The global adoption of cryptocurrency continues to expand at an unprecedented pace, reshaping how people and businesses interact with digital assets. As of 2024, approximately 6.8% of the world’s population, or over 560 million individuals, own cryptocurrency.

This article provides an in-depth look at cryptocurrency owners worldwide, examining key statistics, regional trends, and growth drivers.

Global Cryptocurrency Ownership 2024 Statistics

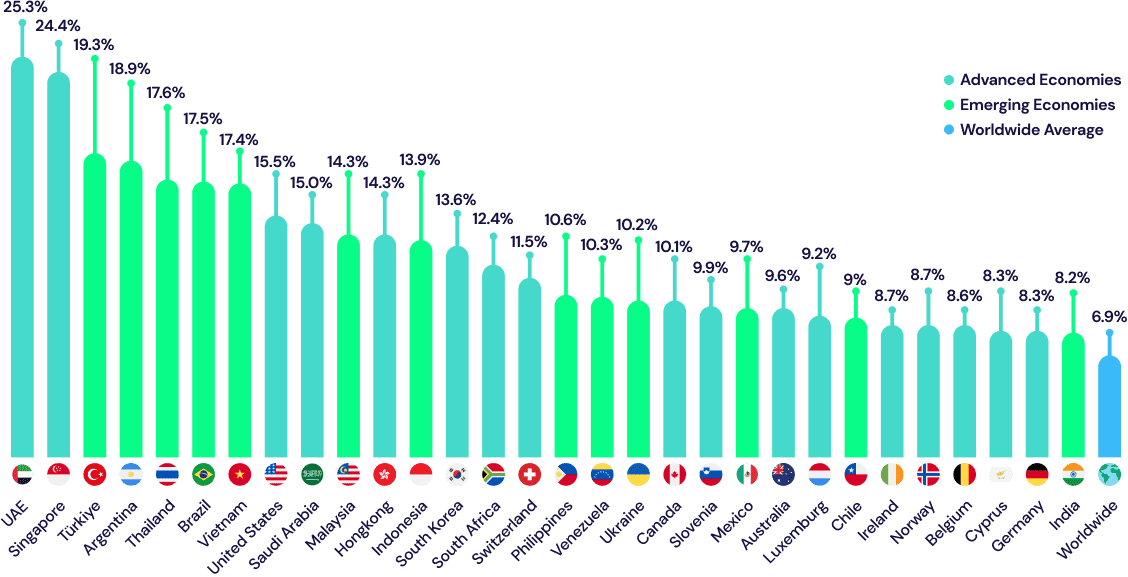

Cryptocurrency ownership in 2024 reflects both the maturity of the market and its growing accessibility. While global ownership averages 6.8%, individual countries show notable variations based on factors like economic conditions, technological infrastructure, and regulatory environments.

Vietnam leads with the highest ownership percentage at 21.19%, highlighting the country’s strong adoption among its population of nearly 99 million. Meanwhile, the United States, despite being a mature economy, has a significant adoption rate of 15.56%, accounting for over 52 million crypto owners.

In terms of absolute numbers, India ranks at the top, with over 93 million crypto users—representing 6.55% of its massive population of 1.4 billion. Other emerging markets, like the Philippines (13.43%) and Pakistan (6.6%), showcase similarly high adoption rates driven by real-world use cases such as remittances and peer-to-peer transactions. On the other hand, countries like China (4.15%) and Indonesia (4.4%) demonstrate modest ownership percentages, reflecting a mix of regulatory challenges and evolving market dynamics. These statistics reveal the diverse adoption landscape and hint at where future growth is likely to occur.

Read also! Why Does Only 4% of the World Hold Bitcoin in 2025?

Regional Trends in Cryptocurrency Adoption

Cryptocurrency adoption varies significantly by region, with Central and Southern Asia & Oceania (CSAO) leading the charge. In 2024, CSAO dominated the Chainalysis Global Crypto Adoption Index, with seven of the top 20 ranked countries located in this region. India, ranked first overall, has robust activity in centralized exchanges and DeFi services, reflecting the region’s growing crypto ecosystem. Vietnam, another top contender, boasts high adoption rates among retail users, driven by widespread familiarity with digital payments. Indonesia further highlights CSAO’s leadership, ranking third globally with strong DeFi engagement.

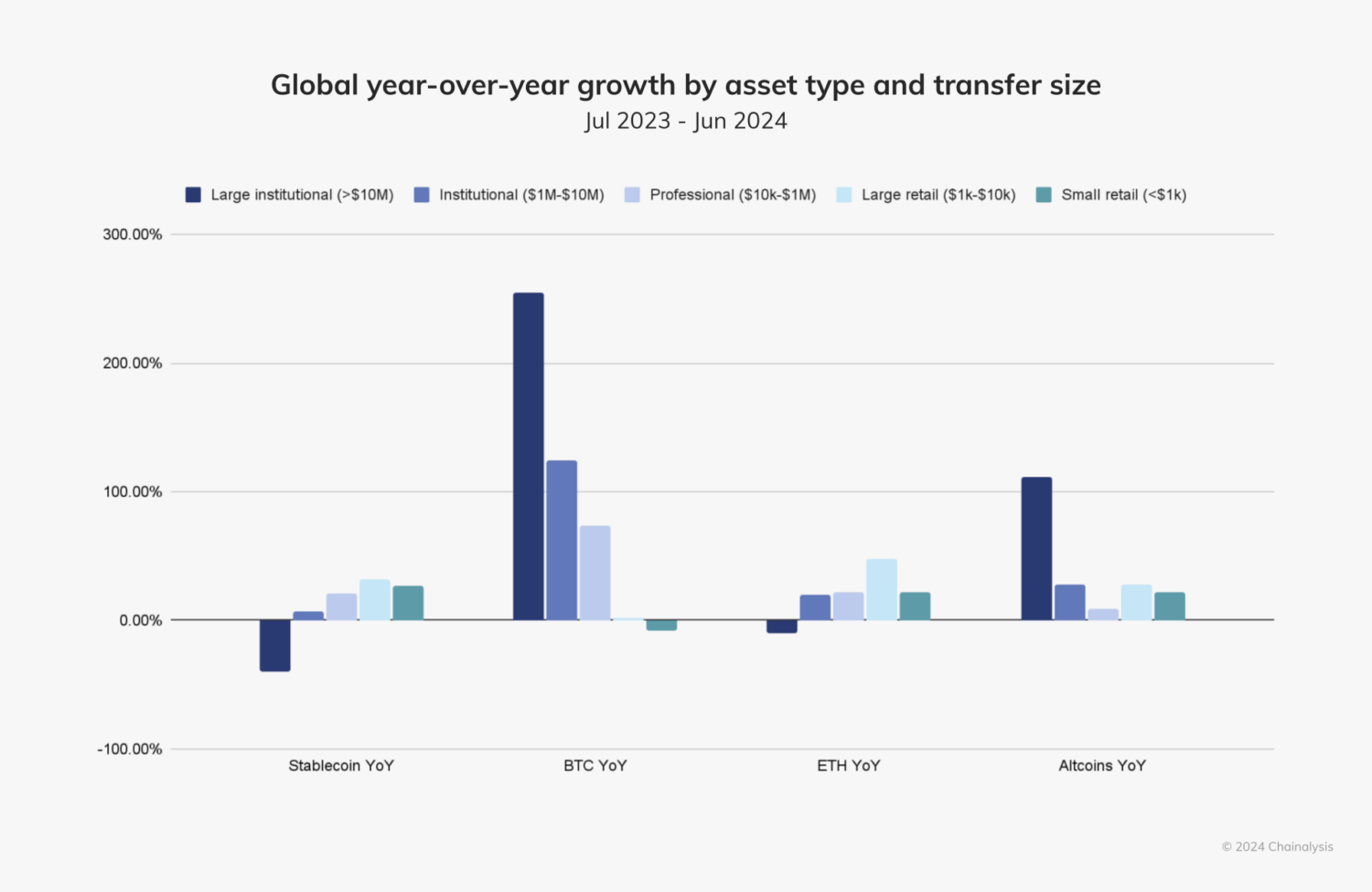

Other regions display unique adoption patterns. In Sub-Saharan Africa, practical use cases such as remittances and stablecoin transactions have fueled growth, particularly in Nigeria, which ranks second globally. Latin America has also seen a surge in adoption, with countries like Brazil and Mexico benefiting from increasing DeFi activity and altcoin use. Meanwhile, in high-income regions like North America and Western Europe, institutional interest—spurred by events like the launch of the Bitcoin ETF—has driven adoption, particularly for high-value Bitcoin transfers. These regional trends underline how different economic and regulatory contexts shape the adoption of cryptocurrencies worldwide.

Growth Drivers and Challenges

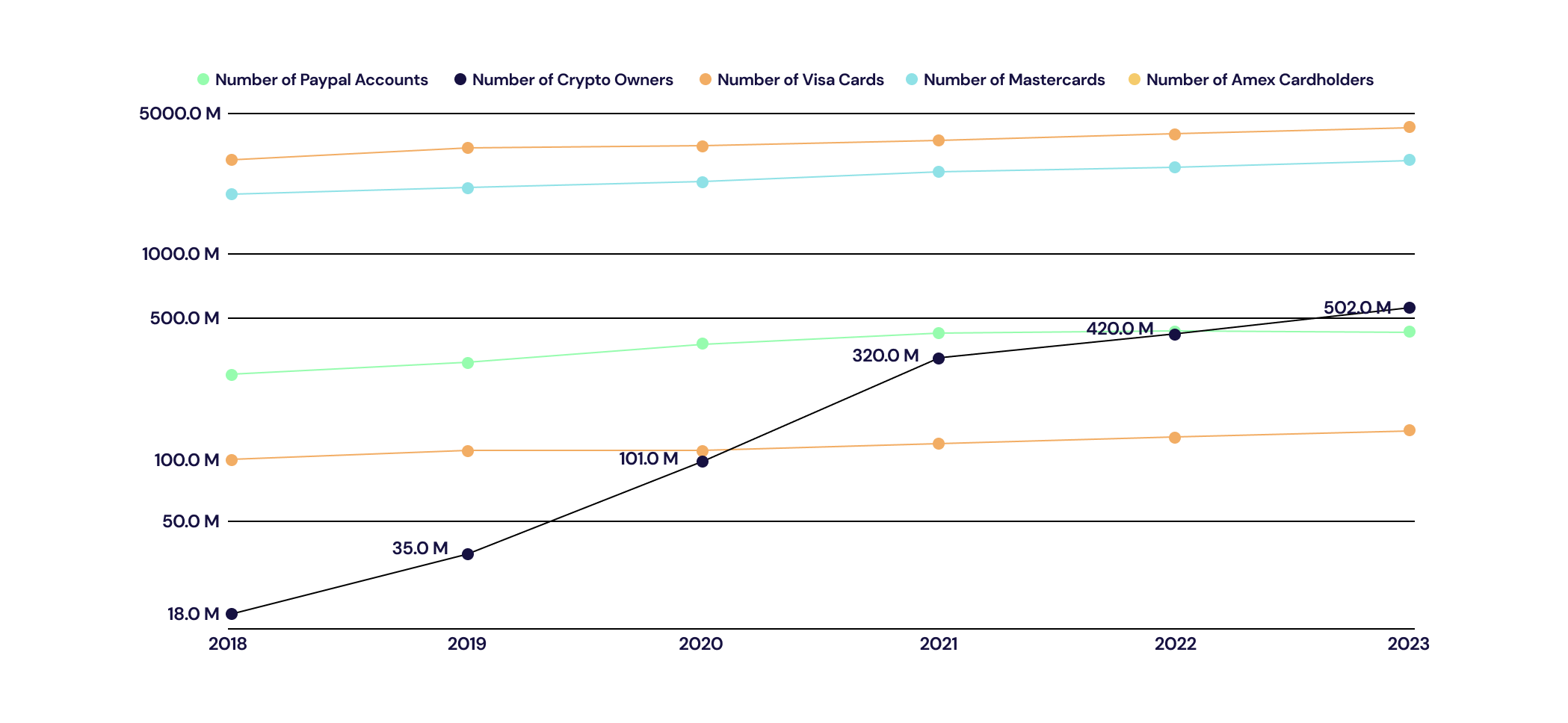

The rapid expansion of cryptocurrency adoption is fueled by a mix of technological innovation, market demand, and financial inclusion. Between 2018 and 2023, cryptocurrency ownership grew at an extraordinary compound annual growth rate (CAGR) of 99%, far surpassing traditional payment methods, which averaged just 8% growth.

DeFi services have played a pivotal role in this surge, especially in lower-middle income countries where decentralized financial tools offer new opportunities for access and investment. Stablecoins have also been instrumental, enabling secure, low-cost transactions in regions with unstable fiat currencies, such as parts of Sub-Saharan Africa and Latin America.

However, significant challenges remain. Regulatory uncertainty continues to hinder adoption in several regions, with inconsistent policies creating barriers for both businesses and users. In developing nations, limited infrastructure and low digital literacy pose additional obstacles. Despite these hurdles, the introduction of innovations like the Bitcoin ETF has sparked renewed interest in institutional adoption, while the proliferation of stablecoin use underscores the growing role of cryptocurrencies in real-world applications. Together, these factors highlight the complex but promising future of global cryptocurrency adoption.

Growth Drivers and Challenges

The explosive growth of cryptocurrency adoption is driven by innovation, inclusivity, and shifting financial priorities. From 2018 to 2023, cryptocurrency ownership skyrocketed at a CAGR of 99%, dwarfing the 8% growth of traditional payment methods. DeFi platforms have become a critical driver, especially in lower-middle income countries, where they offer decentralized solutions for banking and investment.

Stablecoins have also gained traction, facilitating affordable and secure cross-border transactions in regions with volatile fiat currencies, such as Sub-Saharan Africa and Latin America.

Despite this growth, several challenges persist. Regulatory uncertainty remains a major hurdle, with inconsistent policies creating confusion for businesses and users alike.

Additionally, in developing nations, inadequate infrastructure and low levels of digital literacy limit broader adoption. On the other hand, innovations like the Bitcoin ETF have catalyzed institutional interest, while stablecoins continue to support real-world use cases in underbanked regions. Addressing these challenges will be critical to sustaining the current growth trajectory.

Changing Patterns in Crypto Adoption

Crypto adoption is becoming more inclusive, bridging gaps across income levels and geographies. In 2024, adoption expanded significantly across countries of all income brackets, marking a shift from the previous year, when growth was concentrated in lower-middle income nations. High-income countries, such as those in North America and Western Europe, saw increased institutional activity, driven by innovations like the Bitcoin ETF. Conversely, retail and professional adoption of stablecoins surged in low-income regions, supporting practical use cases like remittances and daily transactions.

Additionally, the type of crypto activity is evolving. DeFi usage has grown substantially in regions such as Sub-Saharan Africa, Eastern Europe, and Latin America, where it enables access to alternative financial services.

This increase in DeFi participation has also spurred greater adoption of altcoins in these areas. Meanwhile, institutional-sized Bitcoin transfers continue to dominate in wealthier regions, reflecting the dual nature of cryptocurrency as both a speculative and practical tool. These changing patterns highlight cryptocurrency’s adaptability and its role in addressing diverse economic needs.

The Future of Global Cryptocurrency Ownership

The future of cryptocurrency ownership is marked by sustained growth, deeper integration, and expanding opportunities. As digital assets become more mainstream, projections for 2025 and beyond suggest continued adoption driven by innovation in DeFi, the rise of stablecoins, and increased institutional participation. Regions like Central and Southern Asia & Oceania and Sub-Saharan Africa are poised for significant growth, as they continue to leverage crypto for real-world applications, from remittances to decentralized banking.

Businesses stand to benefit immensely from these trends by addressing the unique needs of emerging markets. Offering localized solutions, such as stablecoin-based payment systems or user-friendly DeFi platforms, will be critical to unlocking untapped potential. Meanwhile, ongoing developments, such as regulatory frameworks and enhanced infrastructure, will shape how quickly crypto becomes a cornerstone of global finance.

Conclusion

Cryptocurrency ownership in 2024 reflects a world in transition, with digital assets redefining financial landscapes across regions and income levels.

As crypto continues to expand, its adaptability will remain a key strength, enabling it to address diverse needs from institutional investment to practical everyday use. For businesses, investors, and policymakers, staying ahead in this dynamic ecosystem will require a deep understanding of emerging trends and a willingness to innovate. Cryptocurrency is not just a financial tool; it is a global movement, reshaping the way people and economies interact.