Is Exness Regulated in South Africa? This is one of the first questions every trader asks before opening an account. In this article, we break down Exness’ FSCA licensing, safety measures, and what real traders are saying.

All regulatory claims mentioned here are verifiable through official sources, ensuring you’re not relying on marketing statements but documented facts.

What Is Exness?

Exness is a global forex and CFD broker that has been operating for more than 17 years, serving millions of traders across multiple regions. The broker provides access to popular trading markets such as forex pairs, commodities like gold, indices, and cryptocurrencies, using well-known trading platforms available on desktop, web, and mobile devices.

What sets Exness apart is its strong focus on transparency and execution efficiency. The broker is particularly known for processing withdrawals extremely fast — with the majority completed in seconds — as well as offering competitive spreads and stable pricing. Over time, these features have helped Exness build a strong reputation among both beginner and professional traders.

Is Exness Regulated in South Africa?

Yes, Exness is regulated in South Africa. The broker operates locally through Exness ZA (PTY) Ltd, a company officially registered in South Africa under registration number 2020/234138/07. Exness is authorized and regulated by the Financial Sector Conduct Authority (FSCA), South Africa’s financial markets regulator, under FSP number 51024.

In addition to FSCA authorization, Exness holds an Over-the-Counter Derivatives Provider (ODP) license, allowing it to legally offer derivative trading products to South African residents.

The company’s registered office is located at 1st and 2nd Floor, Merchant House, 19 Dock Road, V&A Waterfront, Cape Town, 8001, providing a verifiable physical presence in the country.

This level of regulation means Exness must comply with strict rules on client fund protection, financial reporting, and fair trading practices — offering South African traders a regulated and accountable trading environment.

Exness Global Licenses & Regulatory Coverage

Exness does not rely on a single regulator. Instead, it operates through multiple licensed entities, each governed by the financial authority of the region it serves. This multi-jurisdictional structure is important because it ensures Exness complies with local investor-protection laws, rather than applying one-size-fits-all rules across different countries.

To maintain transparency, Exness publicly displays its license numbers at the bottom of every page on its website, allowing traders to independently verify each authorization directly on the regulator’s official register. Some of Exness’ notable global regulatory approvals include:

- South Africa: Financial Sector Conduct Authority (FSCA) — FSP No. 51024

- United Kingdom: Financial Conduct Authority (FCA)

- Cyprus / EU: Cyprus Securities and Exchange Commission (CySEC)

- Kenya: Capital Markets Authority (CMA)

- Seychelles: Financial Services Authority (FSA)

By operating under multiple regulators, Exness demonstrates a long-term commitment to regulatory compliance, transparency, and global best practices — a key trust signal for traders evaluating broker legitimacy.

Client Fund Protection

Regulation is only meaningful if it translates into real protection for traders. Under its regulated entities, Exness follows strict client fund protection protocols designed to safeguard trader capital in all market conditions.

Key safety measures include:

- Segregated client accounts, ensuring trader funds are kept separate from company operating capital

- Negative Balance Protection, preventing traders from losing more than their deposited funds

- Fair execution and pricing standards, monitored under regulatory oversight

- Ongoing financial reporting, ensuring transparency and solvency

These safeguards significantly reduce counterparty risk and are particularly important in volatile markets. For South African traders, FSCA oversight adds an additional layer of local accountability, meaning disputes and compliance issues fall under a recognized domestic regulator.

Exness Security (Account & Platform Safety)

Beyond regulation, Exness invests heavily in technical and operational security to protect trader accounts and data. Account security is built around multi-layer verification systems that ensure only the rightful owner can access or modify sensitive information.

Exness account and platform security features include:

- Account verification via phone, email, or TOTP (availability varies by country)

- Six-digit confirmation codes required for critical account actions

- Unique Support PIN, used to verify identity when contacting customer support

- Advanced cybersecurity protections, including Web Application Firewall (WAF) and DDoS mitigation

- Zero Trust security architecture and an active Bug Bounty program

Together, these measures help protect traders against unauthorized access, cyber threats, and account compromise. When combined with regulatory oversight and client fund protections, Exness offers a trading environment designed for safety, reliability, and long-term trust.

Transparency & Reputation

Security and regulation matter, but transparency is what allows traders to independently verify a broker’s legitimacy. Exness stands out in this area by maintaining a strong and visible company presence, both online and offline. Rather than operating behind anonymous entities, Exness functions as a real, traceable business with identifiable people, offices, and public activity.

The company employs over 2,000 professionals globally, with a large number of verified employees listed on LinkedIn. Exness also maintains physical offices in multiple regions, including South Africa, alongside several international hubs and satellite offices. This physical footprint reduces counterparty risk and reinforces the broker’s accountability to regulators and clients alike.

In addition, Exness maintains an active presence across multiple social media platforms, where it regularly publishes:

- Market updates and economic news

- Trading insights and analysis

- Company announcements and initiatives

This consistent engagement with traders and the wider financial community strengthens Exness’ public credibility and reinforces its reputation as a transparent, operating broker rather than a faceless online platform.

Exness Awards

While regulation and transparency form the foundation of trust, industry recognition adds another layer of external validation. Over the years, Exness has received numerous awards from reputable financial publications and trading industry bodies, recognizing its performance across key areas such as execution quality, trading conditions, and overall broker reliability.

These awards typically highlight Exness’ strengths in:

- Fast and reliable order execution

- Transparent pricing and low spreads

- Trader-focused technology and innovation

Although awards alone should never be the sole reason to choose a broker, consistent recognition across multiple years suggests sustained operational quality rather than short-term marketing success. When combined with strict regulation and verified client protections, these accolades reinforce Exness’ standing as a legitimate and well-established broker.

Exness Reviews on Trustpilot

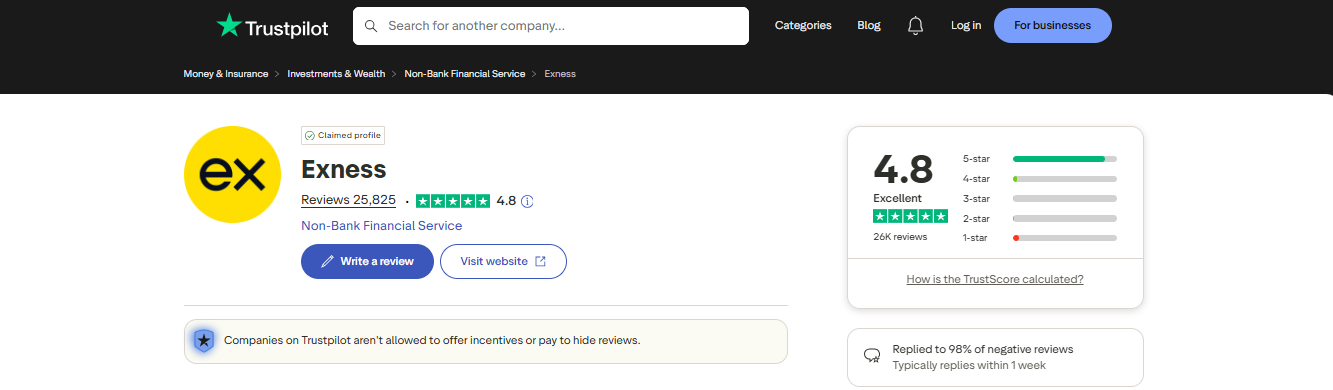

On Trustpilot — one of the world’s most widely used review platforms — Exness currently holds an excellent rating of 4.8 out of 5 stars from over 25,700 reviews.

This rating is based on tens of thousands of trader experiences shared as recently as December 2025, making it one of the most reviewed and highly rated brokers on the platform.

Many positive reviews highlight fast deposits and withdrawals, intuitive platforms, tight spreads, and responsive support, suggesting that both novice and experienced traders find value in the service. A large proportion of reviewers (89%) rate the broker with 5 stars, with comments praising the ease of use, speed of execution, and reliability of financial transactions. A small percentage of lower‑star reviews mention issues such as delayed withdrawals or account verification frustrations, but Exness actively replies to most of these, demonstrating accountability and customer care.

This Trustpilot performance — especially at such a high score and volume — reinforces Exness’ reputation among actual users, adding real‑world trust signals that go beyond marketing claims or regulatory listings.

Exness Deposits & Withdrawals

Another area where Exness often receives high praise is how it handles funds going into and out of your trading account. The broker supports a wide range of deposit and withdrawal methods, catering to both South African and international traders.

Common funding options include:

- Bank transfers (local and international)

- Credit/Debit cards (Visa/Mastercard)

- E‑wallets such as Skrill and Neteller

- Cryptocurrencies like Bitcoin and Tether (USDT)

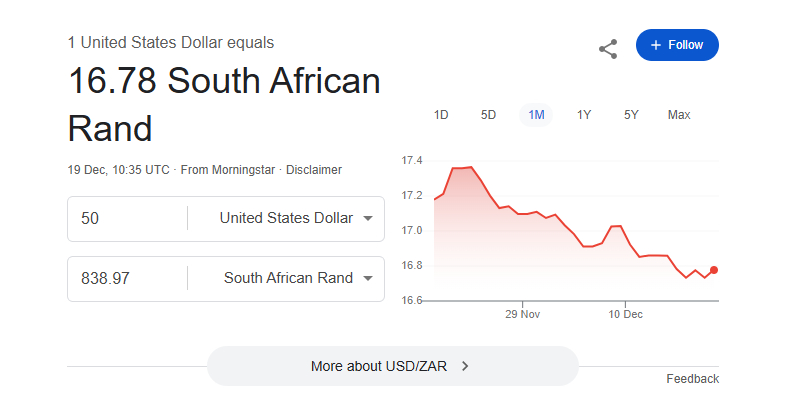

Exness minimum deposit is $50 USD (approximately 838 ZAR), making it accessible for new traders. For specific account types and detailed minimum deposit requirements, you can check our dedicated guide on Exness Minimum Deposits.

This combination of fast processing, low minimum deposits, and wide method availability reinforces Exness’ reputation for transparency and convenience, helping traders manage their funds efficiently.

Trading Conditions on Exness

Once funding is confirmed, trading conditions become the next major consideration. Exness offers access to a modern trading environment through desktop, web, and mobile platforms, ensuring flexibility regardless of trading style or experience level.

The broker is particularly known for:

- Low and stable spreads, especially on gold (XAUUSD)

- Fast execution speeds, reducing slippage

- Real-time tick history, allowing traders to verify price movements

- Flexible leverage options, tailored to different risk profiles

These conditions help traders manage costs more effectively and maintain confidence in price accuracy, especially in fast-moving markets.

How to Get Started With Exness in South Africa

For South African traders, opening an Exness account is a straightforward process designed to meet local regulatory requirements while remaining beginner-friendly.

The general steps include:

- Creating an account online

- Completing identity and address verification

- Choosing an account type that matches your experience level

- Making a minimum deposit (amount varies by payment method)

Once verified, traders gain access to the full trading environment and can begin with small amounts before scaling up, allowing for controlled risk exposure.

Final Thoughts: Should South African Traders Use Exness?

After reviewing Exness through regulatory verification, operational transparency, security infrastructure, and real trader feedback, the conclusion is clear.

Exness is a real broker with verifiable offices, employees, and over 17 years of operational history. Its FSCA regulation, global licensing, and reputation for fast withdrawals address the most common concerns traders have before opening an account.

As always, traders are encouraged to verify licenses independently and start with amounts they are comfortable trading — but based on the evidence, Exness is safe. With segregated funds, advanced cybersecurity, and global regulatory compliance, trader protection is a core priority.

FAQs

1. Is Exness regulated in South Africa?

Yes. Exness operates in South Africa through Exness ZA (PTY) Ltd, registered under 2020/234138/07 and regulated by the Financial Sector Conduct Authority (FSCA) with FSP number 51024. It also holds an Over-the-Counter Derivatives Provider (ODP) license, allowing it to legally offer derivative trading products to South African residents.

2. Is Exness legit?

Yes. Exness is a legitimate, globally recognized broker with over 17 years of operational history, multi-jurisdictional licenses, verifiable physical offices, and thousands of verified employees on LinkedIn. It is regulated in multiple regions, including South Africa, the UK, Cyprus, Kenya, and Seychelles.

3. Is Exness safe for traders?

Yes. Exness prioritizes trader safety with measures such as segregated client funds, Negative Balance Protection, advanced cybersecurity protocols, multi-factor account verification, and strict regulatory compliance across all its licensed entities.

4. Where is Exness located in South Africa?

The South African registered office of Exness ZA (PTY) Ltd is located at:

1st and 2nd Floor, Merchant House, 19 Dock Road, V&A Waterfront, Cape Town, 8001.

This physical presence ensures local regulatory accountability and provides a verifiable point of contact.

5. What is the Exness minimum deposit?

Exness minimum deposit is $50 USD (approximately 838 ZAR), making it accessible for new traders. The exact minimum varies depending on the account type and funding method.

6. What are Exness deposit and withdrawal methods?

Exness supports a wide range of funding options for South African and international traders, including:

- Bank transfers (local and international)

- Credit/Debit cards (Visa/Mastercard)

- E-wallets such as Skrill and Neteller

- Cryptocurrencies like Bitcoin and Tether (USDT)

Most deposits and withdrawals are processed instantly, and 98% of withdrawal requests are completed automatically, even on weekends.