Key Insights

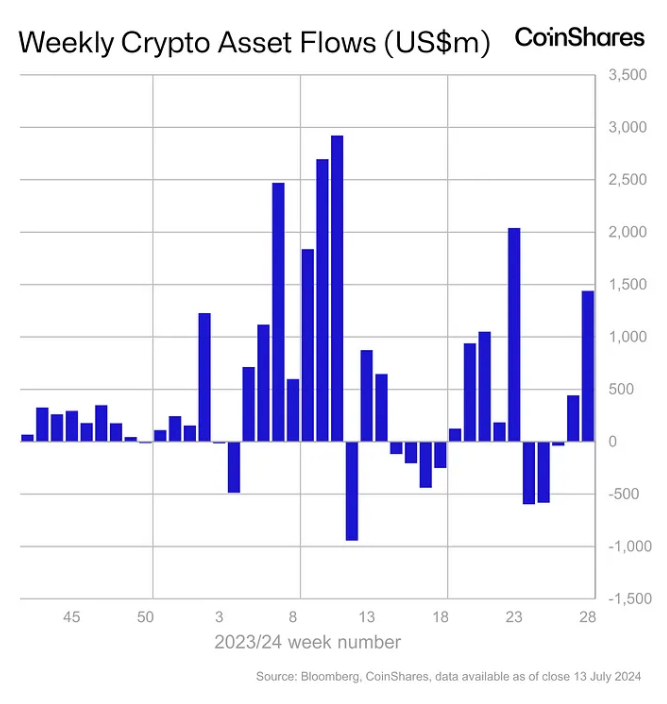

- Global crypto investment products recorded $1.44 billion in net inflows last week, pushing year-to-date figures to a record $17.8 billion.

- Bitcoin-based funds dominated with $1.35 billion in inflows, while Ethereum products saw their largest inflows since March at $72 million.

- U.S.-based funds led regionally with $1.3 billion in net inflows, with U.S. spot bitcoin ETFs alone attracting $1.05 billion last week.

NEW YORK (Reuters) – Global cryptocurrency investment products recorded net inflows of $1.44 billion last week, marking one of the largest weekly gains and pushing year-to-date figures to a record $17.8 billion, according to data from CoinShares.

The surge in inflows, which occurred despite recent price weakness in the crypto market, far surpasses the $10.6 billion generated during the 2021 bull run, CoinShares Head of Research James Butterfill reported.

Bitcoin-based funds dominated the inflows with $1.35 billion, while short-Bitcoin products experienced their largest weekly net outflows since April, totaling $8.6 million. U.S. spot bitcoin exchange-traded funds (ETFs) alone attracted $1.05 billion last week, bringing their total net inflows since January launch to $15.8 billion.

“We believe price weakness due to the German government bitcoin sales and a turnaround in sentiment due to lower than expected CPI in the U.S. prompted investors to add to positions,” Butterfill said.

Bitcoin’s price has rebounded over 10% in the past week, partly attributed to a surge following a failed assassination attempt against pro-Bitcoin former U.S. President Donald Trump.

Ethereum products saw their largest net inflows since March, adding $72 million last week, likely in anticipation of U.S. spot ETF launches. The SEC approved eight 19b-4 forms for spot Ethereum ETFs on May 23, with trading potentially beginning this week pending S-1 registration effectiveness.

U.S. Dominates as Global Crypto Inflows Surge

Regionally, U.S.-based funds led with $1.3 billion in net inflows, followed by Switzerland, Hong Kong, and Canada.

Despite the significant inflows, trading volumes across crypto exchange-traded products remained below the $21 billion weekly average this year, generating just $8.9 million last week, reflecting a seasonal summer lull.

Asset managers including Ark Invest, Bitwise, BlackRock, Fidelity, Grayscale, ProShares, and 21Shares contributed to the record inflows.