You’ve downloaded Robinhood, but now what? If you’re wondering how to make money on Robinhood, you’ve come to the right place. In this article, you’ll learn how to turn Robinhood into your personal money printer through smart investing, savvy trading, and extracting income from the platform’s unique features.

How to make money on Robinhood

Now, let me break down the seven awesome ways you can make money on Robinhood:

- Stocks Trading: Buy and sell stocks like a boss, aiming to profit from those sweet price gains.

- Stock Lending: Get the opportunity to earn income on stocks you already own—just by turning on Stock Lending.

- Options Trading: Get fancy with options contracts, speculating on future stock prices (but be careful, this one’s a high-risk game).

- Dividend Investing: Collect cash payouts from companies that share their profits with shareholders (passive income, anyone?).

- Fractional Share Investing: No more missing out on expensive stocks! You can buy fractional shares with smaller amounts.

- Cryptocurrency Trading: Ride the roller coaster of digital currencies like Bitcoin and Ethereum (just don’t get too dizzy!).

- Cash Management Account: Earn interest on your uninvested cash, because every penny counts!

1# Stocks Trading on Robinhood

Alright, let’s talk stocks! To me, a stock is like owning a tiny slice of a company. When that company does well and grows, the value of my slice (the stock) gets bigger too. But here’s the catch – the stock market can be a real rollercoaster ride! Stock prices go up, down, and all around based on news, earnings, economies, and good ol’ human psychology. It’s my job to try and navigate those twists and turns.

Value investing strategies

One strategy I really dig is value investing. It’s all about being a smart shopper and finding those quality companies that are underappreciated or “on sale” compared to their true worth. I look for solid businesses with good financials, competitive advantages, and potential for growth – but that the market has just overlooked for whatever reason. By buying them at bargain prices, I can cash in when the market finally recognizes their value.

Growth investing strategies

Growth investing is more about finding the next big innovators and future leaders. I hunt for companies with game-changing products, visionary management, and tons of room to expand into new markets. Sure, their stock prices might already be riding high on all that potential. But if they can actually deliver on those lofty expectations, the sky’s the limit for future returns!

Momentum trading strategies

Now, if you’re a bigger risk-taker like me, you might want to try momentum trading. This is all about catching stocks with a ton of, well, momentum behind them! I look for shares that are already ripping higher and try to jump on board that momentum train before it potentially stalls out. It’s an adrenaline rush, but also a great way to capture some massive short-term profits if you time it right.

Technical analysis for stock trading

Finally, there’s technical analysis – my personal crystal ball for predicting stock moves. By closely studying all those candlestick charts and stock patterns, I can try to identify potential buy and sell signals based on historical tendencies. Stuff like classic “head and shoulders” patterns, trend line breaks, and momentum indicators. It takes a ton of practice, but it’s an incredibly powerful tool when combined with fundamental analysis too.

2# Stock Lending on Robinhood

What is Stock Lending? Stock Lending is a neat little income stream hiding in plain sight on Robinhood. Essentially, you can “lend out” the stocks you already own to other traders and investors who need to borrow shares. In exchange, you earn interest payments on the loan – free money!

How Stock Lending Works It’s dead simple to enable. Just toggle on the “Stock Lending Income Program” under your account settings. From there, Robinhood will automatically lend out any shares you own to traders looking to short those stocks or use them for other strategies.

Earning Interest Income

The borrowers pay interest fees to temporarily use your loaned shares. Robinhood takes a small cut, but you pocket the majority as passive income directly credited to your account. More shares lent = more interest earned!

Potential Risks

Of course, lending does involve small risks like the remote chance your shares get caught up in corporate actions while loaned out. But Robinhood has safeguards in place.

You also can’t personally choose which shares get loaned, and may experience some limited sell restrictions. But hey, those are minor quibbles for effortless extra income, right?

Rather than letting your stocks just sit there, Stock Lending allows you to juice extra returns from shares you already planned on holding anyway. It’s a smartly passive way to make your portfolio work even harder!

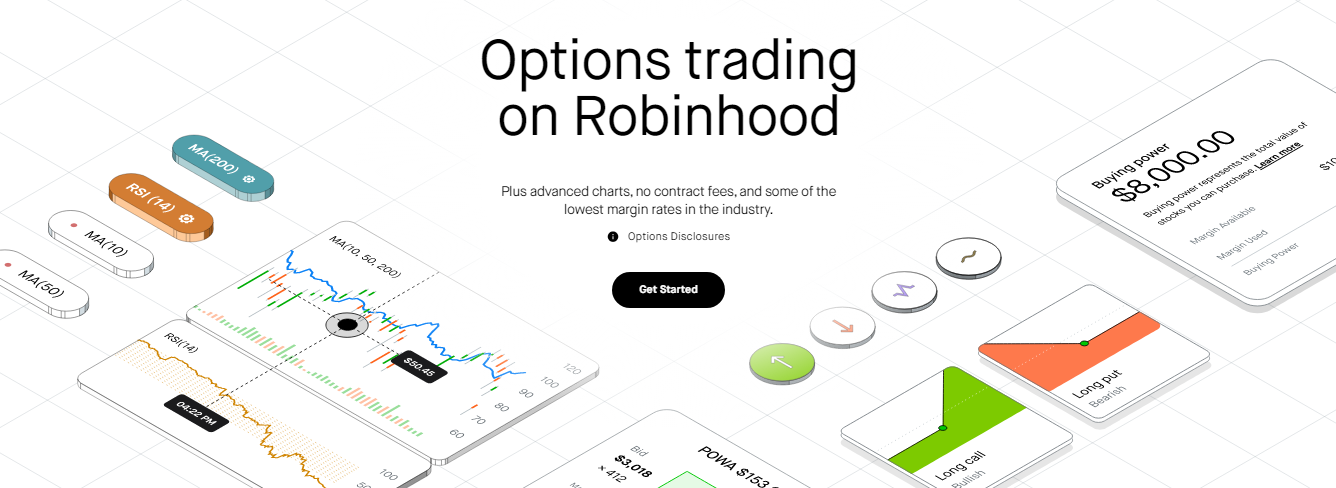

3# Options Trading

What are options and how do they work? An option is like a contract that gives me the right (but not the obligation) to buy or sell a stock at a predetermined price within a set timeframe. It’s like having a crystal ball to capitalize on future stock moves – if I’m right, that is.

Covered call strategy

One options strategy I use is called the covered call. Let’s say I already own 100 shares of Apple at $150 each. I could then sell someone else a call option, giving them the right to buy my shares at a higher strike price, like $160, by next month. If Apple stays below $160, I get to keep my shares and collect the premium I charged for that option contract. Not bad for some extra income, right?

Cash-secured put strategy

Or I could try the cash-secured put strategy to potentially get shares at a discount. With this one, I collect an upfront premium payment for selling a put option – obligating me to buy 100 shares if the stock drops below the strike price. But no biggie, because I have to set aside enough cash to cover that potential purchase. If the stock stays above the strike, I just keep the premium like free money!

Other options strategies (spreads, straddles, etc.)

Those are just a couple basic options tactics though. This world gets crazy with all sorts of advanced strategies like spreads, straddles, iron condors…you name it. I’ve even experimented with option-based volatility plays, betting on big moves either way. But I have to be extremely careful because these strategies can get complicated and risks can compound quickly.

Risk management in options trading

Speaking of risks, that’s probably the most important thing with options! One bad options trade can seriously blow up your whole account in the blink of an eye. Controlling position sizes, enforcing stop losses, and managing that overall portfolio risk is absolutely paramount. I never, ever put more capital at risk than I can truly afford to lose. This stuff is too wild to mess around!

4# Dividend Investing

What are dividends and why invest in them? Dividends are my favourite kind of “mailbox money”! Basically, when a company is profitable, they’ll sometimes share a portion of those profits directly with shareholders like you and me. It’s like getting a special cash thank-you payment just for owning a piece of the business. Talk about passive income!

Identifying dividend-paying stocks

To find the biggest dividend players, I look for large, established companies in stable industries like utilities, consumer staples, financials, and healthcare. Businesses with consistent earnings, steady cash flows, and lower growth prospects tend to be the most generous dividend payers. You can spot ’em by metrics like dividend yield and payout ratios.

Dividend reinvestment plans (DRIPs)

Here’s one of my absolute favorite dividend tactics though: the DRIP, or dividend reinvestment plan. Instead of just pocketing those cash dividends, I tell my broker to use that money to automatically buy more shares of the same stock. It’s super powerful because of how reinvesting and compounding can accelerate your returns over decades. Boom, making your dividends work for you!

Creating a dividend income stream

Over time, as you build up a diverse portfolio of dividend stocks across different sectors, you could potentially create a steady “paycheck” just from all those dividends flowing into your account! Imagine getting recurring income streams from companies like Coca-Cola, Procter & Gamble, JPMorgan, and more every single quarter. That’s the dream of dividend investing.

5# Fractional Share Investing

What are fractional shares? Don’t have thousands of dollars lying around to buy those hot, expensive stocks? No sweat! Thanks to fractional shares on Robinhood, I can buy just a tiny slice of shares like Amazon, Google, or Bitcoin instead of whole ones. It’s like going to a fancy restaurant but splitting that pricey entree among friends so everyone gets a taste.

Benefits of fractional share investing

This fractional share game is a total game-changer, especially for investors just starting out. No more watching in envy as other traders pile into those big-name stocks and assets! Even with a small amount of capital, I can start building a diversified portfolio across various companies, sectors, asset classes – the whole nine yards.

Strategies for investing with fractional shares

One smart approach is using fractional shares to create these “investment bundles” targeted around certain themes or industries you’re bullish on. Love tech? Buy a slice of Apple, Microsoft, NVIDIA, and more all in one shot. Think the future is green energy? Scoop up fractional shares across solar, wind, electric vehicles – you get the picture.

Potential risks and considerations

Of course, fractional investing still carries all the same inherent risks as normal stock trading. Those tiny slices represent real money that can be lost if the underlying companies don’t perform! You’ve also gotta be careful about getting too diversified across hundreds of fractional positions without any real strategy or focus areas. That’s a surefire way to get mediocre returns and lots of headaches.

6# Cryptocurrency Trading on Robinhood

Cryptocurrencies like Bitcoin and Ethereum are digital money, but they’re decentralized and not controlled by any government or bank. They run on blockchain technology and can be traded 24/7 on crypto exchanges. It’s like the internet of money!

When it comes to trading cryptos, there are a bunch of strategies people use.

Crypto trading strategies

Some crypto traders try to ride the intense price swings with short-term strategies like:

- Momentum trading (jumping on coins showing strong uptrends)

- News trading (reacting to events that could impact prices)

- Arbitrage (exploiting temporary price differences across exchanges)

Others take a longer-term “HODLing” approach, buying and holding crypto assets they believe have strong fundamentals and potential for mass adoption.

Risks and volatility in crypto markets

But listen up – crypto is certifiably insane when it comes to volatility. We’re talking about double-digit percentage swings on the regular, huge rallies and crashes. You need a strong stomach and diamond hands to survive this market’s wild swings. Leverage and FOMO can rekt even the most seasoned traders.

Tax implications of crypto trading

Oh, and don’t forget – Uncle Sam wants his cut too! Any profits you make trading cryptocurrencies are taxable as capital gains, just like with stocks. Make sure to keep detailed records because trying to calculate those crypto taxes is a nightmare. Might be worth setting some gains aside for tax time.

7# Robinhood Cash Management Account

What is the cash management account? Robinhood’s cash management account is a total game-changer. It’s like having a high-interest savings account built right into your investment app. Genius, right?

Instead of letting your spare cash sit around doing nothing, you can park it in this handy account and watch it grow. Sure, the interest rates might not be astronomical, but hey, every little bit counts! It’s basically free money just for being a Robinhood user.

Strategies for using the cash account

Here’s how I like to use my cash management account: Whenever I sell some investments and have leftover cash sitting around, I immediately sweep it into the high-yield account. That way, it’s still earning a little something while I decide my next move.

And when I’m ready to invest again? Bam, the money’s right there, already in my Robinhood account. No need to transfer funds from external banks – it’s just a couple of taps, and I’m ready to put that cash to work!

Now that I have listed the six main ways to make money on Robinhood, an excellent question that I get asked a lot is – which money-making method on Robinhood is the “best”?

Which Method is Best for Beginners?

For total newbies just dipping their toes into investing, I’d definitely recommend starting with regular stock trading or dividend investing. Allow me to explain why:

With stock trading, you’re dealing with straightforward buy and sell transactions of actual company shares. It’s about as simple as investing gets – find businesses you understand and believe in, buy some shares, and let your money grow as the company grows over time. No fancy derivatives or complications.

Dividend stocks are also a great entry point. You get paid cash payouts just for owning shares of profitable companies! It’s passive income 101. And dividend stocks tend to be established, stable companies that are perfect for learning the investing ropes.

The biggest advantage of stocks and dividends for beginners? The risk is easily capped to only what you invest. You can’t lose more than your initial amount, unlike with options or margin trading.

My take on options, fractional shares, crypto and cash management

Speaking of options, that’s where I would caution new investors to stay far away, at least initially. Don’t get me wrong, options have awesome income potential. But they are crazy complex with all the Greek metrics, spreads, and advanced strategies. One wrong move and your max loss potential is untenable. Stocks are much more beginner-friendly!

As for fractional shares, I actually think that’s a neat way for investors to get started with smaller amounts of capital. Can’t afford pricey stocks like Amazon? No problem, just buy a slice! It’s a smart way to build a diversified portfolio right out of the gate.

Crypto, on the other hand, is something I’d definitely advise beginners to approach with extreme caution, if at all. The volatility is insane and it’s very easy for novices to get caught up in the hype and over-leverage themselves into oblivion. Maybe put a tiny percentage towards learning crypto, but go slow.

Finally, the cash management account is a nice little bonus feature, but certainly not a focus for making income, especially when you’re new. Use it for earning a bit of interest on idle cash for sure, but don’t overthink it.

Getting Started

You’re ready to get started on Robinhood and start building that wealth! Here are three simple steps to take:

- Download the App First thing’s first – you’ll need to download the Robinhood app and open up an account. The signup process is super straightforward. Just enter some basic personal info, link up your bank account, and approve some disclosures. Bam, you’re in!

- Open an Account The signup process is a breeze – just enter some basic personal deets, link up your bank, and agree to the terms. Then boom! You’re an accredited Robinhood trader.

- Transfer Funds Next up, it’s time to start funding that bad boy. Link your bank account or transfer some cash directly onto the Robinhood platform. I’d advise starting with an amount you’re genuinely comfortable with potentially losing as you learn the ropes. For many beginners, that’s maybe $500 to $1,000.

- Choose Your Investments Here’s where the real fun starts! Browse around, research companies, and decide where you want to deploy that hard-earned capital. Stocks, ETFs, crypto, the options are endless.

Now here’s a pro tip – set up that cash management account I mentioned and park any uninvested funds there. That way, every dollar will be earning that extra interest while you figure out your next move!

That’s it! Follow those four simple steps and you’ll be making money moves in no time. Just remember to always focus on education, diversification, and managing your risk exposure. Steady and smart wins this race!