Choosing between Instant Funding vs Evaluation can determine whether you’ll be trading live capital tomorrow or still grinding through assessments three months from now. Which should you choose?

By the end of this article, you’ll understand exactly how each program works, their real costs and benefits, and most importantly, which path aligns with your trading goals and experience level.

What is Instant Funding?

Instant funding is a prop trading program that gives you immediate access to trading capital without any evaluation period. You pay a fee, receive account credentials, and start trading real money within hours.

The process is refreshingly straightforward: prop firms skip the traditional testing phase entirely, betting on your existing skills rather than making you prove them first. This approach attracts experienced traders who view evaluation periods as unnecessary obstacles to scaling their profits.

How Instant Funding Works

The mechanics are simple but the implications are significant. You select your account size, pay the corresponding fee (typically 2-3x higher than evaluation programs), and receive login details for a live trading account. From that moment, every trade affects real capital, every profit contributes to your income, and every loss impacts the account balance.

Here’s an example of how Instant funding really works. Sarah, a forex trader is ready to scale beyond her personal account. So she paid FXIFY $599 and received $50,000 in trading capital within 2 hours. That afternoon, she spotted a EURUSD setup, risked 2%, made $800 profit, and requested her 80% share ($640) the next day. No waiting, no evaluation stress – just immediate access to capital and profits.

However, Sarah also knows that if she violates the 6% maximum drawdown rule or hits the 3% daily loss limit, her account gets terminated immediately. There’s no “learning phase” or second chances with instant funding.

Advantages of Instant Funding

- Immediate Capital Access: Instant funding means you can capitalize on market conditions right now, not in 60-90 days after completing an evaluation.

- Zero Performance Pressure: Unlike evaluation accounts where you’re racing against the clock to hit profit targets, instant funding removes that psychological burden. You can trade your natural style without artificial constraints.

- Direct Path to Profits: Every profitable trade immediately contributes to your income. There’s no waiting to “graduate” to a funded account – you’re already there.

- Suitable for Proven Strategies: If you have a tested, profitable system, why waste time proving it again? Instant funding respects your experience and lets you apply your edge immediately.

- No Time Constraints: Market conditions change constantly. With instant funding, you can wait for the perfect setups without worrying about monthly deadlines.

Disadvantages of Instant Funding

- Significantly Higher Upfront Investment: While a $100,000 evaluation account might cost $649, the equivalent instant funding account could run $1,299-$1,999. You’re paying a premium for immediate access.

- Immediate Real-Money Consequences: Every mistake costs real money from day one. There’s no “practice phase” where you can adjust your approach without financial consequences.

- Stricter Risk Management: Instant funding accounts typically have tighter drawdown rules because the prop firm is taking a bigger risk on unproven traders. A 6% maximum drawdown versus 10% on evaluation accounts can make a significant difference.

- Higher Barrier to Entry: The combination of higher costs and immediate pressure can be overwhelming for traders who aren’t 100% confident in their abilities.

- Limited Educational Support: Most instant funding programs assume you know what you’re doing and provide minimal guidance or educational resources.

What is an Evaluation Account?

An evaluation account is a testing phase where you must demonstrate profitable trading and risk management skills before accessing funded capital. You pay a lower upfront fee, trade with simulated money under strict rules, and earn access to real funding only after meeting specific performance targets.

This system serves dual purposes: it protects prop firms from unprofitable traders while developing your skills under pressure. Think of it as earning your trading license before being handed the keys to significant capital.

The beauty of evaluation accounts lies in their educational nature. They’re designed not just to test your skills, but to develop them. Most traders, even experienced ones, discover gaps in their risk management or psychology during the evaluation process.

How Evaluation Accounts Work

When you purchase an evaluation challenge, you receive demo account credentials, and face specific profit targets within set timeframes while adhering to daily loss limits and maximum drawdown rules. Most evaluation programs feature two phases with progressively challenging requirements. Success in Phase 1 unlocks Phase 2, which has different parameters. Complete both phases, and you receive a live funded account.

Let’s illustrate this.

John, who’s been trading profitably for 18 months but wants to scale beyond his $10,000 personal account, purchases a $100,000 FTMO Challenge for $649.

Phase 1 (30 days)

John needs to achieve a 10% profit target ($10,000) while maintaining a maximum daily loss of 5% ($5,000) and overall drawdown of 10% ($10,000). The pressure is real – he has exactly 30 days to hit this target.

John starts cautiously, making $2,000 in his first week. By day 15, he’s at $6,500 profit, feeling confident. But then a news event catches him off guard, and he loses $3,200 in a single day. Suddenly, he’s at $3,300 profit with 12 days remaining, and the psychological pressure intensifies.

Through careful risk management and patience, John reaches the $10,000 target on day 28. Relief washes over him, but he’s not done yet.

Phase 2 (60 days)

Now John faces a 5% profit target ($5,000) over 60 days with the same risk parameters. This phase tests consistency and patience. John completes it in 45 days, making exactly $5,200.

Funded Account

John now receives a live $100,000 account with the same rules as his evaluation. He starts earning 80% of his profits, with the potential to scale up to $2 million over time.

Advantages of Evaluation Accounts

- • Lower Financial Barrier: Evaluation fees typically range from $99-$649, making prop trading accessible to traders with limited capital

- • Structured Skill Development: The evaluation process forces you to develop crucial skills like patience, risk management, and consistency under pressure

- • Comprehensive Risk Assessment: You prove not just that you can make money, but that you can do so while managing risk effectively

- • Educational Resources: Most prop firms provide extensive training materials, webinars, and community support during evaluation

- • Refundable Investment: Many firms refund your evaluation fee after your first payout, making the program essentially free for successful traders

- • Multiple Attempts: Unlike instant funding where account termination is final, you can retake evaluations and learn from mistakes

- • Gradual Scaling: Successful evaluation traders often gain access to larger accounts over time, with some firms offering paths to $5 million+ accounts

Disadvantages of Evaluation Accounts

- Extended Timeline: The typical evaluation process takes 90-120 days from start to funded account, which can feel like an eternity when you’re eager to scale

- Artificial Trading Conditions: Profit targets and time constraints don’t exist in real trading, potentially developing bad habits or unsustainable strategies

- High Failure Rates: Industry statistics show evaluation success rates between 10-30%, meaning most traders lose their evaluation fees

- Psychological Pressure: The combination of time limits and profit targets can create performance anxiety that affects decision-making

- Multiple Hurdles: Two-phase evaluations mean you must succeed twice before accessing funded capital, doubling your chances of failure

- Potential for Multiple Attempts: Many traders need 2-4 attempts to pass, significantly increasing the real cost of getting funded

Instant Funding vs Evaluation: Side-by-Side Comparison

The comparison between Evaluation and Instant Funding often centers on immediate gratification versus long-term development, but the data tells a more complex story. Let’s examine the facts that will directly impact your decision.

Instant Funding |

Evaluation Account |

|

|---|---|---|

Time to Access Capital |

Same day |

90-120 days |

Upfront Cost ($100k account) |

$1,299-$1,999 |

$449-$649 |

Success Rate |

~60-70% |

~15-25% |

Skill Verification Required |

None |

Extensive |

Profit Sharing Start |

Day 1 |

Post-evaluation |

Maximum Drawdown |

Typically 6% |

Usually 8-10% |

Daily Loss Limit |

Often 3% |

Usually 5% |

Educational Support |

Minimal |

Comprehensive |

Account Termination Recovery |

None (start over) |

Retake evaluation |

Scaling Opportunities |

Limited |

Extensive |

Evaluation vs Instant Funding: Which Should You Choose?

This is where rubber meets the road, and I’ll give you the honest truth based on years of experience working with traders at every level.

Instant Funding Is Best for…

- An Experienced, Consistently Profitable Trader: You’ve been making money for at least 2-3 years and have detailed records proving your edge. You understand risk management intuitively and have survived multiple market cycles.

- Confident in Your Psychology: You can handle the immediate pressure of trading real money without the safety net of an evaluation phase. You don’t need external validation or structured learning.

- Time-Sensitive: Market opportunities in your niche are immediate, or you have specific timing needs for your trading career progression.

- Well-Capitalized: The higher upfront cost doesn’t strain your finances, and you can afford to lose the investment if things go wrong.

- Focused on Immediate Income: You need to start generating trading income quickly for personal or professional reasons.

Evaluation Accounts Are Better If You Are…

- A Developing Trader: You’re profitable but haven’t proven consistency over extended periods, or you’re still refining your risk management approach.

- Budget-Conscious: The lower upfront cost makes prop trading accessible without significant financial strain.

- Learning-Oriented: You value the educational aspects and structured development that evaluation programs provide.

- New to Prop Trading: Even experienced retail traders need time to adjust to prop firm rules and capital management requirements.

- Risk-Averse: You prefer the safety net of multiple attempts and the gradual progression that evaluations offer.

The Hybrid Approach

Here’s something most people don’t consider: you don’t have to choose just one path. Many successful prop traders start with evaluations to prove their systems, then transition to instant funding once they’ve built confidence and capital. This approach combines the best of both worlds – structured development followed by immediate scaling.

5 Best Prop Firms for Instant Funding

If you decide to pick Instant Funding accounts over Evaluation programs, here are the five best prop firms for instant funding:

1. FundingPips

FundingPips has carved out a reputation as one of the most trader-friendly instant funding providers in the industry. They serve over 1,000,000 traders, making them a significant player in the prop trading space.

Why FundingPips? The Zero Model program allows traders to bypass all evaluation phases and start trading immediately on master accounts with real capital backing.

- Trustpilot Rating: 4.2/5 stars

- Trading Assets: Forex pairs, major indices, commodities, and cryptocurrencies

- Account Sizes: $5,000 to $400,000 available immediately

- Profit Split: Up to 90% after demonstrating consistency

- Payout Schedule: Bi-weekly payouts with same-day processing available

2. FXIFY

FXIFY has emerged as a powerhouse in the instant funding space, particularly popular among scalpers and high-frequency traders. In 2025, they surpassed $30 million paid to traders across 200,000+ payouts, establishing their credibility and financial stability.

Why FXIFY? Account sizes up to $50K with up to 90% performance split available from day 1, plus customizable add-ons for enhanced trading conditions.

- Trustpilot Rating: 4.1/5 stars

- Trading Assets: Forex, indices, commodities, and crypto CFDs

- Account Sizes: $5,000 to $50,000 instant access

- Profit Split: Up to 90% performance split with on-demand payouts

- Payout Schedule: Instant payouts available from first funded trading day

3. FundedNext

FundedNext operates both evaluation and instant funding programs, giving them unique insights into what traders actually need. Their instant program has gained significant traction among intermediate-level traders.

Why FundedNext? The Stellar Instant program offers no evaluation requirements, no time limits, and immediate scaling potential up to $2 million without additional verification.

- Trustpilot Rating: 4.3/5 stars

- Trading Assets: Forex, indices, commodities, crypto, and futures

- Account Sizes: Starting at $6,000, scaling to $2 million

- Profit Split: Up to 80% with performance bonuses

- Payout Schedule: On-demand withdrawals after meeting minimum requirements

4. Maven Trading

Maven Trading positions itself as one of the best prop firms that focuses on quality over quantity. They cater specifically to professional-level traders who demand premium service and support.

Why Maven Trading? Personalized account management and dedicated support teams for instant funding clients, plus advanced analytics and trade review sessions.

- Trustpilot Rating: 4.0/5 stars

- Trading Assets: Forex majors and minors, key indices

- Account Sizes: $10,000 to $200,000 available immediately

- Profit Split: Up to 85% with loyalty bonuses

- Payout Schedule: Weekly payouts with priority processing

5. FTUK (Funded Trading UK)

FTUK brings European regulatory compliance to the instant funding space, appealing to traders who prioritize security and regulatory oversight in their prop trading relationships.

Why FTUK? FCA-regulated operations with instant funding access, providing additional trader protections and European market focus that many competitors lack.

- Trustpilot Rating: 4.2/5 stars

- Trading Assets: Forex, European indices, commodities

- Account Sizes: $5,000 to $300,000 instant access

- Profit Split: Up to 80% with quarterly performance reviews

- Payout Schedule: Bi-weekly with regulatory compliance guarantees

Compare the best instant funding prop firms 2025 for immediate trading capital.

5 Best Prop Firms for Evaluation Programs

If you prefer Evaluation programs over Instant Funding accounts, you can choose any of the following prop firms for evaluation programs:

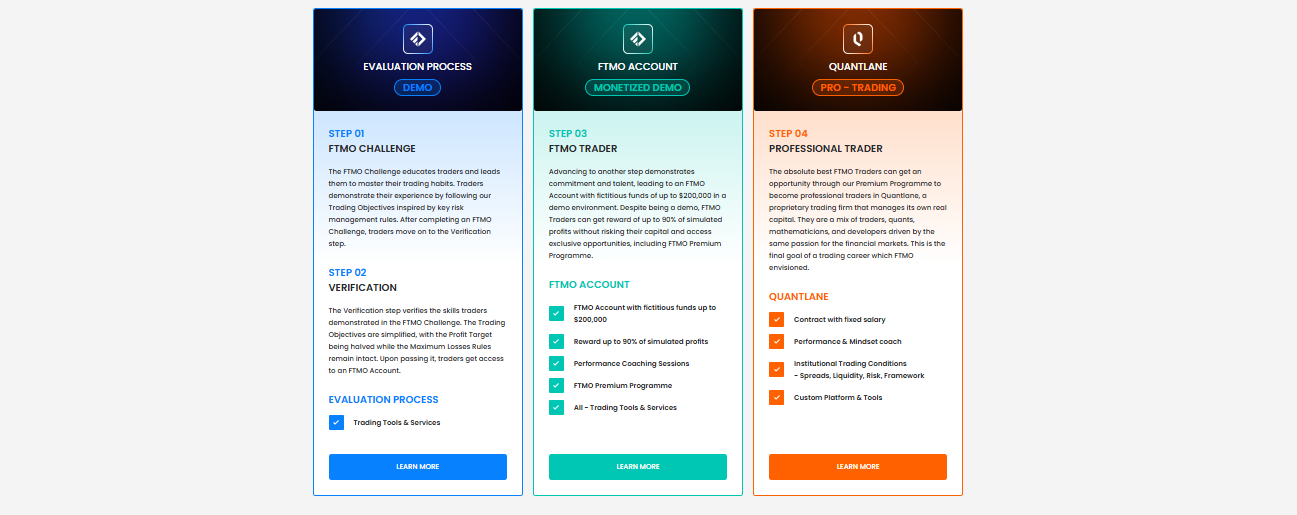

1. FTMO

FTMO remains the gold standard in evaluation-based prop trading, setting the benchmark that other firms measure themselves against. They offer demo environment trading with balances up to $200,000 for successful candidates.

Why FTMO? The most comprehensive evaluation process combined with extensive educational resources, creating a complete trader development ecosystem that has graduated thousands of successful prop traders.

- Trustpilot Rating: 4.1/5 stars

- Trading Assets: Forex, indices, commodities, and cryptocurrency CFDs

- Account Sizes: $10,000 to $400,000 available post-evaluation

- Profit Split: Up to 90% after demonstrating consistency

- Payout Schedule: Bi-weekly with same-day processing options

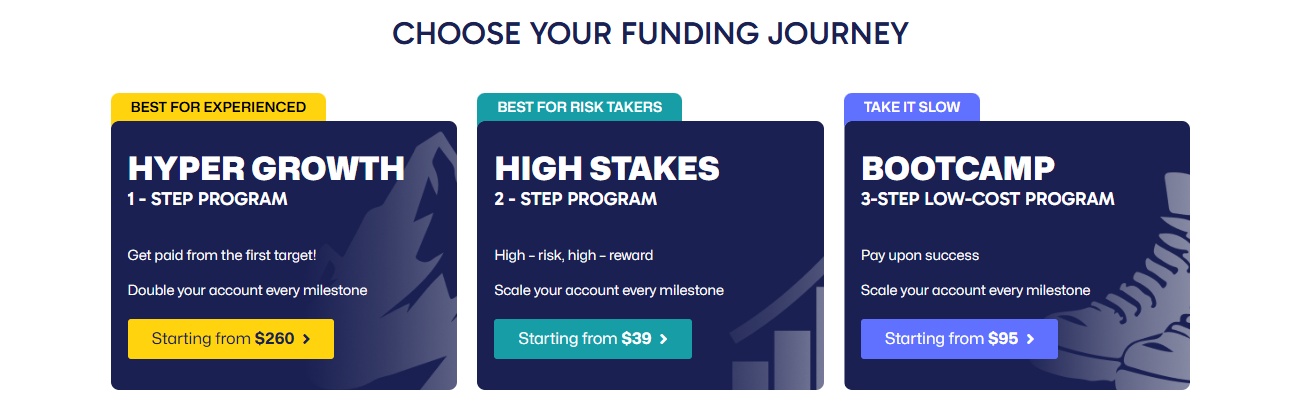

2. The5ers

The5ers operates a unique step-by-step progression system that’s unlike any other prop firm. Their approach focuses on gradual account growth rather than immediate large-scale funding.

Why The5ers? Progressive scaling from demo accounts starting at $95 to over $1.2 million, with salary offers available on select higher-stakes programs.

- Trustpilot Rating: 3.9/5 stars

- Trading Assets: Primarily forex with MT5 platform support

- Account Sizes: $5,000 starting point, scaling to $1,280,000

- Profit Split: Starting at 50%, increasing to 100% based on performance milestones

- Payout Schedule: Monthly distributions with bonus structures

3. FundedNext

FundedNext’s evaluation program offers multiple pathways to funding, making it accessible to traders with different experience levels and time constraints. They provide challenge accounts with up to $300k in simulated funds.

Why FundedNext? Multiple evaluation tracks including Express (15-day) and standard models, plus the industry’s most flexible scaling system allowing growth to $4 million accounts.

- Trustpilot Rating: 4.3/5 stars

- Trading Assets: Comprehensive coverage including forex, indices, commodities, crypto, and futures

- Account Sizes: $6,000 to $4,000,000 progression available

- Profit Split: Up to 90% with performance incentives

- Payout Schedule: Bi-weekly with holiday processing guarantees

4. FundingPips

FundingPips runs parallel evaluation and instant funding programs, giving them deep insights into what works for different trader personalities and skill levels.

Why FundingPips? Two-phase evaluation system with comprehensive educational support, including live trading rooms, market analysis, and one-on-one coaching sessions for struggling candidates.

- Trustpilot Rating: 4.2/5 stars

- Trading Assets: Forex, indices, commodities with expanding crypto offerings

- Account Sizes: $10,000 to $400,000 post-evaluation

- Profit Split: Up to 85% with loyalty bonuses

- Payout Schedule: On-demand requests processed within 24-48 hours

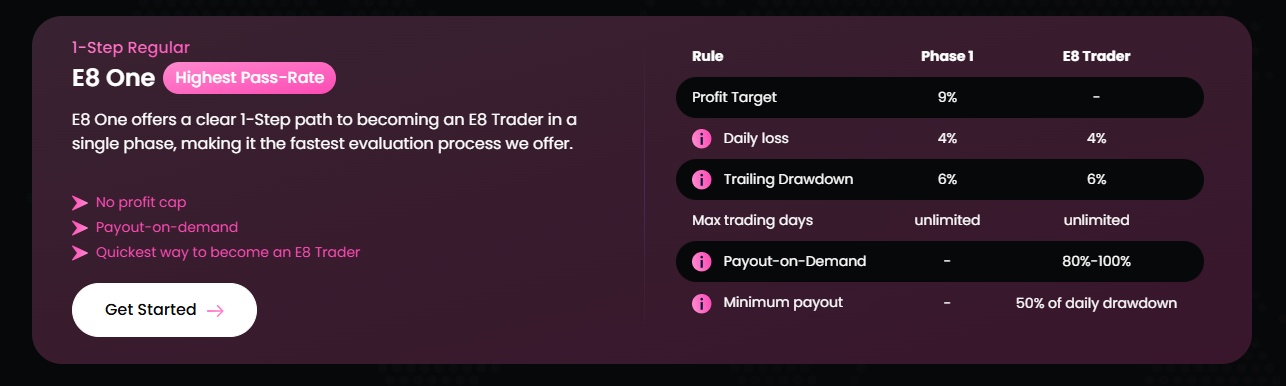

5. E8 Markets

E8 Markets has built a reputation for technological innovation in the evaluation space, using advanced analytics and AI-powered assessment tools to evaluate trader performance.

Why E8 Markets? AI-powered evaluation system providing detailed performance analytics, plus advanced risk management tools that help traders understand their psychological and technical weaknesses.

- Trustpilot Rating: 4.0/5 stars

- Trading Assets: Forex, indices, commodities, and cryptocurrency with expanding offerings

- Account Sizes: $25,000 to $5,000,000 scaling potential

- Profit Split: Up to 80% with technology-driven performance bonuses

- Payout Schedule: Bi-weekly with advanced tracking and analytics dashboard

Instant Funding vs Evaluation: Take Away

After reviewing hundreds of trader journeys and analyzing both success and failure patterns, here’s my straightforward advice: if you’re asking whether you should choose instant funding or evaluation, you probably should start with evaluation. Why?

Traders who are truly ready for instant funding rarely question the decision. They have years of consistent profitability, detailed trading records, and the confidence that comes from proven success. They see the higher upfront cost as an investment in immediate scaling, not a financial burden.

So whether you choose the immediate gratification of instant funding or the structured development of evaluation programs, remember that getting funded is just the beginning. The real challenge lies in maintaining that funding while scaling your profits consistently over months and years.

Your choice between instant funding and evaluation shouldn’t just be about your current skill level – it should align with your long-term trading goals, risk tolerance, and financial situation. Choose the path that sets you up for sustainable success, not just quick access to capital.

Frequently Asked Questions

1. What is an Instant Funding account?

An instant funding account provides immediate access to prop firm capital without requiring any evaluation period. Traders pay a higher upfront fee and can begin trading with real money from day one, earning profit splits immediately upon making successful trades.

2. What is an Evaluation account?

An evaluation account is a testing phase where traders must demonstrate profitability and risk management skills before accessing funded capital. It typically involves meeting specific profit targets within set timeframes while adhering to strict risk parameters across one or two phases.

3. Is an Evaluation account better than Instant Funding?

It depends entirely on your experience level and goals. Evaluation accounts are better for skill development and lower financial risk, while instant funding suits experienced traders seeking immediate capital access. Most traders benefit more from the structured learning of evaluations.

4. How much does Instant Funding cost compared to Evaluation?

Instant funding typically costs 2-4x more upfront than evaluations. For example, a $100,000 instant funding account might cost $1,299-$1,999, while the equivalent evaluation program costs $449-$649. However, instant funding provides immediate profit potential.

5. What is the success rate for Evaluation accounts?

Most prop firms report evaluation success rates between 15-25% for first-time attempts. However, many successful traders require 2-3 attempts, and the learning from failed evaluations often contributes to eventual success in prop trading.

6. Can I lose money with Instant Funding accounts?

Yes, since you’re trading with real capital immediately, losses directly affect the account balance. Violating risk management rules results in immediate account termination with no recovery options, making instant funding higher risk than evaluations.

7. Which type offers better profit splits?

Both instant funding and evaluation accounts typically offer similar profit splits ranging from 80-90%. The difference lies in when you start earning: instant funding from day one, evaluations only after completing the assessment phases successfully.

8. How quickly can I receive payouts from each program?

Instant funding often offers faster payouts since you’re immediately earning real profits. Many firms provide same-day or next-day withdrawals. Evaluation programs require completing the assessment first, but then offer similar payout speeds once you’re funded.