Key Insights

- U.S. spot bitcoin ETFs experienced a fifth consecutive day of net outflows, totaling $139.88 million on Thursday.

- Australia’s largest stock exchange ASX listed its first spot bitcoin ETF, operated by VanEck.

- U.S. ETF issuers are preparing to launch the country’s first batch of spot ether funds, with amended S-1 forms expected to be submitted soon.

NEW YORK/SYDNEY (MarketsXplora) – U.S. spot bitcoin exchange-traded funds (ETFs) experienced their fifth consecutive day of net outflows on Thursday, with $139.88 million exiting the funds, according to data from SoSoValue.

Grayscale’s GBTC led the exodus with $53 million in net outflows, followed closely by Fidelity’s FBTC at $51 million. Bitwise’s BITB saw $32 million leave, while VanEck and Invesco/Galaxy Digital funds reported outflows of $4 million and $2 million, respectively.

BlackRock’s IBIT, the largest spot bitcoin ETF by net asset value, bucked the trend with a modest $1 million in net inflows. It also recorded the highest daily trading volume at $565 million.

The collective trading volume for all spot bitcoin ETFs reached $1.16 billion on Thursday, down from $1.7 billion on Tuesday. U.S. markets were closed on Wednesday for a public holiday.

Since their January launch, the 11 spot bitcoin ETFs have accumulated total net inflows of $14.67 billion.

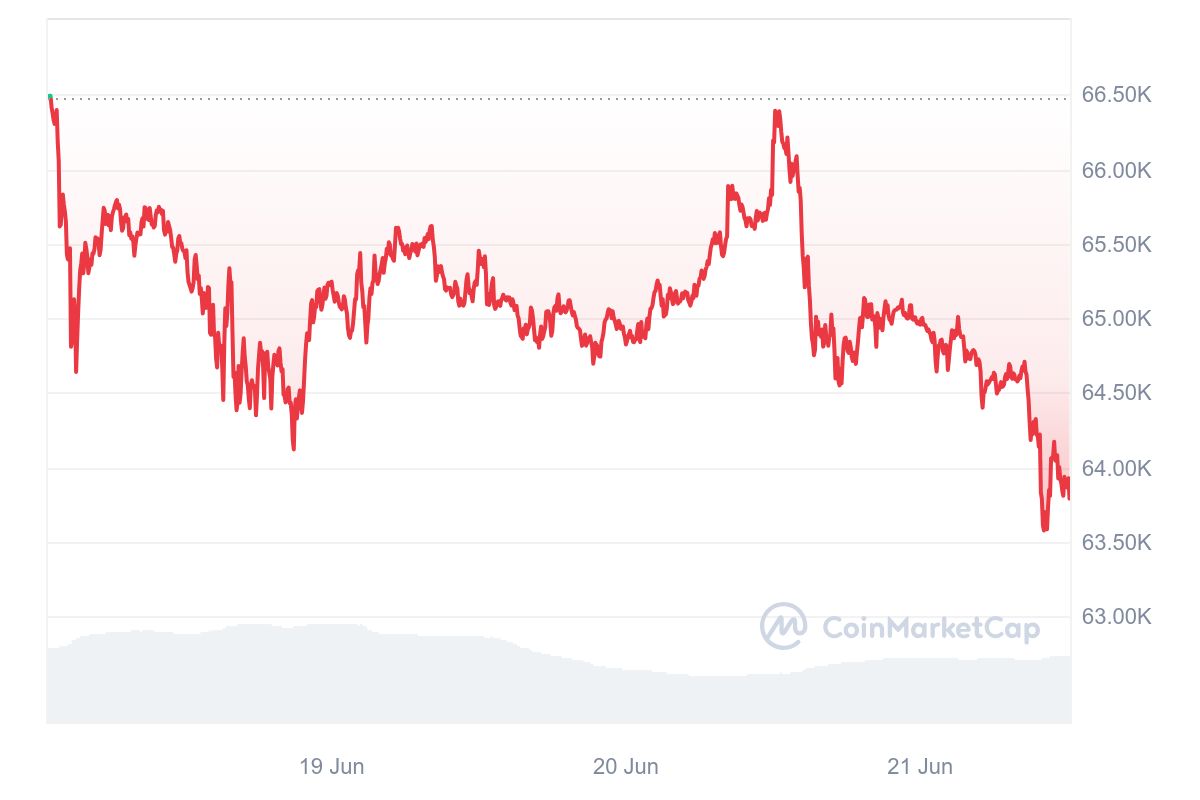

Bitcoin’s price dipped 3% over the past 24 hours, trading at $63,971 at time of reporting, according to CoinMarketCap data.

In a significant move for the Australian market, the country’s largest stock exchange, ASX, listed its first spot bitcoin ETF on Thursday. The VanEck Bitcoin ETF operates as a feeder fund, gaining bitcoin exposure through investments in the U.S.-listed VanEck Bitcoin Trust (HODL).

Meanwhile, U.S. ETF issuers are racing to launch the country’s first batch of spot ether funds. Industry sources reveal that issuers received comments from the Securities and Exchange Commission last week regarding their S-1 forms for ether ETFs. They are now working to submit amended forms by Friday, as reported earlier this week by MarketsXplora.

The introduction of spot bitcoin ETFs in Australia, despite the country having allowed crypto ETFs since 2022, appears to be a response to the growing momentum of crypto ETFs in the U.S. and Hong Kong markets.