Key Insights

- Portofino’s UK unit registered as crypto firm by UK regulator FCA, allowing institutional dealings

- Joins handful of crypto companies to gain FCA approval; cements position as leading global market maker

- Registration enables OTC business growth in UK, requires stringent AML and compliance controls

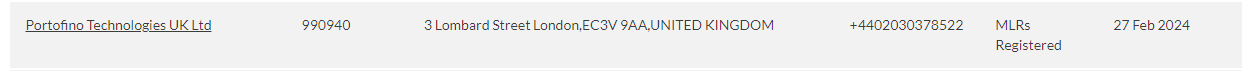

LONDON (MarketsXplora) – Switzerland-based crypto trading technology firm Portofino Technologies said on Wednesday its UK unit has been registered by Britain’s Financial Conduct Authority (FCA), allowing it to deal with institutional investors in digital tokens.

Portofino, founded by former Citadel Securities executives Alex Casimo and Leonard Lancia in 2021 and backed by $50 million in funding, is one of only a few crypto companies to gain clearance from the FCA.

The approval enables its over-the-counter (OTC) trading business to grow its UK client base and cements its position as a leading regulated global market maker, Casimo said.

“Receiving the FCA’s approval to operate as a cryptoasset trading firm in the UK is a significant milestone for Portofino Technologies, which will allow us to expand our institutional client base,” he said.

The company aims to provide liquidity across hundreds of cryptocurrency tokens to banks, trading platforms, asset managers and blockchain projects in Britain.

Registration with the FCA requires firms to meet anti-money laundering and compliance standards governing cryptoasset dealings.

Portofino General Counsel Celyn Armstrong said the approval demonstrates the Swiss company’s “strong and sophisticated” controls.

“Our traditional finance and digital asset clients alike can have full confidence that we are committed to stringent regulatory compliance,” Armstrong added.

The FCA has upped scrutiny of the crypto sector amid some high-profile collapses such as FTX last year. Approving Portofino to deal with professional investors signals Britain’s maturing oversight.