Key Insights

- Only 4% of the global population holds Bitcoin, with the U.S. leading at 14%.

- Bitcoin adoption is still in its early stages, reaching just 3% of its potential.

- Key adoption barriers include lack of financial education and high volatility.

NEW YORK (MarketsXplora) – Despite Bitcoin’s increasing prominence in financial markets, only 4% of the world’s population currently holds the cryptocurrency, with the highest concentration of ownership in the United States, where an estimated 14% of individuals own BTC, according to a recent report from Bitcoin financial services company River.

The research underscores North America as the leading region in Bitcoin adoption among both individuals and institutions, while Africa lags behind with the lowest rate at just 1.6%.

River’s findings suggest that Bitcoin adoption remains disproportionately higher in developed economies compared to developing regions.

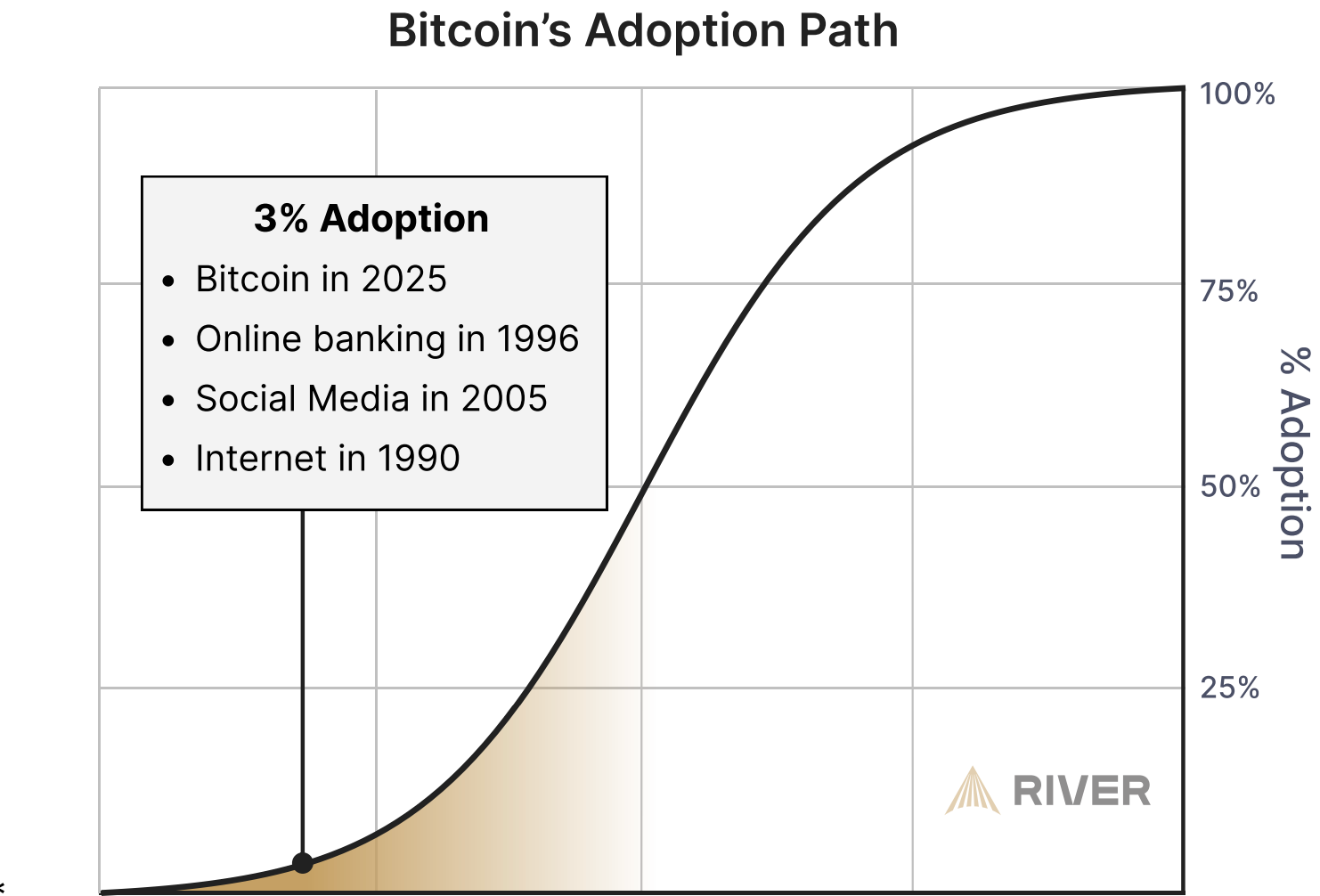

Bitcoin Adoption Still in Early Stages, Reaching Just 3% of Potential

River estimates that Bitcoin has only reached 3% of its total adoption potential, reinforcing the notion that the digital currency is still in the early phases of global integration.

The firm arrived at this figure by assessing Bitcoin’s total addressable market, factoring in adoption among governments, corporations, and institutions—currently standing at just 1%.

Additionally, institutional underallocation and individual ownership rates contributed to River’s calculation, further supporting the argument that Bitcoin still has significant room for growth before reaching mass adoption.

While Bitcoin has made strides from its early cypherpunk origins to recently becoming a reserve asset for the U.S. government, several barriers continue to hinder its widespread acceptance on a global scale.

What’s Stopping Bitcoin From Reaching Mass Adoption?

The most significant obstacle to Bitcoin’s mass adoption is a lack of financial and technical education. Widespread misconceptions persist, with many individuals perceiving Bitcoin as a scam or Ponzi scheme, fueled by misinformation and a general lack of understanding about digital assets.

Additionally, Bitcoin’s notorious volatility remains a key concern. While price fluctuations attract short-term traders, they pose challenges for individuals seeking to use Bitcoin as a stable medium of exchange or a reliable store of value.

This issue is particularly pronounced in developing economies, where residents have increasingly turned to U.S. dollar-pegged stablecoins instead. These digital assets offer lower transaction fees and relative price stability, making them a more viable alternative to Bitcoin for wealth preservation.

During the White House Crypto Summit on March 7, U.S. Treasury Secretary Scott Bessent announced that the United States would leverage stablecoins to uphold U.S. dollar hegemony and maintain its status as the world’s reserve currency.