Looking to buy PayPal USD? This step-by-step guide will walk you through the process in simple terms.

In This Guide

- What is PayPal USD (PYUSD) stablecoin?

- Revolutionizing cryptocurrencies with the PayPal USD stablecoin

- Who can use PayPal USD?

- How to buy the PYUSD stablecoin on PayPal

- PayPal USD Fees

- Challenges ahead for PYUSD in the stablecoin arena

PayPal, the worldwide payments leader, is shaking up the global financial scene by launching a new stablecoin named PayPal USD (PYUSD), which is tied directly to the US dollar.

This groundbreaking move represents a significant step, as a major financial institution enters the stablecoin domain within the realm of cryptocurrencies. This stablecoin, designed to always maintain a 1:1 value with the US dollar, derives its support from deposits and short-term treasuries held in dollars.

Wondering how to buy PayPal USD? Let’s delve into the details of the PayPal stablecoin, PYUSD.

What is PayPal USD stablecoin?

PayPal has taken a bold step by introducing its own stablecoin, showcasing its strong commitment to embracing new financial technologies. This move not only provides customers with a fresh method for payments and transfers, but also underscores PayPal’s strong belief in the future significance of cryptocurrencies within the realm of financial services.

Stablecoins are specifically created to address the common issue of volatility found in traditional digital currencies like Bitcoin and Ethereum. These coins are tied to stable assets, like the US dollar or other financial instruments, which helps maintain a steady and predictable value.

PayPal USD, for example, is pegged to the US dollar and supported by US deposits and treasury bills. This provides users with a reliable option for transactions, eliminating worries about unexpected value changes.

This innovative approach has the potential to redefine the landscape of digital payments, creating a stable and trustworthy framework.

Read also: Does PayPal USD Stablecoin Pose a Threat to Tether?

Revolutionizing cryptocurrencies with the PayPal USD stablecoin

While stablecoins have existed within the cryptocurrency ecosystem for some time, their primary use has been confined to the world of cryptocurrencies itself. PayPal’s move could pave the way for stablecoins to enter the realm of traditional payments, combining extensive experience in mass payments with the advantages of blockchain technology.

PayPal USD has the potential to connect traditional and digital currencies, allowing people, businesses, and developers to easily use them for their day-to-day activities.

Unlike other platforms that need to build a user base, PayPal already boasts an established foundation. This positions PYUSD to seamlessly integrate into the existing financial ecosystem.

Moreover, the adoption of a stablecoin by a giant like PayPal could accelerate the necessity for clear and well-defined regulations in this burgeoning sector.

Who can use PayPal USD?

The PayPal stablecoin is accessible to various qualified users:

- Everyday Consumers: Individuals can utilize PYUSD to manage their daily purchases and streamline online payments, making transactions hassle-free.

- Merchants: Businesses have the option to integrate PYUSD into their payment platforms, providing customers with a reliable digital transaction choice. This proves advantageous for entrepreneurs aiming to steer clear of the value fluctuations commonly seen in traditional cryptocurrencies.

- Developers: PYUSD offers developers the flexibility to create innovative financial solutions and blockchain-based applications. This versatility encourages the development of a wide array of services that harness the stability of PYUSD.

PYUSD presents a range of practical uses:

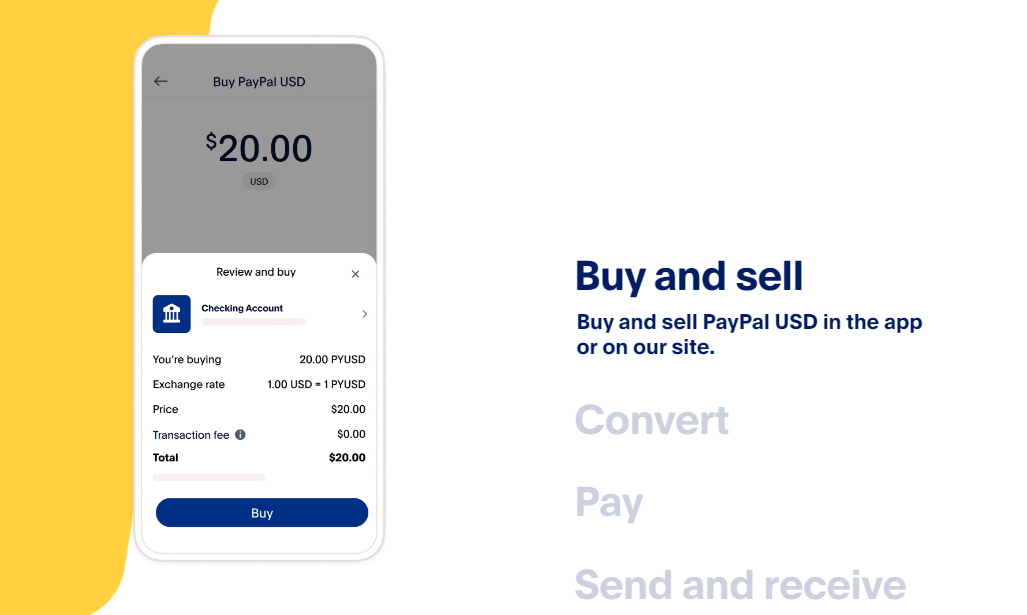

- Buying and Selling: You can use PYUSD for buying and selling within the PayPal platform, offering a steady alternative to conventional currencies.

- Simple Conversion to US Dollars: Users have the convenience of converting PYUSD to US Dollars at a 1:1 ratio, ensuring immediate liquidity.

- Peer-to-Peer Payments: PYUSD enables straightforward person-to-person payments, facilitating transactions among friends, family, and acquaintances.

- Financing Purchases: Opting for PYUSD as a payment method introduces a fresh approach to financing online purchases.

Currently, access to PYUSD is limited to a select group of PayPal customers in the United States. Nevertheless, PayPal intends to broaden this availability to include users in the US, UK, Canada, Australia, and Singapore. This expansion aims to provide more individuals with the opportunity to experience the advantages offered by this stablecoin.

Read also: Huobi Crypto Exchange Announces Support for PayPal USD (PYUSD)

How to buy PayPal USD (PYUSD)

Paxos Trust will issue the PYUSD stablecoin and gradually offer it to PayPal customers in the United States.

To buy the PYUSD stablecoin on PayPal, follow these steps using the Coinbase app or official website:

- Get a PayPal Account: First, make sure you have a PayPal account. If you don’t have one, you can create it by signing up like you normally would.

- Buying PYUSD: Once your PayPal account is ready, you can buy PYUSD in a few ways:

- Convert from Existing Balance: If you have money in your PayPal account, you can change it into PYUSD.

- Deposit and Convert: You can also deposit money into your PayPal account and then convert it into PYUSD.

- Converting Currency:

- Log into your PayPal wallet.

- Find the currency you want to convert (maybe US dollars) and click on the “More” icon next to it.

- Choose “Convert currency” and follow the instructions that appear.

- Redeem or Exchange: Remember, you’re not stuck with PYUSD forever. You can always trade it back for US dollars or swap it for other types of cryptocurrencies that are available on PayPal.

In short, after setting up a PayPal account, you can easily buy the PYUSD stablecoin by converting your existing PayPal balance or by depositing funds into your account and then converting them. And if you change your mind, you can always trade your PYUSD back into US dollars or other cryptocurrencies within PayPal.

PayPal USD Fees

PayPal applies charges for international transactions, though the exact fees for PYUSD-related transactions are yet to be clarified. Here are some typical fees for international PayPal transactions:

- International Personal Transactions: A fee of 5%, with a minimum of $0.99 and a maximum of $4.99.

- Direct transfers to another PayPal account: A fee of 5% of the transferred amount, with a minimum of $0.99 and a maximum of $4.99.

- Currency conversion: Generally around 3% to 4% of the transaction value.

To ensure clarity, it’s advisable to keep an eye on the standard fees and any updates regarding fees for PYUSD transactions.

PayPal’s introduction of a stablecoin linked to the dollar marks a significant change in the financial landscape. This strategic move by PayPal enhances the credibility of digital currencies and demonstrates a strong commitment to innovative payment solutions. In a time of evolving regulations and technology, this development has the potential to redefine the concept of money and foster a more inclusive digital financial future.

Challenges ahead for PYUSD in the stablecoin arena

As the PayPal USD stablecoin steps onto the stage, it holds the promise of becoming a contender in the stablecoin arena, yet it must surmount a series of challenges.

Read also: Fake PYUSD Tokens Emerge Across Blockchains, Investors Beware

Its exclusive availability to American users raises a question mark about its expansion potential. The centralized nature of the cryptocurrency and the inclusion of a security mechanism permitting asset freezing may instill caution among users. Moreover, the apprehensions surrounding data privacy remain a valid concern for those who hold their personal information in high regard.

Adding another layer to the complexity, PYUSD’s launch coincides with a Congressional deliberation over the establishment of a comprehensive regulatory framework for stablecoins. The resulting regulatory changes could present a fresh set of hurdles for PYUSD, as well as its counterparts in the stablecoin market, potentially impeding their entry into new markets.

As PYUSD charts its course, it navigates both the promise of legitimacy and the challenges of a swiftly evolving regulatory landscape. Its journey will undoubtedly shape its role within the intricate tapestry of the crypto world.