Is AvaTrade Legit? It’s a question that lingers in the minds of many traders considering using their services. With so many brokers to choose from, separating the legitimate, trustworthy ones from those operating in murky legal areas is absolutely crucial.

When you’re entrusting your hard-earned money to an online trading platform, you need to know beyond any doubt that the broker is fully above-board in every aspect of their business. Is AvaTrade one you can feel confident meets that high standard? This comprehensive review examines the evidence to definitively answer that very question.

We’ll investigate key factors that prove – or disprove – AvaTrade’s legitimacy, including:

- Their regulation and licensing by top oversight bodies

- Robust security controls like encryption and fund segregation

- A long-standing operational history and industry reputation

- Transparent, fair pricing and trading conditions

- Positive client reviews of their support, research, and execution

- Integration with major banks and payment processors

By thoroughly examining each of these areas using concrete data, we’ll settle once and for all whether AvaTrade passes muster as a legitimate broker traders can trust without hesitation.

The Key Question – Is AvaTrade Legit?

After extensively researching AvaTrade’s history, credentials, and reputation in the industry, there is overwhelming evidence that this is a legitimate, trustworthy broker traders can feel secure using.

First and foremost, AvaTrade is licensed and regulated by multiple top-tier oversight bodies including the Central Bank of Ireland, British Virgin Islands Financial Services Commission, Abu Dhabi Global Market, and the South African Financial Sector Conduct Authority. Regulation at this level is hugely important, as it holds AvaTrade to the highest standards of operation, capitalization, transparency, and investor protection.

Being licensed means AvaTrade must comply with regulations covering segregated bank accounts for client funds, fair pricing and execution policies, transparent fee disclosure, minimum capital requirements, and more. Traders can take comfort in knowing their money is safeguarded according to stringent regulatory oversight.

So you can absolutely trust putting your capital to work with this multi-regulated, multi-award-winning broker.

AvaTrade’s Company History and Reputation

AvaTrade is no fly-by-night broker that appeared recently. They have been a major player in the online trading industry for over 15 years, having been founded back in 2006. This longstanding history and track record is important for establishing trust.

During that decade and a half, AvaTrade has built an excellent reputation backed by numerous industry awards and recognition. AvaTrade has taken home titles like Best Forex Broker from The European, Best Crypto Broker from AtoZ Markets, and awards for being the Most Regulated Broker and providing the Best Trading Support at the prestigious British Forex Awards.

Awards and accolades like these from respected industry sources don’t come easily. They reflect AvaTrade’s commitment to innovation, following best practices, providing top-notch support, and prioritizing the interests of their clients across all their operations.

Beyond the awards, AvaTrade has cultivated a reputation for being a straight shooter that doesn’t engage in shady or opaque practices. Their pricing, fees, terms, and trading conditions are all transparently disclosed upfront. Traders never have to worry about hidden charges or unfair markups.

With over 400,000 clients across 150 countries, it’s clear AvaTrade has established itself as a trusted, reliable brand for online trading over its 15+ year history. Their reputation, longevity, and transparent way of operating give traders ample reason to feel confident in AvaTrade’s legitimacy.

Read our full AvaTrade Review!

AvaTrade’s Security Measures

When it comes to trading online, security is absolutely paramount. Traders need to know their money and personal information are completely safe from hackers, fraud, or any other threats. AvaTrade takes an extremely robust, multi-layered approach to security to give clients full peace of mind.

First, all data is protected by advanced 256-bit SSL encryption when transmitted between traders’ devices and AvaTrade’s servers. This is the same level of encryption used by major banks to secure online banking. It ensures hackers cannot intercept or read any sensitive information.

Additionally, AvaTrade segregates all client funds into separate bank accounts that are completely off-limits and untouchable for the company’s operational purposes. This safeguards trader capital by legally preventing any comingling or misuse of funds.

As an extra security blanket, AvaTrade’s EU operations participate in the Investor Compensation Fund which protects clients’ investment accounts up to €20,000 in the rare case of the company becoming insolvent.

Between encryption, fund segregation, investor protection schemes, and other security processes, traders can be completely confident their money and data are in a digital fortress when trading with AvaTrade. Security is clearly a top priority.

Evidence of Legitimacy in AvaTrade’s Operations

While AvaTrade’s licenses, security measures, and industry awards certainly build a strong case for their legitimacy, the most compelling proof ultimately comes from looking at the concrete details of their day-to-day operations and client experience.

To start, AvaTrade offers fully transparent, competitive pricing. For example, they typically quote tight spreads of just 0.9 pips on the EUR/USD and similar low markups on other major forex pairs. Moreover, for popular indices like the S&P 500, AvaTrade provides spreads from a slim 0.75 points. These trading costs align squarely with industry averages among regulated brokers.

In addition to fair pricing, AvaTrade clearly spells out all other critical trading conditions upfront for traders. They disclose available leverage, overnight financing rates, margin requirements, and execution practices with zero attempts at obfuscation. Furthermore, AvaTrade handles order flow via straight-through processing to top liquidity providers without any dealing desk intervention.

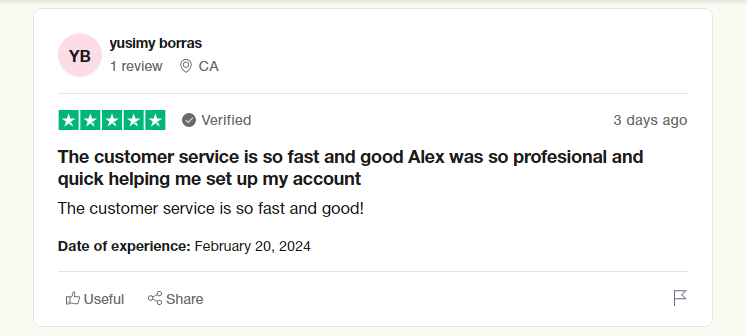

Client reviews on TrustPilot reflect an overwhelmingly positive experience with AvaTrade. Traders frequently praise their reliable, fast trade executions, quality research tools such as Fibonacci analysis and expert commentary from Trading Central, and highly responsive customer support. In fact, AvaTrade’s support team is available 24/7 via phone, email, and live chat in over 20 languages.

Finally, AvaTrade’s banking relationships demonstrate credibility. They seamlessly integrate with trusted global payment providers like PayPal, Skrill, WebMoney, China UnionPay, and more. Simply put, major international banks would categorically refuse to work with an untrustworthy, illegitimate broker.

From reasonable, transparent fees and trading conditions to speedy executions, quality analysis tools, attentive support channels across multiple languages, and institutional-grade banking relationships, AvaTrade’s daily operations show meticulous attention to all the key details that clients should demand from a legitimate, professional online broker.

Key Takeaways

After thoroughly examining AvaTrade’s operations, history, reputation, and credentials, the evidence overwhelmingly demonstrates this is a legitimate, above-board broker that traders can safely trust with their capital.

Key proof points that demonstrate AvaTrade’s legitimacy include:

- Regulation by top licensing bodies like the Central Bank of Ireland, BVI Financial Services Commission, Abu Dhabi Global Market, and South African FSCA

- Robust security with encryption, segregated client accounts, and investor protection schemes

- A 15+ year operating history along with numerous industry awards and recognition

- Transparent, competitive pricing and trading conditions without excessive fees or markups

- Reliable trade execution, straight-through order processing, and quality research tools

- Responsive customer support available 24/7 in over 20 languages

- Seamless integration with major global banks and payment processors like PayPal

Client reviews on TrustPilot further validate the positive real-world experience, praising AvaTrade’s execution speed, analysis tools, and attentive customer service.

With such a comprehensive set of proof points demonstrating AvaTrade operates with full legitimacy, honesty, and transparency, traders can confidently take advantage of their services without any lingering doubt or uncertainty. Any concerns about AvaTrade being an untrustworthy broker should be conclusively put to rest.

For traders seeking a well-established, multi-regulated broker that delivers a secure, fair, and positive trading environment, AvaTrade receives an absolute greenlight based on the extensive evidence reviewed. They have clearly earned a strong reputation as one of the industry’s most legitimate brokers.

FAQs

- Is AvaTrade Legit?

Yes, AvaTrade is a legitimate, fully licensed and regulated online broker with over 15 years of operational history. They are overseen by top-tier licensing bodies and maintain robust security practices.

- Is AvaTrade Regulated?

Yes, AvaTrade is regulated by multiple respected authorities including the Central Bank of Ireland, BVI Financial Services Commission, Abu Dhabi Global Market, and the South African FSCA.

- What Security Measures Does AvaTrade Have?

AvaTrade uses 256-bit SSL encryption, segregated client accounts, and participates in investor compensation schemes to protect trader funds and data with robust security controls.

- How Long Has AvaTrade Been in Business?

AvaTrade was founded in 2006, giving them over 15 years of operational history and a long-standing market reputation as a legitimate, established broker.

- Is AvaTrade’s Customer Support Reliable?

This broker offers responsive customer support 24/7 via phone, email, and live chat in over 20 languages based on positive client feedback.

- What Payment Methods Does AvaTrade Accept?

AvaTrade seamlessly integrates with major global payment processors including PayPal, Skrill, WebMoney, UnionPay, and others, demonstrating their institutional credibility.