Key Insights

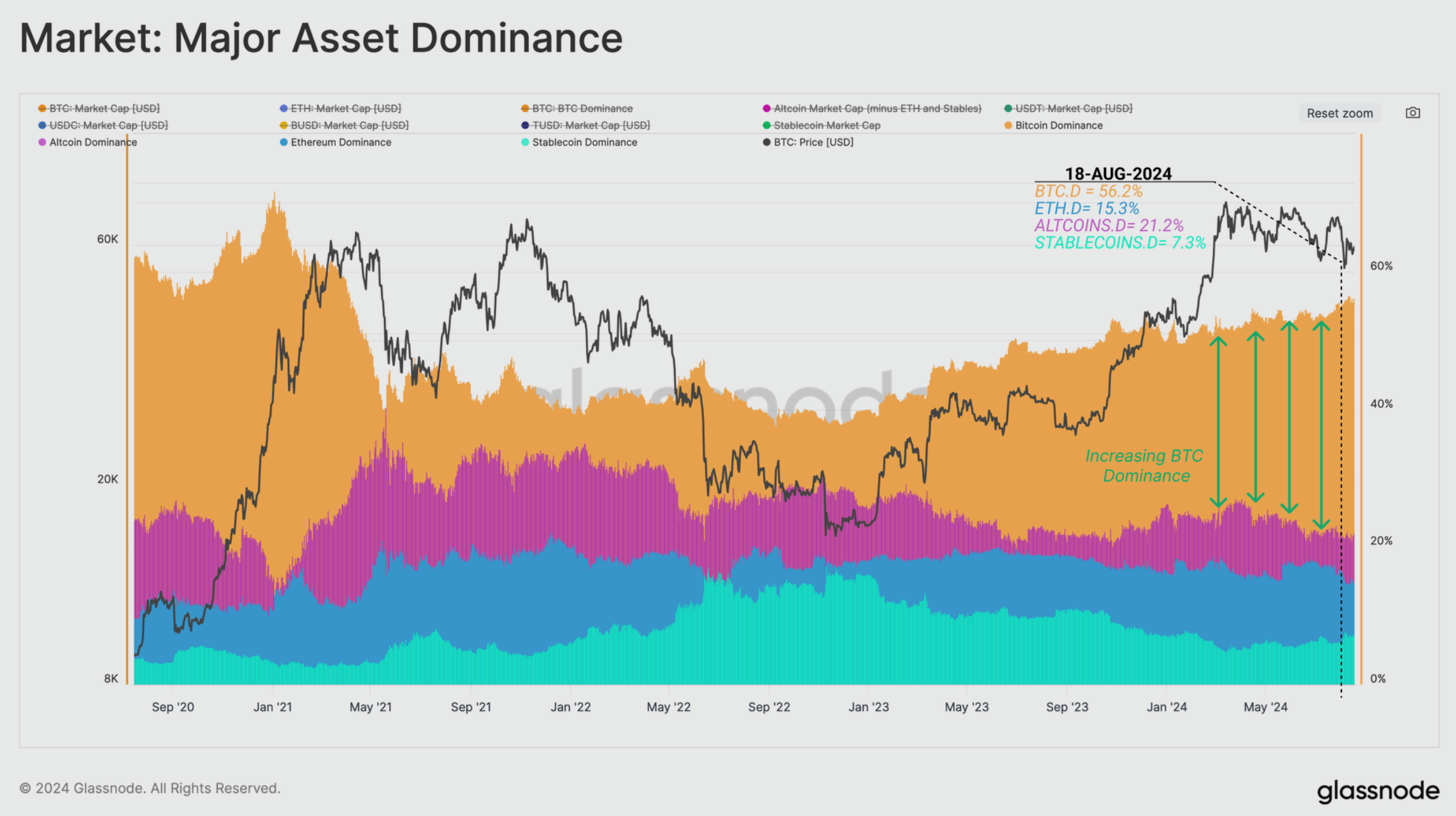

- Ethereum’s dominance has declined by over 1.5% since the November 2022 cycle low, while the wider altcoin sector has experienced a more pronounced 5.9% drop, according to Glassnode’s analysis.

- In contrast, Bitcoin’s dominance has risen from 38% in November 2022 to 56% of the total digital asset market today, reaching its highest level since April 2021.

LONDON (MarketsXplora) – The cryptocurrency market has seen a notable shift in the dominance of Ethereum (ETH) relative to other digital assets, according to the latest analysis from blockchain analytics firm Glassnode.

Since the cycle low established in November 2022, Ethereum has recorded a dominance decline of over 1.5%, while the wider altcoin sector has experienced a more pronounced decline of 5.9%.

Despite Ethereum’s price increasing by around 66% since November 2022, and Bitcoin (BTC) appreciating by over 73%, the data suggests that capital is continuing to accrue towards the major asset end of the digital asset risk curve.

Glassnode’s Weekly on-chain report reveals that altcoin dominance has fallen from 27.2% to 21.3% since the cycle low.

In contrast, the report cited data showing that Bitcoin dominance has risen from 38% in November 2022 to 56% of the total digital asset market today. On August 5th, when Bitcoin’s price dropped to around $49,000, Bitcoin dominance surged to a high of 59.56%.

“With a degree of uncertainty rife amongst market investors, capital continues to flow down the risk curve, leading to a significant expansion in bitcoin dominance,” Glassnode analysts commented.