With Dubai’s fast-growing appetite for global trading, new broker ThinkMarkets enters offering seamless access to worldwide markets. Yet for savvy regional investors, one burning question remains – is ThinkMarkets legit in Dubai?

Is ThinkMarkets Legit in Dubai?

The clear-cut answer is – Yes, ThinkMarkets is indeed fully legitimate to operate in Dubai. We can state this definitively because ThinkMarkets recently met all licensing requirements and secured regulatory approval from the Dubai Financial Services Authority (DFSA).

We’re thrilled to announce that ThinkMarkets has acquired a regulatory licence from the Dubai Financial Services Authority (DFSA). This development further enhances ThinkMarkets’ reach and is another step towards our mission of global expansion.

Find out more here:… pic.twitter.com/JxpKIGcnnt

— ThinkMarkets (@ThinkMarkets_EN) March 1, 2024

The DFSA has stringent standardsbrokerages must comply with related to transparency, financial reporting, safeguarding client assets, data protection, and audits. Granting a license means the DFSA verified ThinkMarkets has the protocols and operations to satisfy these key benchmarks that ensure legitimate, trustworthy, compliant conduct as a brokerage.

So again – yes, DFSA’s licensing of ThinkMarkets proves their complete legitimacy. Traders in Dubai can trust in the standards and authorization of the UAE’s leading financial regulator.

Regulation

When it comes to your money, you rightly demand accountability and oversight. Rest assured, top regulators stand behind ThinkMarkets in major worldwide financial hubs. Specifically, ThinkMarkets holds trusted licenses from major agencies like:

- ASIC regulation in Australia

- FMA authorized in New Zealand

- Recently secured DFSA license to operate in UAE/Dubai

What does this all mean for your security as an investor? Extensive audits and capital checks from these respected regulatory bodies require ThinkMarkets to preserve transparency and operational integrity. Strict anti-fraud controls must protect against fund misuse while securing data privacy.

You also have assurances around asset segregation, trade execution policies, and stringent record-keeping based on compliance rules. Together this oversight delivered through regular reporting and reviews offers multilayered accountability you can trust.

In essence, traders can feel confident that respected worldwide regulation reinforces protections and legitimacy around any brokerage or money manager seeking your business. The foundation of trust starts here.

Security

Beyond foundational regulation, how does ThinkMarkets lock down your assets and data? On top of required standards, they implements robust security protections like 256-bit SSL encryption for all data transfers and account access protocols. Your personal information and account login credentials are protected by this industry-standard scrambling to prevent any potential interception or leaks.

For account access, dual-factor authentication using one-time codes sent to your registered mobile or email is mandatory for all traders. This blocks anyone but you from being able to access your accounts.

Account segregation utilizes identifiers so your specific funds are tracked and walled off from firm finances in dedicated client money accounts at insured custodian banks. This satisfies regulatory asset protection requirements.

The Australian government’s Financial Claims Scheme provides account insurance up to $250,000 AUD as an added investor compensation protection if the extreme worst-case happened.

Ongoing usage analytics, unauthorized login detection, and immediate response incident teams supplement these other controls to fully isolate and defend accounts around the clock against threats.

The bottom line? ThinkMarkets gets their regulatory foundations right while supplementing via cutting-edge security and insurance coverage programs. You can proceed knowing multiple fail-safes actively minimize risks as a trader.

Reputation

With over a decade of operation, ThinkMarkets has a proven history you can rely on. Founded in 2010 and authorized in multiple countries, they have served over 500,000 satisfied traders without major regulatory actions impacting clients.

ThinkMarkets underscores its transparency by publishing full financial statements directly on its website for public scrutiny. Their latest filed accounts showcase $16.3 million USD in shareholder equity – evidence of financial fitness to continue serving traders over the next decade.

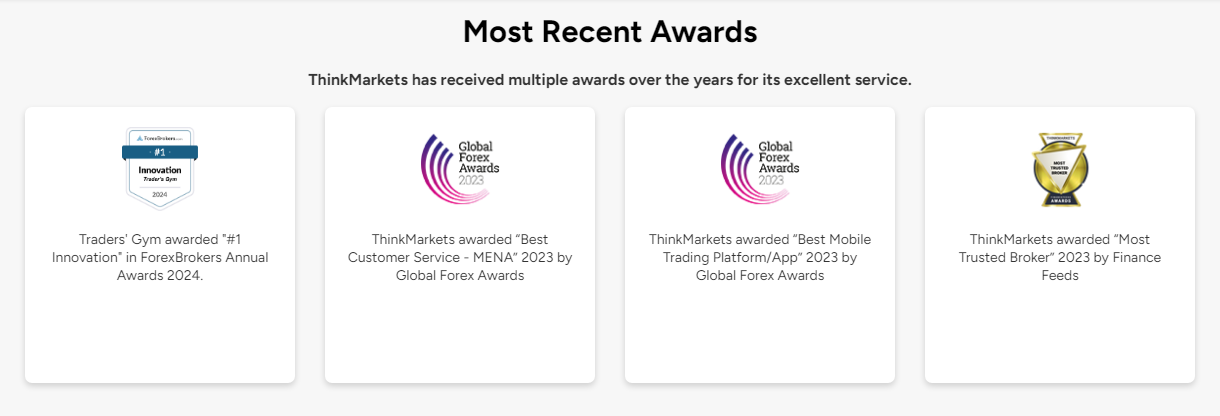

Industry experts at Global Forex Awards and Finance Feeds have both recognized ThinkMarkets as the “Most Trusted Broker” in 2023 – external validation of both innovation plus valuable user experience from real traders.

Through these intersection points of longevity, financial reporting transparency, independent industry accolades, and most importantly – zero black marks on its regulatory record impacting users, you can have full confidence in ThinkMarkets’ history and reputation standing behind every trade you make.

ThinkMarkets Reviews

When evaluating a broker’s legitimacy, real client feedback often speaks louder than corporate pledges. That’s why testimonials on third-party review sites like Trustpilot provide such valuable validation. Here’s what traders globally are saying about ThinkMarkets:

The screenshot below shows a South African trader Shrivad Maharaj giving a full 5-star rating, commending the “excellent” and “outstanding” customer service from his main representative over 4 years. He highlights the quality across ThinkMarkets’ entire support team.

Similarly, Bangladeshi trader Anwarul Kamal Chowdhury praises their “trustworthy” reputation spanning his 6 years, regularly withdrawing funds with zero issues. As a Muslim, he especially appreciates the Swap-free (interest-free) account option alongside the low spreads, 24/7 live chat access and “very cooperative and helpful” agents.

With long-tenured clients from diverse regions lauding the attentive assistance, smooth operations, and religious account accommodations, these testimonials underscore ThinkMarkets’ legitimacy in faithfully serving their global customer base’s needs. The top ratings evidence a reputable experience aligning with their publicly professed practices and values.

Conclusion

In review, ThinkMarkets verifies its legitimacy through multiple interconnected proofs:

- Stringent oversight from globally respected regulators requires consistent transparency and audits safeguarding licensed operations

- A decade-plus track record of awards, responsible conduct, public financial reporting and zero controversies compounds reliability

- Fair pricing, negative balance protection, third party trade execution checks and in-house assistance supply further accountability

Together, these interconnected markers undeniably legitimize ThinkMarkets through layered regulatory, reputational, and operational evidence.

Key Takeaways Demonstrating Legitimacy:

- Complies with top-tier regulators including DFSA and ASIC

- 10+ years of trusted brokerage services

- Awarded “Best Trading Platform” forThinkTrader offering

- Guaranteed negative balance protection

- Fair trading and pricing commitment

Clearly, industry oversight, lengthy history, recognition, client security policies, and customer service align fully in traders’ best interest according to benchmarked expectations. Traders should feel fully secure utilizing ThinkMarkets based on these legitimacy proofs.

Related ↓

FAQs

- Is ThinkMarkets legit in Dubai?

Yes. ThinkMarkets holds a full operating license from the reputable Dubai Financial Services Authority (DFSA), which imposes stringent regulatory standards on brokers in the region.

- What regulations does ThinkMarkets comply with?

ThinkMarkets complies with top-tier financial regulators like the DFSA in UAE along with ASIC in Australia and the FMA in New Zealand. This oversight maintains high transparency.

- Does ThinkMarkets have a long track record?

Yes. Founded in 2010, ThinkMarkets has over a decade of trusted operations with awards for its trading platforms and no controversies impacting clients.

- How are client assets protected by ThinkMarkets?

Segregated accounts at tier-1 banks, 2FA login requirements, 256-bit SSL encryption, and compensation schemes provide multilayered asset protections.

- Does ThinkMarkets allow Islamic Swap-free accounts?

Yes, ThinkMarkets offers Swap-free accounts conforming with Islamic finance standards – an important consideration for MENA-based traders.