Key Insights

- Cryptocurrency theft surged 112% in Q2 2024, totaling $572 million.

- Hacks dominated as the primary cause of losses, increasing 155% year-on-year, while fraud decreased by 81%.

- Ethereum and BNB Chain were the most targeted networks.

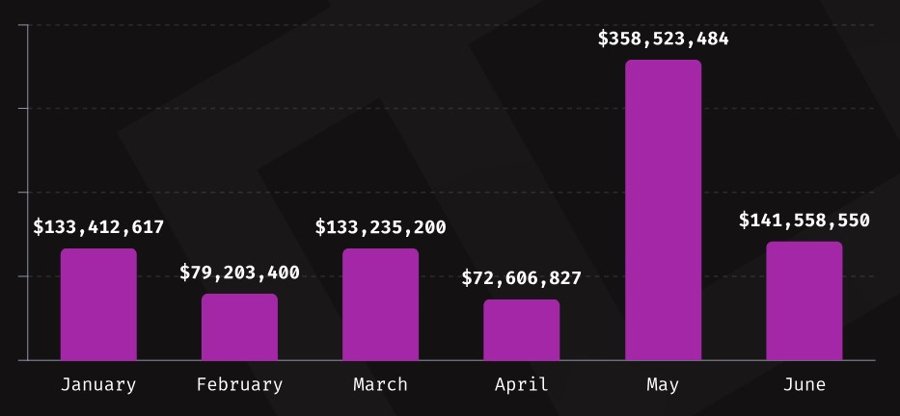

LONDON (MarketsXplora) – Cryptocurrency theft surged in the second quarter of 2024, with losses from hacks and scams more than doubling to $572 million, according to a report released on Wednesday by Immunefi, an on-chain crowdsourced security platform.

The dramatic 112% increase from $265 million in the same period last year marks a troubling resurgence in malicious activities targeting the crypto sector, particularly centralized exchanges, following a period of decline.

Two major incidents accounted for nearly two-thirds of the total losses. Japan’s DMM Bitcoin exchange suffered a devastating $305 million theft, while Turkey’s largest cryptocurrency exchange, BtcTurk, reported a $55 million loss.

Read also! North Korea Hackers Stole Over $1 Billion in Crypto in Record Heists

Hacks dominated as the primary cause of losses

Hacks remained the primary cause of crypto losses, totaling $564 million across 53 incidents, a 155% increase year-on-year. In contrast, fraud, including scams and rug pulls, decreased by 81% to $8.45 million across 19 incidents.

Centralized Finance (CeFi) platforms bore the brunt of the attacks, accounting for 70% of total losses and experiencing a staggering 984% increase to $401 million across five incidents. Decentralized Finance (DeFi) platforms saw a 25% decrease in losses to $171 million across 62 incidents.

Ethereum and BNB Chain emerged as the most targeted blockchain networks, with Ethereum facing 34 incidents representing 46.6% of total losses, and BNB Chain witnessing 18 incidents accounting for 24.7% of losses.

Despite the surge in theft, there was a slight improvement in fund recovery. Approximately $26.7 million, or 5% of total losses, was recovered in Q2 2024, up from a 3.9% recovery rate in Q2 2023.