Key Insights

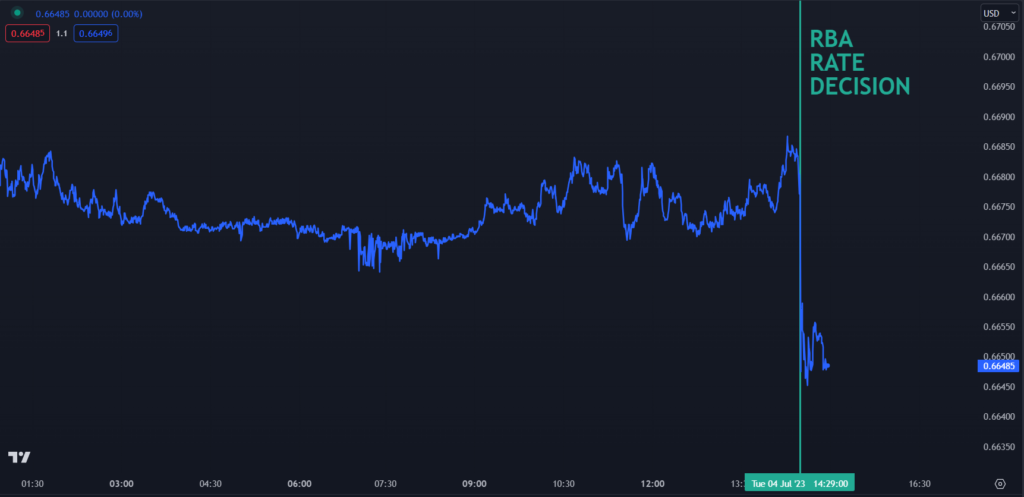

- RBA’s decision to pause monetary policy tightening leads to a dip in the Australian Dollar.

- Mixed signals from the RBA and economic data create uncertainty regarding future rate hikes.

- Attention shifts to the upcoming quarterly CPI figure, which will influence the RBA’s decision-making in the August monetary policy meeting.

The Australian Dollar faced a setback as the Reserve Bank of Australia (RBA) decided to pause its monetary policy tightening, maintaining the cash rate at 4.10% after a 25 basis point increase last month.

Australian dollar weakened 0.25% to 0.6652 against the US dollar.

This unexpected move had a ripple effect, with the ASX 200 receiving a boost.

What are the factors driving the RBA’s cautious approach towards inflation and economic growth?

Interestingly, the RBA’s stance seemed reminiscent of the US Federal Reserve’s approach at its June meeting, adopting a “hawkish hold” perspective.

In its accompanying statement, the RBA acknowledged the possibility of further tightening of monetary policy to ensure inflation returns to its target within a reasonable timeframe. However, the decision ultimately hinges on the evolving state of the economy and inflation.

Prior to the announcement, the futures interest rate market indicated less than a 20% probability of a rate hike.

Economists surveyed by Bloomberg were divided, with 14 in favor of a pause and 13 expecting a rate increase.

The uncertainty surrounding the decision can be attributed to mixed signals from both the RBA and the economic data.

The minutes from the June meeting hinted at a potential hold on rates for the current gathering. However, subsequent comments from RBA board members expressed a more hawkish sentiment regarding their outlook.

Adding to the complexity, the monthly inflation gauge fell short of expectations, coming in at 5.6% year-on-year by the end of May, below the forecasted 6.1%. This gauge, introduced last year, struggles to provide a reliable measure of price pressures within the Australian economy.

The Australian Bureau of Statistics (ABS) releases this monthly Consumer Price Index (CPI) figure, which covers a substantial portion of the weighted quarterly basket. However, the correlation between the monthly figure and the complete quarterly survey has proven to be volatile at best and, at worst, unreliable.

Following the release of the modest monthly CPI figure, retail sales outperformed predictions in May, rising by 0.7% compared to the anticipated 0.1% increase.

Additionally, Australian building approvals for May surprised with an impressive 20.6% month-on-month surge, surpassing the projected 3.0% rise and the previous -8.1% decline. Furthermore, the current unemployment rate stands at a near multi-generational low of 3.6%.

Looking ahead, the focus now turns to the quarterly CPI figure scheduled for publication on July 26, a week prior to the August monetary policy meeting. The RBA’s mandate to target inflation between 2-3% on average over time is closely tied to this figure, rather than the monthly CPI readings.

If the quarterly CPI remains elevated, it could pose a challenge for the RBA, particularly considering mortgage borrowers transitioning from fixed rate loans to significantly higher variable rates.

Conversely, if price pressures have noticeably eased, it is likely to bring a sigh of relief to the decision-makers at the top of Martin Place, the RBA’s headquarters.

How do you think the RBA’s decision to pause its tightening of monetary policy will impact the country’s economy and the Australian Dollar in the near future? Let us know in the comments.

[…] into the crypto exchange. The regulator wants to know what derivatives services Binance Australia offered to retail and institutional […]

[…] to the announcement, the fine, amounting to AU$832,500 (approximately US$538,000), was imposed due to what has been described as negligence on the part of […]