Key Insights

- Despite 150%+ surge in 2023, key bitcoin indicators like Puell Multiple, MVRV and Mayer Multiple suggest bull run still in mid-stage rather than overheated peak

- Blockchain signals like miner outflows and realized versus market price paint rational picture rather than arguing for major pullback

- Investors waiting on sidelines for deep discount entry risk leaving returns on table amid strong technical and on-chain backdrop

Bitcoin has exploded over 150% higher in 2023, easily outpacing traditional assets. With such rapid gains in under a year, some investors may intuitively feel Bitcoin is overextended and due for a pullback. However, key on-chain indicators related to miner patterns, blockchain activity, and historical price averages suggest the crypto king still has ample room left to run.

Why This 150% Bitcoin Rally May Have Room to Run

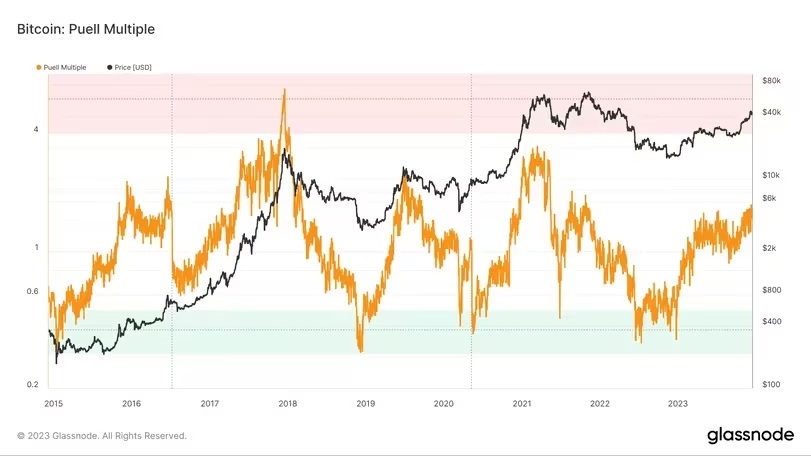

The Puell Multiple tracker of mining profitability shows miners are liquidating coins at a moderate pace – the metric remains well below levels typically associated with distribution and market peaks.

As the next halving event approaches in March 2024, which slashes Bitcoin rewards per block, the indicator could plunge further into undervalued territory.

Similarly, Bitcoin’s current market value based on price significantly exceeds its “realized value,” which adjusts for lost coins. However, the divergence measured by the MVRV Z-score is not close to historical overvaluation thresholds.

Readings above 8 signal bull market exhaustion – Bitcoin’s score is less than half that today.

Finally, despite Bitcoin’s stellar 2023 performance, its price remains 1.4 times above its 200-day moving average, via the Mayer Multiple indicator. While high, it has approached 5x in past bull market frenzies. The metric suggests Bitcoin can rally another 50% just to touch the upper edge of “overbought” territory relative to its long-term trend.

So while Bitcoin has seen massive gains, key blockchain metrics indicate this bull market likely remains in its middling phase rather than the termination phase. Miners are not overselling, realized value is lagging market value, and its prevailing uptrend has historical precedent to persist and reach much greater extremes. Crypto winter may not resume just yet.