Key Insights

- OKX is shutting down operations in India and requiring users to withdraw funds by April 30th

- The move comes after Indian authorities recently issued compliance notices to other major foreign crypto exchanges

- OKX’s exit underscores challenges for crypto firms navigating India’s regulatory environment

MUMBAI (MarketsXplora) – Major cryptocurrency trading platform OKX said on Thursday it was closing down its operations in India and giving customers until April 30 to redeem their funds, citing difficulties operating in the face of local regulations.

The Seychelles-based exchange, ranked second globally by trading volumes, notified users in India that it would restrict user accounts after the end of this month, only allowing them to withdraw remaining balances.

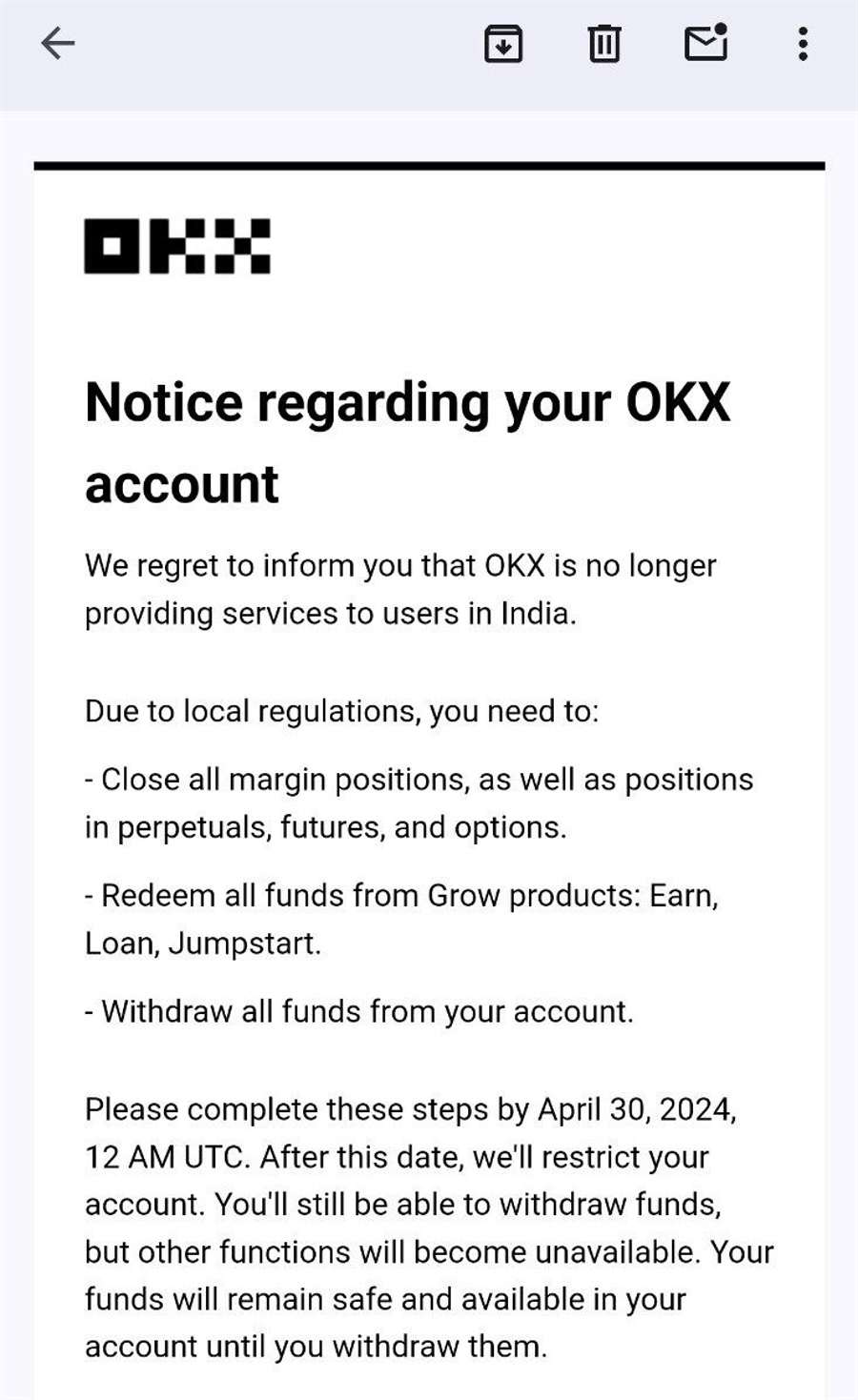

“We regret to inform you that OKX is no longer providing services to the users in India due to local regulations,” the exchange said in a notice to Indian clients seen by MarketsXplora.

OKX’s exit follows India’s financial intelligence agency issuing a compliance notice in January to nine other prominent foreign crypto exchanges including Binance and KuCoin, alleging violation of local anti-money laundering rules.

While OKX was not named in that notice, it had subsequently reinforced user verification processes for Indian clients. But the exchange has now opted to halt all operations for users based in India.

The move deals another blow to India’s crypto industry, which has been whipsawed over the past year by tax changes and the government’s mixed signals toward regulating digital assets.

Read also! OKX Announces Exit from Nigerian Market

It comes despite OKX expanding its global regulatory footprint, recently securing operating licences in Singapore and Dubai while launching crypto trading for the Turkish lira.

A finance ministry source said crypto exchanges had highlighted challenges operating under India’s existing rules around foreign exchange management and anti-money laundering laws. The official added that authorities would study OKX’s decision.

The Indian government is expected to present and debate a comprehensive crypto bill during the upcoming parliamentary session that could finally create a clearer regulatory framework.

India’s digital asset market had swelled to over 100 million users last year, according to industry estimations, despite an ongoing lack of formal regulation.