Key Insights

- Bitcoin achieved a 2022-high, surpassing $34,000 amid the ongoing October crypto market rally.

- Other cryptocurrencies like Chainlink (LINK), Polkadot’s DOT, and Polygon’s MATIC saw significant gains.

- Despite the optimism, some analysts remain cautious as Bitcoin’s blockchain metrics show a drop in transactions and economic throughput.

Bitcoin (BTC) briefly soared past the $34,000 mark on Monday, marking its highest price point since May 2022. This momentous rise continued the cryptocurrency markets’ October bull run, driven by a prevailing sense of optimism that a Bitcoin exchange-traded fund (ETF) may soon receive approval in the United States.

Over the past 24 hours, Bitcoin exhibited impressive growth, clocking an increase of more than 10.5%.

What’s Fueling the October Bull Run?

What ignited this recent spark of hope was the mounting belief that the U.S. would, at long last, embrace Bitcoin ETFs. This sentiment was bolstered by a recent court ruling favoring Grayscale, a development that boosted the odds of converting its flagship GBTC product into an ETF. Additionally, BlackRock’s iShares Bitcoin ETF getting listed on DTCC, provided further fuel to the fire. While this doesn’t yet signal an ETF’s approval, some interpreted it as a sign of BlackRock’s confidence in victory.

Looking beyond Bitcoin, Chainlink (LINK), Polkadot’s native token (DOT), and Polygon’s (MATIC) emerged as some of the best-performing large-cap digital assets, notching substantial gains ranging from 6% to 10%. Ether (ETH) and Ripple-related token (XRP) also entered the green, posting gains of 2% to 3%.

In the broader financial landscape, the U.S. stock market experienced a turbulent day, initially recording losses on Monday before concluding with a mixed performance. Of note, the 10-year Treasury yield exhibited significant volatility, ultimately reversing its trajectory after briefly touching the 5% mark, a level unseen for 16 years.

What is next?

The big question now is, what lies ahead for the price of BTC? According to Bitcoin Trend Indicator BTI, a measure of directional momentum and strength in Bitcoin’s price action, the outlook is bullish as it shifted to a “significant uptrend” following Bitcoin’s robust performance above the $30,000 threshold.

Stephen Ethan, market analyst at MarketsXplora, underlined the decoupling of BTC, ETH, and the Market Index from tech stocks and the rising long-dated yields.

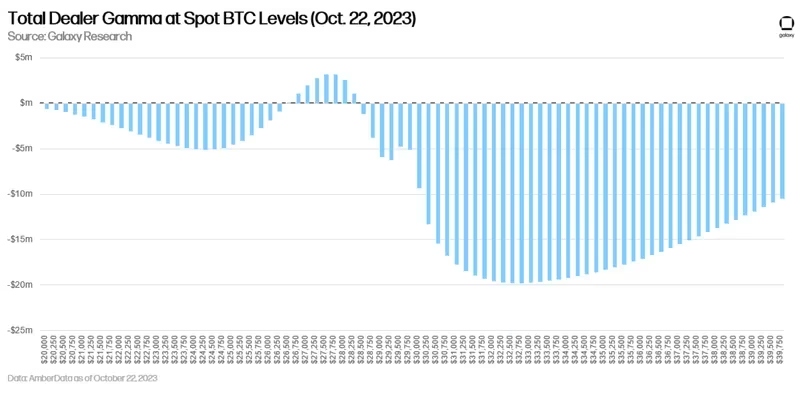

Alex Thorn, research head at digital asset investment firm Galaxy, emphasized that this uptrend could gain even more momentum. Option dealers, in an effort to hedge their positions above the $30,000 price level, may need to acquire Bitcoin on the spot market.

Thorn explained that for every 1% upward movement, nearly $20 million of BTC will need to be purchased by options dealers to maintain a delta-neutral position. This positioning suggests that market makers will need to buy increasing amounts of delta as the spot price surges higher, potentially adding to the volatility in the short term.

Nonetheless, ByteTree analysts present a more cautious view. They observed a significant drop in transaction numbers on the Bitcoin blockchain, a 50% decline in just a month, and a declining economic throughput on the Bitcoin network. ByteTree’s Shehriyar Ali and Seran Dalvi pointed out that this implies the current price surge is largely fueled by anticipation of positive news, a condition that might not be sustainable in the short term.

For those eyeing support levels, Galaxy’s Thorn suggests that the $26,750-$28,250 range should serve as a key support zone for Bitcoin’s price.

[…] shows that demand for higher strike price call options has risen sharply amid bitcoin’s recent rally. This has left options market makers significantly short on gamma exposure above […]