Key Insights

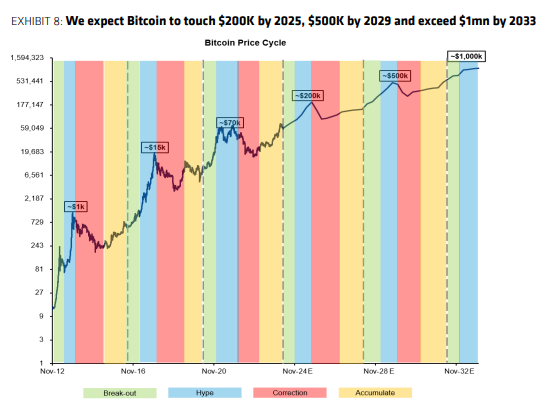

- Bernstein raised its bitcoin price target to $200,000 by end-2025, citing high demand from spot ETFs and constrained supply post-halving.

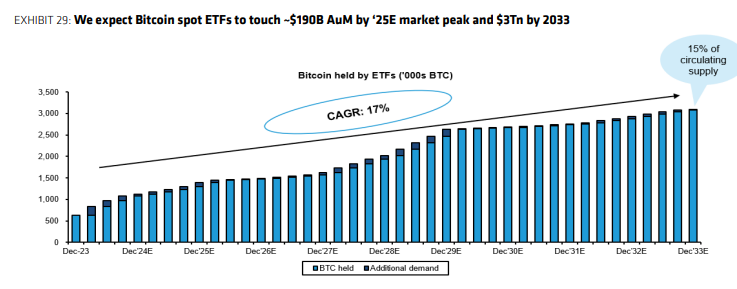

- Analysts expect bitcoin ETF assets to reach $190 billion, representing 7% of circulating supply by 2025 and 15% by 2033.

- Bernstein initiated coverage on MicroStrategy with an “outperform” rating, targeting $2,890 by end-2025, an 80% upside.

NEW YORK (MarketsXplora) – Bernstein has raised its price target for bitcoin to $200,000 by the end of 2025, citing unprecedented demand from spot bitcoin exchange-traded funds (ETFs) and constrained supply following the recent “halving” event.

Analysts Gautam Chhugani and Mahika Sapra expect bitcoin ETF assets under management to surge to around $190 billion from $60 billion currently, driven by inflows from traditional investment pools.

“The launch of U.S. regulated ETFs marked a pivotal moment for crypto, ushering in structural demand from conventional capital sources,” Chhugani told MarketsXplora. “We project bitcoin ETFs will account for roughly 7% of circulating supply by 2025 and 15% by 2033.”

Bitcoin’s latest halving in April, which cut miners’ block rewards to 3.125 BTC from 6.25 BTC, has significantly reduced new supply from an average of 900 coins per day to 450, the analysts noted.

“We’re witnessing the dawn of a fresh bull cycle for bitcoin,” Sapra said. “The halving creates a unique dynamic where natural selling pressure from miners diminishes by half, just as new demand catalysts emerge, potentially leading to exponential price movements.”

Examining past cycles, Chhugani and Sapra observed bitcoin peaking at roughly five times its marginal production cost in 2017 before bottoming at 0.8 times in 2018. In 2021, it climbed to 2.3 times the prevailing cost before hitting a low of 0.7 times in 2022.

“For the 2024-27 cycle, our models indicate bitcoin could rally to 1.5 times its marginal production cost, suggesting a cycle high of $200,000 by mid-2025,” Chhugani said.

The Bernstein team’s long-term projections see bitcoin reaching $500,000 by end-2029 and $1 million by 2033. The cryptocurrency traded around $67,100 on Wednesday.

Bernstein Backs MicroStrategy’s Bitcoin-Centric Approach

Bernstein also initiated coverage on business intelligence firm MicroStrategy with an “outperform” rating, targeting $2,890 by end-2025 – an 80% upside.

“Investors are drawn to MSTR for leveraged equity exposure to bitcoin, given the scarcity of such vehicles in public markets,” Sapra explained. “The company’s active, leveraged strategy has outperformed spot bitcoin, with net asset value per share growing fourfold versus bitcoin’s 2.4 times in about four years.”

MicroStrategy, holding 214,400 bitcoins valued above $14 billion, announced plans to raise $500 million via convertible notes to acquire more bitcoin, with an additional $75 million option.

Read also! Bernstein Analysts: Republican Win May Boost Crypto as Top ‘Trump Trade’

“Our risk analysis indicates low risk for the 2025 convertible notes and moderate risk for 2027/2030 notes based on current bitcoin prices,” Chhugani said. “The long-dated convertible strategy allows ample time to capture bitcoin upside with limited liquidation risk.”

Bernstein forecasts MicroStrategy will own 1.5% of bitcoin’s supply by end-2025.