Key Insights

- Ripple Labs achieved a significant victory in the US District Court in New York.

- Judge Analisa Torres ruled in favor of the company, resolving a case initiated by the Securities and Exchange Commission back in 2020.

- This judgment establishes a clear differentiation between sales made to institutional buyers and those targeting retail investors.

In a significant development, Ripple, the company responsible for the popular cryptocurrency XRP, faced a pivotal moment in its legal battle against the U.S. Securities and Exchange Commission (SEC) on July 13, 2023. Judge Analisa Torres of the United States District Court made two crucial decisions that have far-reaching implications for the status of Ripple’s XRP token.

In the first decision, Judge Torres concluded that when Ripple sold XRP to institutional investors, it constituted an investment contract. Consequently, the substantial sales worth $728.9 million were deemed unregistered securities offerings. This ruling carries considerable weight as it contributes to the broader debate surrounding the regulatory classification of digital tokens.

Ripple SEC lawsuit

The SEC had accused Ripple of not providing investors with the information they needed to assess the risks of their investment.

In making this determination, Torres relied on the Howey test, a standard dating back to a 1946 Supreme Court case. This test states that stocks are “an investment in a common enterprise with the expectation of a return solely through the efforts of others.”

This ruling has angered sections of the crypto community, who argue that the Howey test is out of date.

However, Judge Torres ruled that Ripple’s programmatic and CEO sales are not unregistered securities offerings.

This distinction is crucial as it means that selling tokens on exchanges will not be counted as an unregistered offering of securities.

In another case on the same day, Judge Torres ruled in favor of Ripple Labs, noting that the XRP token is not a security.

This ruling was a significant victory for Ripple Labs, which has been locked in litigation with the SEC since 2020.

Read also: Gemini CEO Slams SEC for Denying Bitcoin ETFs, Leaving US Investors with ‘Toxic’ Products

CEO Brad Garlinghouse reacted to the latest Ripple SEC lawsuit:

The most important part of this ruling:

“XRP, as a digital token, is not in and of itself a “contract, transaction[,] or scheme” that embodies the Howey requirements of an investment contract.”

This is a now a matter of law (not up for trial.)

— Brad Garlinghouse (@bgarlinghouse) July 13, 2023

The SEC had attempted to force Ripple to stop offering its XRP token, on the premise that XRP was a security and therefore required additional regulation.

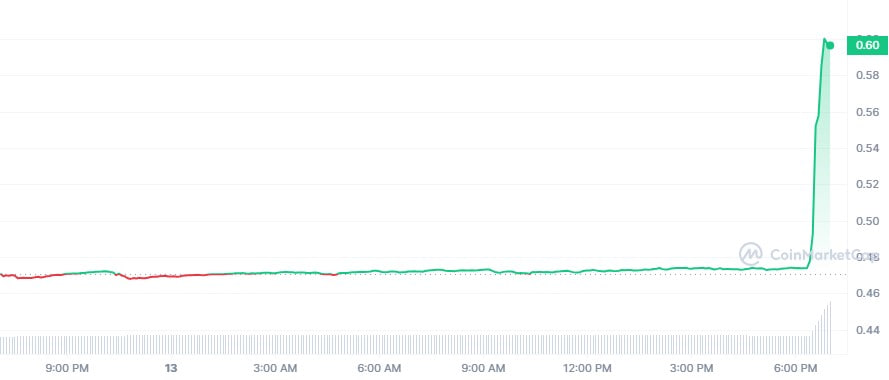

XRP soars 69% on Ripple SEC lawsuit news

On the back of the Ripple SEC news, the price of XRP soared by more than 69%. At the time of writing, the asset is trading at $0.83.

The price of Bitcoin and Ethereum also reacted to the news, as BTC crossed the $31,000 while ETH is currently attempting to break $2000 mark.

How the Crypto community reacted to Ripple’s victory over SEC

Members of the crypto community, for the most part, reacted positively to the news.

The project team was quick to congratulate many popular crypto projects and famous representatives of the crypto industry, including the Kraken crypto exchange, Justin Sun, the founder of Tron, and Changpeng Zhao, the head of Binance.

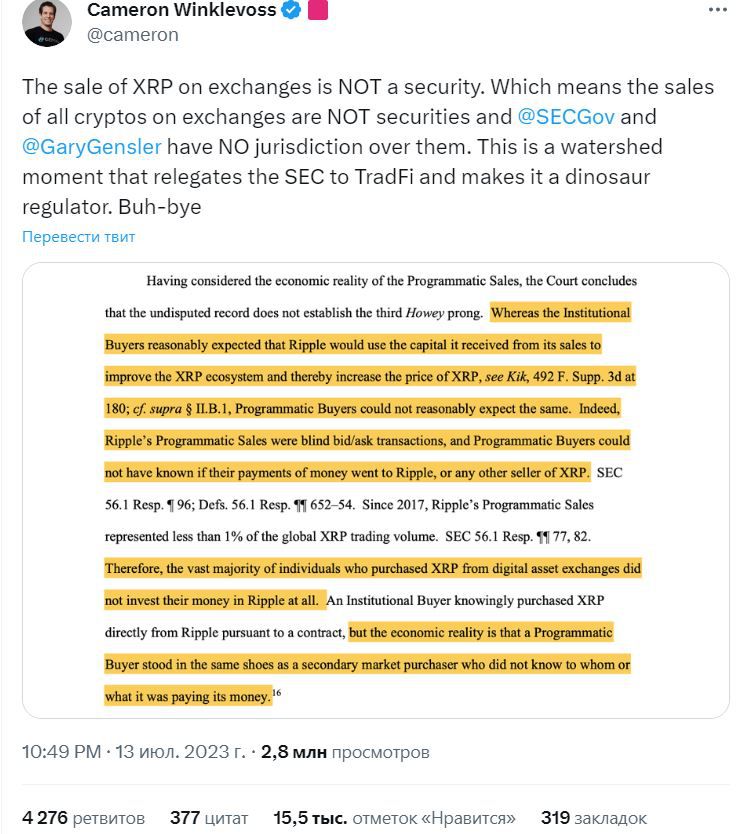

Many believe that Ripple’s victory will help issuers of other coins prove that their tokens are also not a security. Recall that in June 2023, the “black list” of SEC cryptocurrencies grew to 68 positions.

Cameron Winklevoss, the founder of the Gemini crypto exchange, joined the opinion that now all disgraced coins are safe. In his opinion, Ripple’s victory in court proved that the SEC does not have enough rights to put pressure on the crypto market.

Representatives of Ripple, in turn, believe that the victory on the Commission is an important step towards the formation of a transparent regulatory environment for the digital asset market in the United States.

There were also those who were not touched by Ripple’s victory over the SEC.

Whether XRP is a security or not, this coin is still garbage. Only bitcoin is real,” analyst @sunnydecree wrote in his tweet.

What does Ripple’s win mean?

Experts believe that the company’s victory can directly affect the state and further development of the cryptocurrency market as a whole. This could change the entire SEC approach to regulating cryptocurrencies, as well as boost other cryptocurrencies , especially those that are similar in structure to XRP.

What’s more, Ripple’s victory will boost business by allowing the company to operate without the regulatory uncertainty that has plagued it for years. Under these conditions, demand for its products, such as solutions for cross-border payments, may increase.

With these recent developments, will the legal landscape surrounding cryptocurrencies and their regulatory status take another intriguing turn? Let us know in the comments.

[…] court decision in the case of Ripple and the US Securities and Exchange Commission (SEC) may benefit the Coinbase […]

[…] week, the company secured a partial victory as the retail trade of XRP was not deemed a violation of the Securities […]

[…] representing Ripple said that the regulator’s dissatisfaction with the July court decision, according to which the XRP token largely does not fall under the category of securities, cannot be […]

[…] legal saga took a significant turn back in July when a judge ruled that Ripple had not breached federal securities laws by making XRP available to retail investors via […]