Cryptocurrency adoption is accelerating rapidly in South Africa, with platforms like Luno leading the way. As the country’s premier crypto platform with over 10 million customers, Luno enables anyone to safely buy, sell, and earn from digital currencies.

As digital assets become mainstream, more South Africans are realizing there is an opportunity to make money daily by strategically using Luno’s trading tools and crypto financial services.

But how exactly can you generate income through Luno as a South African user? This 2024 guide will walk through the major opportunities uniquely available including:

- Actively trading top cryptocurrencies

- Earning fees as a liquidity provider

- Passive income via crypto savings accounts

- Lending crypto assets to margin traders

By creatively tapping into these profit channels, Luno provides a trusted platform for South Africans to ride the crypto wave to financial success. Now let’s explain each money-making method step-by-step.

Read also! Is Luno Legit in South Africa?

How to Make Money with Luno in SA in 2024

When starting on the Luno platform, the first step is simply to set up your account and fund it so can take advantage of money-making opportunities with crypto.

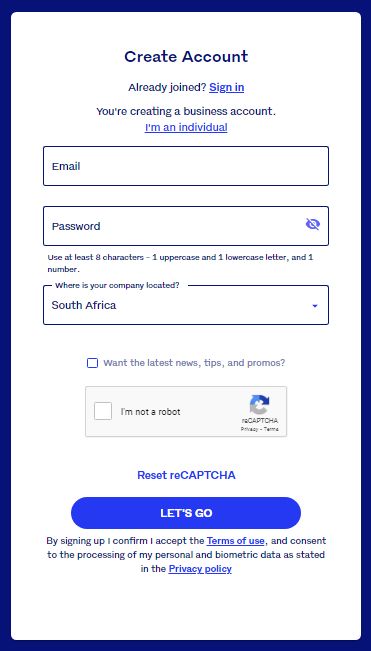

Sign up for an account

As a Luno user in South Africa, signing up for an account only requires adding your name, email address, and South African mobile number to register. This creates your basic Luno account login.

Complete KYC verification

The next step South Africans should complete is identity verification to confirm they are a real local user. By uploading a photo of your national South African ID or passport through the Luno mobile app or website, you can quickly pass KYC requirements.

Deposit South African Rand into your Luno wallet

With ID confirmation, South African Luno members can proceed to the funding phase by linking a local bank account to easily deposit Rand. Thanks to Luno’s Instant EFT system, connecting an ABSA, Standard Bank, FNB or Nedbank account lets South Africans transfer money into their Luno wallet instantly with no deposit fees deducted. This provides accessible base funding to exchange Rand for crypto.

Whether depositing R500 or R5,000 ZAR to start, establishing this pathways between a trusted South African bank and your Luno dashboard sets the infrastructure to load Rand for efficient crypto purchasing power. New Luno traders should fund accounts conservatively as they learn to maximize gains from exchange volatility over time through proven techniques.

Start Crypto Trading

Now with your Luno account funded with ZAR, it’s time to put that balance to work by trading between cryptocurrencies and the Rand. The most straightforward approach to making money is buying digital tokens low, then selling them higher once price appreciates.

Research top coins

Savvy crypto traders will research and monitor the major coins listed on Luno for upside price potential – assets like Bitcoin, Ethereum and Litecoin. Reviewing the historical charts on Luno and staying updated on the latest crypto news flow and adoption metrics can highlight opportune times to enter trades.

Buy low and sell high

Luno conveniently enables both spot trading and market orders via its exchange interface. This means South Africans can either place buy/sell limit orders at targeted rates optimized for their profit goals, or instantly trade at prevailing market prices in real-time.

Employ dollar cost averaging and technical analysis

To reduce volatility risk, new Luno traders should leverage tools like the Dollar cost average to automate buying while analyzing global price charts to target ideal exchanging opportunities.

As experience is gained, employing strategies like swing trading during volatility or going margin with added risk management can amplify profit potential.

Luno simplifies accessing global crypto demand for South Africans. Converting Rand to top assets when prices dip, then back again when market prices rise, creates a clear onramp to maximize gains amidst the inherently volatile crypto markets.

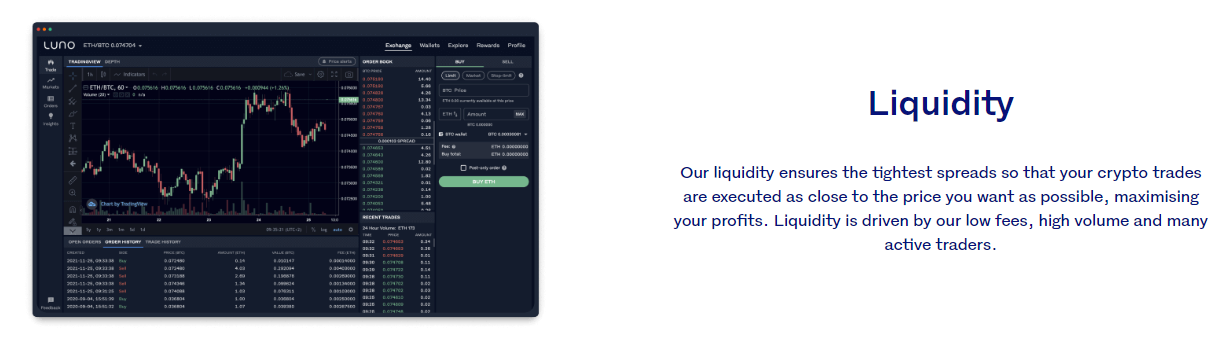

Provide Liquidity with Market Making

Beyond just actively trading, an advanced way South Africans can make money on Luno is by becoming a liquidity provider to generate passive income. This entails standing ready to facilitate crypto buying and selling.

Become a Luno market maker for crypto/ZAR pairs

Luno operates a market-making program where locals supply liquidity for assets paired against the Rand – like BTC/ZAR or ETH/ZAR. You continually place parallel buy and sell orders to enable exchange activity, earning small spreads and market maker fees in return from Luno.

Earn fees for providing liquidity to buyers and sellers

The income earned from fills on these orders pays Luno market makers for providing the invaluable service of liquidity. This lets regular crypto traders seamlessly enter and exit positions. During high volatility, market maker revenue can accelerate rapidly from spread captures and order executions.

Though advanced, supplying liquidity requires less time actively trading while unlocking passive income potential. With crypto demand growing exponentially in SA, becoming a custodian of liquidity is crucial. By standing ready to intermediate supply and demand on Luno’s markets, this route efficiently monetizes your knowledge of crypto asset valuation.

Earn Interest on Crypto Savings

Rather than actively trading currencies or providing liquidity, a simpler way South Africans can make money with Luno is through passive crypto savings accounts to earn interest.

Luno now offers a Savings Wallet product integrated into its platform. This allows effortlessly depositing assets like Bitcoin or Ethereum you own to start generating yield. The interest accrues without having to lock up funds or stake coins elsewhere.

Interest paid out daily, up to 4% APY return

The savings rate paid varies per digital asset – up to 4% APY for Ethereum versus around 1% on Bitcoin currently. Interest is calculated daily based on amount held, and credited straight to your Luno wallet daily so it can compound or be exchanged.

When first learning to make money in crypto, parking unused coins safely in Luno’s Savings Wallet can make previously static holdings start passively working for you at appreciable rates above traditional banks. Consider allocating a portion of long term Bitcoin investments or Ethereum holdings to this automated income generator requiring no maintenance.

Lend Out Crypto Assets

A final way for seasoned South African crypto owners to generate income on Luno is lending assets to margin traders in need of short term borrowing.

Lend coins to margin traders

Luno facilitates crypto lending through its Earn platform – allowing customers with existing coins to provide loans on in-demand assets like Bitcoin and Ethereum. Approved margin traders seek loans when they expect prices to rise but don’t want to fully prepay at current market levels yet.

Interest paid out daily

As an Earn lender, you can set your own rates, with interest typically 0.1% – 5% charged daily based on market dynamics. The extra coins you loan get returned on an agreed schedule. By flexibly servicing this leveraged demand, Earn lenders can stack reliable daily interest income from their holdings.

Crypto lending interest scales reliably based on your supply and loan demand at the time. And the amounts earned get paid straight into your main Luno wallet each day. So for South Africans already holding popular coins, activating Earn is a logical way to further leverage assets for additional yield.

Conclusion

As we have considered so far, Luno offers accessible opportunities for South Africans to realize income daily from crypto market participation – whether actively trading coins, supplying exchange liquidity, or earning passive yield on holdings.

By harnessing Luno’s robust exchange infrastructure, locally compliant fiat gateways, and advanced financial products for Bitcoin and Ethereum, retail traders across skill levels can find a pathway to generate profits from the booming digital asset industry.

From pursuing technical analysis-based trading strategies, to providing frictionless liquidity using market making techniques, to the set-and-forget simplicity of interest accounts – Luno has democratized participation for South Africans to bank crypto’s upside.

While crypto investing always carries market risk and learning curves, Luno has localized and simplified money-making methods for South African abilities and conditions. As adoption continues rising exponentially in the country, Luno provides ideal tools and trust to start benefiting financially from the choice to embrace digital currencies.

FAQs

- How much can South Africans make from Luno?

The income potential on Luno depends greatly on your strategy. Active traders can aim for 10-20%+ returns through frequent buying and selling, while passive saving and lending can generate 4-8% annually. With discipline and experience, Luno users can consistently grow wealth.

- What are the main ways to make money with Luno in South Africa?

The main methods are: active crypto trading between ZAR and coins like BTC and ETH; becoming a liquidity provider to earn exchange fees; saving in Luno’s interest-paying crypto accounts; and lending coins on margin via the Luno Earn platform.

- Does Luno have training for South Africans to learn crypto trading?

Yes. Luno provides a free Crypto School section directly in the app that uses videos, guides and quizzes to train South African users about cryptocurrency trading from beginner to advanced levels.

- What fees does Luno charge South Africa users?

Luno charges a transparent 0.1% as maker fee and 0.2% as taker fee for all crypto trades under their pricing model, one of the most competitive rates globally. Fiat and crypto deposits are free.

- Is it safe to earn interest and lend crypto assets on Luno?

Yes. Up to 95% of funds held across Luno for savings or lending are stored in insured cold wallets. Advanced protocols also protect against threats. This covers assets if any unlikely breaches occur.