If you’ve been exploring ways to get into futures trading without risking your own capital, chances are you’ve stumbled upon Apex Trader Funding. But like many new traders, you’re probably wondering: Is this legit or just another online scheme promising fast money? It’s a smart question — and one that deserves a clear, honest answer.

This article breaks it all down in simple terms. Whether you’re new to prop firms or just trying to figure out if Apex is the right one for you, we’ll walk you through everything you need to know — from how it works to who’s behind it, and what real users are saying on TrustPilot and Reddit. By the end, you’ll know exactly where Apex stands and whether it’s worth your time (and effort) to sign up.

What is Apex Trader Funding?

Apex Trader Funding is what’s known as a proprietary trading firm, or “prop firm” for short. But unlike traditional brokers, they don’t just give you a platform and wish you luck. Instead, Apex offers you access to large trading accounts without requiring you to risk your own money upfront. You prove you can trade profitably through a short evaluation, and if you pass, they “fund” you with a live account — meaning you can earn real payouts while trading their capital.

What makes Apex stand out is how beginner-friendly and flexible their model is. There’s only one evaluation step, and you can qualify in as little as 7 trading days. You’re allowed to trade full-size contracts, during news events, and even on holidays — something most other firms restrict heavily. Plus, there are no daily drawdowns, no scaling rules, and no hidden traps that suddenly disqualify you. If you go over the allowed number of contracts, the trade is simply blocked — not failed. And once you pass the evaluation, you get a paid performance account where you keep 100% of your first $25,000 in profit, and 90% after that.

In short, Apex gives you the tools, the freedom, and the funding — your job is simply to prove you can trade smart.

Who is Behind Apex Trader Funding?

Now, it’s one thing for a company to have great features. But knowing who’s running the show matters just as much — especially in an industry where trust is everything. Apex Trader Funding was founded in 2021 by Darrell Martin, a trader who had firsthand experience with several funding companies and felt something was missing. Instead of copying the usual prop firm blueprint, he set out to build a model that traders — including himself — would genuinely want to use.

Headquartered in Austin, Texas, Apex quickly grew into a global force with tens of thousands of traders across over 150 countries. Darrell and his team built Apex around a trader-first mindset: fewer restrictions, faster payouts, and clear rules that actually make sense. It’s no surprise that Apex has become the top-paying futures funding firm, with over $538 million paid out to traders since 2022 — and averaging nearly $15 million in payouts per month.

This isn’t a faceless corporation. It’s a community-driven company built by traders, for traders — and that’s a big part of why so many people are drawn to it.

Is Apex Trader Funding Regulated?

Here’s a common question, especially from beginners: “Is Apex regulated?” And the short answer is — no, but that’s normal for this type of company.

Let’s clarify. Apex Trader Funding is not a broker — they don’t handle your deposits or hold client funds like a bank or trading platform would. Instead, they’re an evaluation-based prop firm. Their job is to assess whether you can trade futures responsibly, and if you pass, they let you trade using their capital. Because of this structure, they fall outside of typical financial regulations like those from the SEC or CFTC.

That might sound concerning at first, but it’s common in the prop trading world. What’s important is how Apex operates in practice — and they’ve built a strong reputation by being transparent, responsive, and consistent with payouts. They’re also a registered business based in Austin, Texas, with full contact details, a help desk that runs 24/7, and a real team behind the scenes. Regulation may not apply in the traditional sense, but Apex makes up for that with a track record of reliability and community trust.

Apex Trader Funding: Pros and Cons

Let’s quickly lay out what’s great — and what you should keep in mind — before joining Apex:

✅ Pros

- Beginner-friendly rules — no daily drawdowns or scaling traps

- One-step evaluation — qualify in as little as 7 trading days

- 100% payout on first $25k, 90% after — industry-leading

- Flexible trading hours — holidays, news events, and 23-hour sessions allowed

- Multiple accounts — trade up to 20 accounts to scale profits

- Low reset costs and frequent discounts — making evaluations affordable

- Global access — available in over 150 countries

- Free tools — NinjaTrader license, real-time data included

⚠️ Cons

- Futures only — no forex or stock funding

- No formal regulation — as explained above

- Payouts can slow during peak demand — though rare, some users report delays

- Strict on contract overuse and rule violations — rules are fair, but must be followed exactly

Overall, the pros strongly outweigh the cons — especially if you take time to understand the rules before jumping in.

What Apex Trader Funding Users Say on Trustpilot

If you head over to Trustpilot, you’ll see that Apex Trader Funding holds a strong average rating (often 4.5+ stars), with thousands of reviews from active traders worldwide. Many of them praise how smooth the signup and funding process is, and how clear the rules are compared to other firms.

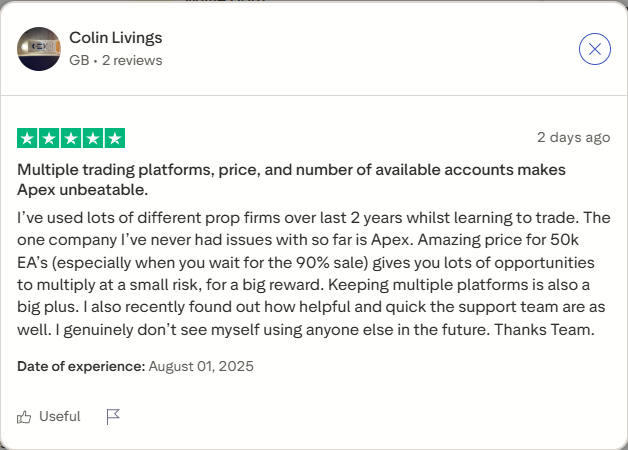

One trader, Colin from the UK, called Apex “unbeatable,” highlighting how affordable their 50K evaluation accounts are — especially during the popular 90% discount promos. He praised the ability to run multiple platforms and accounts at once, calling it a rare combo that sets Apex apart from other firms he’s used over the years.

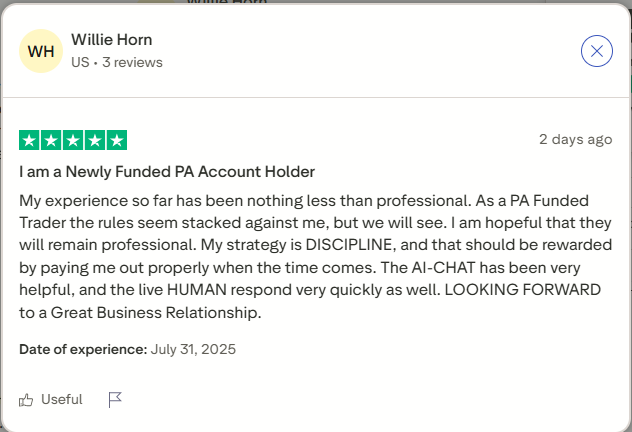

Willie from the U.S., a newly funded trader, shared a similarly upbeat experience. He described the entire process as professional and transparent, noting that both the AI chat and human support staff were quick and helpful. While he acknowledged the rules felt tough, he remained optimistic that his discipline would be rewarded with timely payouts.

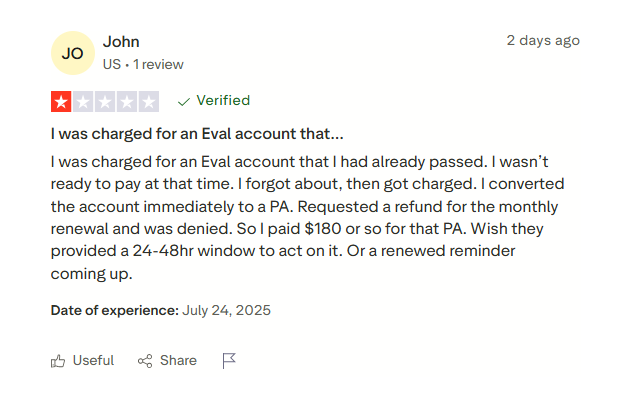

However, not everyone is thrilled. Another reviewer, John, expressed frustration over being charged for a renewal on an evaluation account he had already passed — something he felt could have been avoided with a clearer reminder system or grace period.

Although this kind of issue is relatively rare in the sea of positive feedback, it highlights the importance of carefully managing your account status and understanding the auto-renewal process — especially if you’re not ready to move to a funded account right away.

The bottom line? Apex is far from perfect, but most of the negative reviews aren’t red flags — they’re reminders to do your homework.

What Reddit Users Are Saying About Apex Trader Funding

Reddit threads about Apex Trader Funding are a mix of strong praise, harsh accusations, and level-headed debate — exactly what you’d expect from a trading community that doesn’t hold back.

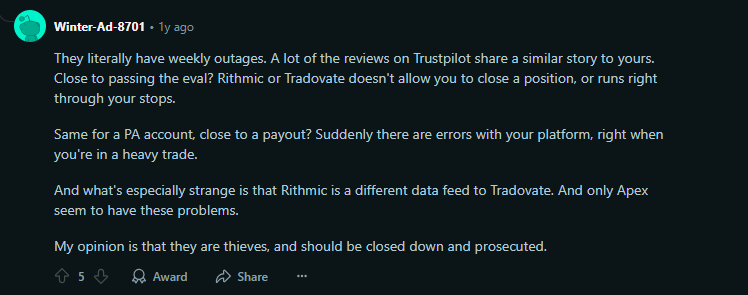

Some users, like Winter-Ad-8701, accuse Apex of conveniently having tech issues — like failed order executions or platform outages — right when traders are close to hitting profit targets. They claim these issues happen with both Rithmic and Tradovate platforms, raising suspicions since those are separate data feeds.

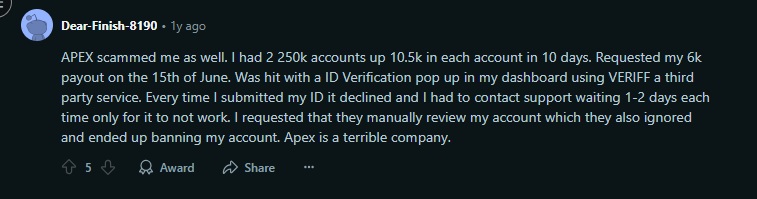

One particularly frustrated trader, Dear-Finish-8190, described how he built up two large funded accounts, only to face repeated ID verification issues with a third-party tool (Veriff) that ultimately led to his account being banned — and his payout denied.

But in the same thread, voices of experience pushed back. User wisdomity shared a very different story — one of consistent payouts, including a recent $14,000 withdrawal, all without issues. They suggested that most problems come down to rule violations, often unintentional, and stressed that Apex will pay — if you play by the rules.

What this tells us is simple: the truth isn’t always black and white. While there are serious accusations that deserve attention, many traders report smooth experiences and regular payouts. For beginners, the takeaway is clear — read the rules carefully, monitor your account status closely, and understand that user error (or misunderstanding) is a major source of conflict in the prop firm space.

Is Apex a Scam or Just Misunderstood?

Let’s get real — some of the complaints about Apex Trader Funding sound serious. Missed payouts, platform issues, or account bans can easily be mistaken as signs of a scam. But when you dig deeper, most of these stories point to something more common in the prop trading world: misunderstanding, miscommunication, or lack of attention to rules.

Apex isn’t perfect. Like any large firm handling thousands of traders, there are going to be mistakes, system errors, and people who feel let down. But calling it a scam doesn’t line up with the facts. The company is publicly visible, responsive, and has paid out over $538 million to traders since 2022. That’s not something a shady operation can fake.

In reality, Apex has built a system with clear rules, big upside, and few restrictions — but if you don’t follow the guidelines exactly, the system will block you. That’s where most of the frustration comes from. So no, Apex isn’t a scam. But it’s also not a “get rich quick” platform. It rewards precision and discipline, and punishes carelessness — sometimes harshly.

Tips for Beginners Considering Apex

If you’re new to prop trading and thinking of joining Apex, here are some friendly but important tips:

- Read the rules slowly — twice. Especially around the trailing threshold, cutoff times, and contract limits.

- Use the 90% discount promos. They pop up often and make it super affordable to try without risking much.

- Start with one account, get comfortable, then scale to multiple if you’re profitable.

- Practice with a demo on NinjaTrader first — they give you a free license and real-time data.

- Ask questions in the Apex community — Reddit, Discord, and the support desk are full of helpful voices.

- Keep a checklist before each trading day: trading hours, platform settings, max contracts, and trailing drawdown.

Trading with Apex isn’t difficult — but success depends on how well you understand their structure.

Want to Explore Other Options?

While Apex Trader Funding offers one of the most flexible futures funding models, it’s not the only firm out there. If you’re curious about how it compares to other popular prop firms, here’s a quick look at Topstep and FundedNext — two strong alternatives with different strengths. Use this table to decide which one best fits your trading goals and experience level.

|

|

|

|

Founded |

2021 |

2012 |

2022 |

Market Focus |

Futures only |

Futures only |

Forex, crypto, indices, metals |

Evaluation Steps |

1-step |

2-step |

1-step or 2-step |

Profit Split |

100% of first $25K, then 90% |

Up to 90% |

Up to 90% |

Payout Frequency |

Every 8 days |

Monthly |

Bi-weekly or monthly |

Trading Rules |

No scaling, no daily drawdown |

Scaling & daily loss limit |

News restrictions, time-based trading rules |

Beginner Friendly? |

✅ Very |

⚠️ Moderate |

✅ Very |

Global Reach |

150+ countries |

140+ countries |

190+ countries |

Platform Options |

NinjaTrader, Rithmic, Tradovate |

NinjaTrader, Rithmic |

MT4, MT5, cTrader |

👉 Click here to see the full comparison guide with pros, cons, pricing, and trader feedback on all three.

Final Verdict: Is Apex Trader Funding Legit?

So, is Apex Trader Funding legit? Yes — and in many ways, it’s one of the most trader-friendly prop firms out there. With simple rules, affordable entry costs, fast payouts, and a clear path from evaluation to funded account, Apex offers a genuine opportunity for futures traders to grow without risking their own capital.

That said, it’s not for everyone. If you’re looking for hand-holding or expect to trade casually and still get paid, you’ll likely run into trouble. But if you’re disciplined, focused, and willing to follow the rules, Apex can be a powerful stepping stone — especially for beginners who want real-world experience without real-world financial risk.

In the end, Apex isn’t a shortcut — it’s a serious platform built for serious traders. And for those ready to take it seriously, it delivers.

Frequently Asked Questions

- Is Apex Trader Funding legit or a scam?

Apex Trader Funding is legit. It’s a U.S.-based prop firm that has paid out over $538 million to traders since 2022. While some users have shared negative experiences, the majority of traders report fair evaluations, fast payouts, and reliable support.

- Is Apex Trader Funding regulated?

No, Apex is not regulated in the same way brokers are — and that’s normal for prop firms. Since they don’t hold client deposits or offer brokerage services, they don’t fall under SEC or CFTC oversight. However, they operate transparently with a strong reputation in the industry.

- Which broker does Apex Trader Funding use?

Apex uses NinjaTrader Brokerage and provides access to trading platforms like Rithmic and Tradovate for executing trades during evaluations and performance accounts.

- Who is the owner of Apex Trader Funding?

Apex Trader Funding was founded by Darrell Martin in 2021. He’s an experienced trader who built the company after testing other funding firms and wanting to create a more trader-friendly model.

- Apex Trader Funding is based in which country?

Apex is based in the United States, with its headquarters in Austin, Texas.