Key Insights

- Cryptocurrency market sees sharp decline, with Bitcoin falling nearly 20% and Ether losing all 2024 gains.

- Bernstein analysts remain optimistic, citing growing institutional adoption and potential for crypto as a hedge against recession.

- U.S. politics and upcoming elections expected to influence crypto market performance in the short term.

NEW YORK (MarketsXplora) – The cryptocurrency market experienced a sharp decline over the weekend and into Monday, with bitcoin plummeting nearly 20% to below $50,000 and ether shedding all its year-to-date gains, dropping almost 30% since Friday to under $2,200. However, analysts at Bernstein argue that the crypto market’s reaction is a typical response to broader economic concerns rather than sector-specific issues.

“Bitcoin’s initial reaction as a ‘risk off’ asset is not surprising,” Bernstein analysts Gautam Chhugani, Mahika Sapra, and Sanskar Chindalia wrote in a note to clients on Monday. “This has often been the pattern for bitcoin markets, particularly as it is the only market trading over the weekend. We remain calm.”

The analysts drew parallels to the March 2020 flash crash, suggesting that such behavior is not unprecedented for the crypto market. They maintained that there are no “incremental negatives” specific to the crypto sector in this downturn.

Despite the current turbulence, Bernstein remains optimistic about the long-term prospects of cryptocurrencies, particularly bitcoin. The analysts suggest that if rate cuts and increased monetary liquidity become the standard response to U.S. recession fears, “hard assets” like bitcoin, often referred to as “digital gold,” could see significant price appreciation.

The firm highlighted the growing institutional adoption of cryptocurrencies as a positive factor. Unlike previous market cycles, investors now have easier access to bitcoin through highly liquid spot Bitcoin exchange-traded funds (ETFs), which are trading around $2 billion in daily volume. The recent approval from major wirehouses, including Morgan Stanley’s decision to allow its financial advisors to offer spot Bitcoin ETFs to select clients from August 7, is expected to provide further on-ramps for asset allocation to bitcoin.

“We expect more wirehouse approvals into Q3 and Q4, thus providing further on-ramps for asset allocation to bitcoin. Bitcoin ETF flows have remained sticky so far, exceeding $17 billion year-to-date,” the Bernstein team noted.

The analysts also pointed out that newly launched spot Ethereum ETFs have shown promise, generating $1.6 billion worth of inflows. However, they cautioned that ether’s price might need to see stabilized flows over the coming weeks before entering a new demand cycle.

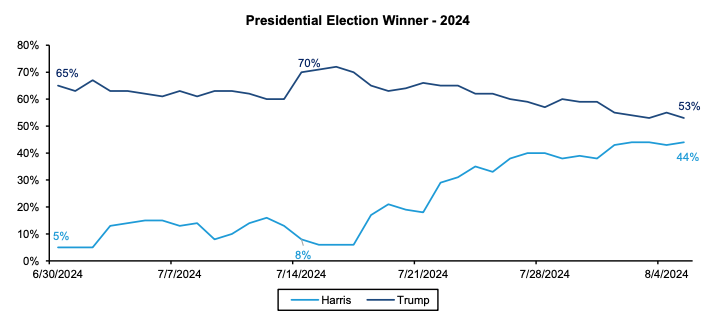

Bernstein also highlighted the influence of U.S. politics on the crypto market, describing bitcoin as a “Trump trade” due to the market favoring the former president’s pro-crypto stance.

“It’s not surprising that as the Polymarket odds between Trump and Harris narrowed, bitcoin and crypto have traded weak,” the analysts observed.

They expect the crypto market to remain range-bound until the U.S. elections, reacting to catalysts such as presidential debates and the final election outcome.

Looking ahead, Bernstein anticipates that the crypto market will continue to respond to macroeconomic and election cues throughout the third quarter. However, they predict that if broader equity markets recover in response to potential Federal Reserve actions, bitcoin and other cryptocurrencies are likely to follow suit.

It’s worth noting that Chhugani, one of the report’s authors, maintains long positions in various cryptocurrencies, underlining the firm’s continued confidence in the sector despite current market volatility.