Key Insights

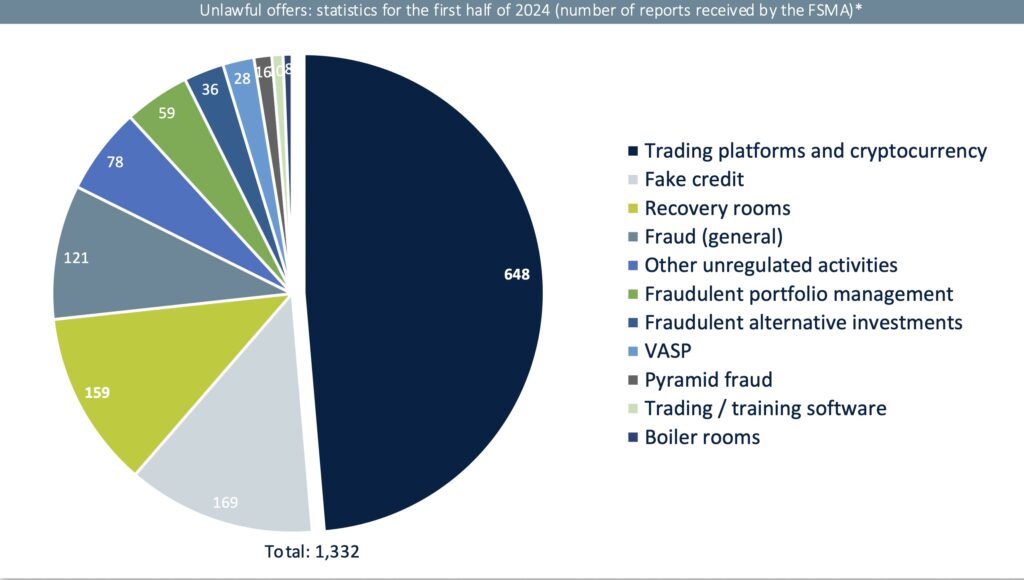

- FSMA reports a 44% year-on-year increase in consumer reports of unlawful financial activities in H1 2024, with 1,332 cases recorded.

- Fraudulent trading platforms and cryptocurrency scams account for about half of all reports, while ‘recovery room’ fraud cases have surged by 59%.

- The regulator issued 9 new warnings targeting 187 fraudulent entities and 239 websites in response to the growing threat of investment fraud.

BRUSSELS (MarketsXplora) – Belgium’s Financial Services and Markets Authority (FSMA) on Thursday released its investment fraud dashboard for the first half of 2024, revealing a significant increase in consumer reports and a concerning rise in “recovery room” fraud.

The FSMA received 1,332 consumer reports about unlawful activities in the first six months of 2024, marking a 44% increase from the 925 reports received during the same period in 2023. More than half (52.3%) of these reports were complaints from consumers who had lost money due to investment fraud or false credit offers.

Fraudulent trading platforms and cryptocurrency scams continue to dominate, accounting for approximately half of all reports received. However, the regulator highlighted a 59% year-on-year increase in reports of “recovery room” fraud, where scammers contact previous victims offering false assistance in recovering earlier losses.

“The FSMA has observed that fraudsters almost systematically re-contact victims of earlier frauds in order to offer them so-called ‘assistance’ in recovering losses incurred,” the regulator stated in its report.

In response to the growing threat, the FSMA issued 9 new warnings in the first half of 2024, targeting a total of 187 fraudulent entities and 239 websites.

The remaining reports received by the FSMA were inquiries from consumers seeking information about suspicious market participants or potentially unlawful activities, but who had not yet invested any funds.

Other types of fraud reported to the FSMA remained stable compared to the previous year, according to the dashboard.

The FSMA, tasked with combating unlawful activities in financial investments, uses this biannual dashboard to provide statistics and highlight key trends in investment fraud, aiming to better inform and protect Belgian consumers.