Wealthfront and Betterment are two of the largest and most respected robo-advisors in the industry, both offering automated portfolio management at competitive prices. While they share many similarities, key differences in human advisor access, pricing structure, and advanced features set them apart.

Wealthfront vs Betterment: Quick Comparison

Trying to choose between these top robo-advisors? Learn the essential details from this quick overview before going into more detail.

|

||

|---|---|---|

Management Fee |

0.25% (Digital); 0.65% (Premium) |

0.25% (flat) |

Account Minimum |

$10 to invest |

$500 |

Human Advisors |

Yes (Premium: $100K min) |

No |

Tax-Loss Harvesting |

Yes, standard |

Yes, advanced + daily |

Direct Indexing |

No |

Yes ($100K+ accounts) |

529 Plans |

No |

Yes |

Portfolio Variety |

12+ strategies |

~5-6 options |

SRI Options |

3 focused portfolios |

Basic SRI |

Crypto |

ETF portfolio (1% fee) |

ETF exposure in taxable/IRA |

Cash Account APY |

3.75% |

3.75% |

FDIC Coverage |

Up to $2M |

Up to $8M |

Checking Account |

Yes |

No |

Portfolio Line of Credit |

No |

Yes ($25K+ min) |

Financial Planning |

Goal-based tools |

Path (comprehensive, free) |

Mobile App Rating |

4.8 (iOS), 4.5 (Android) |

4.8 (iOS), 4.6 (Android) |

Customer Support |

Email, chat, phone (Premium) |

Email, phone (limited hours) |

Founded |

2008 |

2008 |

AUM |

$50B+ |

$70B+ |

Best For |

Beginners, goal-focused, advisor access |

Tax-efficiency, self-directed, advanced tools |

Quick Decision Guide:

- Choose Betterment if: You want access to human financial advisors, prefer a $10 minimum to start, need goal-based planning tools, want socially responsible investing options, or appreciate flexible pricing

- Choose Wealthfront if: You prioritize advanced tax optimization, need a 529 college savings plan, want sophisticated financial planning software (Path), prefer portfolio line of credit options, or are comfortable with a fully automated approach

Now that you understand the basics, let’s talk about what matters to you and figure out which approach suits you best!

Betterment vs Wealthfront: Background

What is Wealthfront?

Wealthfront is an automated digital wealth management platform empowering hands-off investing through powerful algorithms. The company was originally called KaChing – not exactly a confidence-inspiring brand.

Founded in 2011 by Andy Rachleff, Dan Carroll, and Jeff Lu, Wealthfront aimed to open robust money optimization normally only accessible to the ultra-wealthy up to everyday folks.

Headquartered in Silicon Valley, Wealthfront’s set-it-and-forget-it financial autopilot approach plus next-gen tech advantages like direct indexing and tax-loss harvesting quickly resonated. Today, Wealthfront boasts over 1.3M users entrusting over $90 billion in assets under management.

Through its slickness and specialization, this disruptive upstart has cemented itself as a top fintech innovator. But can flashy new tech overtake pioneering vision?

What is Betterment?

Betterment was launched in 2008 by Jon Stein and Eli Broverman. Betterment became the first to fully automate key investing activities through algorithms.

Based in NYC, Betterment now serves over 1,000,000 customers with $65 billion+ in assets under management as of October 2025. Beyond baseline digital management, Betterment’s Premium plan opened access to human CFP pros – a differentiator setting it apart.

So while Wealthfront packs cutting-edge advancement, Betterment boasts the wisdom, stability and name recognition that comes from trailblazing.

Pricing & Fees

Betterment

Two-Tier Pricing Model:

Digital Plan:

- Management Fee: 0.25% annually (or $4/month for smaller accounts)

- $4/Month Option: Applies to accounts under $20,000 without $250+/month recurring deposits

- Account Minimum: $0 to open; $10 minimum to start investing

- Additional Benefits: None beyond core features

Premium Plan:

- Management Fee: 0.65% annually (previously 0.40%)

- Account Minimum: $100,000 required

- Premium Benefits:

- Unlimited access to Certified Financial Planners (CFPs)

- Financial planning for assets outside Betterment

- Priority customer service

- Enhanced cash account APY boost

Fee Discounts for High Balances:

- $1M-$2M: 0.15% on portion in this tier

- Over $2M: 0.10% on portion above $2M

Wealthfront

Flat-Rate Pricing:

- Management Fee: 0.25% annually (flat rate for all account sizes)

- Account Minimum: $500 to open investment accounts

- No Monthly Fee Option: Always percentage-based

- No Premium Tiers: Same rate regardless of balance

Special Fee Structures:

- S&P 500 Direct Portfolio: 0.09% fee (requires $5,000 minimum)

- 529 College Savings: 0.25% advisory fee + underlying fund costs (total 0.42-0.46%)

- Cash Account: No management fees

Winner on Price:

- Betterment for very small accounts (under ~$1,600) due to lower minimum

- Tie for accounts $20,000+ at Digital tier (both 0.25%)

- Wealthfront if you want human advisor access (Betterment charges 0.65% for Premium)

Account Types Available

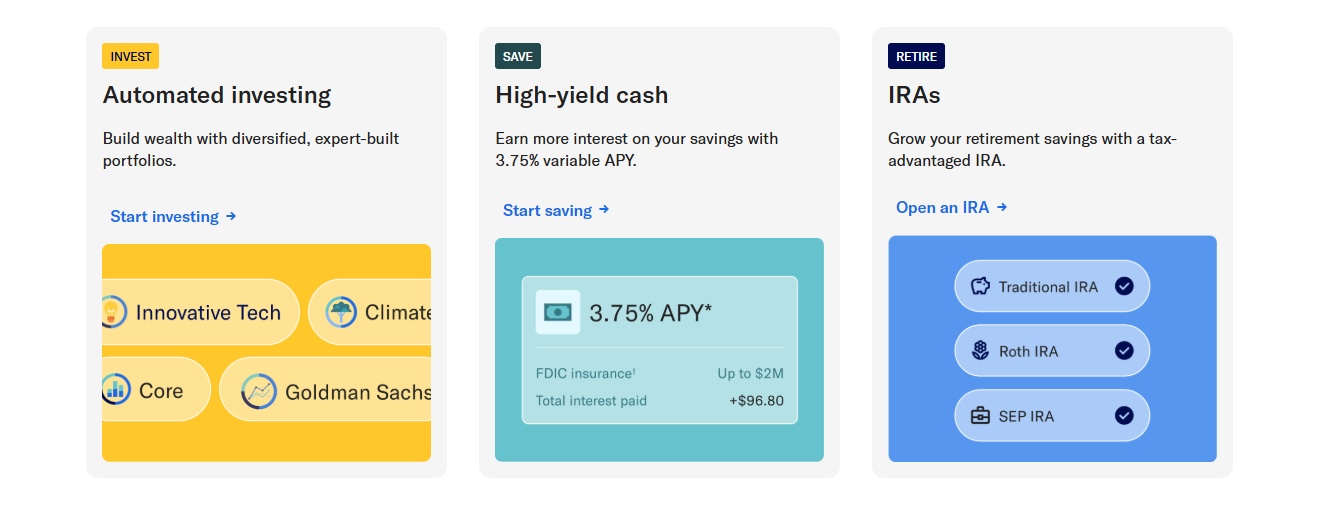

Betterment

Retirement Accounts:

- Traditional IRA

- Roth IRA

- SEP IRA

- Rollover IRA (401k rollovers)

Other Account Types:

- Individual taxable accounts

- Joint accounts

- Trust accounts

- Crypto investing

- Cash Reserve (high-yield savings: 3.75% APY)

- Betterment Checking account

Note: Does NOT offer 529 college savings plans

Wealthfront

Retirement Accounts:

- Traditional IRA

- Roth IRA

- SEP IRA

- Rollover IRA (401k rollovers)

Other Account Types:

- Individual taxable accounts

- Joint accounts

- Trust accounts

- 529 College Savings Plans (Nevada-sponsored)

- High-yield Cash Account (3.75% APY)

- Stock Investing Account (separate self-directed option)

Winner: Wealthfront – includes 529 college savings plans, which Betterment doesn’t offer

Investment Strategy & Portfolio Options

Betterment

Portfolio Strategies (12+ options):

Core Portfolio:

- Globally diversified, low-cost ETFs

- 101 possible stock-to-bond allocations

- Primary stock funds from Vanguard

- Automatic rebalancing when allocation drifts 3%+

Socially Responsible Investing (3 SRI options):

- Broad Impact: ESG criteria across all three pillars

- Climate Impact: Focus on lower carbon emissions and green projects

- Social Impact: Emphasis on gender diversity and minority empowerment (includes JUST, SHE, VETZ ETFs)

Specialized Portfolios:

- Innovative Technology: High-growth tech companies (AI, semiconductors, clean energy, blockchain)

- Value Tilt: Focus on value stocks with potential to outperform

- Crypto ETF Portfolio: Bitcoin and Ethereum ETF exposure (1% management fee)

- Flexible Portfolio: Custom asset class weights for experienced investors

- Goldman Sachs Smart Beta: Risk-adjusted returns

- BlackRock Target Income: For higher-income individuals

Asset Classes: US stocks, international stocks, emerging markets, bonds (government, corporate, municipal), real estate

Wealthfront

Portfolio Options:

Classic Portfolios:

- Risk-based allocation (score 0.5-10)

- Up to 17 global asset classes

- Automatic daily rebalancing

- Dividend reinvestment

Specialized Options:

- Socially Responsible (SRI) Portfolios

- US Direct Indexing: For accounts $100K+ (owns individual S&P 500 stocks)

- S&P 500 Direct Portfolio: Lower 0.09% fee, $5,000 minimum

- Smart Beta: For accounts $500K+ (factor-based investing)

- Custom Portfolios: Mid-2021+ feature for personalization

- Automated Bond Portfolio: Stable income focus (0.25% fee)

Asset Classes: US stocks, foreign stocks, emerging markets, dividend stocks, real estate, natural resources, bonds (government, corporate, municipal), crypto ETFs (Bitcoin, Ethereum)

Winner: Betterment – offers significantly more portfolio variety and customization options (12+ strategies vs. Wealthfront’s handful)

Tax Optimization Features

Betterment

Tax-Loss Harvesting (TLH+):

- Available to all taxable accounts

- No minimum balance required

- Monitors for tax-loss harvesting opportunities

- 2022 Data: 69% of customers using TLH had advisory fees covered by tax savings

Additional Tax Features:

- Tax Coordination (optimizes asset location across accounts)

- Automatic rebalancing to minimize tax impact

- Municipal bond portfolios for high-income earners (Target Income portfolio)

Limitations:

- Less sophisticated than Wealthfront’s offering

- Standard ETF-based TLH (no stock-level harvesting)

Wealthfront

Daily Tax-Loss Harvesting:

- Available to ALL taxable accounts (no minimum)

- Daily monitoring for opportunities

- 2024 Performance: Generated estimated $1 billion in tax savings for clients

- Average Benefit: 1.63% annually (6.5x the 0.25% fee)

- 96% of clients had fees covered by tax savings

Advanced Tax Features:

- US Direct Indexing: Stock-level tax-loss harvesting for $100K+ accounts (owns individual S&P 500 stocks)

- S&P 500 Direct Portfolio: Enhanced TLH at 0.09% fee

- Tax-minimized account transfers

- Sophisticated wash-sale rule monitoring

- Municipal bond optimization

- Smart Beta tax efficiency ($500K+ accounts)

Winner: Wealthfront – significantly more sophisticated tax optimization, especially for larger accounts. Tax benefits often exceed management fees.

Human Advisor Access & Customer Support

Betterment

Digital Plan ($0.25% fee):

- Email support during business hours

- Live chat support

- In-app messaging

- No phone access to financial advisors

- Help center and FAQ

Premium Plan ($100K minimum, 0.65% fee):

- Unlimited phone access to team of Certified Financial Planners (CFPs)

- Scheduled consultations

- Financial planning for assets both inside and outside Betterment

- Advice on:

- Retirement planning

- Tax strategies

- Portfolio adjustments

- Major life changes (marriage, children, retirement)

- Backdoor Roth IRA conversions

- Priority customer service

One-Time Consultations (Discontinued):

- Previously offered $299 advice packages

- No longer available as of 2024

Response Times: Generally good, but slower during peak periods (tax season)

Wealthfront

No Human Financial Advisors:

- Completely automated, software-based approach

- No access to CFPs or financial planners at any tier

Product Specialists:

- FINRA-registered support team

- Series 7, Series 66 certifications

- Some hold CFA and CFP designations

- Available by phone and email

Support Hours:

- Monday-Friday, 11 AM – 8 PM EST

- Phone: 1-844-995-8437

- Email: support@wealthfront.com

What They Provide:

- Technical support

- Account-related questions

- Platform navigation help

What They Don’t Provide:

- Investment advice

- Financial planning guidance

- Performance guarantees

- Transaction requests over phone

Philosophy: Software handles financial planning and investment decisions; humans help with technical issues only

Winner: Betterment – clear advantage for investors who value human interaction and personalized financial advice (though you pay extra for Premium)

Financial Planning Tools

Betterment

Goal-Based Planning:

- Multiple goal tracking (retirement, home purchase, emergency fund, general savings)

- Personalized recommendations for each goal

- Visual progress tracking

- Automatic allocation to different goals

Projection Tools:

- Retirement projections

- Goal likelihood calculators

- Scenario testing

- Timeline adjustments

Additional Features:

- Social Security integration

- Tax-efficient withdrawal strategies

- Portfolio performance tracking

- Mobile app with clean interface

Limitations:

- Less comprehensive than Wealthfront’s Path

- No detailed college cost projections

- Limited “what-if” scenario planning

Wealthfront

Path Financial Planning Tool:

- Completely free (available even without Wealthfront account)

- Comprehensive financial planning software

- Available on mobile and desktop

Path Features:

- Retirement Planning:

- Detailed projections with Social Security integration

- Multiple retirement scenarios

- Early retirement calculations

- Time-off for travel planning

- College Savings Planning:

- Specific college cost estimates by institution

- 529 plan recommendations

- Savings goal tracking

- Home Buying Planning:

- Affordability calculator

- Down payment planning

- Impact on other goals

- General Savings Goals:

- Unlimited custom goals

- Timeline tracking

- Progress monitoring

Self-Driving Money:

- Automated cash flow management

- Automatically moves excess funds from Cash Account to:

- Taxable investment accounts

- Traditional IRA

- Roth IRA

- 529 plans

- Set categories for specific savings goals

Time Off for Travel:

- Calculate affordable vacation time

- Budget planning for travel

- Impact analysis on long-term goals

Portfolio Customization:

- Adjust allocations across hundreds of ETFs

- Test different investment scenarios

- Risk tolerance adjustments

Winner: Wealthfront – Path tool is significantly more sophisticated and comprehensive, offering detailed life planning beyond basic goal tracking

Additional Features & Services

Betterment

Cash Management:

- Cash Reserve Account: 3.75% APY (variable)

- FDIC insured up to $2 million ($4M for joint accounts)

- No monthly fees

- No minimum balance

Betterment Checking:

- Debit card included

- ATM fee reimbursements

- No overdraft fees

- No monthly fees

Crypto Investing:

- Crypto ETF Portfolio (launched November 2024)

- Bitcoin and Ethereum ETF exposure

- Higher Fee: 1% annual management fee

- Automatic rebalancing included

- Note: Direct crypto investing discontinued in late 2024

Fractional Shares:

- Available for all portfolio investments

- Ensures all cash is invested

Portfolio Variety:

- 12+ expert-built portfolios

- Flexible customization for experienced investors

Automatic Features:

- Dividend reinvestment

- Tax-loss harvesting

- Rebalancing (when allocation drifts 3%+)

Wealthfront

High-Yield Cash Account:

- Currently 3.75% APY

- FDIC insured up to $8 million through program banks

- No account fees

- Direct deposit available

- Bill pay functionality

- Debit card with ATM access

- Unlimited withdrawals

Portfolio Line of Credit:

- Borrow up to 30% of portfolio value

- Requirements: $25,000+ in taxable investment account

- APR: 7.65% – 8.90% (varies by amount borrowed)

- No credit check required

- No paperwork

- Funds available in 1 business day

- No repayment schedule (pay interest monthly)

- Lower rates than credit cards or personal loans

529 College Savings Plan:

- Nevada-sponsored plan

- $500 minimum to open

- 20 personalized glide paths

- Up to 9 asset class ETFs

- Automatic risk reduction as college approaches

- Total expense ratio: 0.42-0.46%

Stock Investing Account:

- Separate self-directed account

- Buy individual stocks and fractional shares

- Not part of robo-advisor management

Automated Bond Portfolio:

- Focus on stable income

- 0.25% management fee

- U.S. Treasuries, corporate bonds, mortgage-backed securities

- Less volatile than stocks

- Higher returns than Cash Account

401(k) Rollover Service:

- Streamlined IRA rollover process

- Guidance through transfer

Smart Beta:

- Available for accounts $500K+

- Factor-based investing for potentially higher returns

Winner: Wealthfront – more comprehensive suite of financial services, especially Portfolio Line of Credit and 529 plans

Investment Minimums & Account Requirements

Betterment

Digital Plan:

- To Open Account: $0 minimum

- To Start Investing: $10 minimum deposit

- Monthly Fee Trigger: $4/month if balance under $20,000 AND no $250+/month recurring deposits

Premium Plan:

- Minimum Balance: $100,000 required

- Calculated across eligible investments

- Excludes: Cash Reserve, Checking, HSA, 401(k), Self-Directed Investing balances

No Minimums for:

- Cash Reserve account

- Checking account

Wealthfront

Automated Investing Account:

- Minimum to Open: $500 required

- No monthly fee option

- Always percentage-based fee

Special Minimums:

- 529 College Savings: $500 minimum

- S&P 500 Direct Portfolio: $5,000 minimum (0.09% fee)

- Portfolio Line of Credit: $25,000 in taxable account

- US Direct Indexing: $100,000 minimum

- Smart Beta: $500,000 minimum

Cash Account:

- No minimum balance required

- No fees

Winner: Betterment – significantly lower barrier to entry ($10 vs. $500), making it more accessible for beginners

Tax-Advantaged Account Features

Betterment

IRA Options:

- Traditional, Roth, SEP, Rollover IRAs

- Same 0.25% management fee

- Tax-loss harvesting NOT available (IRAs are tax-deferred)

- Automatic rebalancing included

- Free IRA transfers from other providers

Roth Conversion Support:

- CFPs can guide on backdoor Roth conversions (Premium only)

- Software handles basic Roth strategies

HSA Available:

- Health Savings Account option

- Separate from regular investing balance

No 529 Plans

Wealthfront

IRA Options:

- Traditional, Roth, SEP, Rollover IRAs

- Same 0.25% management fee

- Tax-loss harvesting NOT available (IRAs are tax-deferred)

- Daily rebalancing included

- Streamlined 401(k) rollover service

529 College Savings:

- Nevada-sponsored plan

- 20 personalized glide paths

- Automatic age-based risk adjustment

- Tax-free growth for education expenses

- Total fees: 0.42-0.46%

Winner: Wealthfront – offers 529 plans that Betterment lacks; otherwise similar IRA offerings

User Experience & Technology

Betterment

Interface Design:

- Clean, intuitive layout

- Goal-centric dashboard

- Visual progress tracking

- Easy-to-understand charts

Mobile App:

- iOS Rating: 4.8/5 stars

- Android Rating: 4.5/5 stars

- Highly rated for user-friendliness

- Simple to track balances

- Easy recurring deposit setup

- Goal monitoring

Website:

- Well-organized

- Comprehensive educational resources

- Easy account opening

- Extensive help center

Account Opening:

- Takes 5-10 minutes

- Questionnaire determines risk tolerance

- Multiple goal setup

- Intuitive process

Awards & Recognition:

- Bankrate: Best Overall Robo-Advisor 2025

- Consistently top-rated across major review sites

- NerdWallet top pick

User Feedback – Positives:

- Very beginner-friendly

- Excellent goal-based tools

- Responsive customer service (Premium)

- High-yield cash account

User Feedback – Negatives:

- Customer service slower during peak times

- Some app technical issues reported

- Limited customization beyond preset portfolios

- Crypto features less developed

Wealthfront

Interface Design:

- Sophisticated but clean

- Data-rich dashboards

- Comprehensive portfolio views

- Feature-heavy (may overwhelm beginners)

Mobile App:

- iOS Rating: 4.8/5 stars

- Android Rating: 4.6/5 stars

- Award-winning design

- Path tool integration

- Portfolio tracking

- Cash management features

Website:

- Detailed information

- Extensive educational content

- Sophisticated planning tools

- Help center and FAQ

Account Opening:

- Straightforward questionnaire

- Risk assessment

- Portfolio recommendation

- 10-15 minutes total

Awards & Recognition:

- NerdWallet: Top robo-advisor (multiple years)

- Webby Award winner

- Consistently highly rated

- Known for innovation

User Feedback – Positives:

- Excellent tax-loss harvesting

- Robust financial planning (Path)

- Clean automation

- Comprehensive features

- Low fees

User Feedback – Negatives:

- No human advisor access

- Higher $500 minimum than competitors

- Customer support response times can be slow

- Limited customization under $100K

Winner: Tie – Betterment wins for pure simplicity and goal-based approach; Wealthfront wins for sophisticated features and planning tools

Performance & Returns

Betterment

Historical Performance:

- Performance data available in app for each portfolio

- Returns vary by portfolio strategy and risk level

- Generally tracks market indices closely

Expected Returns:

- Core portfolio designed to match market returns

- Value Tilt may outperform in certain market conditions

- SRI portfolios may have slightly lower yields (lower dividends)

Tax Efficiency:

- TLH+ can add 0.77% annually (Betterment estimate)

- 69% of TLH users had fees covered by tax savings (2022)

- Tax Coordination optimizes asset location

Benchmark Tracking:

- Closely tracks intended asset class performance

- Low tracking error

- Daily dividend reinvestment

Wealthfront

Historical Performance:

- Performance varies by risk score (0.5-10)

- Publicly shares performance data

- Generally tracks market indices

Expected Returns:

- Designed to capture market returns efficiently

- Smart Beta aims for enhanced returns ($500K+)

- Direct Indexing provides additional tax alpha

Tax Efficiency:

- Average 1.63% annual benefit from TLH

- 96% of clients had fees covered by tax savings

- $1 billion in tax savings generated (2024)

- Stock-level TLH provides additional advantage

Benchmark Tracking:

- Low tracking error

- Daily rebalancing

- Efficient execution

Winner: Difficult to compare directly (performance depends on risk level and time period), but Wealthfront’s superior tax optimization often results in higher after-tax returns

Security & Regulatory Protection

Betterment

Regulatory Status:

- SEC-registered investment advisor

- Member of FINRA

- Assets held by Apex Clearing Corporation (SEC-registered custodian)

Insurance Coverage:

- SIPC Protection: Up to $500,000 (including $250,000 cash)

- Cash Reserve: FDIC insured up to $2 million through program banks

- Checking: FDIC insured up to $250,000

Security Measures:

- 256-bit SSL encryption

- Two-factor authentication (2FA)

- Regular security audits

- Secure login protocols

Company Stability:

- Founded: 2008

- Assets Under Management: $50 billion+

- Active Users: 900,000+

- Well-established, profitable company

Wealthfront

Regulatory Status:

- SEC-registered investment advisor

- Member of FINRA

- Assets held by partner custodians

Insurance Coverage:

- SIPC Protection: Up to $500,000

- Cash Account: FDIC insured up to $8 million through program banks

- No checking account offered

Security Measures:

- Bank-level encryption

- Two-factor authentication

- Secure data protocols

- Regular security updates

Company Stability:

- Founded: 2008

- Assets Under Management: $70 billion+

- Active Users: 1 million+

- Strong Silicon Valley backing

Winner: Tie – both offer robust security and regulatory protection

Pros & Cons Summary

Betterment — Pros & Cons

Pros |

Cons |

|---|---|

✅ Very low barrier to entry ($10 minimum) |

❌ No 529 college savings plans |

✅ Access to human CFPs with Premium plan |

❌ Premium tier requires $100K minimum |

✅ 12+ portfolio strategies (industry-leading variety) |

❌ Premium fee increased to 0.65% (from 0.40%) |

✅ Goal-based investing (beginner-friendly) |

❌ $4/month fee for small accounts without recurring deposits |

✅ Three SRI options with different focuses |

❌ Tax-loss harvesting less sophisticated than Wealthfront |

✅ Crypto ETF portfolio available |

❌ No portfolio line of credit |

✅ Flexible portfolio customization option |

❌ Customer service can be slow during peak times |

✅ Cash Reserve with $2M FDIC coverage |

❌ Crypto portfolio has 1% management fee |

✅ Checking account with debit card |

❌ Limited customization vs. Wealthfront Direct Indexing |

✅ No account minimum to open |

|

✅ Excellent mobile app ratings |

|

✅ Bankrate’s #1 robo-advisor 2025 |

Wealthfront — Pros & Cons

| Pros | Cons |

|---|---|

| ✅ Superior tax-loss harvesting (daily, all accounts) | ❌ No human financial advisors |

| ✅ Stock-level TLH for $100K+ accounts | ❌ $500 minimum to start (vs. $10 at Betterment) |

| ✅ 529 college savings plans available | ❌ Limited customer support (product specialists only) |

| ✅ Comprehensive Path planning tool (free) | ❌ Fewer portfolio variety options |

| ✅ Portfolio Line of Credit ($25K+) | ❌ Limited customization for accounts under $100K |

| ✅ Self-Driving Money automation | ❌ Support only M-F, 11 AM–8 PM EST |

| ✅ S&P 500 Direct Portfolio at 0.09% | ❌ May overwhelm absolute beginners |

| ✅ Smart Beta for $500K+ | ❌ No checking account |

| ✅ $8M FDIC coverage on cash | ❌ Can’t buy individual stocks in robo-advisor account |

| ✅ No monthly fee option | ❌ Risk Parity Fund wound down (2024–25) |

| ✅ Tax benefits often exceed fees | |

| ✅ Clean, award-winning interface |

Wealthfront vs Betterment: Which Should You Choose?

Choose Betterment If You:

- Are a complete beginner with limited funds ($10-$500)

- Want access to human financial advisors (willing to pay Premium)

- Prefer goal-based investing with visual tracking

- Value portfolio variety (12+ strategies to choose from)

- Want socially responsible options with multiple focus areas

- Need a checking account integrated with investing

- Have $100K+ and want CFP guidance without going to traditional advisor

- Prefer lower initial commitment to test robo-advising

- Want crypto ETF exposure in your portfolio

- Appreciate having advisor support for major life decisions

- Are intimidated by technology and want simpler interface

Choose Wealthfront If You:

- Have $500+ to start investing

- Prioritize tax optimization and after-tax returns

- Are comfortable with automation and no human advisors

- Need 529 college savings plans for children

- Want sophisticated financial planning (Path tool)

- Have $25K+ and want Portfolio Line of Credit access

- Prefer self-service and don’t need phone support

- Have $100K+ and want Direct Indexing (stock-level TLH)

- Value advanced features over human interaction

- Want higher FDIC coverage ($8M vs. $2M)

- Are tech-savvy and appreciate comprehensive tools

- Have $500K+ and want Smart Beta factor investing

Getting Started

Opening a Betterment Account:

- Visit betterment.com or download mobile app

- Create account (email and password)

- Complete risk assessment questionnaire

- Set financial goals (retirement, house, emergency fund, etc.)

- Choose portfolio strategy (Core, SRI, or specialized)

- Select account type (taxable, IRA, etc.)

- Link bank account

- Deposit minimum $10 to start investing

- Portfolio automatically built and managed

- Optional: Upgrade to Premium when you reach $100K

Timeline: 5-10 minutes for account setup

Opening a Wealthfront Account:

- Visit wealthfront.com or download mobile app

- Create account (email and password)

- Answer financial goals questionnaire

- Complete risk tolerance assessment (score 0.5-10)

- Choose account type (taxable, IRA, 529, etc.)

- Review recommended portfolio

- Link bank account

- Deposit minimum $500 to start

- Portfolio automatically created and daily rebalancing begins

- Explore Path tool for comprehensive financial planning

Timeline: 10-15 minutes for account setup

Betterment vs Wealthfront: The Verdict

Both are excellent, established robo-advisors that will serve you well. You can’t make a “wrong” choice between them – only a choice that’s more or less optimal for your specific circumstances.

The most important decision is to start investing with either platform rather than delaying while seeking the “perfect” option. Both will help you build wealth through disciplined, automated investing at a fraction of traditional advisor costs.

Final Tip: Start with one platform based on your immediate needs. You can always:

- Upgrade tiers as your balance grows

- Add a second platform for different account types

- Switch platforms if your needs change significantly

The key is taking action and letting time in the market work in your favor, regardless of which robo-advisor you choose.

Compare also! Wealthsimple vs Wealthfront

FAQs

Which has better tax optimization?

Wealthfront clearly wins. Daily tax-loss harvesting for all accounts, stock-level TLH for $100K+, and an average 1.63% annual tax benefit that often exceeds the management fee.

Which is better for beginners?

Betterment is more beginner-friendly with its $10 minimum, goal-based interface, and access to human advisors (Premium). However, Wealthfront’s Path tool provides excellent self-service guidance.

Which has lower fees overall?

Tie at Digital tier (both 0.25%). Wealthfront is cheaper if you want advisor access (Betterment Premium is 0.65%).

Which offers more investment options?

Betterment offers 12+ portfolio strategies vs. Wealthfront’s ~5-6 core options. However, Wealthfront offers more customization for large accounts ($100K+).

Can I talk to a real person?

Yes with Betterment Premium (unlimited CFP access for $100K+ accounts at 0.65% fee). Wealthfront has no financial advisors, only product support specialists.

Which is better for college savings?

Wealthfront – offers 529 plans with personalized glide paths. Betterment does not offer 529 plans.

Which has better cash management?

Tie – both offer 3.75% APY. Betterment adds checking account with debit card. Wealthfront offers higher FDIC coverage ($8M vs. $2M).