its first-half trading volume in 2025 came from the Middle East, compared with just 15 percent from Europe. While the broker counted 35,000 traders across the MENA region, UAE-based clients alone generated 71.7 percent of its $804.1 billion in regional turnover.

Local brokers are also seeing record volumes. CFI Financial, a CFDs provider with a strong Middle East presence, handled $1.51 trillion in trading during the second quarter of 2025—surpassing half its total annual volume of $2.79 trillion in 2024.

With these figures in mind, XM’s latest licence marks a calculated step to secure a larger share of one of the world’s fastest-growing trading hubs.