Key Insights

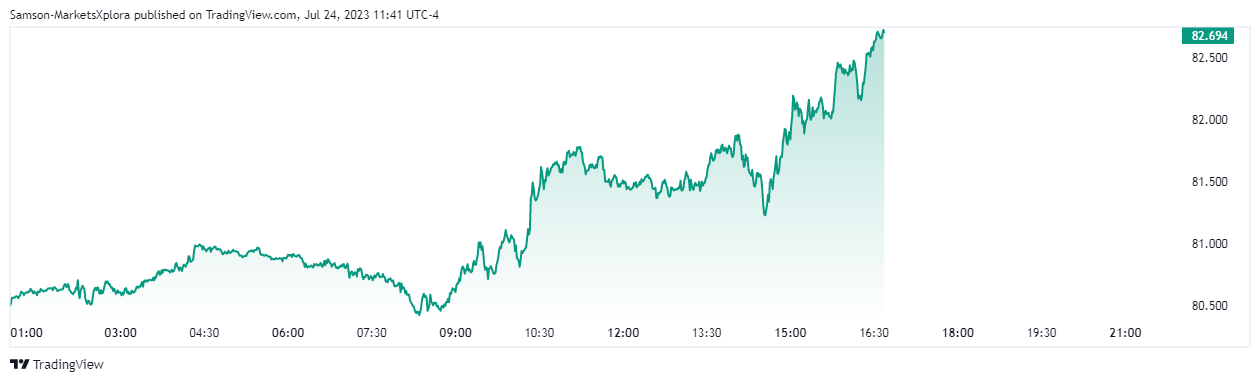

- The price of Brent oil approached $82 per barrel for the first time since April 24.

- Oil rises in price for the fourth week in a row, which analysts attribute to a decline in production in Saudi Arabia and Beijing’s plans to stimulate economic growth

The price of Brent crude oil approached $82 per barrel for the first time since April 24, 2023, according to trading data on the London ICE exchange.

September Brent futures peaked at $81.96 a barrel. At the time of writing, Brent crude for September 23 delivery was selling at $81.93 per barrel, up 1.06%.

The last time the price of Brent oil approached these levels was three months ago – on April 24, a barrel of this brand was trading at $81.76.

West Texas Intermediate (WTI) oil rose in price by 0.79% to $77.68 per barrel.

Surging Brent Crude: Potential for $90 per Barrel

Oil on world markets is rising in price for the fourth week ago against the backdrop of a reduction in its production by Saudi Arabia and its partners in OPEC +, the price of Brent has increased by 10% during this time.

The cut in Saudi Arabia’s oil production has weighed on the market … even though demand for gasoline and jet fuel was slightly higher in the summer,” Citi Research said in a Reuters report.

The bank’s analysts see the potential for oil prices to rise in the summer and forecast an average price in the third quarter of the year at $83 per barrel.

Tighter market conditions due to OPEC supply cuts and increased market speculation about further stimulus in China will continue to push prices higher in the third quarter of 2023,” analysts at the National Australian Bank agreed.

Related: Brent Oil Prices Unlikely to Fall Below $70, Citigroup Predicts

The agency recalls that the Chinese authorities on July 24 announced measures to stimulate private investment in infrastructure, noting that they will strengthen financial support for private projects. These measures are likely to increase demand for oil from the world’s second largest oil consumer.

Fatih Birol, chief executive of the International Energy Agency, said over the weekend that the market could return to a supply deficit, recalls Bloomberg. The agency notes that the US Federal Reserve may announce another rate hike this week to curb inflation. This could send the world’s largest economy into recession and hurt demand for oil.

There are probably still some concerns about the upcoming Fed meeting. But in general, I would say that the market seems to believe that onshore oil reserves are starting to decline, said Giovanni Staunovo, an analyst at UBS Group in Zurich.

According to his forecast, by the end of the year, the price of Brent oil may rise to $90 per barrel.

[…] may extend the decision to reduce production further, as well as further reduce the volume of oil produced, the report […]

[…] price of Brent crude oil exceeded $87 per barrel for the first time since April 12. October futures for Brent on the ICE […]