Key Insights

- Bitcoin ETFs saw volatile first day trading Thursday, swinging with the cryptocurrency’s price fluctuations during a choppy session.

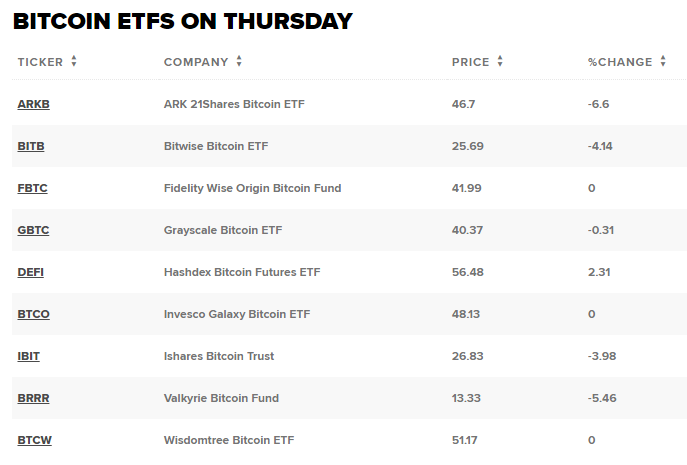

- The Grayscale Bitcoin Trust rose over 1.3% midday while the iShares Bitcoin Trust dropped 4% after an early spike.

- Bitcoin topped $49,000 briefly before falling back under $47,000 to leave it almost flat as asset managers bet ETFs bring new investors.

NEW YORK – The first bitcoin exchange-traded funds (ETFs) in the United States saw volatile trading on their launch day Thursday, mirroring swings in cryptocurrency prices during a choppy session.

The Grayscale Bitcoin Trust (GBTC), the largest of 11 bitcoin ETFs debuting, rose over 1.3% midday after heavy early volume. Meanwhile, the iShares Bitcoin Trust (IBIT) dropped more than 4% following an initial jump.

Their price swings coincided with fluctuations in bitcoin itself, which briefly topped $49,000 before falling back below $47,000 – leaving the cryptocurrency almost flat on the day.

ETFs allow mainstream investors exposure to an asset’s returns without directly owning it. Asset managers bet bitcoin ETFs will draw fresh money into the $1 trillion crypto market from investors and financial advisors.

This will mainstream the asset class, said WisdomTree CEO Jonathan Steinberg on CNBC. It will allow less tech-savvy investors to buy bitcoin in a way they’re comfortable with.

The ETFs’ early trading action will be scrutinized to see how closely shares track actual bitcoin prices. Prolonged gaps could indicate issues with the funds and ward off potential buyers even during temporary outperformance.

Trading volume will also be key for efficiency. To attract investors, several issuers cut fees before launch while others offered temporary 0% management fees.

Ultimately the ETFs stand to benefit from growing institutional adoption of cryptocurrencies to hedge risks like inflation. This year, electric vehicle maker Tesla and hedge fund managers Paul Tudor Jones and Stanley Druckenmiller all endorsed bitcoin.

Approval for bitcoin ETFs also marks a shift for regulators like the Securities and Exchange Commission, which repeatedly rejected such proposals in prior years. Chair Gary Gensler has targeted crypto companies but appears open to mainstream offerings allowing regulated access.

Thursday’s volatile launch keeps open the prospect of wider integration between the crypto asset and mainstream financial worlds. As one digital asset manager said: “it’s still only day one.”