Choosing between Forex.com vs Eightcap can feel tricky when both promise top-tier trading conditions. Yet, subtle differences in regulation, spreads, and platforms can impact your profits more than you think. Let’s break down which broker truly gives traders the edge.

Eightcap and Forex.com: Side-by-Side Comparison

Overall Rating |

4.5/5 |

4.5/5 |

Founded |

2015 |

2001 |

Headquarters |

Melbourne, Australia |

United States |

Regulators |

ASIC, FCA, CySEC, SCB, FSASVG (5 total) |

NFA, CFTC, FCA, ASIC, CySEC, MAS, CIMA, FSA, CIRO (9 total) |

Tradable Instruments |

800+ |

4,500+ |

Forex Pairs |

56 |

84 |

Crypto CFDs |

92 |

12 |

Stock CFDs |

585 |

5,500 |

Minimum Deposit |

$100 |

$100 |

Maximum Leverage |

Up to 1:500 (SCB) |

Up to 1:400 (CMA) |

Platforms |

MT4, MT5, TradingView, WebTrader |

MT4, MT5, TradingView, WebTrader |

US Clients |

Not Accepted |

Accepted |

Regulation and Security

When comparing Forex.com vs Eightcap on regulatory strength, both brokers demonstrate solid oversight, but with different geographical advantages.

Eightcap Regulatory Licenses

Eightcap runs several entities worldwide, each authorized by respected financial authorities.

-

Australia: Eightcap Pty Ltd — Regulated by the Australian Securities and Investments Commission (ASIC), License No. AFSL 391441.

-

United Kingdom: Eightcap Group Ltd — Authorized by the Financial Conduct Authority (FCA), FRN 921296.

-

Bahamas: Eightcap Global Limited — Overseen by the Securities Commission of The Bahamas (SCB), License SIA-F220.

-

Seychelles: Eightcap International Ltd — Licensed by the Financial Services Authority (FSA), SD100.

-

Cyprus: Eightcap EU Ltd — Regulated by the Cyprus Securities and Exchange Commission (CySEC), License 246/14.

Together, these entities give Eightcap solid regulatory coverage across Europe, Asia, and offshore jurisdictions.

Forex.com Regulatory Licenses

Forex.com boasts one of the broadest global regulatory footprints among retail brokers. It operates under multiple top-tier regulators, ensuring robust client protection.

-

United States: Registered with both the National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC).

-

United Kingdom: Authorized by the Financial Conduct Authority (FCA).

-

Australia: Licensed by the Australian Securities and Investments Commission (ASIC).

-

Cyprus: Supervised by the Cyprus Securities and Exchange Commission (CySEC).

-

Canada: Member of the Canadian Investment Regulatory Organization (CIRO).

-

Cayman Islands: Authorized by the Cayman Islands Monetary Authority (CIMA).

-

Japan: Regulated by the Financial Services Agency (FSA).

-

Singapore: Licensed by the Monetary Authority of Singapore (MAS).

With oversight in North America, Europe, and Asia, Forex.com stands out for its regulatory diversity and credibility.

Client Fund Protection

Eightcap:

- Segregated client accounts across all entities

- Negative balance protection for EU and UK clients

- €20,000 investor compensation for CySEC clients

- £85,000 FSCS protection for FCA clients

- No investor protection for offshore entity clients

Forex.com:

- Segregated accounts as regulatory standard

- FSCS protection up to £85,000 (UK clients)

- ICF protection up to €20,000 (EU clients)

- No compensation scheme for US clients despite CFTC regulation

- Backed by StoneX Group Inc., a NASDAQ-listed company with $7.1+ billion in assets

🏆 Winner: Forex.com – With nine regulators including the ultra-strict US authorities and backing from a publicly-traded parent company, Forex.com edges ahead on trust and security despite both brokers being highly credible.

Trading Platforms and Tools

The Eightcap vs Forex.com platform battle showcases two different philosophies. Both brokers offer MT4, MT5, and WebTrader, but Eightcap distinguishes itself with full TradingView integration, while Forex.com provides its proprietary platforms alongside MetaTrader options. Platform ratings give Forex.com a slight edge at 4.6/5 versus Eightcap’s 4.3/5.

Platform Options

Eightcap:

- MetaTrader 4: Classic platform with Expert Advisors support

- MetaTrader 5: Advanced charting and multi-asset capabilities

- TradingView: Award-winning charting platform (primary platform for UK clients)

Trade with 15+ customizable chart types, including Kagi, Renko, and Point & Figure. - WebTrader: Browser-based access without downloads

- Mobile Apps: iOS and Android with full functionality

Forex.com:

- MetaTrader 4: Industry standard with extensive automation

- MetaTrader 5: Enhanced technical analysis tools

- TradingView: Integrated charting solution

- Forex.com Web Platform: Proprietary browser-based interface

- Advanced Trading Platform: Desktop application for active traders

- Mobile Apps: iOS and Android with real-time quotes

Trading Tools & Features

Tool/Feature |

Eightcap |

Forex.com |

|---|---|---|

VPS Hosting |

✅ Free |

✅ Free |

Economic Calendar |

✅ AI-powered |

✅ Advanced |

Trading Central |

✅ Yes |

✅ Yes |

Autochartist |

✅ Yes |

✅ Yes |

Trade Ideas |

✅ Daily |

✅ Available |

Capitalise.ai |

✅ Code-free automation |

✅ Yes |

Flash Trader |

✅ Unique tool |

❌ No |

API Trading |

✅ Available |

✅ Available |

Copy Trading |

❌ No |

❌ No |

🏆 Winner: Slight edge to Forex.com – While Eightcap offers excellent TradingView integration and unique tools like Flash Trader, Forex.com’s proprietary platforms and broader tool ecosystem give it a marginal advantage for professional traders.

Account Types and Minimum Deposit

Both brokers in this Forex.com vs Eightcap comparison maintain accessible entry points with $100 minimum deposits. Eightcap offers three account types: Standard, Raw, and TradingView accounts, while Forex.com provides Standard and Raw Spread accounts. The account structures cater to different trading styles and cost preferences.

Account Tiers Compared

Account Feature |

Eightcap Standard |

Eightcap Raw |

Eightcap TradingView |

Forex.com Standard |

Forex.com Raw Spread |

|---|---|---|---|---|---|

Minimum Deposit |

$100 |

$100 |

$100 |

$100 |

$100 |

Spread Type |

Fixed |

Raw from 0.0 pips |

Fixed |

Variable from 0.8 |

Raw from 0.0 pips |

Commission |

None |

$3.50 per side per lot |

None |

None |

$5 per side per lot |

Platform |

MT4, MT5 |

MT4, MT5 |

TradingView only |

MT4, MT5, Proprietary |

MT4, MT5 |

Best For |

Beginners |

Active traders |

Chart enthusiasts |

General trading |

Cost-conscious pros |

Base Currencies |

8+ options |

8+ options |

8+ options |

Multiple |

Multiple |

Islamic Account |

✅ Available |

✅ Available |

✅ Available |

✅ Available |

✅ Available |

Demo Account |

✅ Unlimited |

✅ Unlimited |

✅ Unlimited |

✅ Available |

✅ Available |

Special Account Features

Eightcap:

- MAM/PAMM accounts for managed portfolios

- Professional trader accounts with higher leverage (conditions apply)

- Corporate accounts available

- No account protection for non-EU clients (significant limitation)

Forex.com:

- MAM accounts for money managers

- Active Trader program with volume-based rebates

- Institutional accounts with dedicated support

- Protection for UK/EU clients only (US clients excluded from compensation schemes)

🏆 Winner: Tie – Both offer identical $100 minimums and comparable account structures. Eightcap provides slightly lower raw account commissions ($3.50 vs $5), but Forex.com counters with more account currency options.

Trading Costs

This is where the Eightcap vs Forex.com comparison shows the clearest differentiation. Eightcap receives a fees rating of 4.7/5 (categorized as “Low”), while Forex.com scores 3.7/5 (categorized as “High”). For cost-conscious traders, this difference becomes substantial over hundreds of trades.

Spreads and Commissions

Instrument |

Eightcap Standard |

Eightcap Raw |

Forex.com Standard |

Forex.com Raw |

|---|---|---|---|---|

EUR/USD |

1.0 pips |

0.0 + $3.50 |

1.2 pips |

0.0 + $5.00 |

GBP/USD |

1.2 pips |

0.1 + $3.50 |

1.5 pips |

0.2 + $5.00 |

USD/JPY |

1.0 pips |

0.1 + $3.50 |

1.3 pips |

0.1 + $5.00 |

Gold (XAU/USD) |

Variable |

0.1 + $3.50 |

Variable |

Variable + $5.00 |

BTC/USD |

Variable |

Variable |

Variable |

Variable |

US500 |

Variable |

Low |

Variable |

Competitive |

Example:

- Trading 10 standard lots EUR/USD monthly on raw accounts:

- Eightcap: $3.50 × 2 × 10 = $700/month

- Forex.com: $5.00 × 2 × 10 = $1,000/month

- Savings with Eightcap: $300/month or $3,600/year

Hidden Fees to Watch

Eightcap:

- Deposit Fees: None across all methods

- Withdrawal Fees: None (broker absorbs costs)

- Inactivity Fee: None reported

- Currency Conversion: Standard bank rates apply

- Overnight Swaps: Competitive rates, Islamic accounts available

Forex.com:

- Deposit Fees: None for most methods

- Withdrawal Fees: Generally waived

- Inactivity Fee: Applied after 12 months of no trading activity

- Currency Conversion: May apply for non-base currencies

- Overnight Swaps: Market-standard rates

- Wire Transfer: May incur bank charges

🏆 Winner: Eightcap – Significantly lower raw account commissions, no inactivity fees, and superior cost efficiency make Eightcap the clear winner for traders prioritizing low expenses.

Available Instruments

The Forex.com vs Eightcap instrument comparison reveals dramatically different strategies. Forex.com offers 5,680 tradable instruments compared to Eightcap’s 763, making it one of the most comprehensive multi-asset brokers available. However, Eightcap specializes in areas like cryptocurrency CFDs.

Market Coverage by Asset Class

Forex Pairs:

- Eightcap: 56 currency pairs (majors, minors, exotics)

- Forex.com: 84 currency pairs (extensive exotic coverage)

- Winner: Forex.com for variety

Indices:

- Eightcap: 16 global indices (major markets covered)

- Forex.com: 38 indices (comprehensive global reach)

- Winner: Forex.com

Commodities:

- Eightcap: 14 commodities (metals, energies, agricultural)

- Forex.com: 46 commodities (extensive selection)

- Winner: Forex.com

Cryptocurrencies:

- Eightcap: 92 crypto CFDs (industry-leading selection)

- Forex.com: 12 crypto CFDs (major coins only)

- Winner: Eightcap (massive advantage)

Stock CFDs:

- Eightcap: 585 stocks (popular US/AU equities)

- Forex.com: 5,500+ stocks (extensive global coverage)

- Winner: Forex.com (10x more options)

ETFs:

- Eightcap: Limited selection

- Forex.com: Extensive ETF offerings

- Winner: Forex.com

Specialization Notes

Eightcap Strengths:

- Received best-in-class honors for Crypto Trading in the 2025 ForexBrokers.com Awards with over 200 cryptocurrency CFDs

- Focused instrument selection for forex and crypto traders

- Streamlined offering reduces analysis paralysis

Forex.com Strengths:

- True multi-asset broker with institutional-grade breadth

- Access to international stock exchanges

- Comprehensive commodity and index coverage

- Better for diversified portfolio strategies

🏆 Winner: Forex.com – Unless you’re specifically focused on crypto CFDs, Forex.com’s 7x larger instrument selection provides unmatched trading opportunities across asset classes.

Leverage and Margin

Leverage regulations create the biggest divide in the Eightcap vs Forex.com comparison, as both brokers must comply with regional restrictions. Eightcap offers leverage up to 1:500 under SCB regulation, 1:30 under ASIC/FCA/CySEC, while Forex.com provides up to 1:400 under CMA, 1:50 under NFA, and varies by jurisdiction. Your location determines your maximum leverage, not just your broker choice.

Maximum Leverage by Jurisdiction

Regulator |

Eightcap |

Forex.com |

Applies To |

|---|---|---|---|

ASIC (Australia) |

1:30 |

1:30 |

Australian residents |

FCA (UK) |

1:30 |

1:30 |

UK residents |

CySEC (EU) |

1:30 |

1:30 |

EU residents |

NFA/CFTC (USA) |

Not available |

1:50 |

US residents only |

MAS (Singapore) |

Not available |

1:20 |

Singapore residents |

SFC (Hong Kong) |

Not available |

1:20 |

Hong Kong residents |

JFSA (Japan) |

Not available |

1:25 |

Japanese residents |

CIMA (Cayman) |

Not available |

1:250 |

International clients |

CIRO (Canada) |

Not available |

1:45 |

Canadian residents |

SCB (Bahamas) |

1:500 |

Not available |

International clients |

CMA (Kenya) |

Not available |

1:400 |

Kenyan residents |

Leverage by Asset Class

Both brokers apply different leverage limits based on asset type:

Forex Pairs:

- Major pairs: Maximum allowed by jurisdiction

- Minor/exotic pairs: Typically reduced by 20-50%

Indices:

- Major indices: Up to 1:200 (offshore entities)

- Minor indices: Up to 1:100

Commodities:

- Metals (Gold/Silver): Up to 1:500 (Eightcap SCB) / 1:200 (Forex.com)

- Energy (Oil/Gas): Typically 1:100-1:200

- Agricultural: Usually 1:50-1:100

Cryptocurrencies:

- Major crypto: 1:2 to 1:5 (regulatory restriction)

- Minor crypto: 1:2 maximum

Stock CFDs:

- Popular stocks: 1:5 to 1:20

- Penny stocks: 1:5 or lower

Margin Call Policies

Eightcap:

- Margin call: 100% of required margin

- Stop-out level: 50% for most entities

- Negative balance protection: EU/UK clients only

Forex.com:

- Margin call: 100% of required margin

- Stop-out level: Varies by jurisdiction (50-80%)

- Negative balance protection: EU/UK clients only

🏆 Winner: Eightcap – For international traders seeking higher leverage, Eightcap’s SCB entity offering 1:500 leverage significantly outperforms Forex.com’s maximum 1:400. However, both offer identical regulated leverage in major jurisdictions.

Deposits and Withdrawals

Transaction convenience proves nearly equal in this Forex.com vs Eightcap analysis. Both brokers receive top ratings for deposits and withdrawals, with Eightcap scoring 4.9/5 and Forex.com achieving a perfect 5.0/5. Processing times and available methods show minimal practical differences.

Payment Methods Comparison

Method |

Eightcap |

Forex.com |

Typical Processing |

|---|---|---|---|

Credit/Debit Card |

✅ Visa, Mastercard |

✅ Visa, Mastercard |

Instant (deposit) / 3-5 days (withdrawal) |

Bank Wire/Transfer |

✅ SWIFT, local |

✅ International wire |

1-3 days (deposit) / 1-5 days (withdrawal) |

PayPal |

✅ Available |

✅ Available |

Instant (deposit) / 1-2 days (withdrawal) |

Skrill |

✅ Available |

❌ Not listed |

Instant / 24 hours |

Neteller |

✅ Available |

❌ Not listed |

Instant / 24 hours |

BPAY |

✅ Australia only |

❌ No |

1-2 days |

UnionPay |

✅ Available |

❌ No |

1-2 days |

Cryptocurrency |

✅ Bitcoin accepted |

❌ No |

Near-instant |

ACH (eCheck) |

❌ No |

✅ US only |

2-4 days |

POLi |

✅ Australia/NZ |

❌ No |

Instant |

Processing Times and Limits

Eightcap:

- Minimum Deposit: $100 (all methods)

- Minimum Withdrawal: No minimum stated

- Deposit Processing: Instant (cards, e-wallets) / 1-3 days (wire)

- Withdrawal Processing: 1-2 business days (e-wallets) / 3-5 days (wire)

- Verification Required: Yes, before first withdrawal

- Withdrawal Fees: None (broker covers costs)

Forex.com:

- Minimum Deposit: $100 standard / $50 possible on some accounts

- Minimum Withdrawal: $50 typically

- Deposit Processing: Instant (most methods) / 1-3 days (wire)

- Withdrawal Processing: 1-2 days (cards/PayPal) / 2-5 days (wire)

- Verification Required: Yes, KYC mandatory

- Withdrawal Fees: Generally waived, bank charges may apply

Special Considerations

Eightcap Advantages:

- More e-wallet options (Skrill, Neteller, UnionPay)

- Bitcoin deposits accepted

- BPAY for Australian convenience

- Explicitly states no withdrawal fees

Forex.com Advantages:

- ACH transfers for US clients (low-cost)

- Slightly lower minimum deposit option

- Faster processing to cards reported by users

🏆 Winner: Eightcap (narrow margin) – The inclusion of cryptocurrency deposits, more e-wallet options, and guaranteed zero withdrawal fees give Eightcap a slight edge. However, Forex.com’s perfect 5.0 rating reflects excellent service in practice.

Customer Support

Support quality shows marginal differences in the Eightcap vs Forex.com matchup. Customer support ratings place Forex.com at 4.6/5 versus Eightcap’s 4.3/5, with both offering 24/5 availability and live chat. Response quality matters more than availability since neither provides 24/7 weekend support.

Support Availability Comparison

Support Channel |

Eightcap |

Forex.com |

|---|---|---|

Live Chat |

✅ 24/5 (Mon-Fri) |

✅ 24/5 (Mon-Fri) |

Phone Support |

✅ International numbers

(+61 3 8592 2375) |

✅ Multiple regional numbers

(1.877.367.3946) (1.908.731.0750) |

Email Support |

✅ Email, Ticketing system |

✅ Dedicated email |

Social Media |

||

FAQ/Help Center |

✅ Comprehensive |

✅ Extensive |

Weekend Support |

❌ Limited |

❌ Limited |

Video Tutorials |

✅ Available |

✅ Extensive library |

Response Times (User-Reported)

Eightcap:

- Live chat: Average 2-3 minutes

- Email: 4-12 hours typical response

- Phone: Immediate during business hours

- Quality: Generally helpful, occasional language barriers reported

Forex.com:

- Live chat: Average 1-2 minutes

- Email: 2-8 hours typical response

- Phone: Immediate with minimal hold times

- Quality: Professional, well-trained staff

Language Support

Eightcap:

- English (primary)

- Mandarin Chinese

- Spanish

- Arabic

- Vietnamese

- Thai

- Additional languages through entities

Forex.com:

- English (primary)

- Extensive multilingual support (15+ languages)

- Dedicated teams for major markets

- Regional offices provide native language support

Account Manager Access

Eightcap:

- Available for all account types

- Proactive support for active traders

- Educational guidance offered

Forex.com:

- Standard accounts: General support

- Active Trader program: Dedicated manager

- Institutional accounts: White-glove service

🏆 Winner: Forex.com – Faster response times, more comprehensive multilingual support, and better-trained staff justify the higher rating. The backing of a large publicly-traded company ensures consistent support quality.

Education and Research

Educational content represents a strength for both brokers in this Forex.com vs Eightcap comparison. Both receive perfect 5.0/5 research ratings, offering news from top-tier sources, economic calendars, videos/webinars, Trading Central, and Autochartist. However, educational depth differs significantly.

Educational Resources

Eightcap:

- Eightcap Labs: Curated educational content hub

- Trading Guides: Beginner to advanced strategies

- Video Tutorials: Platform walkthroughs and strategy videos

- Webinars: Regular live sessions (frequency varies)

- Market Analysis: Daily trade ideas and outlooks

- Glossary: Comprehensive trading terminology

- Blog: Trading psychology and market insights

- Demo Account: Unlimited practice with $100,000 virtual funds

Forex.com:

- Forex.com University: Structured learning path

- Beginner Courses: Forex fundamentals and basics

- Advanced Courses: Technical analysis and risk management

- Video Library: Extensive archive (100+ videos)

- Live Webinars: Multiple weekly sessions

- Trading Guides: Comprehensive PDF resources

- Podcasts: Weekly market commentary

- Demo Account: Practice account with real market conditions

Research and Analysis Tools

Both Brokers Offer:

- Trading Central: Pattern recognition and trade ideas

- Autochartist: Automated technical analysis

- Economic Calendar: AI-powered (Eightcap) / Advanced filtering (Forex.com)

- Daily Market Analysis: Written commentary and video outlooks

- News Feeds: Reuters, Dow Jones, and proprietary analysis

Eightcap Exclusives:

- Flash Trader tool for quick execution

- Capitalise.ai integration for code-free automation

- “Trading Week Ahead” video series (paused since February 2025)

Forex.com Exclusives:

- Trading Central’s Analyst Views

- Comprehensive fundamental research reports

- Market Heat Maps

- Trader Sentiment indicators

- More consistent content publishing schedule

Educational Quality Comparison

Aspect |

Eightcap |

Forex.com |

|---|---|---|

Beginner Friendliness |

⭐⭐⭐⭐ Good |

⭐⭐⭐⭐⭐ Excellent |

Content Depth |

⭐⭐⭐⭐ Solid |

⭐⭐⭐⭐⭐ Comprehensive |

Update Frequency |

⭐⭐⭐ Moderate |

⭐⭐⭐⭐ Regular |

Video Quality |

⭐⭐⭐⭐ Professional |

⭐⭐⭐⭐⭐ Studio-grade |

Interactive Learning |

⭐⭐⭐ Limited |

⭐⭐⭐⭐ Webinars |

🏆 Winner: Forex.com – While both excel at research tools, Forex.com’s structured educational pathway, consistent content updates, and comprehensive beginner resources make it superior for traders seeking to improve their skills. The education rating of 5.0/5 (Forex.com) vs 4.4/5 (Eightcap) reflects this advantage.

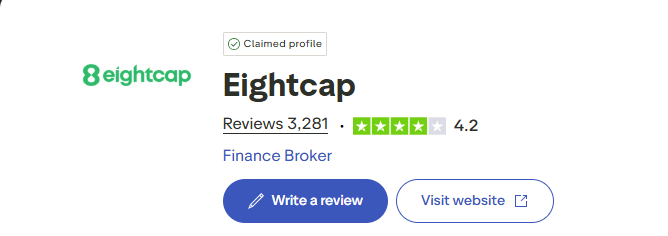

Trustpilot Reviews: Eightcap vs Forex.com

User reputation reveals contrasting public perception in the Eightcap vs Forex.com debate. Independent assessment showed Eightcap achieving an overall score of 9.1 out of 10, while Forex.com scored 6.99 out of 10. Real user experiences on review platforms provide additional context beyond expert ratings.

Trustpilot Scores (October 2025)

Eightcap:

- Rating: 4.2/5 stars

- Total Reviews: 3,200+ reviews

- “Excellent” Ratings: 68%

- “Poor” Ratings: 12%

Common Positive Themes:

- Fast execution speeds praised repeatedly

- Competitive spreads appreciated by active traders

- TradingView integration highlighted as major advantage

- Withdrawal processing faster than promised

- Responsive customer support during trading hours

Common Complaints:

- Limited instrument selection compared to competitors

- No investor protection for non-EU clients causes concern

- Some users report slippage during high volatility

- Educational content could be more comprehensive

- Platform occasionally experiences minor glitches

Forex.com:

- Rating: 4.6/5 stars

- Total Reviews: 2,200+ reviews

- “Excellent” Ratings: 62%

- “Poor” Ratings: 18%

Common Positive Themes:

- Extensive instrument selection valued by diversified traders

- Strong regulatory oversight provides peace of mind

- Professional-grade research tools and analysis

- Reliable platform stability during news events

- Excellent support for institutional clients

Common Complaints:

- Higher trading costs mentioned frequently

- Inactivity fees frustrate occasional traders

- Platform interface considered less intuitive than competitors

- Withdrawal processing can be slow during verification

- Limited leverage for US clients (regulatory requirement, not broker’s fault)

Independent Expert Ratings

Eightcap:

- Overall Expert Score: 9.1/10

- Trust Score: 4.2/5

- Fees Score: 4.7/5 (Low costs)

- Platforms Score: 4.3/5

Forex.com:

- Overall Expert Score: 6.99/10

- Trust Score: 4.7/5 (Higher due to more regulators)

- Fees Score: 3.7/5 (Higher costs)

- Platforms Score: 4.6/5

Real Trader Testimonials

Eightcap User (Verified Trader, 2 years): “Switched from another broker to Eightcap for the TradingView integration and lower spreads. Raw account commissions save me about $400 monthly compared to my previous broker. Execution is lightning-fast, and I’ve never had issues with withdrawals.”

Forex.com User (Verified Trader, 5 years): “As a US-based trader, Forex.com is my only viable option for regulated forex trading. The platform is rock-solid, research tools are institutional-grade, and I appreciate the extensive instrument selection. Costs are higher, but the security and reliability are worth it.”

🏆 Winner: Eightcap – Higher user satisfaction scores, better cost feedback, and stronger overall ratings give Eightcap the edge. However, Forex.com’s trust score of 4.7/5 versus Eightcap’s 4.2/5 reflects its superior regulatory backing.

Forex.com vs Eightcap: Which should you choose

After comprehensive analysis of regulation, costs, platforms, instruments, and user feedback, the choice between Forex.com vs Eightcap ultimately depends on your trading profile and location.

Eightcap excels in cost efficiency with raw spreads from 0.0 pips and $3.50 commissions, plus industry-leading cryptocurrency CFD selection with 92 instruments.

Forex.com dominates in regulatory breadth with nine global licenses including NFA/CFTC, instrument diversity with 5,680+ tradable assets, and comprehensive educational resources scoring 5.0/5.

Choose Eightcap If:

- You prioritize low trading costs: Raw account commissions of $3.50 per side save thousands annually versus competitors

- You’re a crypto CFD trader: 92 cryptocurrency CFDs dwarf Forex.com’s 12 offerings

- You use TradingView: Full integration as primary platform option (especially for UK clients)

- You trade frequently: Lower costs compound dramatically over hundreds of trades

- You’re outside the USA: Not regulated for US clients, so American traders must look elsewhere

- You want higher leverage: Up to 1:500 under SCB entity versus Forex.com’s maximum 1:400

- You prefer no-fee withdrawals: Explicitly stated zero withdrawal fees across all methods

Choose Forex.com If:

- You’re a US-based trader: Only option between these two, with NFA/CFTC regulation

- You want maximum instrument variety: 5,680+ instruments versus Eightcap’s 800+ provides extensive diversification

- You trade stocks extensively: 5,500+ stock CFDs compared to Eightcap’s 585 stocks

- Regulatory oversight is paramount: Nine global regulators provide maximum oversight and credibility

- You need structured education: Superior educational content with Forex.com University and 5.0/5 rating

- You’re a diversified trader: Broad asset class coverage including extensive commodities and indices

- You value brand recognition: Owned by NASDAQ-listed StoneX Group with $7.1+ billion in assets

- You require multiple language support: 15+ languages versus Eightcap’s more limited options

The Bottom Line

In this comparison of Eightcap vs Forex.com, we recommend you choose Eightcap for low-cost, crypto-focused trading outside the US, or select Forex.com for maximum regulation, instrument diversity, and US market access. Both are legitimate, well-regulated brokers worthy of consideration.

Both brokers maintain excellent reputations with 4.5/5 overall ratings, making either a solid choice. Your location (US vs international) and trading priorities (costs vs variety) should drive your decision in this Eightcap vs Forex.com comparison.

Read also!

Eightcap vs IC Markets (2026): We Tested Both—Here’s What We Found

Exness vs HFM: Which Forex Broker Is Better For You In 2026?

Octa vs Exness: Read This Before Choosing Your Forex Broker

❓ Frequently Asked Questions

Q: Which broker is better for beginners?

Forex.com edges ahead for beginners with its structured Forex.com University, comprehensive video library, and 5.0/5 education rating. However, Eightcap’s simpler account structure and TradingView integration may appeal to tech-savvy beginners.

Q: Which has lower trading costs?

Eightcap significantly outperforms with a 4.7/5 fees rating (Low) versus Forex.com’s 3.7/5 (High). Eightcap’s raw account charges $3.50 per side per lot compared to Forex.com’s $5.00, saving active traders $3,600+ annually on 10 lots monthly.

Are both brokers regulated?

Yes, both are heavily regulated. Eightcap holds five licenses (ASIC, FCA, CySEC, SCB, FSASVG) while Forex.com maintains nine regulatory relationships (NFA, CFTC, FCA, ASIC, CySEC, MAS, CIMA, FSA, CIRO).

Can I trade crypto on both platforms?

Yes, but with massive differences. Eightcap offers 92 cryptocurrency CFDs, earning recognition as best-in-class for crypto trading in the 2025 ForexBrokers.com Awards. Forex.com provides only 12 crypto CFDs focusing on major coins like Bitcoin, Ethereum, and Litecoin.

What are the minimum deposit requirements?

Both Eightcap and Forex.com require $100 minimum deposits for standard accounts, making them equally accessible to new traders.

Can US traders use Eightcap?

No, Eightcap does not accept US clients as it lacks NFA/CFTC regulation. US residents must use NFA-regulated brokers like Forex.com.

Do these brokers offer copy trading or social trading?

Neither Eightcap nor Forex.com currently offers copy trading or social trading features directly on their platforms. However, both support Expert Advisors (EAs) on MetaTrader 4/5, allowing automated trading strategies.