In this Acorns vs Robinhood review, we compare two of the most popular investing apps for beginners. Acorns focuses on automatic investing, while Robinhood puts you in control of every trade. Here’s how they stack up in 2026.

Acorns vs Robinhood: Quick Comparison

|

|

|

|---|---|---|

Best For |

Hands-off investors, savers who struggle |

DIY traders, active investors |

Investment Type |

Robo-advisor (managed portfolios) |

Self-directed brokerage |

Pricing |

$3, $6, or $12/month (flat fee) |

$0 (free); $5/month for Gold |

Account Minimum |

$5 to start investing |

$0; fractional shares from $1 |

Investment Options |

5-7 ETF portfolios (pre-built) |

Individual stocks, ETFs, options, crypto |

Unique Feature |

Round-Ups spare change investing |

Commission-free trading, crypto wallet |

IRA Match |

1% (Silver) or 3% (Gold) |

1% (standard) or 3% (Gold) |

Control Level |

No control (robo-managed) |

Full control (DIY) |

Tax-Loss Harvesting |

❌ No |

❌ No |

The Verdict Up Front

Choose Acorns if: You want hands-off investing, struggle to save consistently, need “forced savings” through Round-Ups, prefer managed portfolios, or are a complete beginner who doesn’t want to pick stocks

Choose Robinhood if: You want to pick your own stocks and ETFs, enjoy active trading, need options and crypto trading, have investing knowledge, or want maximum control over investments

Fundamental Difference: Robo-Advisor vs Self-Directed Brokerage

Acorns: The Robo-Advisor Approach

Robinhood is your traditional, individual, taxable investment account, while Acorns has been a trailblazer for micro- and robo-investing services

How Acorns Works:

- Answer risk tolerance questionnaire

- Acorns assigns you to one of 5 pre-built portfolios

- Portfolios consist of 5-7 ETFs managed by Acorns

- You cannot pick individual stocks or change ETF selections

- Automatic rebalancing every quarter

- Round-Ups automate investing from everyday purchases

Philosophy: “Set it and forget it” – Acorns makes all investment decisions for you

Robinhood: The Self-Directed Trading Platform

Robinhood gives you the ability to buy stocks and cryptocurrencies, and even trade advanced financial products like options without jumping through the same sort of hoops that a lot of traditional brokers impose

How Robinhood Works:

- Open account with no minimum

- Research and choose individual stocks, ETFs, options

- Buy/sell whenever you want

- You control all investment decisions

- Access to advanced products (options, crypto)

- No automatic rebalancing (you manage everything)

Philosophy: “Democratize finance” – Give everyone access to markets traditionally reserved for the wealthy

Pricing and Fees

Acorns Flat Monthly Fees

Bronze ($3/month = $36/year):

- Acorns Invest (taxable account)

- Acorns Later (IRA: Traditional, Roth, SEP)

- Acorns Checking

- Round-Ups

- Found Money cashback

Silver ($6/month = $72/year):

- Everything in Bronze PLUS:

- 1% IRA match

- Emergency Savings (3.82% APY)

- Checking earns 2.42% APY

- 25% Found Money match (up to $200)

Gold ($12/month = $144/year):

- Everything in Silver PLUS:

- 3% IRA match

- Acorns Early (kids’ accounts)

- Custom Portfolio

- 50% Found Money match

- 1% match on kids’ investments

Fee Analysis:

- $100 balance = 36% annual fee

- $1,000 balance = 3.6% annual fee

- $5,000 balance = 0.72% annual fee

- $14,400 balance = 0.25% (matches typical robo-advisors)

Robinhood Zero Fees

Robinhood has no account fees aside from obvious miscellaneous one-time fees for things like paper statements, outbound account transfers, etc

Standard Account (Free):

- Commission-free stock and ETF trading

- 1% IRA match on contributions

- Fractional shares

- Cryptocurrency trading

- No monthly fees

- No minimum balance

Robinhood Gold ($5/month = $60/year): As of August 2025, Gold subscribers earn 4% APY on idle cash

- 3% IRA match (vs. 1% standard)

- 4% APY on uninvested cash

- Professional research reports

- Deeper market data

- $1,000 interest-free margin borrowing

- Instant deposits

Additional Robinhood Fees:

- $75 outbound account transfer fee

- Margin interest: 4.7-5.75% (beyond first $1,000 for Gold)

- Regulatory fees (passed through)

Winner on Cost: Robinhood is free for basic use; Acorns charges $36-$144/year regardless of balance

Investment Options

What You Can Invest In

Acorns: As a true robo-advisor, Acorns provides 5 ready-to-go, expert-built portfolios – comprised of low-cost ETF’s – based on your risk tolerance. This obviously limits your investing options, but allows you to be completely hands-off in your investing

Portfolio Options:

- 5 core portfolios (Conservative to Aggressive)

- 4 ESG portfolios

- 5-7 ETFs per portfolio from Vanguard, iShares

- Up to 5% Bitcoin ETF exposure (select portfolios)

What You CANNOT Do:

- Pick individual stocks

- Choose specific ETFs

- Exclude ETFs you dislike

- Time the market (automatic investing)

- Trade options

- Actively manage positions

Robinhood: Between Robinhood vs Acorns, there is no contest regarding investment options. Robinhood is a full-on trading platform, allowing its users to control their investments. Users can buy individual stocks, ETFs, and even trade options contracts

Investment Universe:

- 5,000+ individual US stocks

- 1,000+ ETFs

- Options contracts (if approved)

- 20+ cryptocurrencies direct trading

- American Depositary Receipts (ADRs)

- Fractional shares (buy $1 worth of any stock)

What You CAN Do:

- Build custom portfolios

- Pick individual stocks

- Trade options for advanced strategies

- Day trade (with $25K+ and Gold)

- Direct crypto trading (Bitcoin, Ethereum, Dogecoin, etc.)

- Time your trades

Winner: Between Robinhood vs Acorns, there is no contest regarding investment options. Robinhood is a full-on trading platform

Unique Features

Acorns’ Signature Features

1. Round-Ups (Spare Change Investing)

Acorns has a flagship feature called Round Ups which invests your spare change for you. This is a surprisingly powerful feature, and all you need to do is think about your daily expenses. $7.20 for a cup of coffee? $78.65 for fuel? $23.45 for a handful of groceries? Well, when you round each of those purchases up, you’ll see how things add up—and in this case, just those three hypothetical bills give you a difference of $1.70

How It Works:

- Link unlimited debit/credit cards

- Every purchase rounds to nearest dollar

- Spare change accumulates until $5

- Automatic investment into your portfolio

- Multipliers available (2x, 3x, 10x)

Example: 100 purchases/month × $0.30 average = $30/month = $360/year invested effortlessly

2. Found Money (Cashback)

- Shop at 450+ partner brands

- Earn cashback percentage

- Cashback automatically invested

- Silver: 25% match up to $200

- Gold: 50% match up to $200

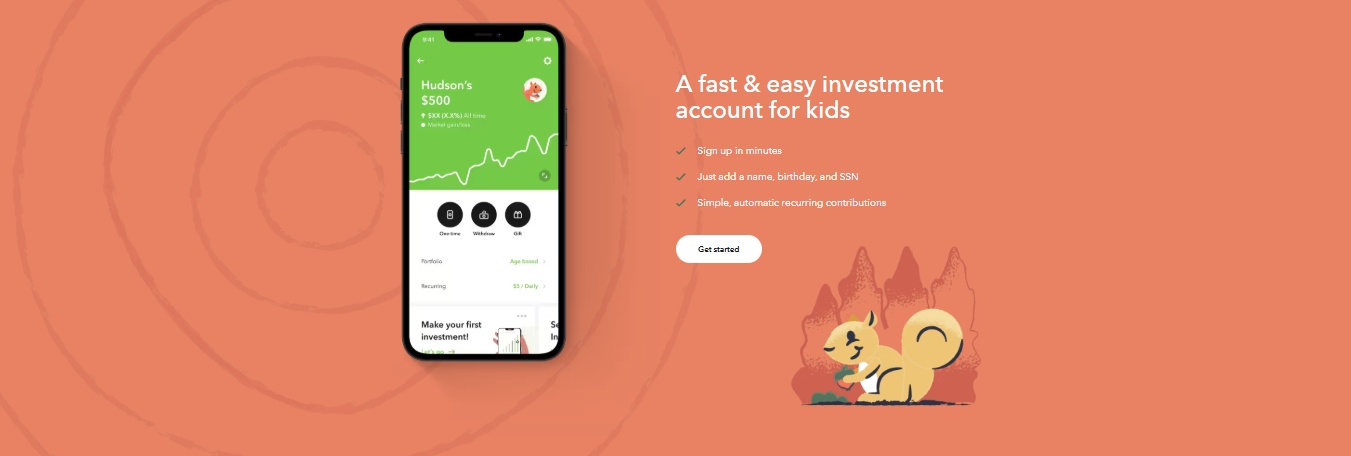

3. Acorns Early (Kids’ Accounts) When exactly your child can access the funds depends on your jurisdiction and usually is between 18-25, and funds in Early Invest are placed into the Acorns Aggressive Portfolio

- UGMA/UTMA custodial accounts

- Early debit cards for kids

- Allowance and chore tracking

- Family gifting invitations

- 1% match on kids’ investments (Gold)

Robinhood’s Signature Features

1. Commission-Free Trading

Robinhood have played a leading role in the industry move towards eliminating fees on stock trades

Before Robinhood, traditional brokers charged $7-$10 per trade. Robinhood revolutionized the industry by offering $0 commissions, forcing competitors to follow.

2. Fractional Shares

Beyond the fact that you don’t need to worry about paying commissions on any trades or stock purchases that you make, one of Robinhood’s big benefits is the fact that it allows you to purchase fractional shares. This is a huge boon for retail investors, since it allows adding exposure to some pretty expensive stocks into small starter portfolios

Example:

- Amazon stock: $180/share

- With fractional shares: Buy $10 worth (0.056 shares)

- Access expensive stocks with any budget

3. Options Trading

Not every trading platform makes it easy to trade options, and you’re certainly not going to get a sight of them on an app like Acorns. Even brokers who do offer options will limit access to this complex derivative, and for good reason—it’s very, very easy to lose money with options

- No commission options trading

- Easy approval process

- All strike prices and expirations available

- Advanced strategies possible

4. Cryptocurrency Trading

Robinhood even allows users to invest in cryptocurrencies directly through its app. In addition, the Robinhood Crypto wallet also offers 0% trading fees for crypto transactions

- 20+ cryptocurrencies

- 0% trading fees on crypto

- Cold storage security

- Crypto wallet functionality

- Bitcoin, Ethereum, Dogecoin, and more

IRA Accounts and Matching

Acorns IRA Features

Available IRAs:

- Traditional IRA

- Roth IRA

- SEP IRA

- Rollover IRA

IRA Matching: Acorns Later: 3% IRA match on new contributions that you make and keep in your Acorns Later retirement account for 4 years or 1% match with Acorns Silver subscription

- Bronze ($3/month): No match

- Silver ($6/month): 1% match

- Gold ($12/month): 3% match

- Requirement: Keep contributions 4 years

- On $7,000 contribution: $70 (Silver) or $210 (Gold) free

Robinhood IRA Features

Available IRAs:

- Traditional IRA

- Roth IRA

- Rollover IRA

IRA Matching: The IRA match is a 3% match on annual contributions with a Robinhood Gold subscription ($5/month) or 1% without. You get matched on any amount from contributions, IRA transfers, or old 401(k)s. We’ll add 1%. No cap

- Standard (free): 1% match

- Gold ($5/month): 3% match

- Requirement: Keep contributions 5 years

- Bonus: 1% match on transfers/rollovers (unlimited)

- On $7,000 contribution: $70 (standard) or $210 (Gold) free

Winner on IRA Match: Tie on contribution match rates, but Robinhood offers unlimited 1% match on transfers/rollovers (Acorns doesn’t)

Account Types Available

Both Offer:

- Individual taxable accounts

- Traditional IRA

- Roth IRA

- SEP IRA

Acorns Additionally Offers:

- Acorns Checking (all tiers)

- Emergency Savings account (Silver/Gold: 3.82% APY)

- UGMA/UTMA custodial accounts (Gold only)

Robinhood Additionally Offers:

- Margin accounts (Gold subscribers)

- Crypto-only accounts

What Neither Offers:

- Joint accounts (Robinhood recently removed)

- Trust accounts

- 529 college savings plans

- HSA accounts

- 401(k) plans

Robinhood only offers a standard individual taxable account at this time. They do not offer retirement, joint, trust, or custodial accounts. They state that they hope to offer some of these in the future

User Experience

Mobile App Design

Acorns:

- Award-winning design

- iOS: 4.7/5 stars (1M+ reviews)

- Android: 4.6/5 stars (750K+ reviews)

- Praised for gorgeous, intuitive interface

- Simple navigation

- Perfect for beginners

Robinhood:

- Gamified interface

- iOS: 4.2/5 stars

- Android: 3.9/5 stars

- Sleek, modern design

- Instant feedback on trades

- Confetti animations for trades (controversial)

Winner: Acorns wins on ratings and beginner-friendliness; Robinhood designed for active traders

Ease of Use

While Robinhood assumes you’re a savvy investor who has the capacity to do your homework, Acorns aims to make your investing experience as easy as possible with its spare-change savings tool and cash-back rewards program

Acorns:

- 5-10 minute setup

- Answer simple questions

- Portfolio assigned automatically

- Link cards for Round-Ups

- Completely automated thereafter

Robinhood:

- 5 minute signup

- Immediate trading access

- Research stocks yourself

- Make all buy/sell decisions

- Requires investment knowledge

Customer Support

Acorns Support

Available:

- Phone: 7 days/week, 5 AM-7 PM PT

- Live chat: Limited hours

- Email support

- Help center/FAQ

Response Quality:

- Generally helpful for account issues

- Cannot provide investment advice

- Support for automated features

Robinhood Support

Available:

- Phone support: Limited hours

- Live chat: 24/7

- Email support

- Help center

Notable Issues: Perhaps most importantly, though, the customer service and overall stability of Robinhood seem questionable, given the widespread user complaints and pending lawsuit over its March 2020 outages

Controversy:

- March 2020 outages during market volatility

- GameStop trading restrictions (Jan 2021)

- Customer service complaints

- Ongoing lawsuits

Winner: Neither excels, but Acorns has better reputation for stability

Pros and Cons

Acorns Pros

✅ Effortless micro-investing through Round-Ups

✅ Completely hands-off (no decisions required)

✅ Perfect for beginners who don’t want to pick stocks

✅ $5 minimum to start investing

✅ Award-winning app design

✅ Found Money cashback (450+ partners)

✅ IRA matching (1-3%)

✅ Kids’ custodial accounts (Gold)

✅ Automatic rebalancing

✅ Forces savings habit

Acorns Cons

❌ Expensive for small balances (36% on $100)

❌ No control over investments

❌ Cannot pick individual stocks

❌ Limited portfolio options (9 total)

❌ No tax-loss harvesting

❌ $50 per ETF transfer-out fee

❌ Recent price increases

❌ Small portfolios (5-7 ETFs)

Robinhood Pros

✅ Completely free (no monthly fees)

✅ Full control over investments

✅ 5,000+ stocks to choose from

✅ Options trading available

✅ Direct cryptocurrency trading

✅ Fractional shares from $1

✅ IRA matching (1-3%)

✅ No minimum deposit

✅ Commission-free trading

✅ Gold subscribers earn 4% APY on cash

Robinhood Cons

❌ Requires investment knowledge

❌ No automatic rebalancing

❌ No managed portfolios

❌ Customer service issues

❌ March 2020 outage controversy

❌ GameStop trading restrictions controversy

❌ No tax-loss harvesting

❌ Easy to overtrade

❌ Gamification can encourage risky behavior

❌ $75 outbound transfer fee

Robinhood or Acorns: Which Platform Should You Choose?

Choose Acorns If You:

Are a Complete Beginner: Acorns might be a good place to invest money you want to be hands-off with — especially with the feature that automatically invests your spare change

Struggle to Save Consistently: Round-Ups provide “forced savings” that trick you into investing

Want Zero Investment Decisions: Perfect if you don’t want to research stocks or time markets

Have Under $1,000 to Start: $5 minimum makes it accessible

Value Automation: Set it and forget it completely

Don’t Want to Learn Investing: Acorns handles everything for you

Are Investing for Kids: Gold tier includes custodial accounts

Choose Robinhood If You:

Want to Pick Your Own Stocks: Robinhood is an approachable way to learn how to trade stocks and other investments on your own

Enjoy Active Trading: Full control over buy/sell decisions

Want to Trade Options: Advanced strategies available

Are Interested in Cryptocurrency: Direct crypto trading with wallet

Have Investment Knowledge: Or willing to learn through research

Prefer $0 Fees: No monthly subscription required

Want Maximum Flexibility: Build your own portfolio however you want

Real-World Scenarios

Scenario 1: 22-Year-Old with $500, No Investing Knowledge

Acorns:

- Fee: $36/year (7.2% of balance)

- Round-Ups add ~$360/year automatically

- Zero decisions required

- Learn by observing

- Best choice ✅

Robinhood:

- Fee: $0

- Must research and pick stocks

- Risk of poor choices without knowledge

- Steep learning curve

- Could lose money quickly

Winner: Acorns—automation prevents costly mistakes

Scenario 2: 30-Year-Old with $10K, Wants Active Trading

Acorns:

- Fee: $36/year (0.36%)

- Cannot pick stocks

- No control over timing

- Limited to 9 portfolios

- Frustrating for active traders

Robinhood:

- Fee: $0

- Full control over trades

- Pick any stocks/ETFs

- Options strategies available

- Crypto trading

- Best choice ✅

Winner: Robinhood—designed for active traders

Scenario 3: 45-Year-Old with $50K IRA, Wants Simple Retirement Investing

Acorns:

- Fee: Silver $72/year or Gold $144/year for IRA match

- 1% or 3% IRA match

- Completely automated

- Conservative portfolio options

- Good choice ✅

Robinhood:

- Fee: $0 (or $60/year for Gold 3% match)

- Must pick IRA investments yourself

- More work but lower cost

- Can build custom retirement portfolio

- Also good choice ✅

Winner: Depends—Acorns if you want automation, Robinhood if you want control at lower cost

Can You Use Robinhood and Acorns?

There’s one option here you might not have considered: having accounts at both Robinhood and Acorns. Why? Because these two brokerage firms are more different than they are similar, and they serve unique purposes

Strategic Combination

I have found the perks of having multiple brokerage accounts — especially when each offers a unique benefit — outweigh the administrative hassle of having your money spread out a bit. In this case, I’d probably opt for the lowest-tier Acorns account for low-cost portfolio management of a taxable account, and then open an IRA at Robinhood to get its 1% match

One Effective Strategy:

- Acorns Bronze ($3/month): Automated taxable account with Round-Ups for effortless saving

- Robinhood IRA (free): Self-directed retirement account with 1% match, pick your own stocks

Benefits:

- Get automation AND control

- Separate “set it and forget it” from active trading

- IRA match from Robinhood

- Round-Ups from Acorns

- Total cost: Just $36/year + time investment

Compare

Acorns vs Betterment 2026: Which Robo-Advisor Is Best for You?

Acorns vs Robinhood 2026: Which Investment App Is Right for You?

Acorns vs Wealthfront 2026: Which Robo-Advisor Wins?

The Bottom Line

Overall Ratings

Acorns: 4.0/5 ⭐⭐⭐⭐

- Brilliant for beginners needing automation

- Award-winning design

- Fees too high for small balances

- Limited for anyone wanting control

Robinhood: 3.8/5 ⭐⭐⭐⭐

- Excellent for self-directed traders

- Completely free

- Controversial history

- Requires investment knowledge

If you just want to start integrating investing into your everyday life with most of it done automatically for you, then a cool micro-investing app like Acorns is a great option to try. With its spare change round-up feature that invests money for you, you’ll feel less of a pinch and be able to grow your portfolio gradually

But if you want to learn investing, pick your own stocks, trade options, or invest in crypto, Robinhood is the clear choice.

Get started:

- Acorns: acorns.com

- Robinhood: robinhood.com

Disclaimer: This Robinhood vs Acornscomparison is for educational purposes. Investment decisions should be based on your personal situation. All investing involves risk of loss. All information accurate as of January 2026 but subject to change.