Key Insights

- An MIT alumnus and SoftBank executive has launched a dirham-backed stablecoin called DRAM to provide relief to nations with high inflation.

- Distributed Technologies Research (DTR), based in Abu Dhabi, has been developing this stablecoin since October 2022.

- Despite regulatory limitations, DRAM aims to meet the demands of companies in the UAE and regions facing inflation and currency challenges.

In a bid to provide relief to nations battling hyperinflation, a former Massachusetts Institute of Technology (MIT) alumnus and SoftBank executive has launched an innovative dirham-backed stablecoin. This digital currency venture seeks to offer exposure to the United Arab Emirates‘ (UAE) fiat currency, providing a haven from the economic turmoil often associated with skyrocketing inflation.

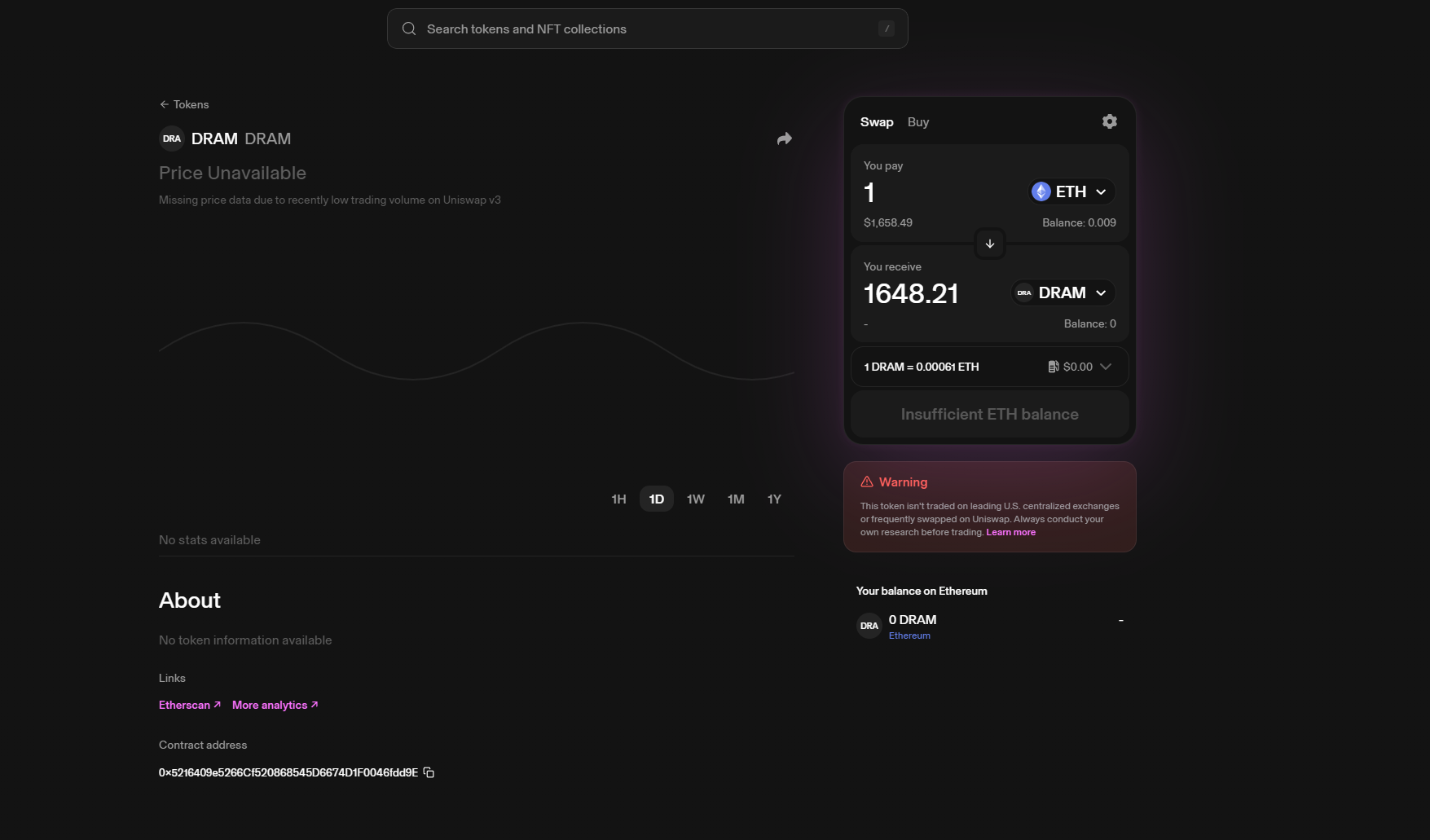

Akshay Naheta, co-founder, and CEO of Distributed Technologies Research (DTR), was the driving force behind this groundbreaking initiative. He recently unveiled the DRAM stablecoin, which made its debut on decentralized finance platforms Uniswap and PancakeSwap on October 3.

How does DRAM stablecoin work?

Distributed Technologies Research, a company based in Abu Dhabi, has been diligently working on the technology underpinning this dirham-backed stablecoin since October 2022. Notably, Naheta chose to reboot DTR in Abu Dhabi, despite initially co-founding it in Switzerland back in 2019.

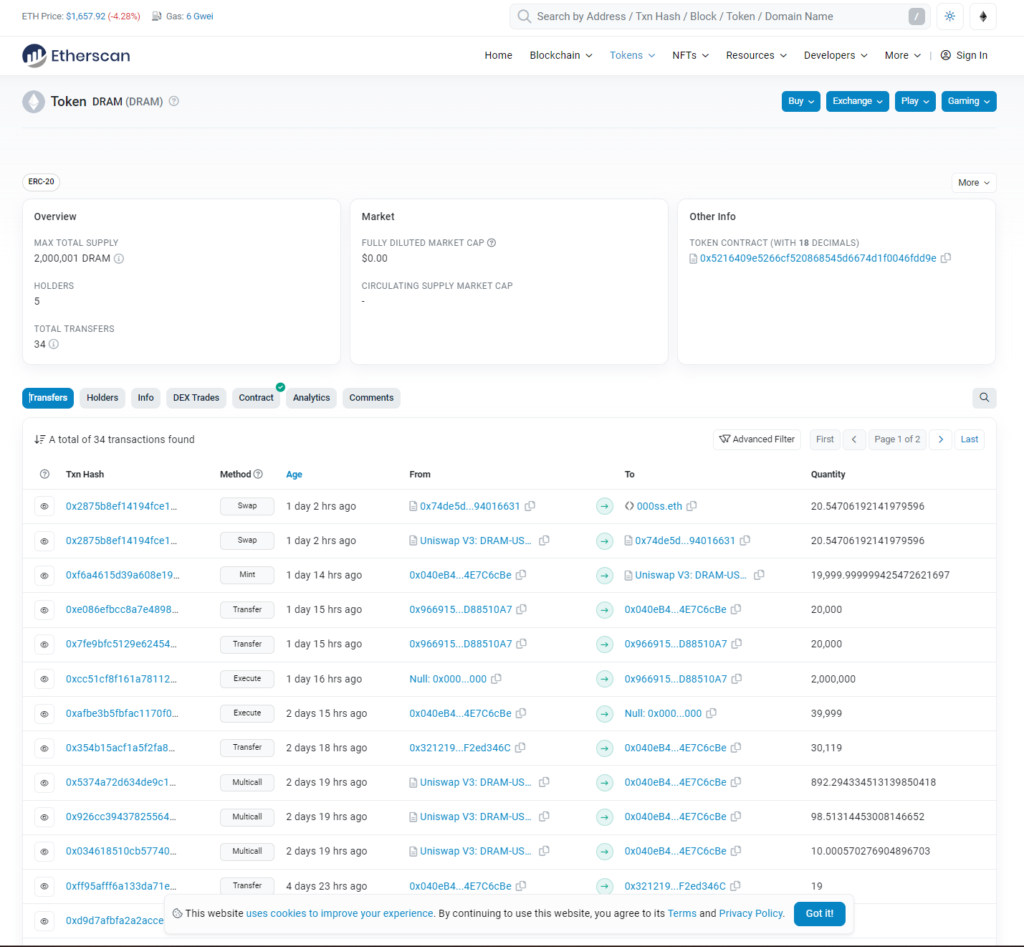

DRAM, the stablecoin in question, operates as an Ethereum ERC-20 token and is issued by Dram Trust, a Hong Kong-based entity. For regulatory compliance and oversight, an independent trustee with licensing and regulation from the Hong Kong Monetary Authority is responsible for approving token creations and burns.

At present, DRTR is unable to offer DRAM within Hong Kong or the UAE. However, Naheta hinted at ongoing discussions to facilitate token liquidity, potentially enabling listings on centralized exchanges beyond these two jurisdictions. Compliance with regulatory guidelines necessitates the deposit of dirham fiat reserves before minting any DRAM tokens, with these reserves held in regulated financial institutions.

The DRAM ecosystem extends across various blockchain networks, including Ethereum, BNB Smart Chain, and Arbitrum. The Ethereum token contract currently reflects a maximum total supply of 2 million DRAM. In contrast, the Arbitrum contract shows 499,999 DRAM, and the BNB Smart Chain contract holds 2.5 million DRAM.

Backstory of Distributed Technologies Research

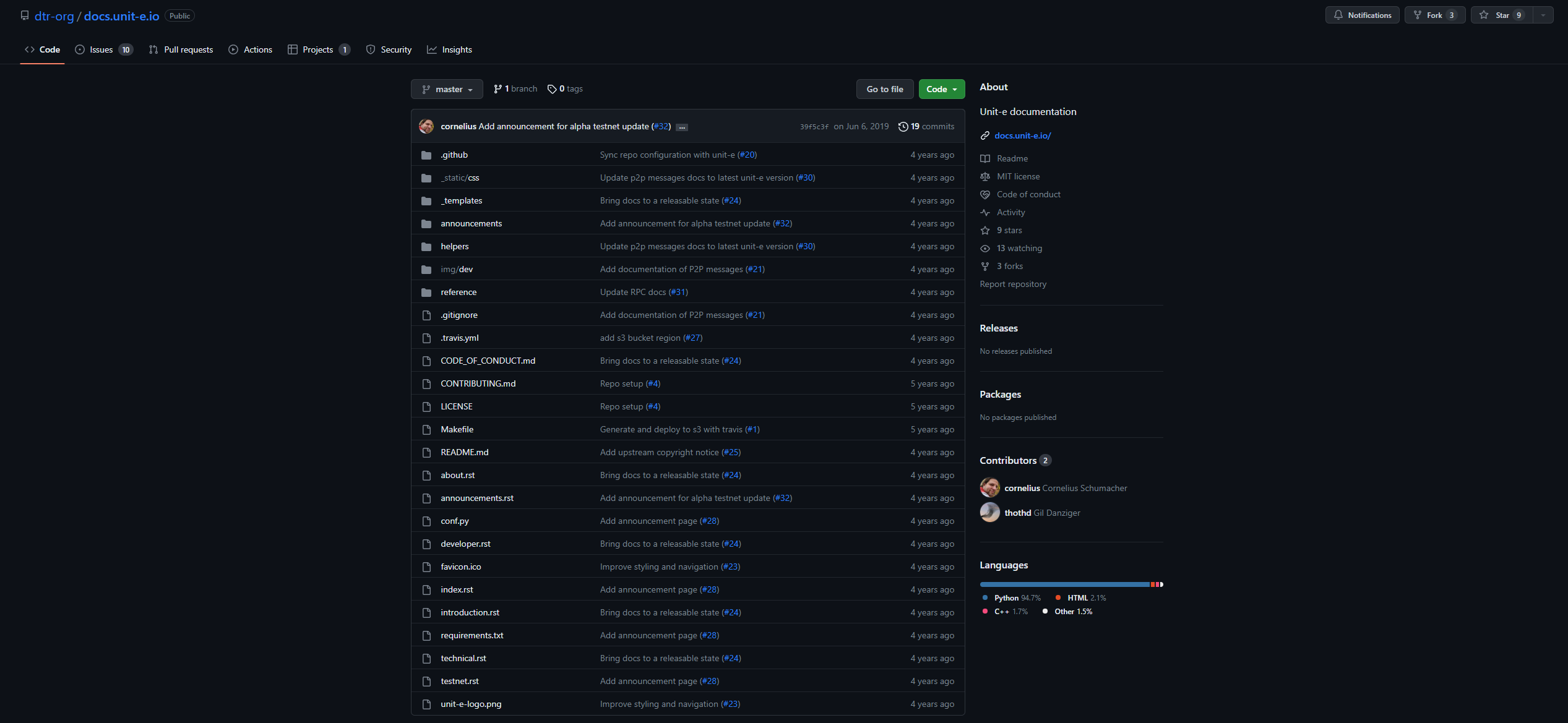

In a surprising twist, MarketsXplora’s background investigation revealed DTR’s previous launch in Switzerland four years ago. The company gained recognition for its development of Unit-e, a decentralized payments system.

This ambitious project was a collaborative effort, drawing on the expertise of academics and developers through partnerships and grants with esteemed institutions like Stanford University, MIT, and the University of Illinois.

Notably, Naheta founded DTR during his tenure at SoftBank, and DTR’s Unit-e project was developed by a Berlin-based team of developers. The primary goal was to disrupt payment systems and create a protocol capable of handling high throughput with exceptional cost efficiency.

Naheta explained the motivation behind DTR’s foray into the DRAM stablecoin, stating that although they cannot market it in the UAE, they anticipate substantial demand from regional companies grappling with high inflation and currency instability. He highlighted the robust performance and allure of the UAE economy as key factors influencing this decision.

The UAE is increasingly positioning itself as a prominent hub for cryptocurrencies and the broader Web3 ecosystem, thanks to its favorable regulatory environment designed to encourage financial innovation and the widespread adoption of digital assets. Industry giants like Coinbase have openly discussed future operations within the jurisdiction, while Binance, a heavyweight in the cryptocurrency space, is already actively operational in Dubai.