Few events have seared such lasting trauma into the American psyche as the catastrophic stock market crash of 1929. It wasn’t just a dip; it was a financial earthquake that reshaped the course of history.

In an instant, fortunes were obliterated, livelihoods destroyed, and the nation plunged into the most devastating economic collapse in its history.

The crash marked a turning point between the roaring prosperity of the 1920s and the sobering hardship of the 1930s. Its shadow haunts markets to this day.

So how did this market mayhem unfold, and what fueled the frightening freefall? Let’s take a closer look at the infamous crash that kicked off the Great Depression.

What was the Stock Market Crash of 1929?

The Stock Market Crash of 1929 was a catastrophic event that marked the abrupt and severe collapse of stock prices on the New York Stock Exchange.

Beginning on October 29, 1929, also known as “Black Tuesday,” it signaled the end of the Roaring Twenties and triggered a chain of events leading to the Great Depression. The crash wiped out billions in wealth and ended the prosperity of the 1920s.

Causes of the crash

The Stock Market Crash of 1929 had several underlying causes that collectively led to one of the most significant financial meltdowns in history:

Speculation and Overvaluation

The 1920s saw a speculative frenzy, with investors borrowing heavily to buy stocks, often on margin. The prices of stocks became disconnected from their actual value, creating an unsustainable bubble. For instance, RCA Corporation’s stock price soared, reaching unrealistically high levels compared to its earnings.

Easy Credit and Margin Trading

The availability of easy credit encouraged excessive speculation. Investors were allowed to buy stocks with only a fraction of the total cost, known as margin trading. This practice magnified both gains and losses. For example, Florida land speculation and investment in utilities like Public Service Corporation of New Jersey were driven by easy credit.

Unequal Distribution of Wealth

The prosperity of the 1920s was unevenly distributed, leading to a concentration of wealth among the upper class. The majority of Americans did not participate in the stock market, and income inequality reached staggering levels. This imbalance had social and economic repercussions.

Declining Agricultural Prices

The agricultural sector faced a crisis with falling commodity prices, impacting farmers’ incomes. The decline in agricultural revenue contributed to economic distress in rural areas. For instance, falling wheat prices severely affected farmers’ livelihoods.

Banking Failures

The banking system was fragile, with some banks heavily invested in the stock market. As stock prices plummeted, banks faced insolvency. The collapse of the Bank of the United States in December 1930 illustrated the vulnerability of financial institutions.

International Economic Factors

Global economic conditions, including the aftermath of World War I and reparations imposed on Germany, added strain. The Smoot-Hawley Tariff Act of 1930 exacerbated international trade tensions, contributing to the worldwide economic downturn.

Consumer Confidence Erosion

As stock prices plummeted, consumer confidence evaporated. People started hoarding money, avoiding spending, and contributing to a decline in economic activity.

Panic Selling

Black Tuesday on October 29, 1929, saw a massive sell-off as panic gripped investors. The sheer volume of selling further depressed stock prices, setting off a devastating chain reaction.

These interconnected causes formed a perfect storm, culminating in the Stock Market Crash of 1929 and initiating the prolonged economic hardship of the Great Depression.

Who profited from the 1929 crash?

While the Stock Market Crash of 1929 left a trail of financial devastation for many, a select few savvy individuals and entities managed to turn the crisis into an opportunity, profiting from the chaos in various ways:

- Short-Sellers: One group that notably profited were the short-sellers. One of these investors, Jesse Livermore, bet against the market, anticipating the downward trend. As stock prices plummeted, these individuals made substantial profits by selling borrowed stocks at high prices and then buying them back at lower prices.

- Bankers and Financiers: Some shrewd bankers and financiers took advantage of the distressed market conditions to consolidate their power and expand their wealth. They capitalized on the financial distress of others, acquiring assets at significantly reduced prices.

- Insiders and Market Manipulators: There were instances of insiders and market manipulators who had privileged information or used cunning strategies to profit during the crash. By exploiting their knowledge of impending market movements, they positioned themselves to benefit while others suffered losses.

- Gold Investors: With the stock market in turmoil, many investors sought refuge in tangible assets like gold. As the value of gold soared during the Great Depression, those who had wisely diversified their portfolios to include precious metals experienced substantial gains.

- Real Estate Investors: As the stock market crumbled, the real estate market saw a shift. Investors with liquidity were able to scoop up distressed properties at bargain prices, positioning themselves for significant profits when the economy eventually recovered.

It’s important to note that while some individuals profited, their gains often came at the expense of others who faced financial ruin.

What were the effects of the 1929 Black Tuesday?

The effects of the Wall Street Crash of 1929 were profound and far-reaching, triggering one of the darkest chapters in economic history – the Great Depression. Here’s a closer look at the devastating consequences:

Great Depression

The Wall Street Crash is often considered the catalyst for the Great Depression, one of the most severe economic downturns in modern history. The crash led to a cascade of events, including bank failures, widespread unemployment, and a sharp decline in industrial production. The Great Depression lasted throughout the 1930s, causing immense suffering for millions of people.

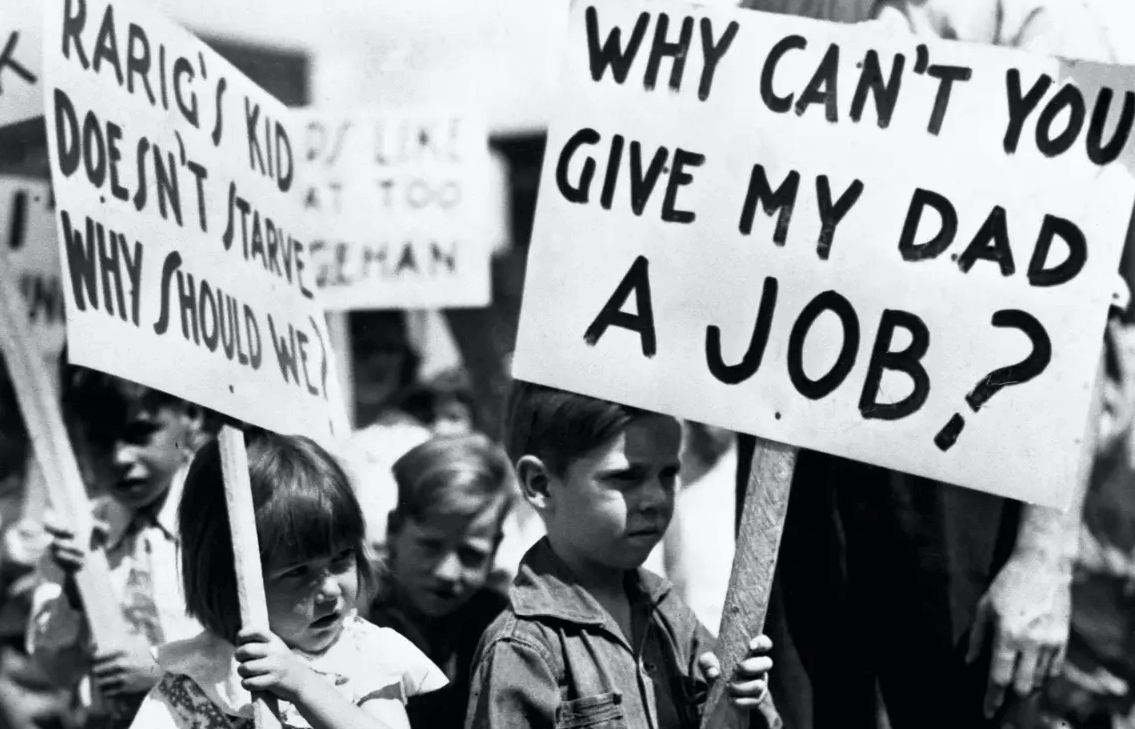

Unemployment and Poverty

As businesses collapsed and industrial production plummeted, unemployment soared. People across the nation found themselves without jobs and struggling to make ends meet. Poverty rates spiked, and many families faced destitution.

Bank Failures

The panic triggered by the crash led to a wave of bank runs, where individuals rushed to withdraw their savings. Many banks couldn’t withstand the massive withdrawals and subsequently failed. The lack of a robust banking system further exacerbated the economic crisis.

Global Economic Impact

The Wall Street Crash had repercussions beyond U.S. borders. The interconnectedness of global economies meant that the economic downturn in the United States reverberated around the world. International trade declined sharply, contributing to a worldwide economic slump.

Shrinking Industrial Production

The crash had a crippling effect on industrial production. Companies faced a sharp decrease in demand for goods and services, leading to factory closures and mass layoffs. This decline in industrial output contributed to the prolonged economic slump.

Housing Market Collapse

The housing market also suffered as property values plummeted. Many homeowners found themselves underwater on their mortgages, owing more than their homes were worth. Foreclosures became widespread, further deepening the economic distress.

Social and Psychological Impact

The economic hardship took a toll on society at large. Families were torn apart, and communities struggled to cope with the widespread suffering. The psychological impact of the Great Depression lingered for years, shaping the attitudes and behaviors of an entire generation.

Government intervention

In response to the devastating effects of the Wall Street Crash of 1929 and the ensuing Great Depression, the U.S. government implemented a series of measures under President Franklin D. Roosevelt’s leadership. These measures, collectively known as the New Deal, aimed at providing relief, recovery, and reform. Here are some key aspects of government intervention:

- Emergency Banking Act (1933): The first days of Roosevelt’s presidency saw the closure of all banks to prevent further financial collapse. The Emergency Banking Act was enacted to assess the solvency of banks before allowing them to reopen.

- Federal Deposit Insurance Corporation (FDIC): To restore confidence in the banking system, the FDIC was established in 1933. It provided insurance for deposits in member banks, assuring individuals that their savings were secure.

- Securities Act of 1933 and Securities Exchange Act of 1934: These acts aimed to regulate the securities industry and prevent the fraudulent practices that had contributed to the stock market crash.

- Social Security Act (1935): Social Security was introduced to provide financial support for retirees, the unemployed, and the disabled. It marked a significant step in creating a social safety net.

- Works Progress Administration (WPA) and Civilian Conservation Corps (CCC): These New Deal programs focused on providing employment opportunities. The WPA aimed at creating jobs in infrastructure and the arts, while the CCC focused on conservation projects.

- Tennessee Valley Authority (TVA): The TVA was established to address economic and environmental issues in the Tennessee Valley region by developing infrastructure and providing electricity.

- National Industrial Recovery Act (NIRA): This act aimed to stimulate industrial recovery by promoting fair business practices and encouraging collective bargaining.

- Glass-Steagall Act (1933): This act separated commercial and investment banking activities, aiming to prevent conflicts of interest and speculative practices.

In what year did the US economic recovery begin?

The process of economic recovery began in the mid-1930s, with the implementation of the New Deal programs. While it’s challenging to pinpoint an exact year for the start of recovery, there were signs of improvement by 1935. The economy experienced a moderate upturn, and key indicators, such as industrial production and employment, showed signs of stabilization.

However, the road to full recovery was long, and the United States did not fully emerge from the Great Depression until the industrial mobilization for World War II in the early 1940s. The war effort injected a massive stimulus into the economy, leading to increased production, employment, and economic growth. The combined effects of the New Deal and wartime efforts marked the eventual recovery of the U.S. economy from the depths of the Great Depression.

Lesson learned

The devastating stock market crash of 1929 provides some crucial lessons that all investors should take to heart:

- Don’t speculate blindly. Many investors in the 1920s borrowed heavily to buy stocks, feeding market mania. Don’t buy stocks on margin or invest in things you don’t understand.

- Recognize irrational exuberance. If everyone is euphoric, a correction is likely coming. Don’t get caught up in the herd mentality.

- Valuations matter. Stocks were extremely overvalued before the 1929 crash. High valuation ratios like P/E signaled trouble. Don’t ignore fundamentals.

- Diversify wisely. Many people invested their entire savings in stocks. Diversifying across asset classes reduces portfolio risk.

- Stay calm during panics. Many investors panicked and sold when the crash started. But panics often allow buying opportunities.

- Markets are cyclical. Booms inevitably lead to busts as excesses are wrung out. Accept that volatility is normal, not the end of the world.

- Don’t use too much leverage. Buying stocks with borrowed money worsened many investors’ losses in 1929. Use leverage judiciously.

Learning from past crashes helps us avoid repeating history’s worst financial mistakes. The 1929 crash teaches the value of rational investing over emotion and speculation.