Wealthsimple and Wealthfront are two leading robo-advisors that offer automated investment management, but they cater to different audiences and priorities. Wealthsimple provides unlimited access to human financial advisors with higher fees, while Wealthfront offers lower fees with a fully automated approach and sophisticated tax optimization tools.

Wealthsimple vs Wealthfront: Quick Comparison

Need some help deciding between these two top robo-advisors? Get the key facts with this snapshot overview before digging deeper.

|

||

|---|---|---|

💰Fees & Minimums

|

Management Fee: 0.5% (under $100K), 0.4% (over $100K) Account Minimum: $0 No minimum requiredOther Fees: 1.5% currency conversion on USD trades |

Management Fee: 0.25% (flat rate) 50% lower than WealthsimpleAccount Minimum: $500Other Fees: None |

👤Human Support

|

✓ Unlimited access to human financial advisors

|

✗ No human financial advisors

|

📊Tax Optimization

|

Tax-Loss Harvesting: Only for accounts over $100K

|

Daily Tax-Loss Harvesting for ALL taxable accounts No minimum required

|

📁Account Types

|

Best for Canadian investors:

|

Best for US investors:

|

🛠️Planning Tools

|

Basic tools focused on simplicity:

|

Comprehensive Path planning tool (free):

|

🌍Geographic Availability

|

Available in:

Protection: |

Available in:

Protection: |

Quick Decision Guide:

- Choose Wealthsimple if: You want human advisor access, have no initial capital (no minimum), prefer a Canadian platform (though available in US), or want socially responsible/Halal investing options

- Choose Wealthfront if: You prioritize lower fees, want advanced tax-loss harvesting, need 529 college savings plans, have at least $500 to start, or prefer sophisticated financial planning tools

Now that you’ve got the lay of the land, let’s discuss your personal priorities and see which approach resonates most!

Wealthsimple vs Wealthfront: Background

What is Wealthsimple?

Established in September 2014 by Michael Katchen and Brett Huneycutt, Wealthsimple is a Toronto-based financial management firm that’s been making waves in the robo-advisor scene. The Power Company of Canada owns the majority, holding 83.2% of the reins.

Now, consider this – over 3 million Canadians entrust their finances to Wealthsimple, and what are the assets under management? A whopping $70 billion! That’s some serious trust in those algorithms.

Wealthsimple made its debut in the US back in 2017, bringing its robo-advisor magic across the border. With an easy-to-use platform tailored for millennials, it’s been turning heads with both automated investing and the added touch of human advisors.

What is Wealthfront?

Wealthfront was founded by Andy Rachleff and Dan Carroll. This California-born robo-advisor has seniority, entering the game in November 2011. Considered one of the pioneers, Wealthfront boasts being among the best and most popular robo-advisors in the United States.

And guess what? It’s got quite the fan following. 1.3M+users are part of the Wealthfront family. That’s like a small city of people trusting Wealthfront with their finances.

But wait, there’s more to this story too. Wealthfront is not just about being digital; it’s a financial powerhouse managing over $50 billion in assets. That’s a ton of cash, right? It’s clear they’re not messing around. This robo-advisor prides itself on accessibility and customizability, catering to both beginners and seasoned investors.

Pricing & Fees

Wealthsimple

- Management Fee: 0.5% annually for accounts under $100,000; 0.4% for accounts over $100,000

- Account Minimum: $0 (no minimum deposit required)

- Additional Fees: None for basic service; 1.5% currency conversion fee for USD trades

Wealthfront

- Management Fee: 0.25% annually (flat rate for all account sizes)

- Account Minimum: $500 required to open an investment account

- Additional Fees: None; tax-loss harvesting included at no extra cost

- ETF Expense Ratios: Average 0.06-0.18% (industry-low)

Winner on Price: Wealthfront has significantly lower fees (half of Wealthsimple’s), which compounds to substantial savings over time.

Account Types Available

Wealthsimple (Canada-focused)

Registered Accounts:

- TFSA (Tax-Free Savings Account)

- RRSP (Registered Retirement Savings Plan)

- RESP (Registered Education Savings Plan)

- FHSA (First Home Savings Account)

- LIRA (Locked-In Retirement Account)

- RRIF (Registered Retirement Income Fund)

- Spousal RRSP

Non-Registered:

- Personal investment accounts

- Corporate accounts

- Margin accounts

- Chequing accounts (formerly Cash accounts)

Note: Wealthsimple is primarily designed for Canadian residents, though US services are available with more limited options.

Wealthfront (US-focused)

Retirement Accounts:

- Traditional IRA

- Roth IRA

- SEP IRA

- Rollover IRA (401k rollovers)

Other Account Types:

- Individual taxable accounts

- Joint accounts (JTWROS)

- Trust accounts

- 529 College Savings Plans (Nevada-sponsored)

- High-yield Cash Accounts

Winner: Tie – both offer comprehensive account types for their respective markets (Wealthsimple for Canada, Wealthfront for US).

Investment Strategy & Portfolio Options

Wealthsimple

- Investment Philosophy: Modern Portfolio Theory using low-cost index ETFs

- Portfolio Options:

- Classic portfolios (based on risk tolerance)

- Socially Responsible Investing (SRI) portfolios

- Halal investing options (compliant with Islamic law)

- Asset Classes: US stocks, Canadian stocks, international stocks, bonds, real estate, commodities

- Automatic Features: Rebalancing, dividend reinvestment

- Tax-Loss Harvesting: Available for accounts over $100,000

Wealthfront

- Investment Philosophy: Modern Portfolio Theory with passive index investing

- Portfolio Options:

- Classic portfolios (risk-based)

- Socially Responsible portfolios

- Custom portfolios (mid-2021+)

- US Direct Indexing (for accounts $100k+)

- Asset Classes: US stocks, foreign stocks, emerging markets, dividend stocks, real estate, natural resources, bonds (government, corporate, municipal), crypto ETFs

- Automatic Features: Daily rebalancing, dividend reinvestment

- Tax-Loss Harvesting: Daily monitoring for ALL taxable accounts (no minimum)

Winner: Wealthfront – offers more customization options and superior tax optimization available to all account holders.

Tax Optimization Features

Wealthsimple

- Tax-loss harvesting available only for accounts over $100,000

- Tax-efficient asset location

- Automatic RRSP/TFSA contribution optimization (for Canadians)

- Basic tax reporting

Wealthfront

- Daily Tax-Loss Harvesting: Available to all taxable accounts regardless of size

- Advanced Features:

- Stock-Level Tax-Loss Harvesting (US Direct Indexing for $100k+ accounts)

- Tax-minimized account transfers

- Municipal bond optimization for high-income earners

- Sophisticated wash-sale rule monitoring

- Performance: Average clients see tax benefits worth 1.63% annually (6.5x the 0.25% fee over 10 years)

- 2024 Results: Generated an estimated $1 billion in tax savings for clients

Winner: Wealthfront – industry-leading tax optimization that often exceeds its management fee.

Human Advisor Access & Customer Support

Wealthsimple

- Human Advisors: Unlimited access to licensed financial advisors via phone, email, text, or video chat for ALL clients

- Availability: Available to help with portfolio questions, financial planning, and investment guidance

- Customer Service: Phone and email support available 7 days a week

- Philosophy: Hybrid approach combining automated investing with human expertise

Wealthfront

- Human Advisors: None – completely automated approach

- Product Specialists: FINRA-registered support team (Series 7, Series 66, some CFAs and CFPs) available by phone and email

- Support Hours: Monday-Friday, 11 AM – 8 PM EST

- Phone: 1-844-995-8437 | Email: support@wealthfront.com

- What They Don’t Provide: Investment advice, performance guarantees, financial planning advice (handled by Path tool), transaction requests over phone

- Philosophy: Software delivers the advice; specialists help with technical issues only

Winner: Wealthsimple – clear advantage for investors who value human interaction and guidance.

Financial Planning Tools

Wealthsimple

- Planning Tools: Minimal – focuses on simplicity

- Investment Tracking: Portfolio performance tracking across all accounts

- Mobile App: Clean, user-friendly interface

- Philosophy: Straightforward approach without overwhelming features

Wealthfront

- Path Tool: Comprehensive free financial planning software (available even without an account)

- Retirement planning with detailed projections

- College savings planning (specific college cost estimates)

- Home buying planning and affordability calculator

- General savings goal tracking

- Pulls in spending data from linked accounts

- Incorporates Social Security and inflation projections

- Self-Driving Money: Automated cash flow management that moves excess funds to appropriate investment accounts

- Portfolio Customization: Ability to adjust allocations across hundreds of funds

- Scenario Planning: Test different financial scenarios

Winner: Wealthfront – significantly more sophisticated planning and projection tools.

Additional Features

Wealthsimple

- Roundup Feature: Automatically invests spare change from purchases made with Wealthsimple debit card

- Crypto Trading: Available through platform (separate from robo-advisor)

- Commission-Free Trading: Self-directed option with $0 trading fees (but higher currency conversion fees)

- Fractional Shares: Available for stock purchases

- Cash Account Features: Chequing account with competitive interest rates

Wealthfront

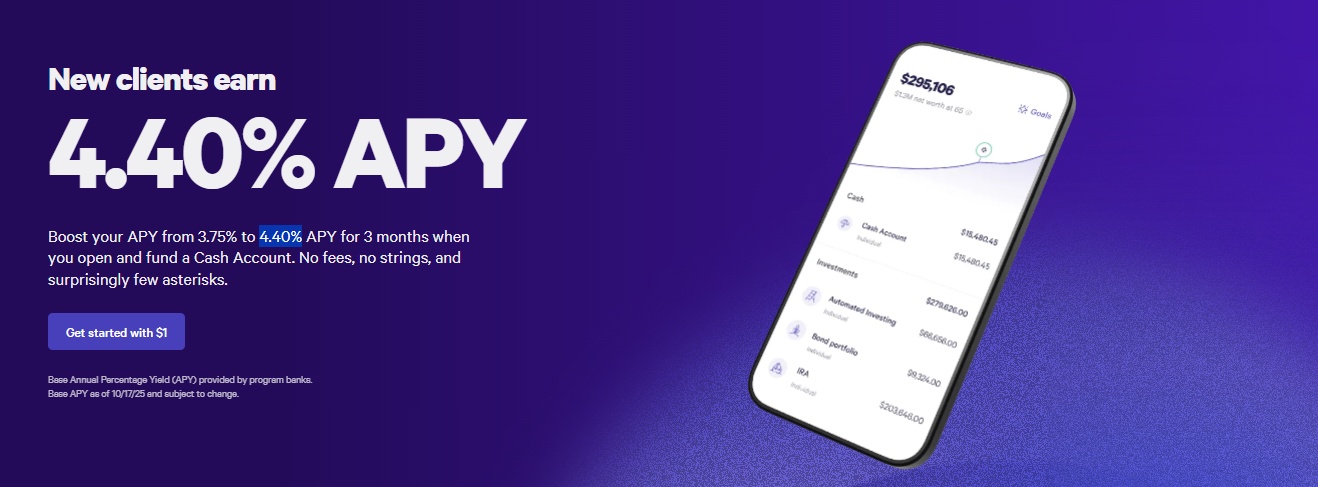

- High-Yield Cash Account: Currently 4.40% APY with checking features

- No account fees

- Direct deposit available

- Bill pay functionality

- ATM access via debit card

- Portfolio Line of Credit: Borrow up to 30% of account value (APR 2.4%-3.65%) for accounts over $25,000

- 529 College Savings: One of few robo-advisors offering this (Nevada-sponsored plan)

- 401(k) Rollover Service: Streamlined IRA rollover process

- Stock Investing: Ability to buy individual stocks and fractional shares in separate account

- Automated Bond Portfolios: Introduced mid-2023

Winner: Wealthfront – broader range of integrated financial services, especially for US investors.

Investment Minimums & Special Tier Benefits

Wealthsimple

Tier Structure:

- Core: Standard service

- Premium: Automatically at $100,000 invested

- Lower 0.4% management fee

- Access to additional advisor perks

- Generation: Automatically at $500,000 invested

- Enhanced benefits including health services through Medcan

- Priority service

Wealthfront

Tier Benefits by Account Size:

- $500: Access to basic automated investing

- $25,000: Portfolio Line of Credit eligibility

- $100,000: Access to:

- US Direct Indexing (Stock-Level Tax-Loss Harvesting)

- Risk Parity Fund

- $500,000: Smart Beta portfolio weighting for maximized returns

Winner: Wealthsimple – no minimum makes it more accessible to beginners; tier benefits start at lower thresholds.

Geographic Availability & Regulatory Protection

Wealthsimple

- Primary Market: Canada

- Also Available: United States, United Kingdom

- Regulatory Protection:

- Canada: CIPF coverage up to CAD $1M

- US: SIPC coverage up to $500,000 (through Apex Clearing)

- UK: FSCS coverage up to £85,000

- Founded: 2014, Toronto

- Assets Under Management: Over CAD $100 billion (as of Oct 2025)

- Users: Over 3 million

Wealthfront

- Primary Market: United States only

- Eligibility: Must be US tax resident with US Social Security number

- Regulatory Protection:

- SIPC coverage up to $500,000

- Cash accounts: FDIC insured through partner banks

- Founded: 2008, Silicon Valley

- Assets Under Management: Over $70 billion

- Users: Over 1 million

Winner: Depends on location – Wealthsimple for Canadians, Wealthfront for Americans.

User Experience & Technology

Wealthsimple

- Interface: Simple, beginner-friendly mobile-first design

- Mobile App: Highly rated for ease of use

- Website: Clean, minimalist design

- Awards: Webby Award for Best Financial Services Website (multiple years)

- Account Opening: Quick, no minimum deposit required

- Target Audience: Millennials, first-time investors, those who want simplicity

Wealthfront

- Interface: More feature-rich, sophisticated but still user-friendly

- Mobile App: Available for iOS and Android

- Website: Comprehensive with extensive educational resources

- Awards: Consistently top-rated robo-advisor by major reviewers

- Account Opening: Straightforward questionnaire process

- Target Audience: Tech-savvy investors, hands-off investors who want optimization

Winner: Tie – Wealthsimple for absolute simplicity, Wealthfront for features while maintaining usability.

Pros & Cons

Wealthsimple — Pros & Cons

| Pros | Cons |

|---|---|

| ✅ Unlimited access to human financial advisors | ❌ Higher management fees (0.4–0.5% vs 0.25%) |

| ✅ No minimum investment required | ❌ Tax-loss harvesting only for accounts over $100k |

| ✅ Socially responsible & Halal investing options | ❌ Fewer planning tools and customization options |

| ✅ Great for Canadian investors (registered accounts) | ❌ Higher currency conversion fees for US trades |

| ✅ Very beginner-friendly interface | ❌ Limited features for US-based investors |

| ✅ Roundup micro-investing feature | ❌ Higher long-term costs due to fees |

| ✅ Lower barriers to entry |

Wealthfront — Pros & Cons

| Pros | Cons |

|---|---|

| ✅ Half the management fee of Wealthsimple (0.25%) | ❌ No human financial advisor access |

| ✅ Daily tax-loss harvesting for all taxable accounts | ❌ $500 minimum to open investment account |

| ✅ Sophisticated Path financial planning tool | ❌ Only available to US residents |

| ✅ 529 college savings plans available | ❌ May be overwhelming for absolute beginners |

| ✅ High-yield cash account with competitive rates | ❌ Conservative allocations may not suit aggressive investors |

| ✅ More customization options | ❌ Customer service focused on technical issues only |

| ✅ Superior tax optimization often exceeds fees | |

| ✅ Portfolio Line of Credit available |

Wealthsimple vs Wealthfront: Which Platform Should You Choose?

Choose Wealthsimple If You:

- Are a Canadian resident (or UK resident)

- Want unlimited access to human advisors for guidance

- Are a complete beginner with little to no starting capital

- Value personal interaction and having someone to call with questions

- Want socially responsible or Halal investing options

- Prefer simplicity over advanced features

- Don’t mind paying higher fees for human touch

Choose Wealthfront If You:

- Are a US resident

- Have at least $500 to start investing

- Want to minimize fees and maximize long-term returns

- Value sophisticated tax optimization

- Are comfortable with a fully automated approach

- Need college savings planning (529 plans)

- Want integrated financial planning tools

- Prefer to handle finances independently with software assistance

- Have higher balances that benefit from advanced features

Wealthfront Wealthsimple: Getting Started

Opening a Wealthsimple Account:

- Visit wealthsimple.com

- Choose account type (TFSA, RRSP, personal, etc.)

- Complete risk assessment questionnaire

- Fund account (no minimum required)

- Portfolio is automatically created and managed

- Contact advisors anytime via phone/email/text

Opening a Wealthfront Account:

- Visit wealthfront.com

- Answer financial goals questionnaire

- Choose account type (IRA, taxable, 529, etc.)

- Deposit minimum $500

- Portfolio is automatically built based on risk profile

- Use Path tool for ongoing financial planning

- Contact product specialists for technical support

Final Recommendation

Both platforms are legitimate, well-established robo-advisors that will serve you well. Your choice should align with your geographic location, starting capital, and preference for human vs. automated guidance.