Key Insights

- Global stocks in Asia and Europe experienced a significant surge today in response to renewed risk appetite.

- This surge was partly attributed to the U.S. Federal Reserve’s hints at a halt in interest rate hikes, leading to a decline in Treasury yields.

- Japan led the Asian market’s bullish momentum, with its Nikkei 225 index rising over 2.4%, while European markets, notably the STOXX 600, saw substantial gains due to dovish comments from U.S. Federal policymakers.

On October 10th, global stock markets experienced a notable upswing driven by a renewed appetite for risk, and the optimism stemming from the United States Federal Reserve’s outlook on bond yields played a pivotal role in this resurgence.

Federal Reserve’s Optimism on Bond Yields

- U.S. Treasury yields witnessed a sharp decline, largely influenced by hints from Federal Reserve officials suggesting that further interest rate hikes might not be imminent. Fed Vice Chair Philip Jefferson underscored the need for cautious deliberation in determining additional rate increases. Dallas Fed President Lorie Logan even hinted that rising Treasury yields could potentially deter the Fed from pursuing such hikes.

- This shift in sentiment resulted in a reduction of investments in safe-haven assets like the U.S. dollar, gold, and government bonds. Additionally, oil prices retraced from their previous surge.

Asian Markets Rally Led by Japan

- The Asian stock market experienced a notable surge, with Japan’s benchmark index, the Nikkei 225, leading the charge with a remarkable 2.4% increase. The Nikkei closed at 31,763.50 points, marking a robust recovery just a day after Japan’s national holiday.

- This resurgence was largely fueled by a significant surge in the shares of Inpex Corporation, an oil and gas exploration company, which recorded an impressive 8.6% increase in its stock value.

- However, South Korea’s Kosdaq Index faced a 2.62% decline, reaching its lowest level since March 16, while the Kospi Index reversed previous gains to close at 2,402.58, its lowest since March 21.

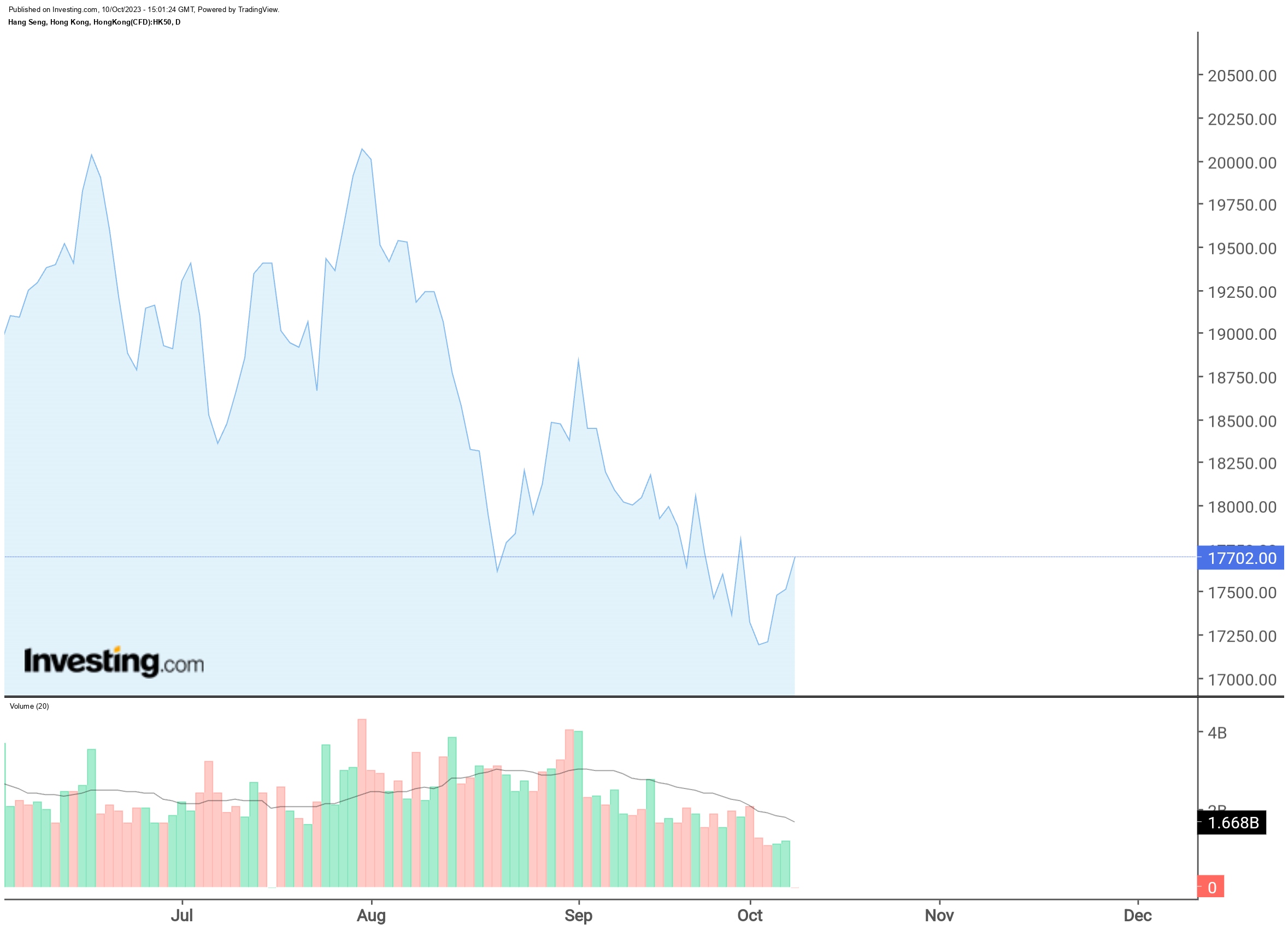

- In Hong Kong, the Hang Seng Index managed to secure an 0.84% increase, thanks in part to the Federal Reserve’s dovish comments. Conversely, mainland Chinese markets continued to face challenges, with the CSI 300 index declining 0.75%, marking its third consecutive day of losses.

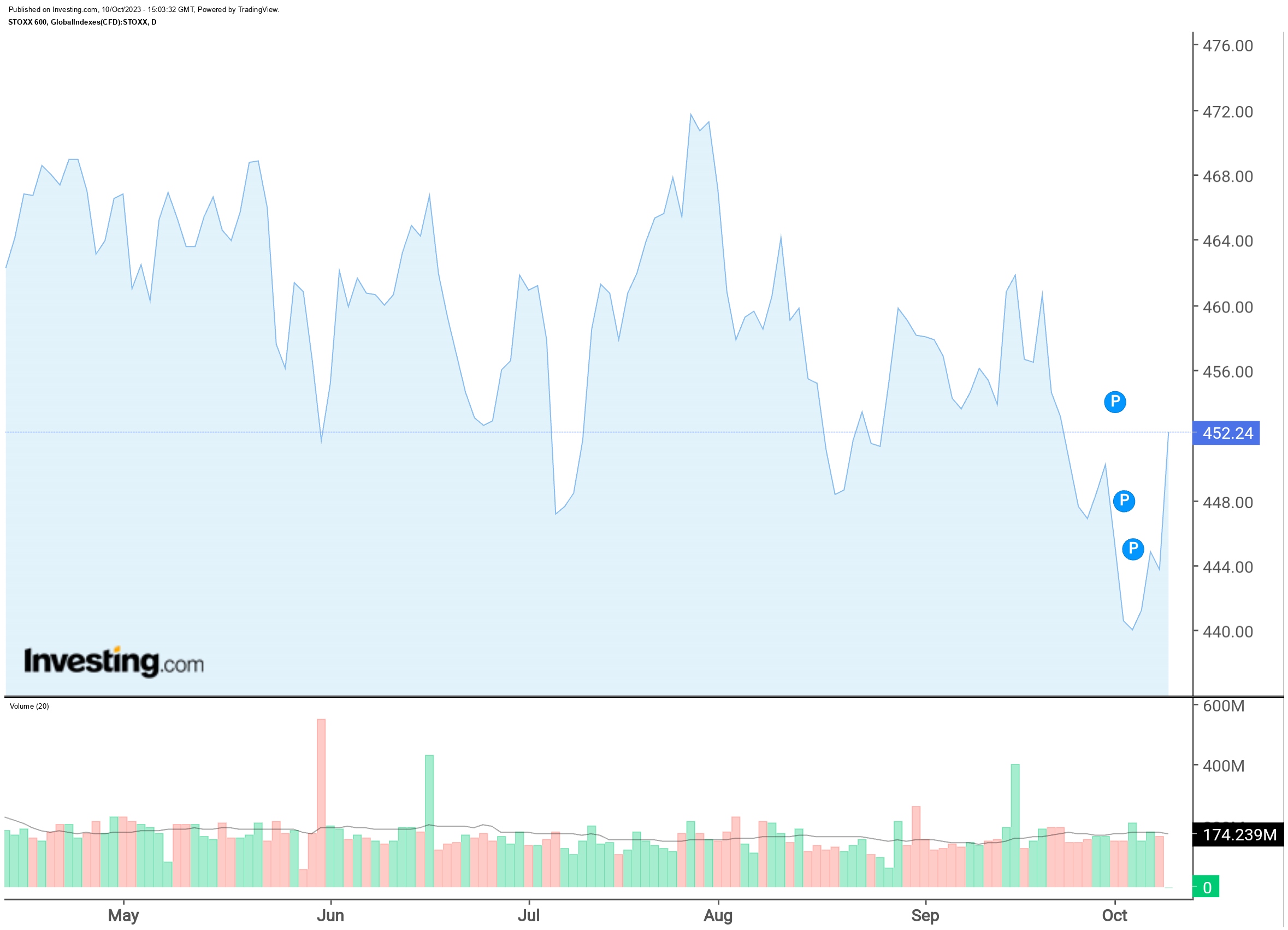

European Markets on the Upswing

- European stock markets experienced a significant recovery on Tuesday, buoyed by the dovish remarks from U.S. Federal policymakers, which injected renewed confidence into the market.

- Europe’s benchmark STOXX 600 index surged by 1.5%, approaching its most substantial single-day percentage gain in nearly four weeks. This upswing followed a period marked by increased oil prices and a flight to safety assets like Treasurys and gold.

- In the United Kingdom, the FTSE 100 Index reached a one-week high on the back of Federal Reserve optimism and expectations that the Bank of England would refrain from raising interest rates. Additionally, the domestically focused FTSE 250 Index rose by 1.6%, while the globally oriented FTSE 100 jumped by 1.4%.

[…] stock markets had a divergent day, with the majority of Asian stock markets climbing while their European […]