Key Insights

- FOMC to announce interest rate decision tonight

- The market is hoping that today’s 25bp uptrend. will be the last

- Fed Chairman Jerome Powell says another rate hike is possible this year

As the long-awaited meeting of the Federal Open Market Committee (FOMC) approaches, the financial world is seething with speculation about the possible consequences of raising the key rate for bitcoin (BTC) and other cryptocurrencies.

Tonight, the FOMC will announce its interest rate decision and Federal Reserve Chairman Jerome Powell will speak to the media.

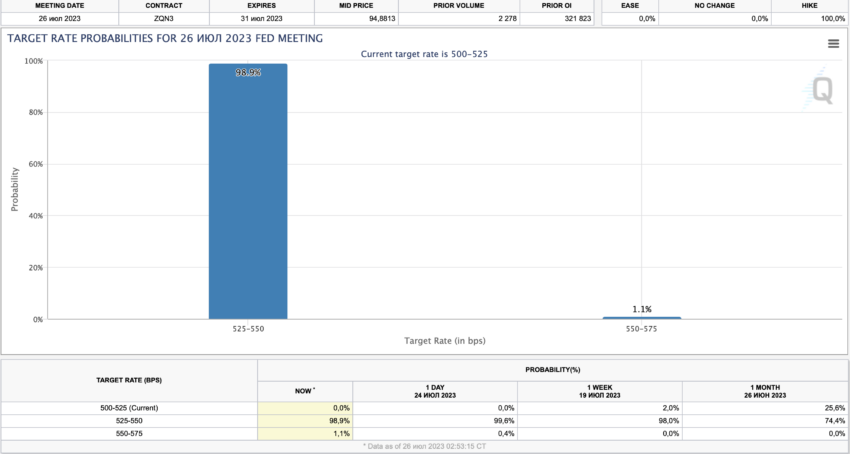

According to the CME FedWatch tool , the majority of market participants (99.8%) expect a 25 basis point rate hike. However, the real intrigue lies in what happens after this move and whether it will mark the end of the rate hike cycle.

Fed chairman favors further rate hike

Over the past 16 months, the Fed has been actively fighting inflation and raising interest rates to the highest level in the last 20 years. However, more and more signs point to the possible end of the austerity cycle. Traders are hoping that today’s 0.25 bp rate hike will in the range of 5.25-5.5% will be the last.

Factors such as declining inflation in the US and a weak labor market are driving up market expectations. June consumer price index (YoY) data showed that inflation eased to 3.0% from 4.0%. The base rate dipped from 5.3% in May to 4.8% in June. It is noteworthy that the key rate is now below the level of the US federal funds rate, which was a rather rare occurrence over the past 20 years.

Read also: Can Raising Interest Rates Truly Tame Inflation?

The prolonged tightening of the situation in the labor market, caused by an imbalance between supply and demand, has become the biggest headache for the Federal Reserve. At the peak of the imbalance, there were two vacancies for every available worker, causing wages to rise. As supply and demand balance, the number of jobs created decreases. In addition, the first signs of a slowdown in the growth of consumer spending appeared.

However, traders’ expectations may not match reality. In June, Fed Chairman Jerome Powell signaled the possibility of another rate hike this year, with some committee members calling for two. Thus, today’s FOMC meeting will help determine the further position of the central bank.

How the FOMC decision will affect the crypto market

Since early 2023, Bitcoin and other cryptocurrencies have shown relative resilience in the face of major macroeconomic events. However, this time market participants preferred to be cautious, realizing that the July FOMC meeting could have a more serious impact on digital asset quotes.

In addition, the bullish momentum that drove BTC to a new yearly high has all but faded away, with the price of the main cryptocurrency briefly dropping below $29,000 on Monday, signaling a potential surge in volatility amid the Committee’s decision.

This means that crypto traders should keep a close eye on the decision of the Interest Rate Committee and subsequent statements by Jerome Powell.

Any signal of a future rate hike cycle could have an impact on both the traditional and crypto markets, triggering further selloffs.

[…] Read also: Impact of FOMC Decision on Crypto Market […]