Key Insights

- UBS Group AG announced a new $2 billion share repurchase program, commencing on April 3, 2024.

- This follows the completion of the bank’s previous $5.2 billion buyback plan, launched in March 2022.

- UBS aims to eventually exceed pre-acquisition buyback levels by 2026, after its emergency takeover of Credit Suisse.

ZURICH (MarketsXplora) – UBS Group AG announced on Tuesday plans to launch a new share buyback program of up to $2 billion, reinforcing the Swiss banking giant’s commitment to return capital to shareholders following its emergency takeover of Credit Suisse.

The Zurich-based lender said it intends to commence the 2024 share repurchase program on April 3, buying back UBS stock through a separate trading line on the SIX Swiss Exchange.

According to the announcement, UBS has earmarked expected repurchases of up to $1 billion under the new program for 2024.

The move comes after UBS exhausted its previous $5.2 billion buyback plan, launched in March 2022, under which it repurchased 298.5 million shares – representing 8.62% of its current registered share capital.

Buybacks under that program, which concluded on March 28, totaled 5 billion Swiss francs ($5.2 billion), including 1.18 billion francs spent this year before UBS unveiled its surprise Credit Suisse takeover on March 19.

In a concession to Swiss takeover rules during that process, UBS agreed to deploy up to 178 million of the repurchased shares, originally intended for cancellation, as part of the all-share acquisition of its smaller rival.

Tuesday’s repurchase announcement reinforces UBS’s ambition to eventually exceed pre-takeover buyback levels, with the bank targeting higher capital returns from 2026 as it works to conclude the complex Credit Suisse integration.

The buyback plan underscores UBS’s efforts to boost shareholder payouts and support its share price following the $3.2 billion rescue of Credit Suisse, a deal that raised questions over capital demands and added risks for the combined group.

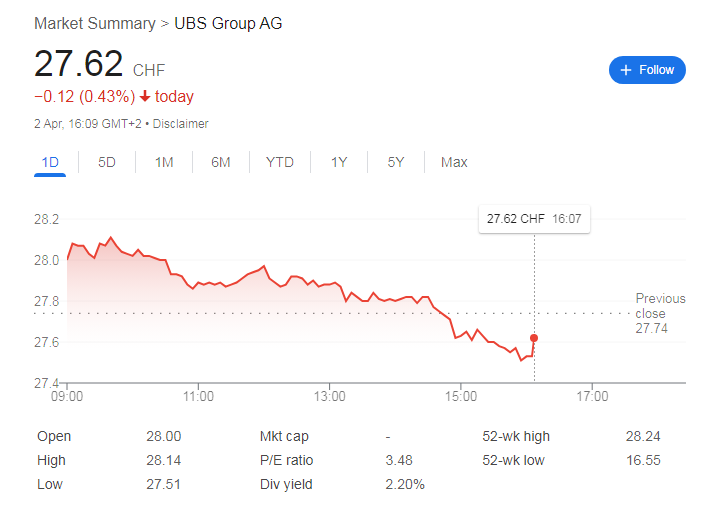

UBS shares have fallen around 4% since the takeover was first announced, as investors fretted over the challenges of melding the two Swiss banking titans together. UBS shares closed at 27.62 Swiss francs on Monday, down 0.47% on the day.

The bank has pledged to maintain a solid capital base, while delivering sustainable profit growth and returns through the deal, which creating a wealth manager overseeing $5 trillion in assets and controlling about one third of Switzerland’s lending market.

UBS Chairman Colm Kelleher has said the bank aims to have share repurchases again exceed pre-takeover levels within the next two years as stability returns.