Key Insights

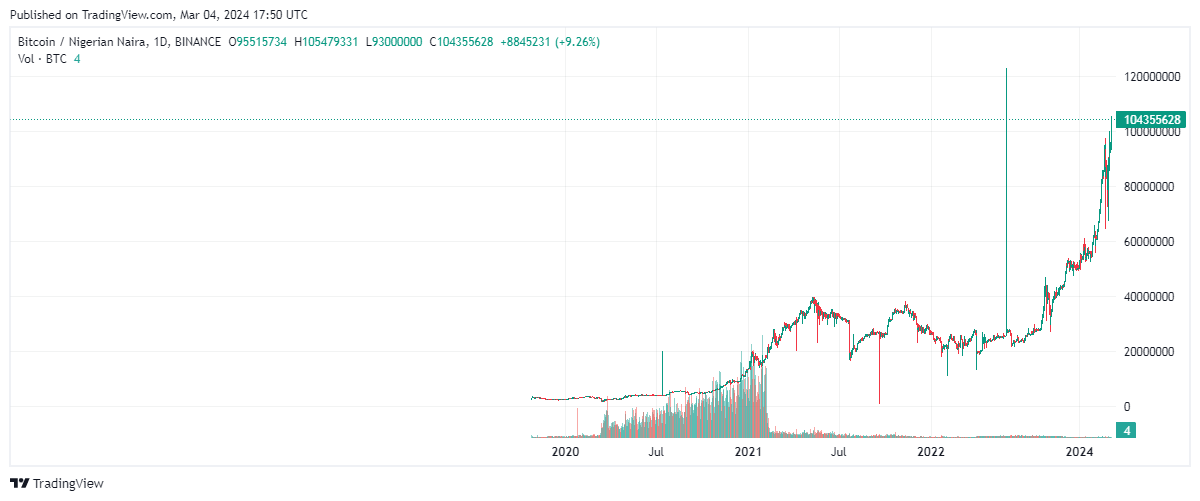

- Bitcoin hit a new all-time high of 104,002,640 Naira ($66,367) on Monday

- Rally fueled by halving event anticipation, geopolitical risks, institutional FOMO

- Analysts see Bitcoin surging past $69,000 as “halving frenzy” accelerates

LAGOS (MarketsXplora) – Bitcoin hit a record peak against the Nigerian naira on Monday, driven by a potent mix of geopolitical risks, institutional demand and expectations that an upcoming halving event will deliver a supply shock to cryptocurrencies.

The world’s biggest cryptocurrency had soared past 104 million naira for the first time ever on Monday, around $66,367, fueled by euphoric sentiment around an upcoming halving event that promises to constrict new supply.

Bitcoin’s Naira dream shattered as Nigeria cracks down on crypto

But the naira rally was cut short this week as major telecoms firms in Nigeria blocked access to leading global exchanges such as Binance, Coinbase, Kraken, OKX, Bybit and Crypto.com on orders from the Nigerian Communications Commission (NCC).

Among other affected platforms were forex brokers ForexTime (FXTM), OctaFX, and local player Luno. The chaotic scenes underscored the struggle by Nigerian authorities to curb rampant cryptocurrency trading that has battered the naira.

The crackdown caps a series of hawkish policies aimed at curbing naira weakness by targeting unregulated crypto flows that bypass official channels.

Nigeria has argued informal digital asset trading, worth billions of dollars annually, worsens volatility for the naira and enables illicit fund transfers – something the exchanges have denied.

The National Security Adviser’s office has also reportedly detained two senior Binance officials in Abuja as the clampdown intensifies.

In response, Binance said on Wednesday it had disabled its naira peer-to-peer trading service “to prevent further infrastructure breakdown.”

The shutdown could further undermine by making it harder for Nigerians to use crypto as a de-facto currency given the shortcomings of the embattled naira, one analyst said.

“There’s huge demand for crypto trading here and the government seems to be waging war against that,” said Adedeji Owolabi at Lagos-based CBN Capital. “Good luck trying to contain the uncontainable though.”

The crackdown marks a stark reversal from late 2023 when Nigeria lifted a two-year ban on banks dealing in cryptocurrencies and launched its central bank digital currency (CBDC) eNaira.

Africa’s biggest economy was also the second country to roll out a CBDC and has sought to promote the naira-backed cNGN stablecoin launched in February.

But the naira has continued its relentless slide on the parallel market, losing over a third of its value in the past five years as forex shortages and policy fumbles dent investor confidence.

That has seen Nigerians flock to crypto as a store of value and for cross-border payments despite central bank curbs, fuelling concern among authorities.

“A clampdown just puts Nigeria further behind the curve on digital assets and payments innovation,” Stephen Ethan, financial analyst at MarketsXplora.